The Wage Divide is Widening Again and AI May Be to Blame

The K-shaped economy is evident from job posting wages

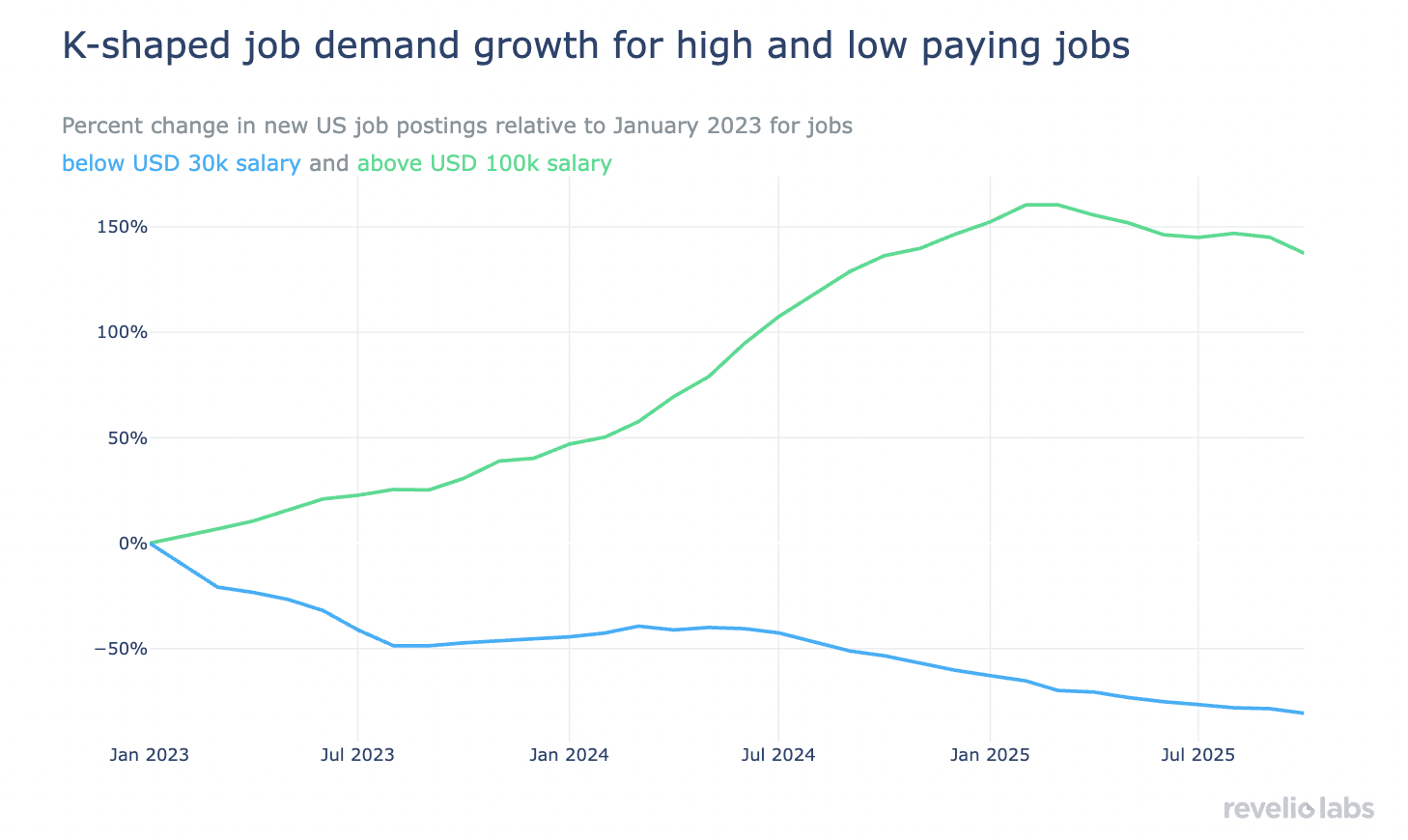

The labor market is becoming increasingly bifurcated again and the K-shaped economy shows up clearly in job postings. While demand for high wage jobs remains strong, low wage jobs have seen falling demand over the last two years.

