Regulator Today, Lobbyist Tomorrow

The revolving door between the public and private sectors spins on

The Revolving Door, the movement of public sector employees to private sector companies, is a heavily scrutinized Washington D.C. phenomenon. The movement between regulators and the companies they regulate can be problematic: when lobbyists turn into regulators, and vice versa, the transparency and fairness of regulatory policy is potentially jeopardized.

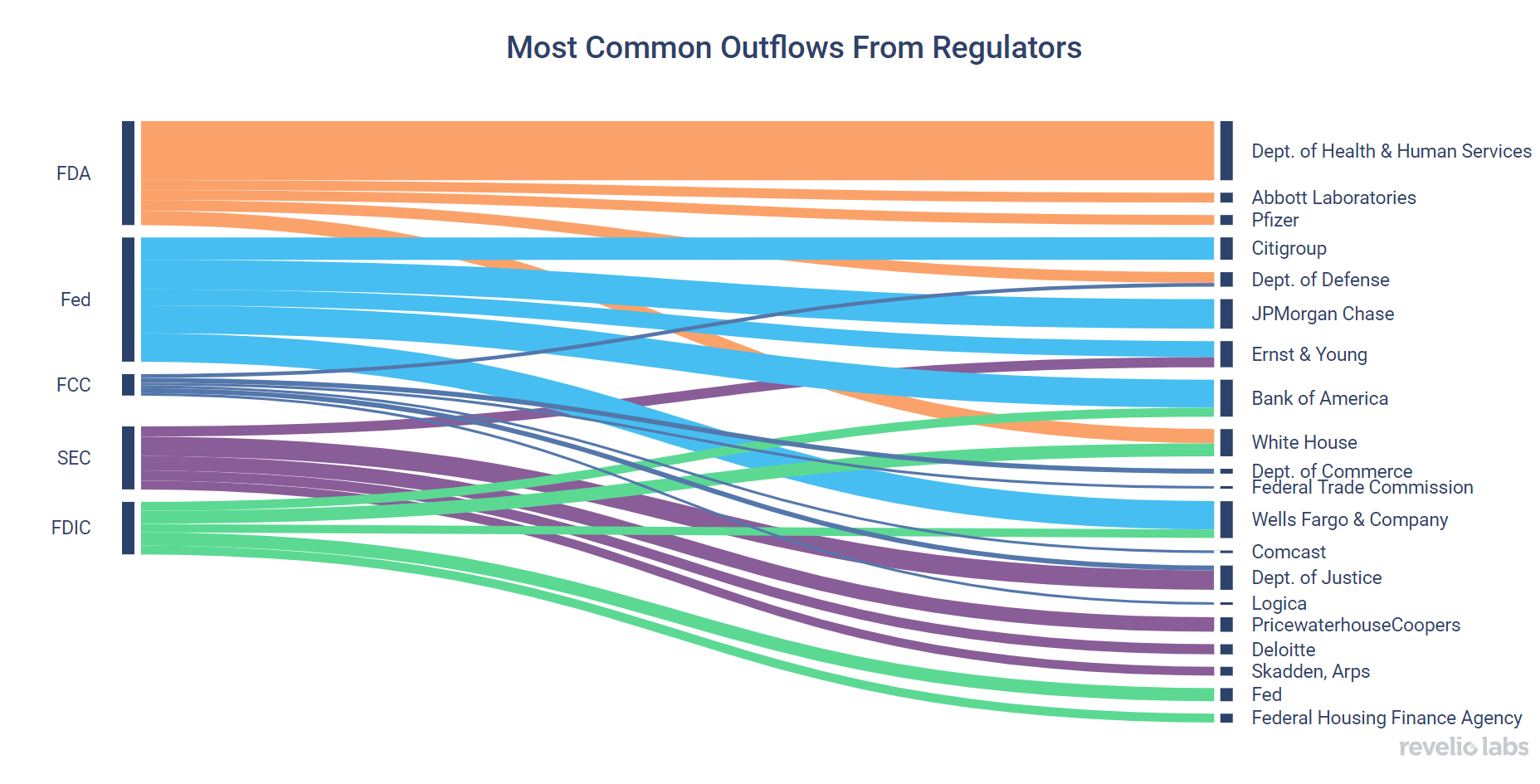

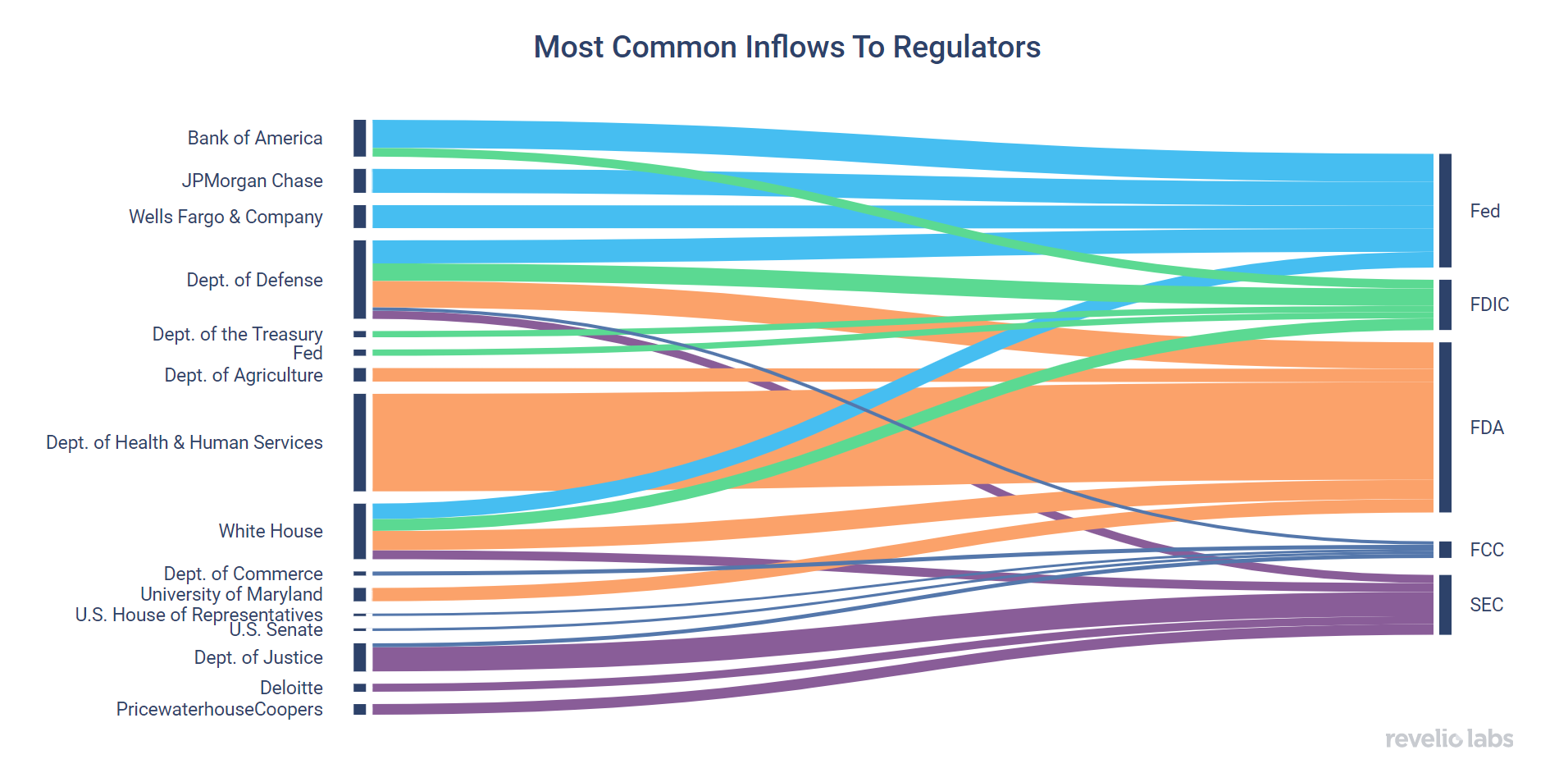

With Revelio Labs workforce intelligence spanning hundreds of millions of careers, we detect the inflows and outflows of regulators. The charts below show the most frequent transitions out of and into the largest regulatory bodies in the US.

The Revolving Door is particularly striking at the Federal Reserve, where the most common transitions are with large commercial banks. At other regulators, the most common transitions are intragovernmental.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

