Closing the Year With a Solid Labor Market

A deeper dive into the workforce

⬇️ 1.6% workforce growth rate in November 2023. This is lower than in October (1.7%). The decrease in the growth rate is a combination of a slight decline in the hiring rate and a stable attrition rate.

⬇️ 43% of workers who started a new job in November transitioned to a new role and 68% transitioned to a new industry. Information had the largest increase in the share of workers coming from other industries.

⬇️ 5.8% decrease in active job listings in November from October. The decrease in demand for workers was widespread across all industries, with the largest hit industry being Finance.

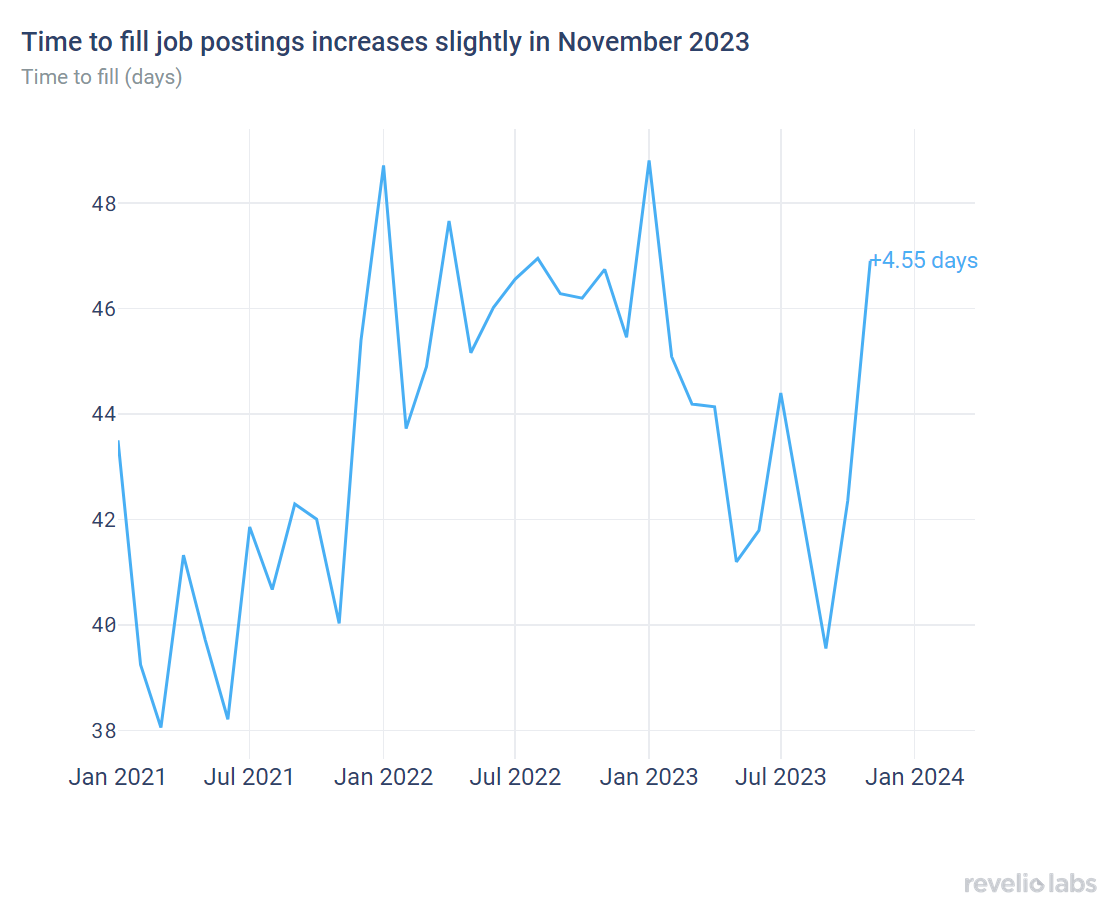

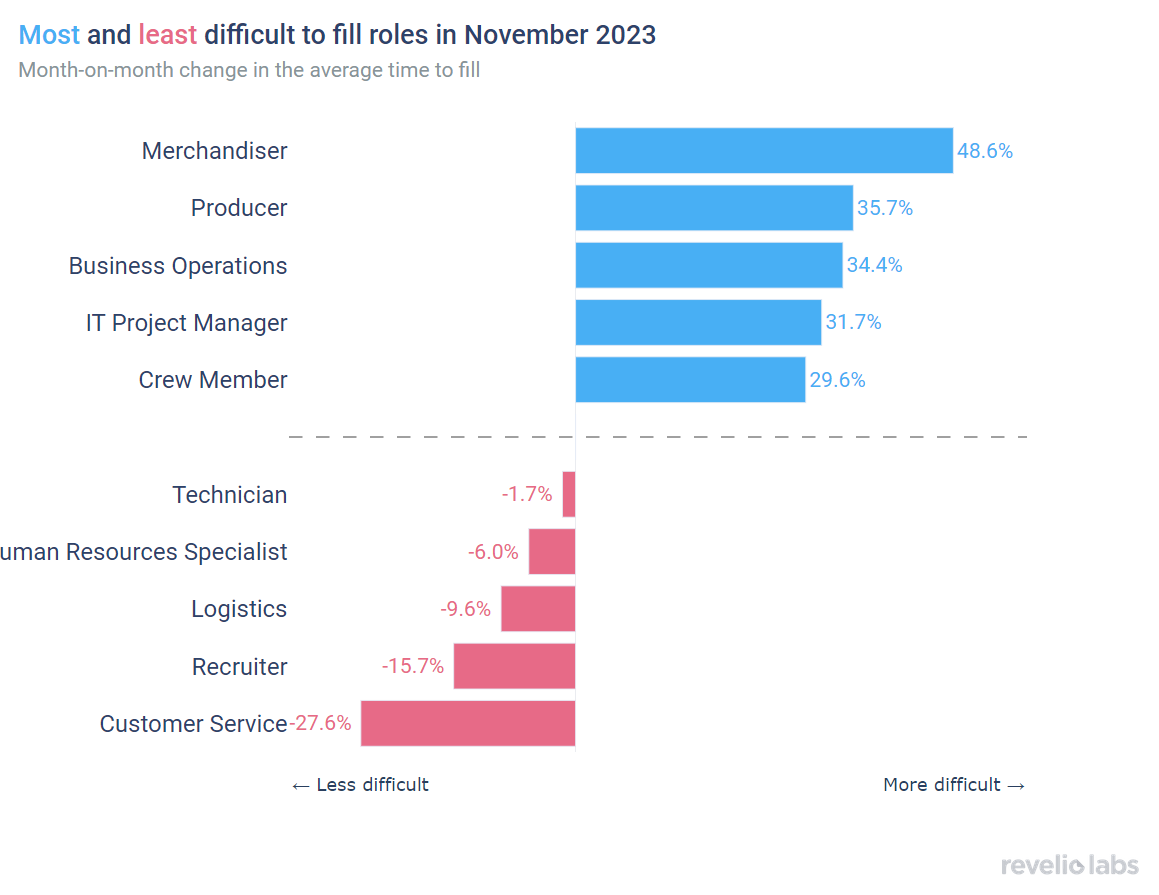

⬆️ 46.9 days to fill job openings. This is 4.55 days more than in October 2023 and 0.16 days more than in November 2022. Merchandiser roles were the hardest to fill in November.

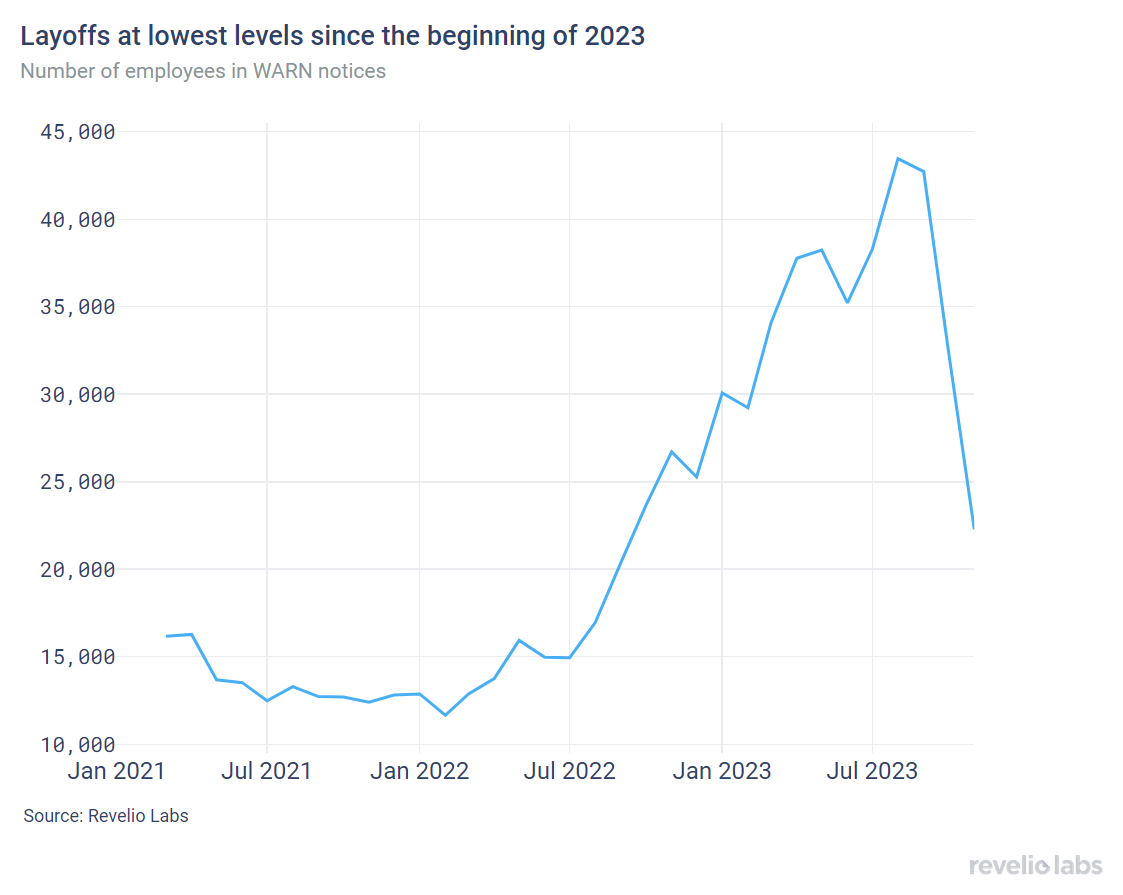

⬇️ 31% decrease in the number of employees notified of layoffs under the WARN Act compared to October 2023.

