Workforce Digest: More Signs of Soft Landing

Revelio Labs' deep dive into the state of the workforce

⬇️ 2.4% workforce growth rate in August 2023, which is lower than in July (2.7%). The decrease in growth rate is a combination of a decline in the workforce attrition rate and a larger decline in the hiring rate.

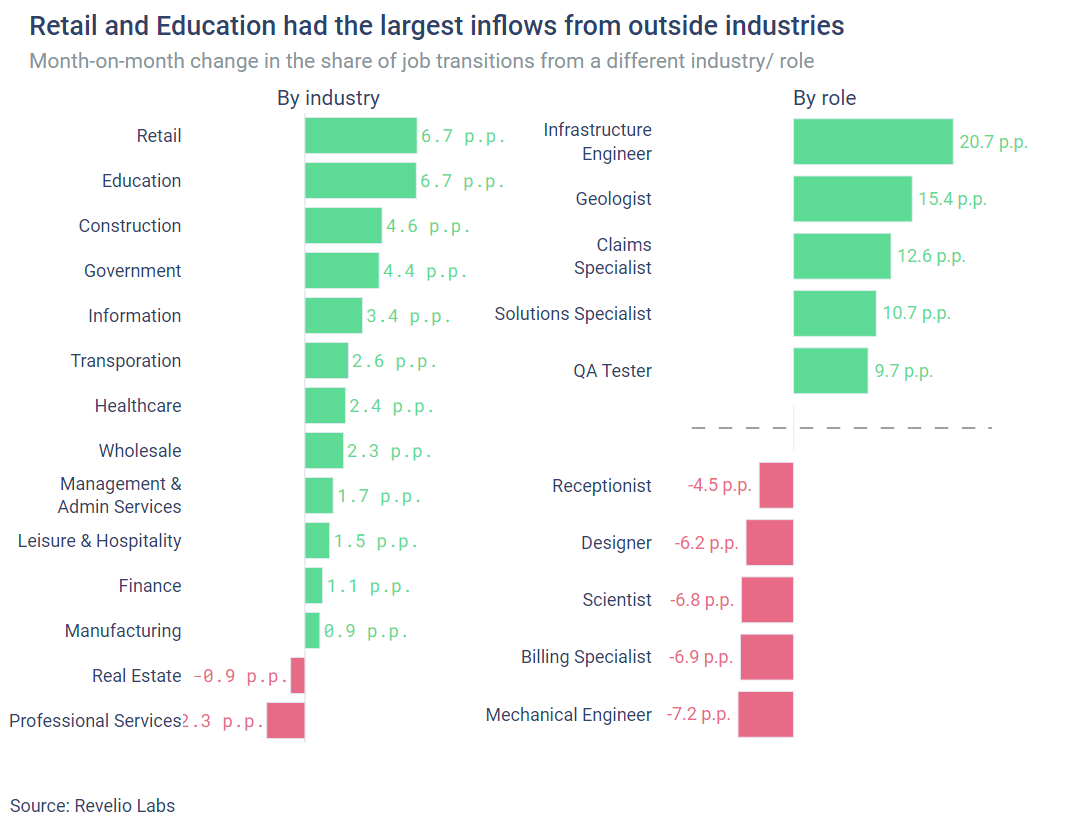

⬆️ 69.4% of workers who started a new job in August switched to a new industry. Retail and Education had the largest increase in the share of workers coming from other industries.

