Aldi’s Workforce Efficiency Playbook

Lean crews, competitive wages, and a top-tier data science operation keep costs low

German discount supermarket Aldi keeps prices low by running an extremely efficient workforce model. It operates with far fewer employees per store than other grocery companies and relies on tightly engineered efficiency to keep prices low.

Workers are pushed to be fast and efficient but are paid better than most peers, with suburban locations helping make commutes easier.

A strong analytics team helps plan stores and control costs, giving Aldi an edge as shoppers become more price-sensitive.

Aldi is known to have its own cult following, though the source of that loyalty differs from Trader Joe’s. The two grocery chains share lineage but have been run independently for decades. While Trader Joe’s fandom centers on quirky private-label products and culinary novelty, enthusiasm for Aldi is rooted in efficiency and money-saving: a no-frills experience, fewer choices, and consistently low prices. From a workforce perspective, Aldi also diverges from most conventional grocers. The business model is engineered for high labor productivity. Our recent collaboration with Bloomberg News used our workforce data to quantify some of these differences.

Aldi runs with far fewer employees per store than other grocers in the US. Based on our estimates, Aldi has about 5 employees per store in the US, compared with roughly 30 at other chains. This lines up with the in-store experience. If you’ve been to an Aldi, you are probably familiar with the quarter-for-a-cart system. Instead of paying staff to collect carts, customers “rent” a cart for 25 cents and get the quarter back when they return it. The small hassle cuts labor and supports Aldi’s low-price model—one of many efficiency tweaks that add up across thousands of stores.

Aldi’s model depends on productivity, and the company pays for it. Workers are incentivized to be highly efficient, with performance tracked on tasks such as checkout speed and how quickly they can unload bulk deliveries. With fewer employees per store, that efficiency matters even more. And Aldi does pay more in the US than most peers, including Trader Joe’s, Whole Foods, and Walmart, trailing only Costco, which is widely viewed as the market leader when it comes to pay and benefits.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