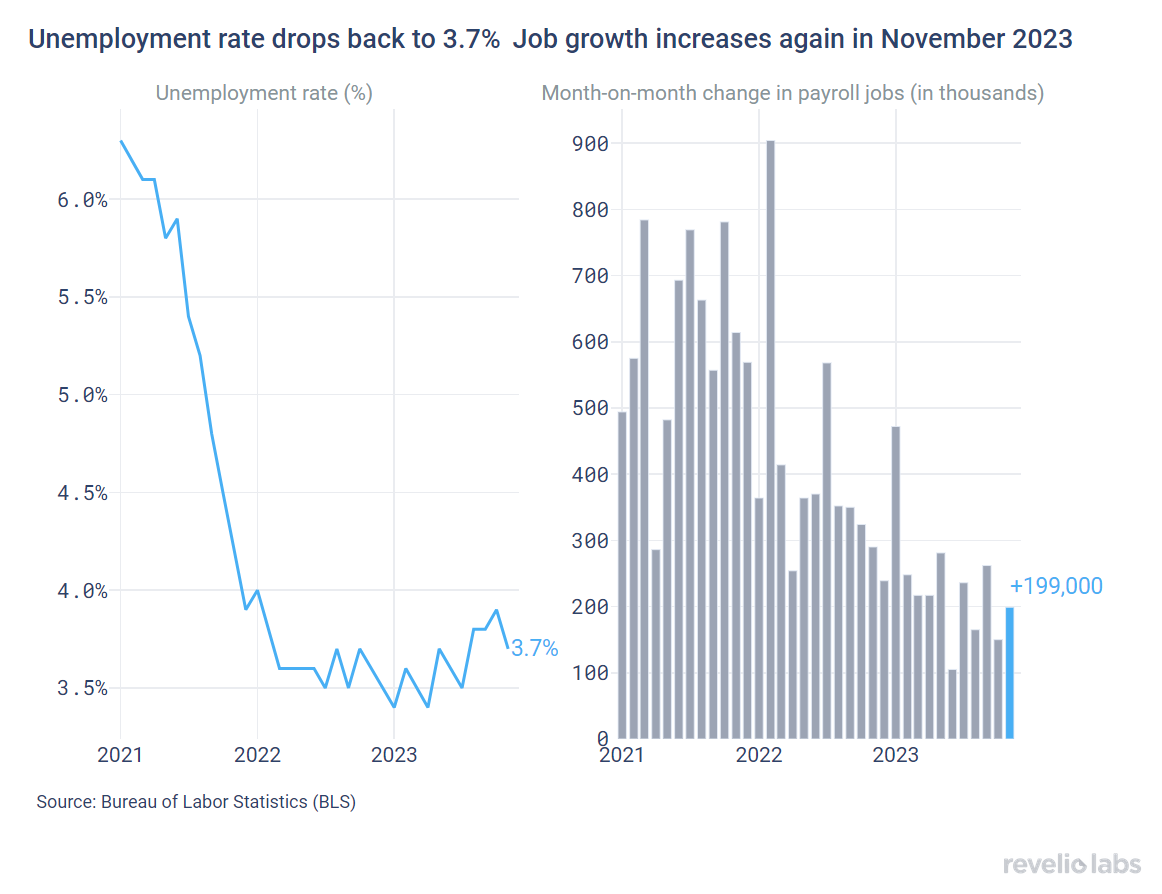

December's Jobs Report ends the year on a strong note

The main takeaway for December’s Jobs Report is that 2023 has been the year for a resilient labor market. The unemployment rate ranged between 3.4% and 3.9% throughout 2023, ending the year at 3.7%. The US economy added new jobs every month in 2023; In November, the economy added a solid 199,000 jobs. Similar to last month, job gains were largely driven by Healthcare and the Government sectors. In November the Manufacturing sector also recorded net job gains as the Auto sector strikes are over. Interestingly, employment in Retail Trade declined around the holidays.

What does the granular workforce intelligence data from Revelio Labs have to say about the health of the labor market, and what do they signal about the labor market in the near future? Read our detailed labor market analysis below.