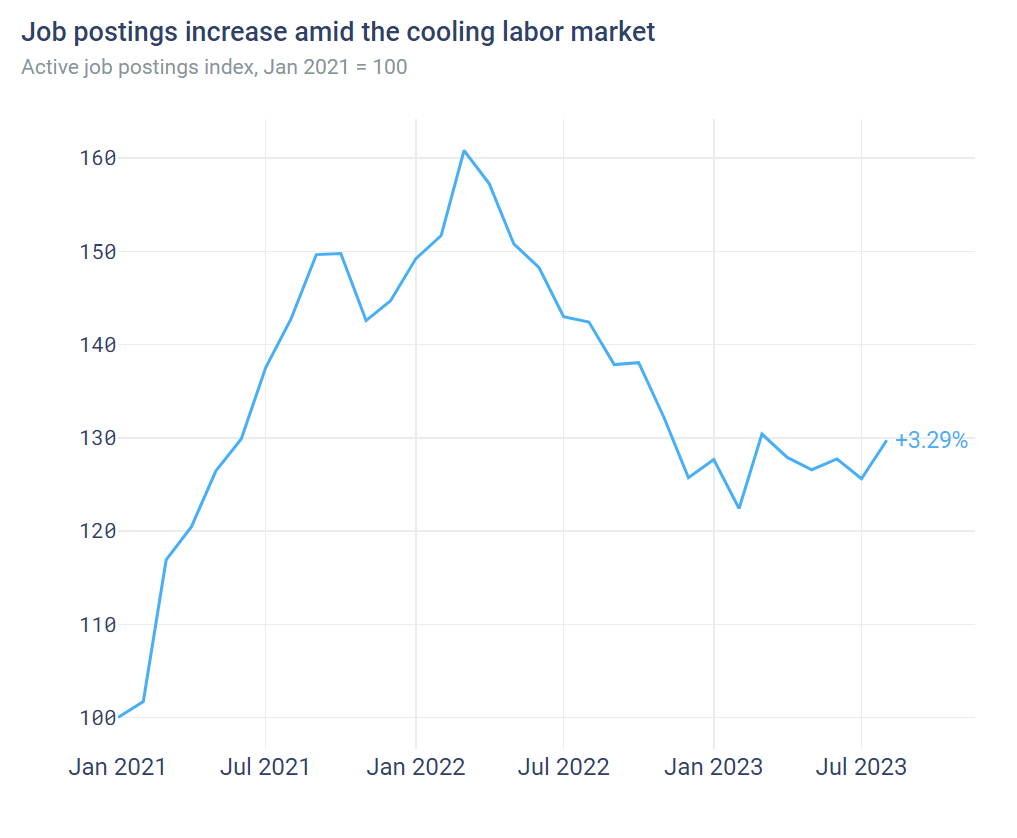

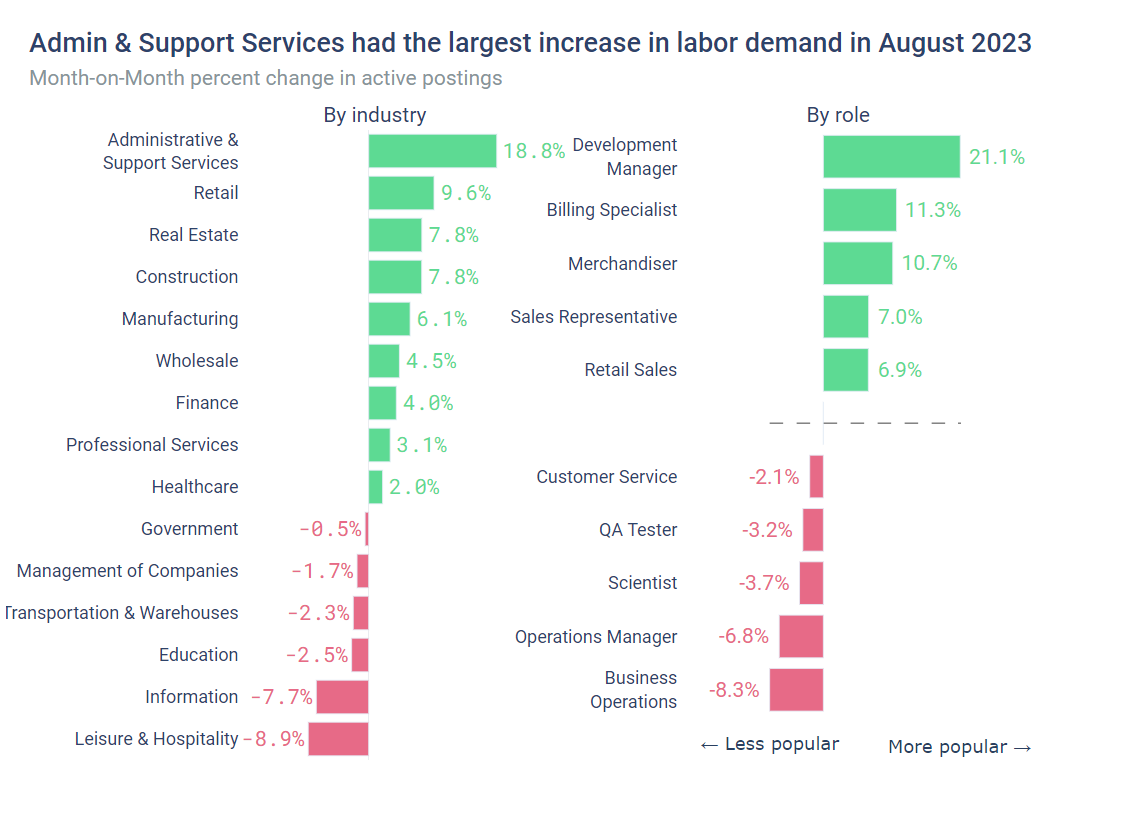

⬆️ 3.2% increase in active job listings from July. Demand for customer-facing roles in retail continues to increase.