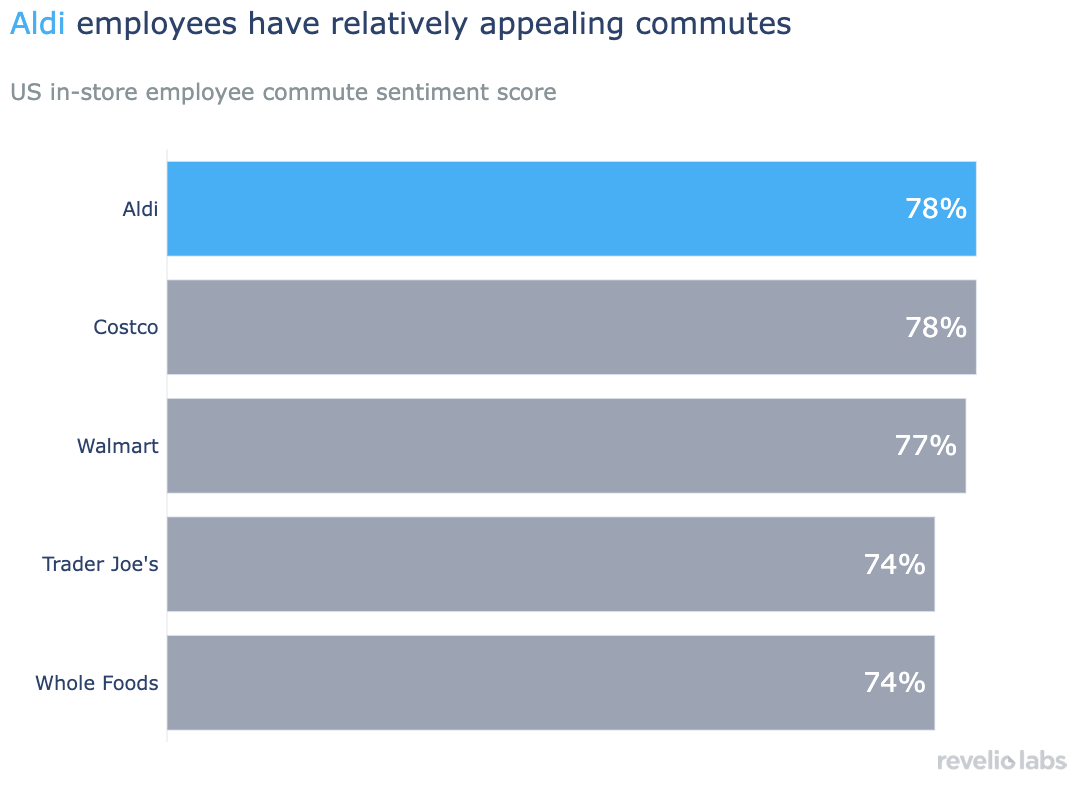

While productivity and efficiency expectations can bring stress, higher pay isn’t the only factor that helps balance the equation. Employee satisfaction also shows up in commute patterns. Unlike Trader Joe’s and higher-end grocers like Whole Foods that cluster in dense city centers in the US, Aldi locations tend to sit in suburban areas, offering shorter and less stressful commutes for many workers, including those pushed out of cities by high cost of living. Locating stores closer to where employees actually live lowers time and transportation burdens, and suburban sites typically offer easier parking, further reducing day-to-day friction.

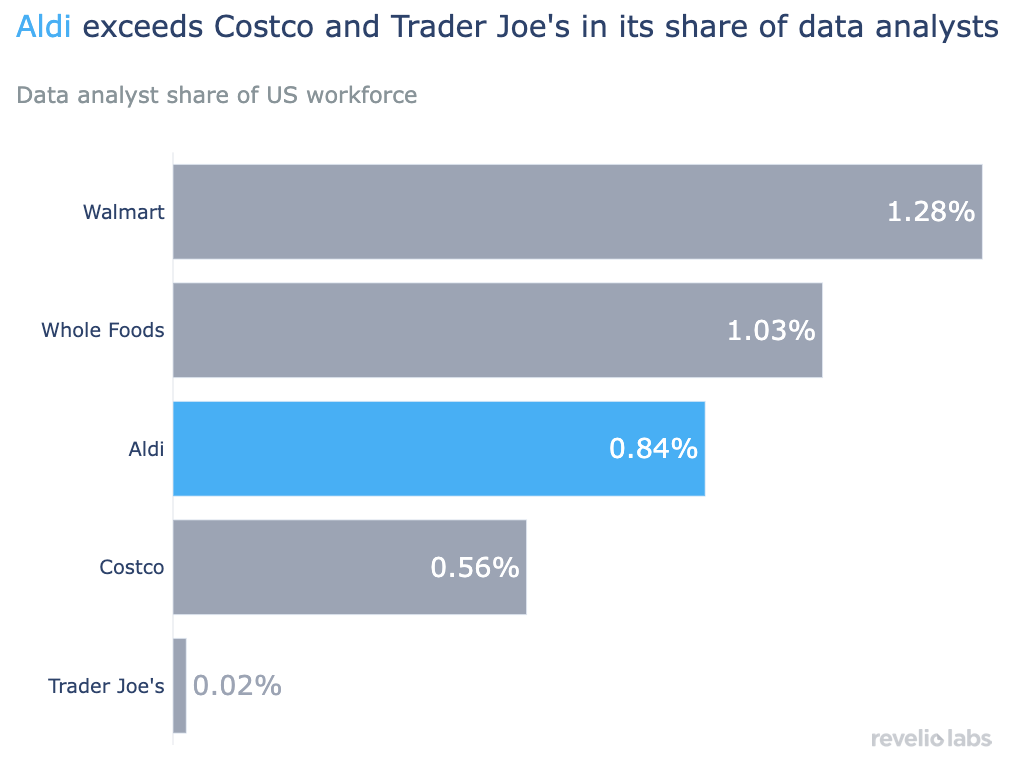

The meticulously planned productivity and efficiency—down to shorter hours, smaller footprints, and even dumpster placement—are supported by a sizable analyst workforce at the corporate level. Looking at the share of US employees working in data and analytics roles, Aldi sits well ahead of Trader Joe’s and Costco and just behind Walmart and Whole Foods, which are both known for larger tech and analytics teams and their online presence. But for Aldi, which operates strictly brick-and-mortar stores, the share of data and analytics roles is unusually high, underscoring how much of the store planning and cost control depends on advanced analytics.

Aldi’s success in the US isn’t simply a pricing story. It reflects a labor model built for speed and efficiency, a willingness to pay for productivity, and a sizable analytics function that keeps costs in check. As consumers become more price-sensitive, that combination gives Aldi a unique edge over many competitors.