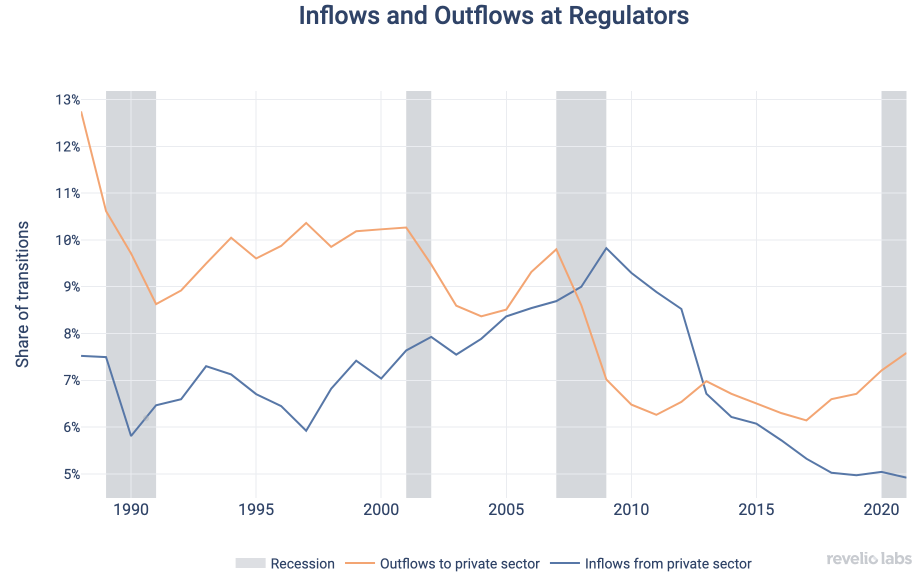

Inflows and outflows tend to move in opposite directions along the business cycle. During recessions, outflows from regulators to related private sector companies decrease, while inflows from related industry to regulators increase. As the public has become more aware of the Revolving Door phenomenon, it has declined over the last few decades, Revelio Labs workforce intelligence shows.

Key Takeaways:

- The Federal Reserve System has a strong pattern of a Revolving Door, with the most common transitions occurring to and from large commercial banks.

- The most common transitions at other agencies are intragovernmental.

- During recessions, inflows from the private sector to regulators increase, while outflows from regulators to the private sector decrease. The opposite happens during boom times, inflows decrease and outflows increase.