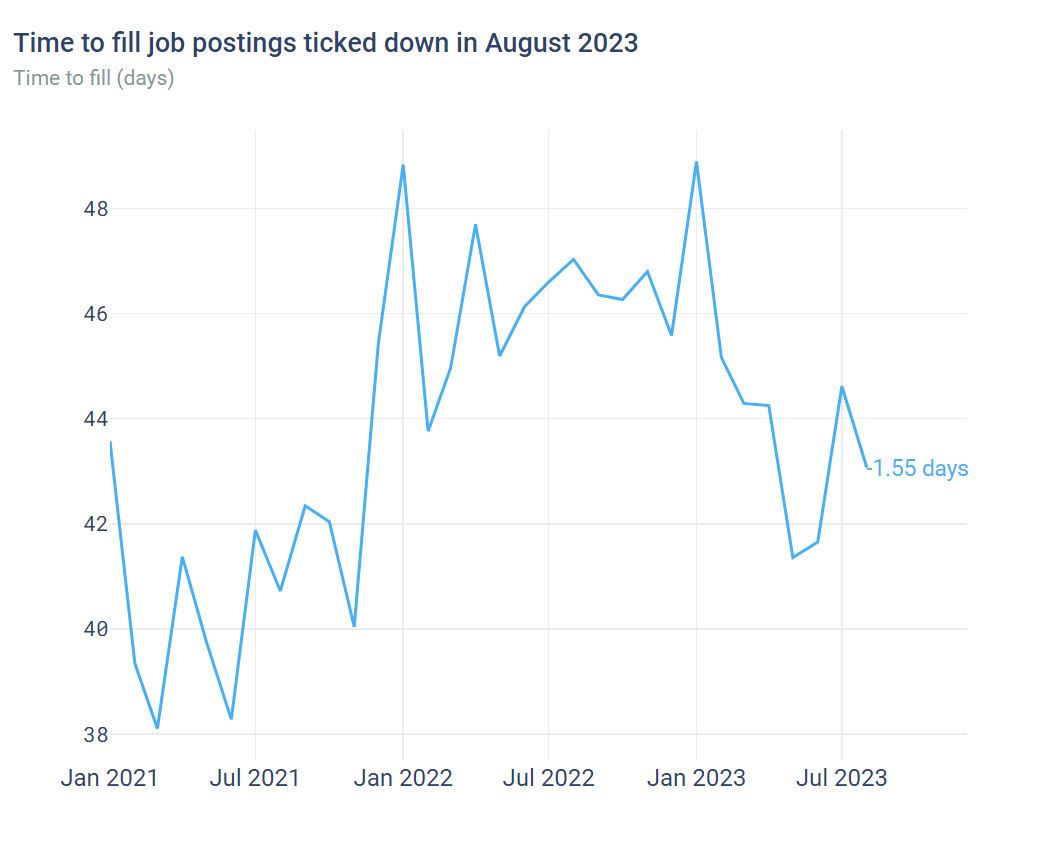

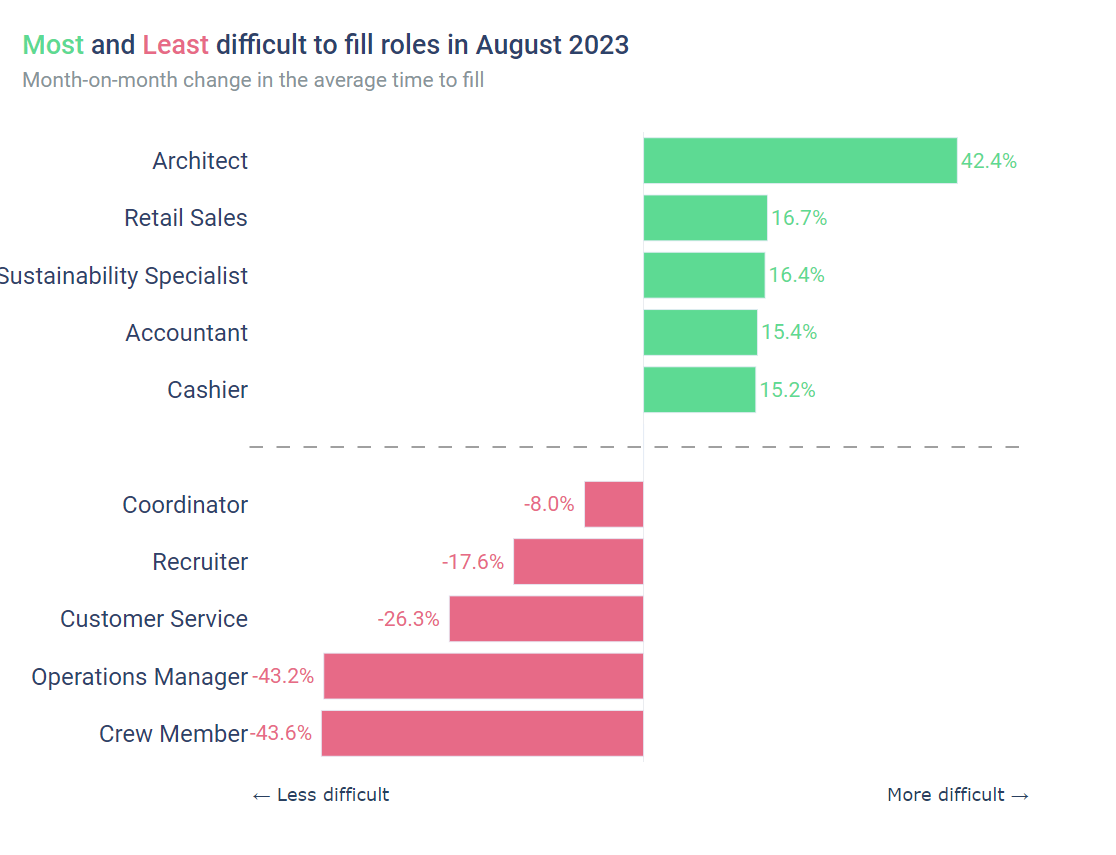

⬇️ 43 days to fill job openings. This is 1.55 days fewer than in July 2023 and 4 days fewer than in August 