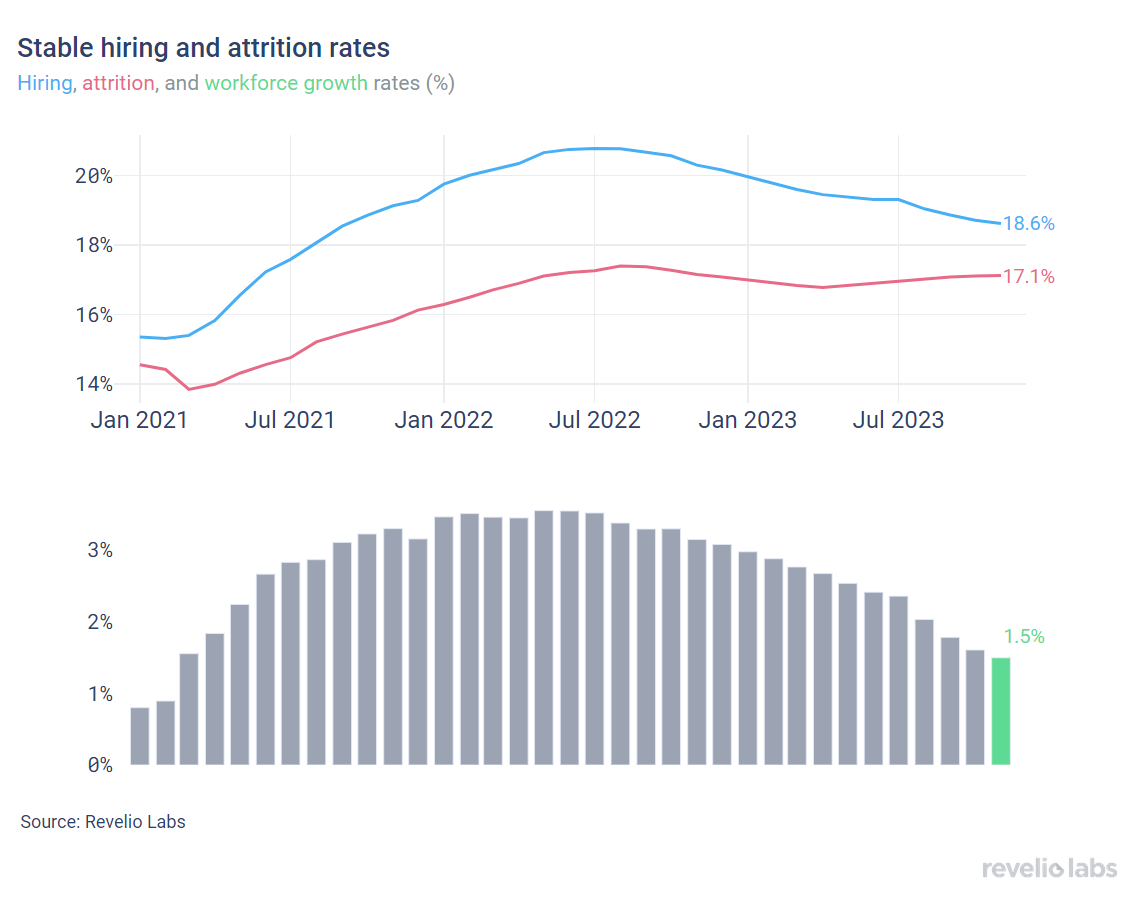

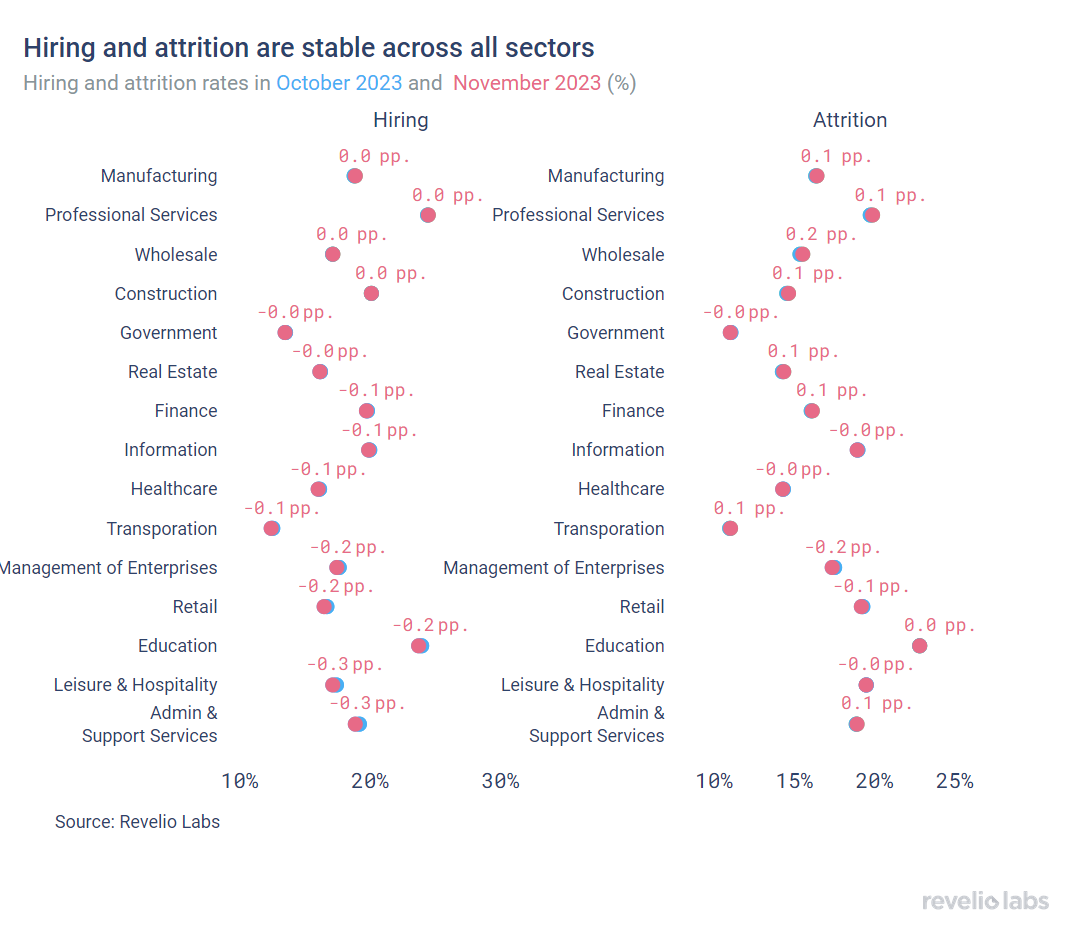

Stable hiring and attrition rates

Revelio Labs’ workforce intelligence data show that hiring and attrition rates were stable in November. The hiring rate stood at 18.6% (almost unchanged from the 18.7% recorded in October) and the attrition rate stood at 17.1% (unchanged from October). The workforce growth rate (difference between hiring and attrition rates) was 1.5% (0.1 percentage points less than October on a m.o.m basis).