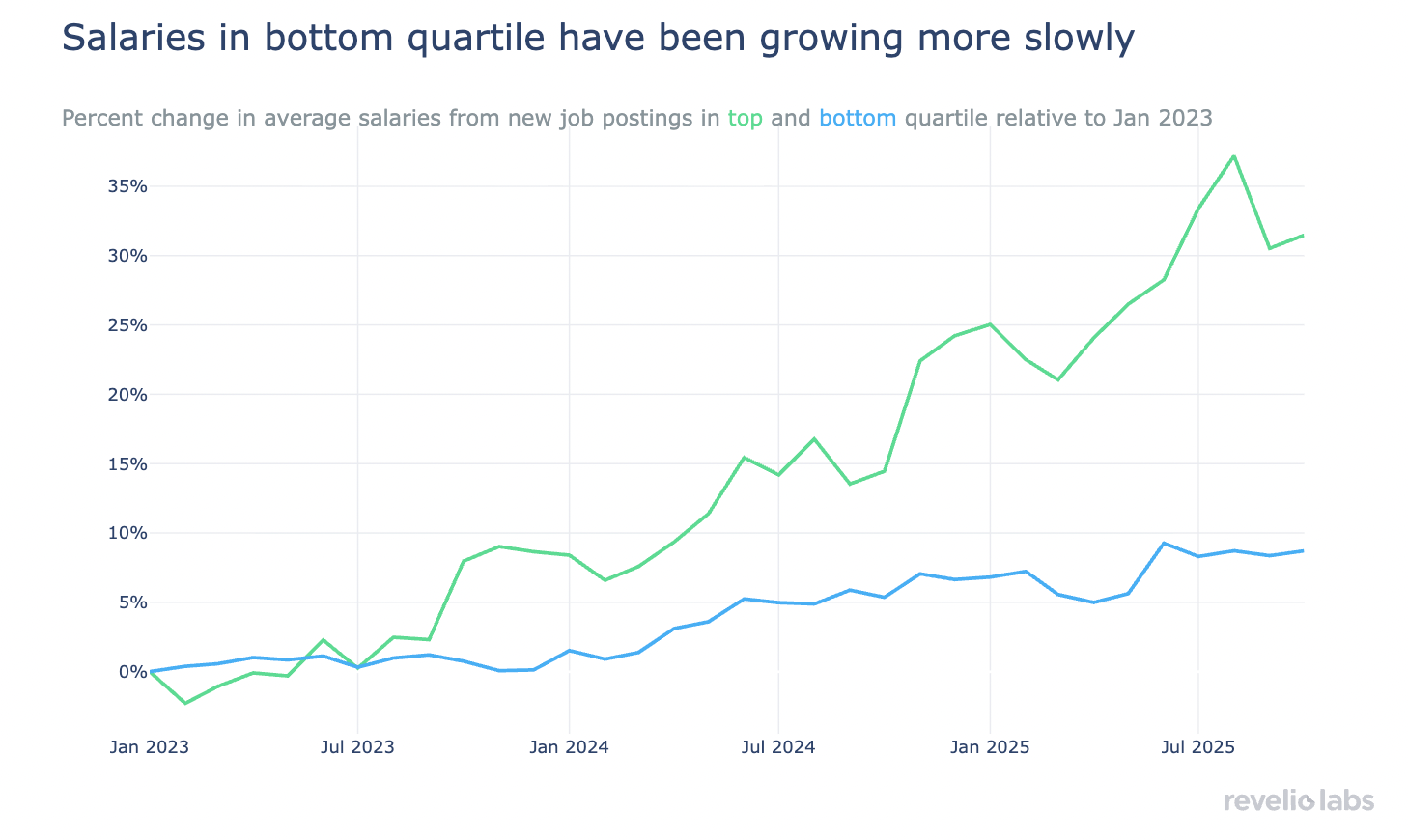

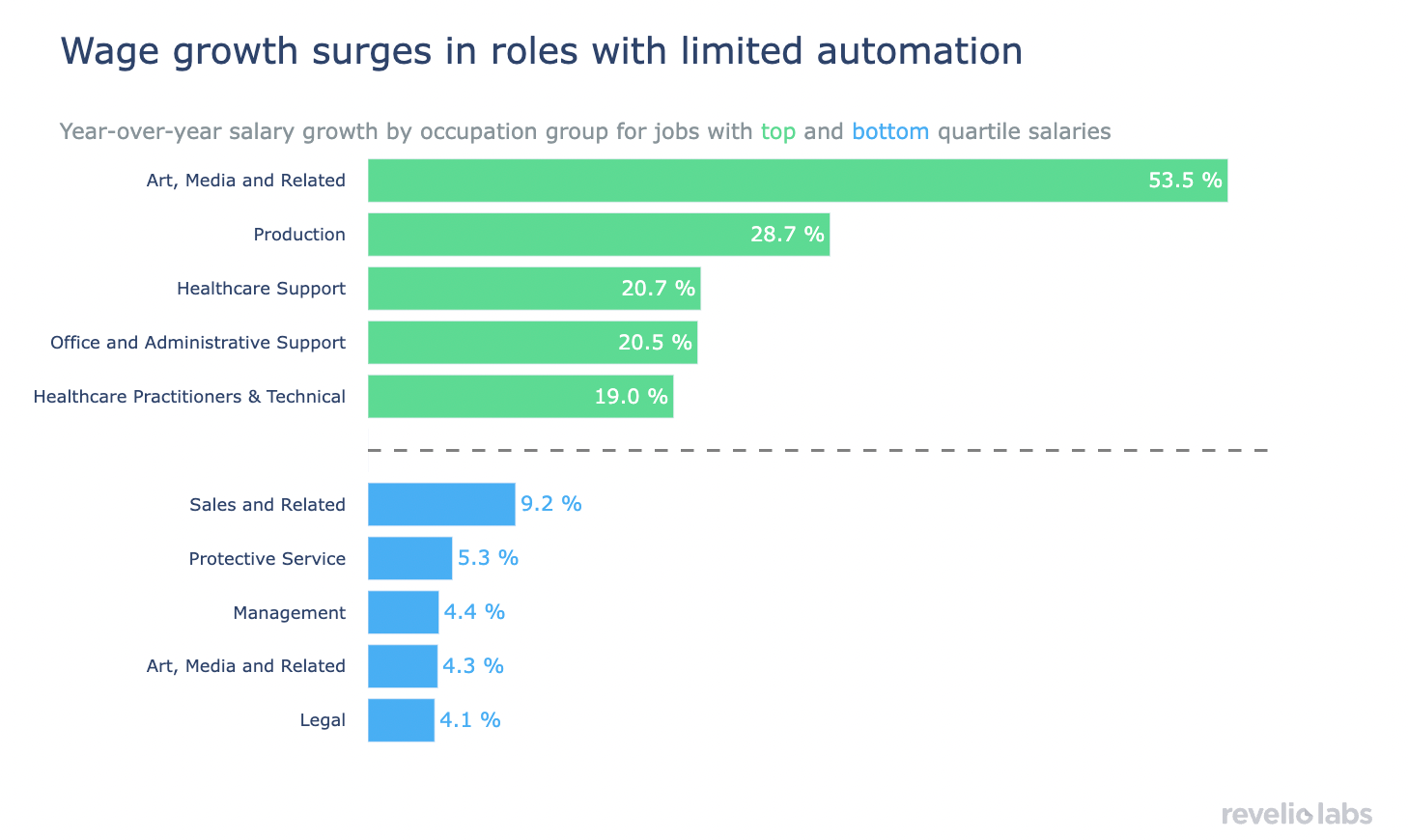

Revelio Public Labor Statistics (RPLS) wage data show that while the top quartile of salaries has grown by over 30% since January 2023, the bottom quartile has seen a mere 10% increase. This reverses the post-pandemic trend, when lower wages were growing faster. Jobs with the highest wage growth even at the bottom of the wage distribution are in Sales, Legal and Protective services–all labor intensive jobs with currently low propensity for automation.