2022. Architect roles were the hardest to fill in August.

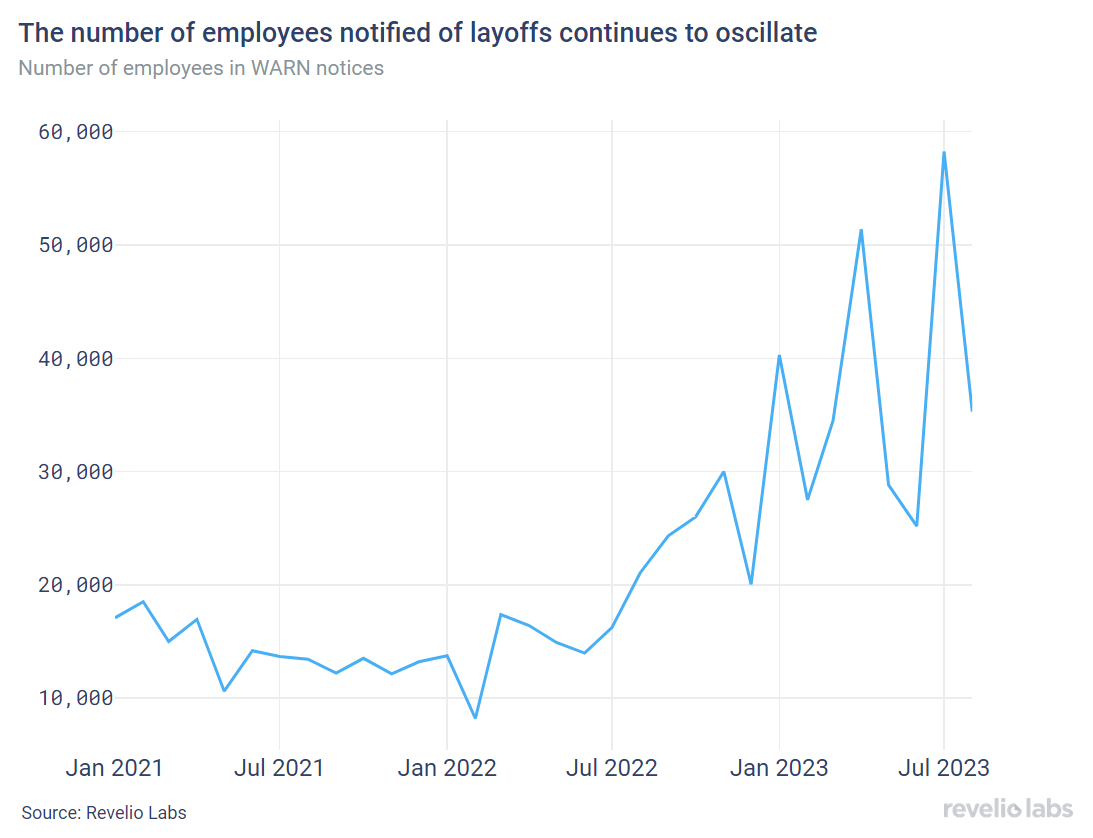

⬇️ 39% decrease in the number of employees notified of layoffs under the WARN Act compared to July 2023.