Hiring and attrition have been mostly constant in all sectors, with very slight decreases. Compared to October 2023, the Administrative and Support Services sector experienced the largest decline in hiring (-0.3 pp). Meanwhile, the Management of Enterprises sector had the largest decline in attrition in November.

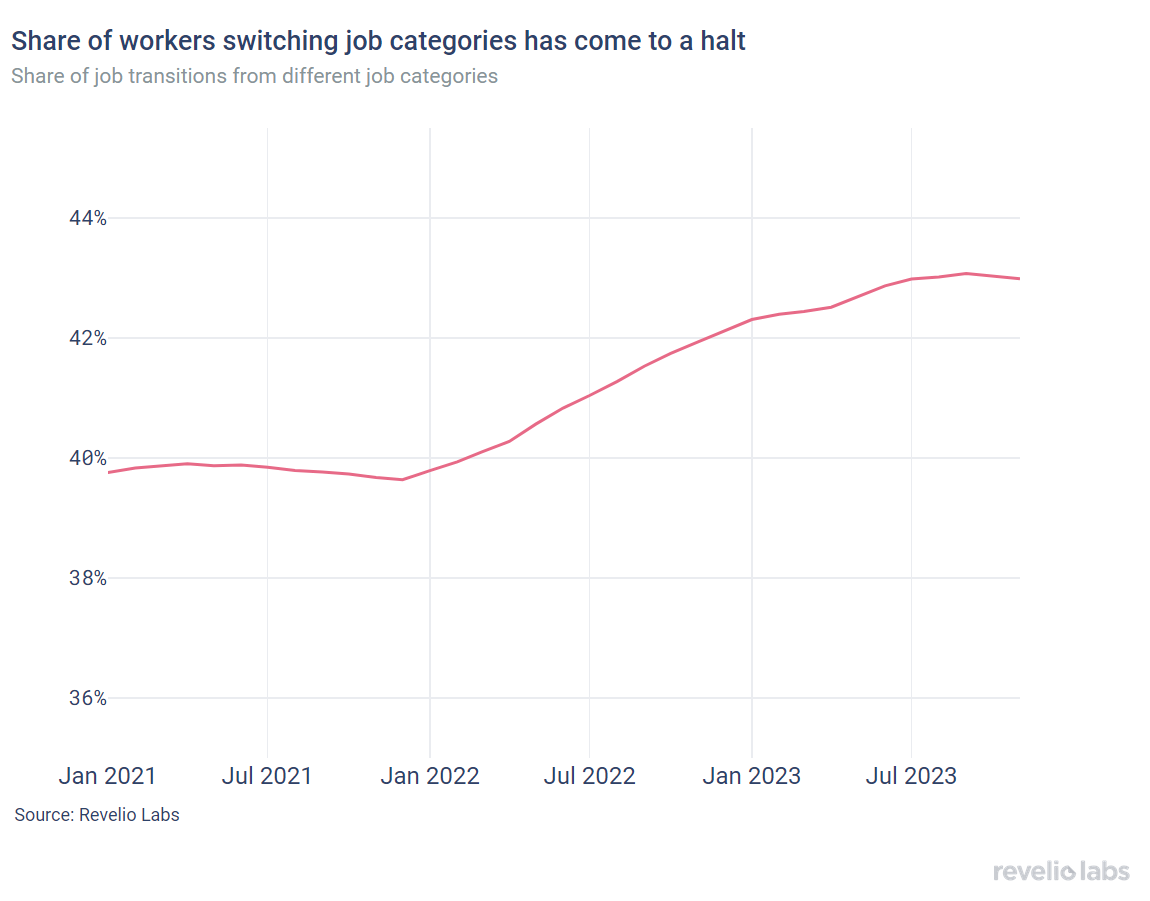

Of those who started a new job in November, 43% have transitioned to different roles and 68% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 43% of workers who started a new job in November, did so by switching their broad job categories; unchanged from the rate observed since September. Furthermore, 67.8% of workers who started a new job in November, started jobs in different industries. The share of employees switching roles has largely stagnated since July, signaling ongoing ,but slightly cooling confidence in the labor market.