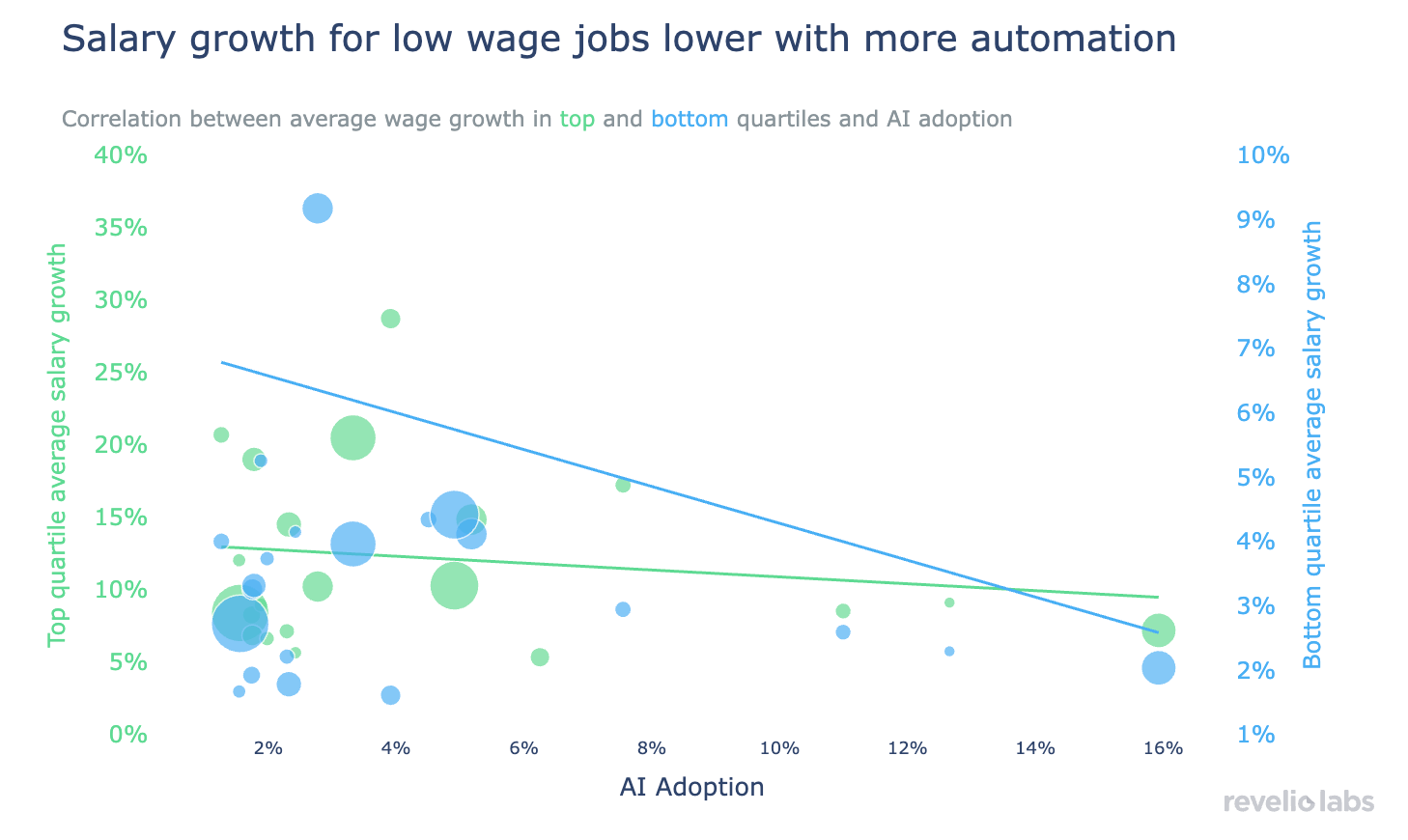

Average AI adoption rates by occupations are negatively correlated with wage growth at the bottom of the wage distribution, and only weakly correlated for top-quartile jobs. This suggests that automation pressures are disproportionately suppressing wage gains in lower-paid roles, which is contrary to narratives that AI is mostly impacting high-earning, white-collar jobs.