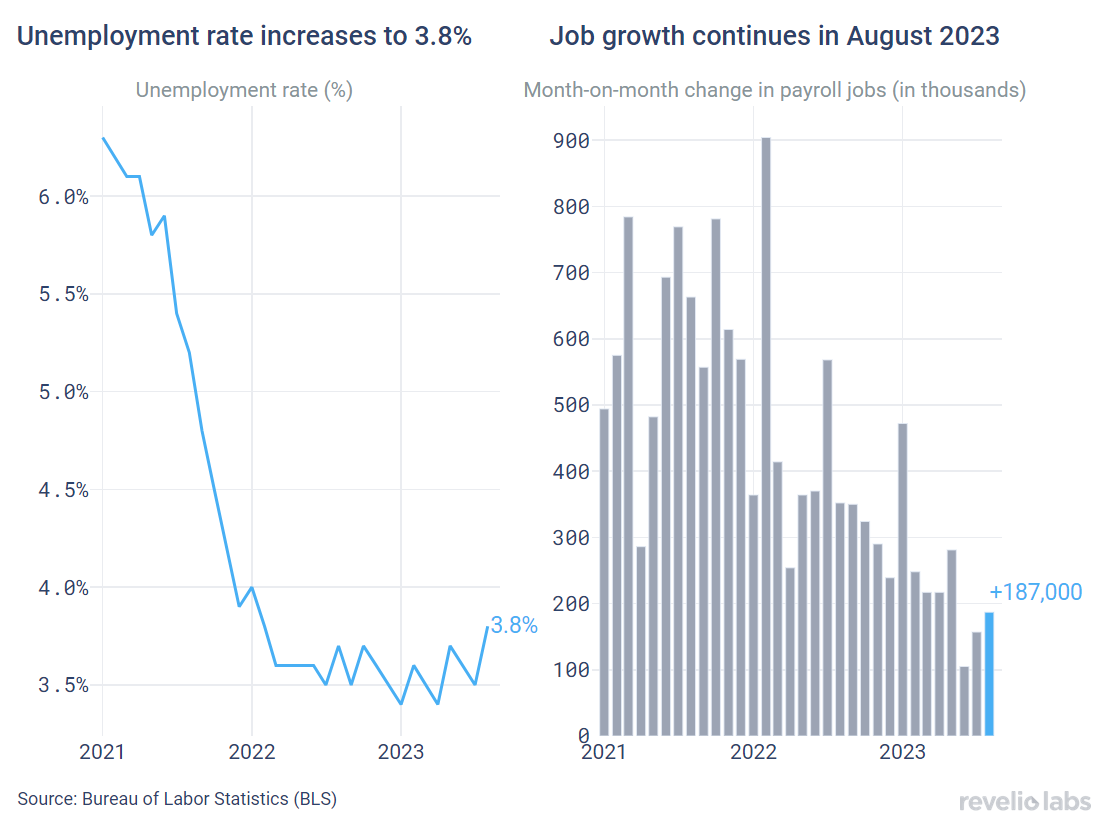

September's Jobs Report still signals a relatively strong labor market

The US labor market continues to slow down in response to the Federal Reserve’s effort to curb inflation. The US economy managed to add 187,000 jobs in August with a notable downward revision to payroll jobs in June and July. The slowdown in the growth in nonfarm payroll employment over the summer is linked to the slowdown in new and active job postings since March of this year. Job growth continues to be driven by the healthcare sector following the pattern of the past two months. The unemployment rate ticked up in August, recording 3.8%, compared to 3.5% in July, largely due to an increase in labor force participation.

What does the granular workforce data from Revelio Labs have to say about the labor market, and what do they signal about the labor market in the near future?