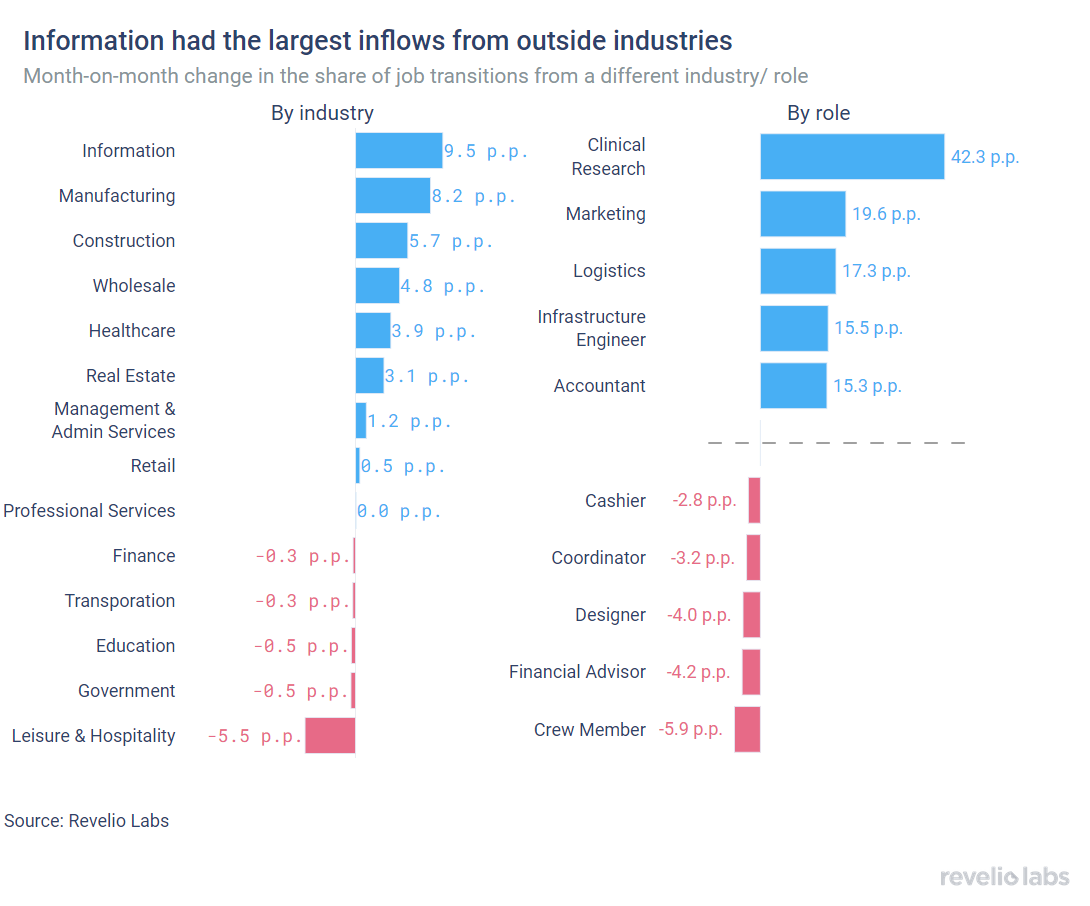

Next, we analyze industry and role switches in positions in November. The left panel in the figure below shows the difference in the share of workers who switched to a different industry, relative to October 2023. Notably, the Information industry had a substantial increase in the influx of workers from other industries. 71.9% of workers who started a job in Information in November came from other industries, relative to 62.4% in October 2023 (+9.5 percentage points). In contrast, the Leisure and Hospitality industry experienced the largest decline in the share of workers joining the industry from other industries. 70.9% of workers who started a job in Information in November had backgrounds in other industries, relative to 76.4% in October 2023 (5.5 percentage points decrease).

The right panel shows the difference in the share of workers who started a new job in a different role, relative to October 2023. Clinical Research roles exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while store roles witnessed the largest decline.