The US economy is increasingly driven by those at the top of the earning distribution. While headline indicators still show resilience, such as steady spending, strong equity markets, and continued investment growth, much of this strength is concentrated among high-income households and high-wage industries. Affluent consumers continue to spend freely, buoyed by rising asset values and healthy labor-market prospects, while lower-income households are feeling the strain of slower wage gains, reduced savings, and elevated living costs. This widening gap between economic conditions at the top and bottom is reshaping everything from consumer demand to labor-market dynamics, reinforcing a K-shaped pattern in which prosperity rises sharply for some while flattening or falling for others.

Wage inequality is a major culprit of this pattern, and it is on the rise. After a brief period of post-pandemic convergence when wage gains were strongest for low-income workers, the pattern has reversed. Demand for high-wage roles remains robust, while job postings for low-wage work have been falling steadily for nearly two years. The result is a labor market where opportunity and wage growth are increasingly concentrated at the top. Our job postings data (also used for RPLS job openings) show that demand for high wage jobs with salaries over USD 100,000 (~ average wage in top wage quartile) has grown by about 150% over the past two years, albeit stagnating in 2025. Low wage jobs earning USD 30,000 (~ average wage in bottom wage quartile) and below have decreased steadily by over 50% since January 2023.

The divergence is further underscored by salaries in new job openings. We observe a strong increase in wage inequality from new salaries in RPLS . Since January 2023, salaries at the top quartile of the wage distribution have grown by more than 30%. Over the same period, salaries at the bottom quartile have risen by only around 10%. This marks a stark reversal from the early post-pandemic recovery, when employers, particularly in service occupations, raised wages aggressively to compete for scarce frontline workers.

Looking at which occupations drive this pattern, we first see that salary growth is highest in jobs with limited automation and high labor intensity– both at the top and bottom quartiles of salaries. Second, the fastest growing salaries for jobs in the top quartile outpace the highest job growth for bottom quartile jobs almost by an order of magnitude. High paying jobs in Arts, Design and Entertainment have seen the highest year-over-year growth of 53%. At the same time, in the bottom quartile jobs in Sales, Legal, and Protective Services, jobs that remain heavily human-powered and have limited near-term automation potential, show some of the strongest wage growth among low-wage roles, but with much more muted growth around 9%. These pockets of relative resilience stand out against a broader slowdown affecting most other lower-paid occupations. Remarkably, both high and low paid jobs within legal occupations have seen strong wage growth. But while top quartile jobs in legal had salary growth around 37% year-over-year, bottom quartile jobs only grew by 6%.

A major force behind this new pattern appears to be automation pressures. Across occupations, average AI-adoption rates are strongly negatively correlated with wage growth at the bottom of the distribution. In other words, the roles seeing the slowest wage gains tend to be those where employers are investing most heavily in AI. By contrast, the same relationship is much weaker for higher-paid roles, where wage growth has been driven by continued demand for specialized and technical talent.

This contradicts the widely held narrative that AI is primarily a white-collar shock. Instead, the data suggests that early automation gains are disproportionately suppressing wage growth in lower-paid occupations, particularly those involving predictable, repetitive tasks that machine-learning systems can increasingly perform. The result is a labor market in which many employers appear comfortable expanding high-paid headcount but are becoming more cautious about hiring or raising pay in roles more susceptible to automation.

Taken together, these trends point toward an economy that is once again pulling apart. High income earners continue to benefit from strong demand and rising wages, while lower-paid workers face reduced job opportunities and slower wage gains. As AI adoption accelerates, these divergences may grow sharper and there will be once again strongly increasing wage inequalities.