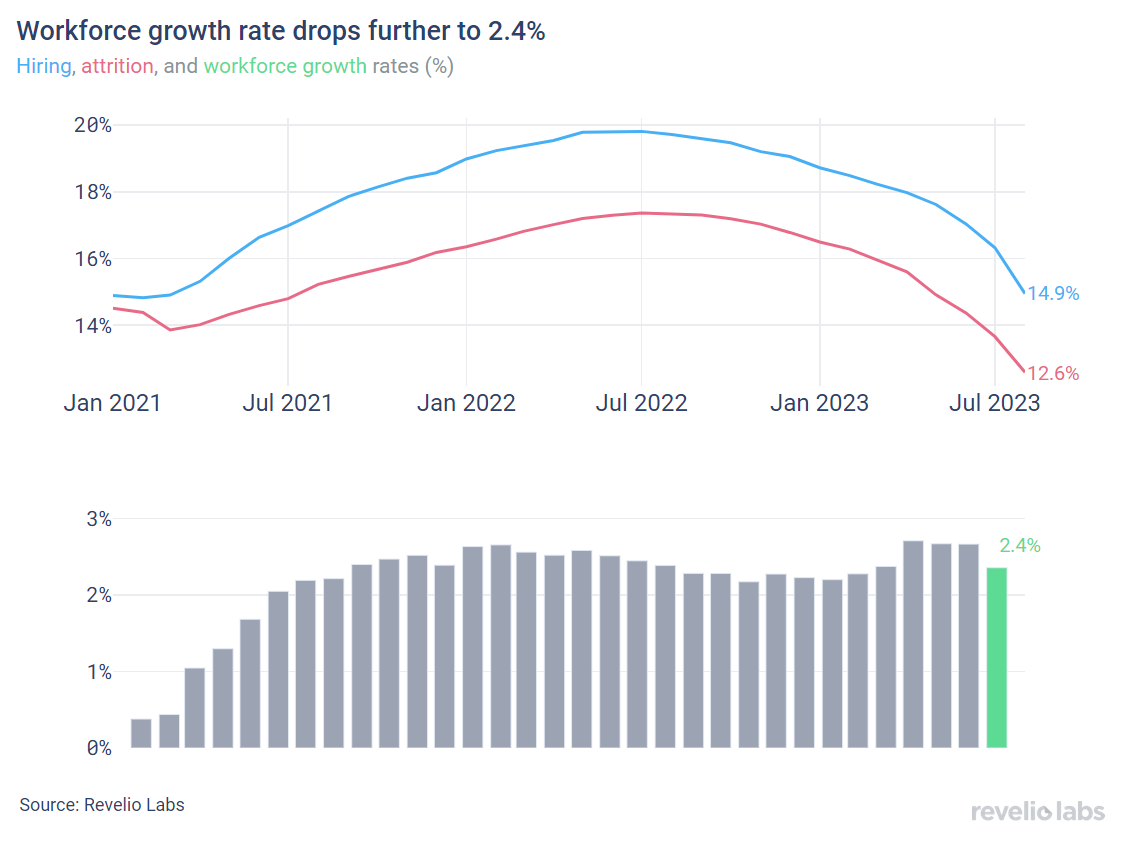

Hiring and attrition rates continue to decline

Despite the increase in nonfarm employment, Revelio Labs’ workforce data show that hiring rates have continued to decline since October 2022. In August, the hiring rate stood at 14.9% (compared to 16.3% in July). Workforce attrition rates have also continued to decelerate but at a slower pace than hiring. The combination of declining job postings and increasing time to fill jobs in the past months indicates that workers have both fewer opportunities to switch jobs and are less willing to do so. The workforce growth rate (difference between hiring and attrition rates) shrank by 0.3 percentage points m.o.m with no change on a yearly basis.