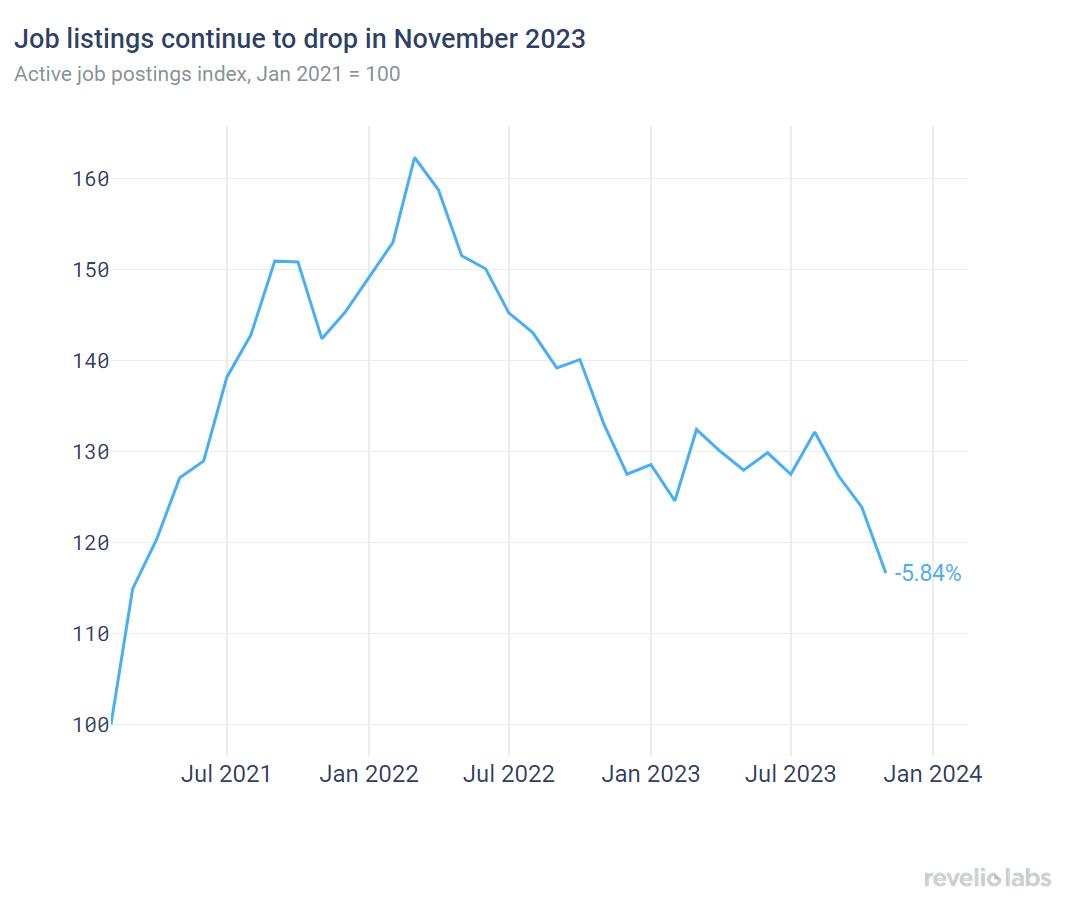

Job postings continue to decrease for the third month in a row

The active job postings index continued its downward trend for the third month. Job listings saw a 5.8% decrease compared to the previous month, following a 2.7% decrease in October and a 3.7% decrease in September. The growth in new job postings was the weakest in November, although historically new jobs growth has always been the lowest in November. Currently, the active job postings index stands at its lowest level in 2023.

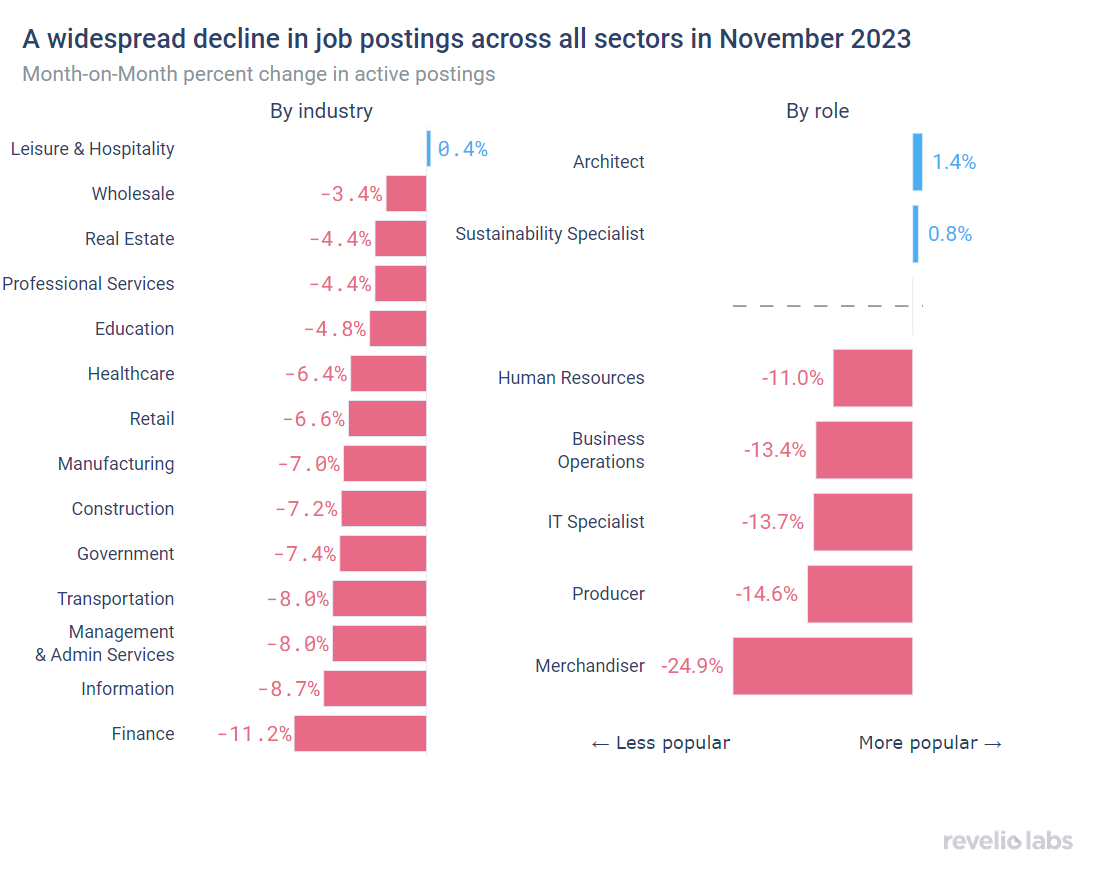

The substantial decline in job listings in November suggests a widespread decrease in demand for workers across sectors. All sectors saw a decrease in job listings in November, with the exception of Leisure and Hospitality that experienced a very small uptick in job listings in November, in preparation for the holidays. Finance and Information saw the largest decline in active job postings.

The decline in labor demand was also widespread across roles. Only two roles had a modest increase in active job listings in November: Architect and Sustainability Specialist. Interestingly, demand for all retail roles (sales associates, retail sales, merchandisers, and sales representatives) has also significantly decreased around the holidays, which continues the trend we documented at the same time of the year last year.

The time-to-fill for open listings continued to increase in November after it had seen a large increase in October. Average days-to-fill stood at 43.5 days in October compared to 46.9 days in November 2023 (+4.5 days).

In November 2023, time to fill Sales roles like Crew Member and Merchandiser increased notably compared to October. In contrast, filling customer service roles was relatively less difficult, with a 28% decrease in the time to fill compared to October.

Layoffs continued to decrease in November

The number of employees receiving layoff notices under the WARN Act continued to decrease further in November, following a declining trend that started in the summer. While the number of layoffs remains elevated compared to the Fall of 2022, November layoff notices were the lowest during 2023.

What are workers in America talking about this month?

By examining thousands of employee reviews posted in November, we picked the most common topics that appeared in positive and negative reviews relative to September. In November, workers continued to be positive about culture. They were also positive about flexibility and opportunities. Yet, employees continued to be more negative about their hours and balance. Workers also complained about their work environment.

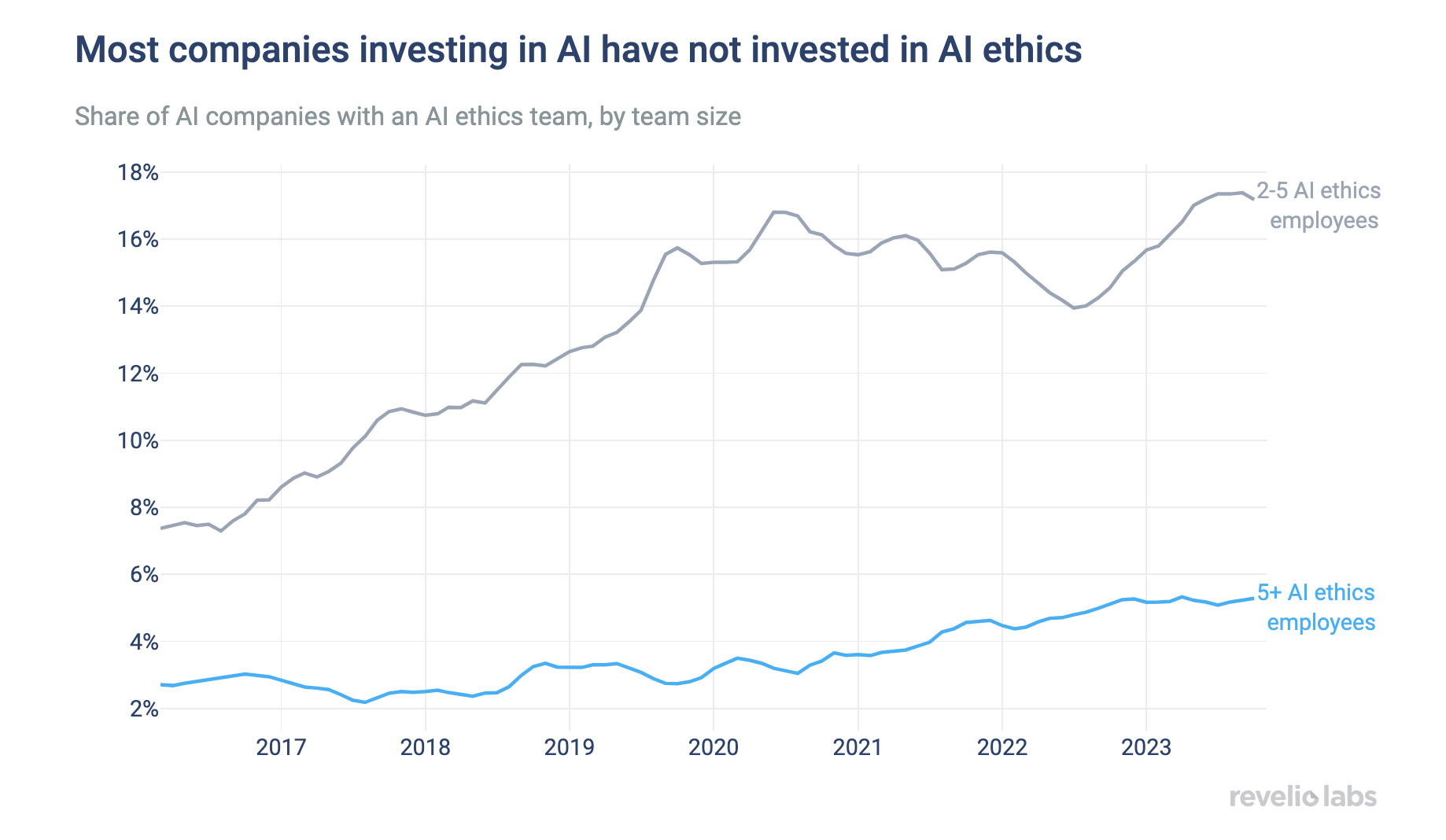

Highlight of the month: How invested are AI companies in regulating AI?

Our recent research shows that companies are not really invested in AI regulation. Amid the AI revolution, and the heated discussions around the biases embedded in AI tools, we find that AI companies are far from prioritizing responsible AI practices. This is particularly interesting in light of the EU’s AI regulation act that passed last weekend. Less than 20% of AI companies have dedicated AI ethics teams. Although AI companies have dedicated teams, the number of AI ethics professionals is very small: three AI ethics professionals for every 100 AI employees. Despite concerns about the prevalence and size of AI ethics teams, there are some positive signs in their makeup. AI ethics teams exhibit a greater diversity of backgrounds compared to general AI teams, placing a stronger emphasis on social sciences, law, and politics.

Conclusion

In 2023, the US labor market faced its share of upheavals but ended on a promising note. The year kicked off with substantial layoffs in tech, finance, and manufacturing industries. It was also marked by widespread strikes, including prominent ones like the writers’ and auto strikes, tallying up to 345 strikes across various industries. Despite these challenges, unemployment rates remained relatively steady, buoyed by robust hiring across the board. Confidence in the labor market steadily rose throughout the year and has now stabilized. Although job listings decreased consistently, we haven’t seen this translate into drastically lower hiring. As the year draws to a close, the labor market remains solid.

Please view our data and methodology for this job report here and our recent newsletter on ghost job postings here.