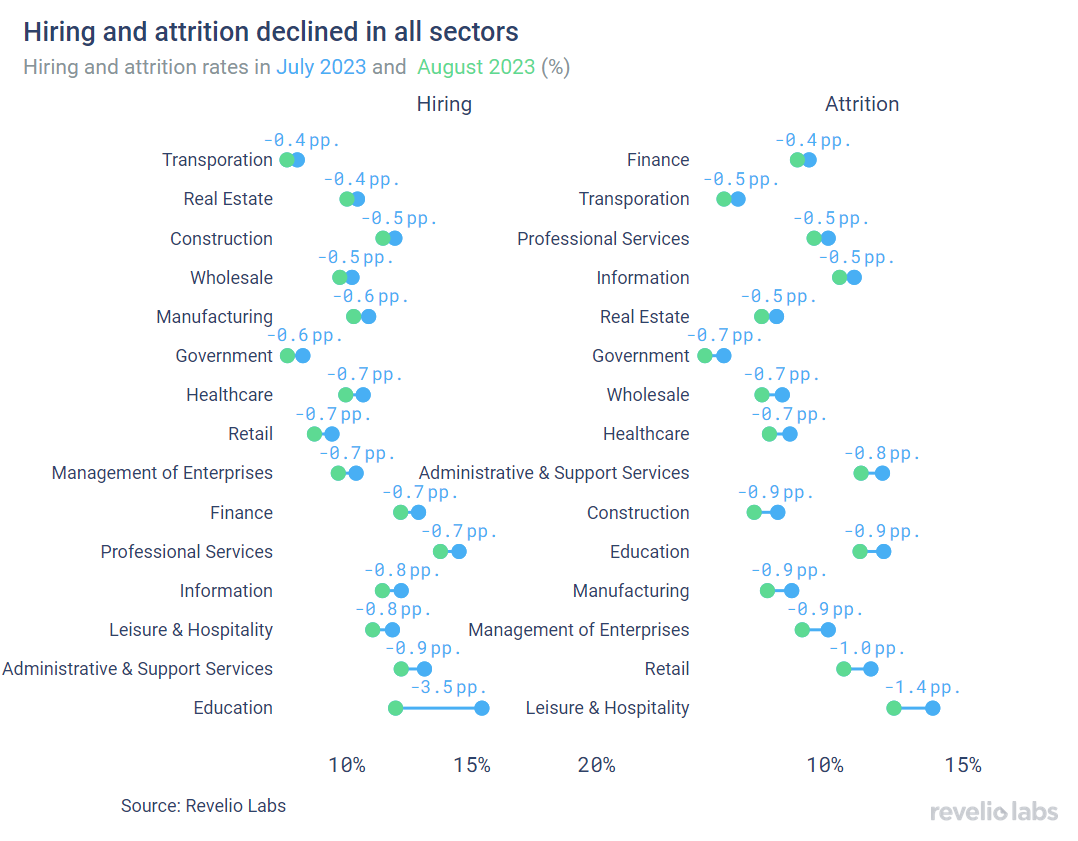

Hiring and attrition have continued to slow down in all sectors, although the degree of slowdown varies between sectors. The figure below shows the change in the hiring and attrition rates in all industries. Compared to July 2023, the Education industry experienced the largest decline in hiring (-3.5 pp), while Leisure & Hospitality recorded the largest decline in attrition.

69.4% of workers who started a new job in August have switched industries. The Retail and Education industries had the biggest increase in the share of workers transitioning from other industries.

Using Revelio Labs’ extensive data on millions of workers’ profiles in the US, we are able to track workers’ transitions between industries and occupations. Our analysis for this job report shows that 69.4% of workers who started a new job in August came from a different industry. Inflows from other industries can be interpreted as a sign of confidence in the labor market in general as well as the specific occupation or industry. The left panel of the figure below shows the change in the share of workers who started a new position in a specific industry, having transitioned from another industry, relative to July 2023. Notably, the Retail and Education industries had a substantial increase in the influx of newcomers from outside industries. In August 2023,83.8% of workers who started new jobs in the Retail sector had backgrounds in other industries, relative to 77.1% in July 2023 (+ 6.7 percentage points). In Education, 70.3% of workers who started a job in August 2023 had backgrounds in other industries, relative to 63.6% in July 2023 (+ 6.7 percentage points). The Professional Services industry experienced a decline in the share of workers joining the industry from other industries through August 2023.

The right panel of the figure below shows the difference in the share of workers who started a new job in a different role relative to June 2023. Infrastructure engineering exhibited the largest increase in the share of workers transitioning from different roles relative to July 2023, while mechanical engineering witnessed the largest decrease in the share of workers transitioning from different roles.

Job postings increased in August and they took less time to fill

The active job postings index increased in August after a continuous decline since March. Job listings increased by 3.3% compared to July; an unexpectedly large increase given the slowdown in the labor market.

The increase in job postings in August was driven by the increase in active job postings in Administrative and Support Services, which had 18.8% more job postings in August than in July. Retail comes second with 9.6% more active job postings in August. As summer is coming to an end, the Leisure Hospitality industry had the largest decrease in the number of active job postings through August, recording 8.9% less postings. The Information industry also continues the decrease in active job postings.

Demand for retail-related roles has witnessed an upsurge in August, whereby active job postings have increased for store-related occupations, such as Merchandisers, Sales Representatives, and Retail Sales. Conversely, the demand for operational roles has experienced a slowdown.

The increase in active job postings was accompanied by a decrease in the average time to fill open jobs relative to July 2023. Average days-to-fill stood at 43 days in August compared to 44.6 days in July 2023 (-1.6 days). Yet, the labor market slack has generally continued, with average days-to-fill stabilizing in the range of 41 to 45 days in the past six months compared to a peak of 49 days in January 2023.

In August 2023, architect roles had the largest increase in the time to fill compared to July (42.4%). Other roles with large increases are retail-related: time to fill roles such as retail sales and cashiers increased by 15-17% relative to July. In contrast, filling customer service roles was relatively less difficult, with a 43% decrease in the time to fill compared to July.

Layoffs continue their general upward trend

The number of employees receiving layoff notices under the WARN Act has been oscillating throughout 2023 with a general upward trend. In August, the number of employees in layoff notices was 39% lower than in July, although still 68% higher than it was in August 2022.

What are workers in America talking about this month?

By examining thousands of employee reviews during the month of August, we picked the most common words that appeared in positive and negative reviews relative to July. Employees were more positive about their flexible schedules and teams and colleagues. Employees were more negative about their work-life balance, culture, as well as their work environment and management relative to July.

Highlight of the Month: Who is handling the dirty data work for fancy machine learning models?

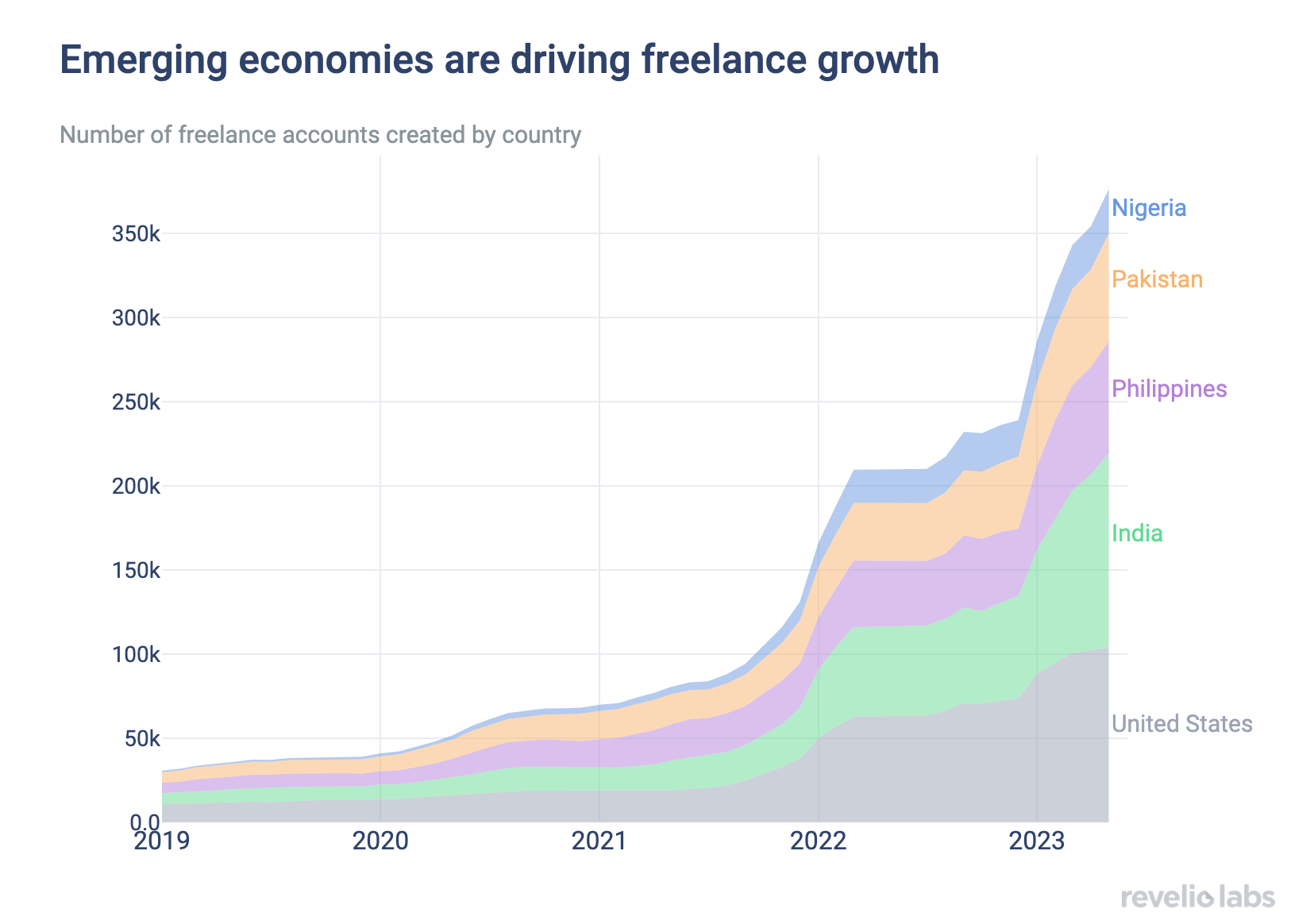

In our recent research, we analyzed the international freelancing market using data from a large gigwork platform. Freelancers from India, the Philippines, Pakistan, and Nigeria are leading the expansion of the global freelance community, with a large fraction of these freelancers specializing in data entry and labeling. The average wage of data entry freelancers in these countries is notably lower than in the US. Filipino freelancers offer data entry work at a third of the price compared to Americans. As a result, three times as many data entry freelancing jobs are being done in the Philippines relative to the US. The total revenue generated from data entry work is close to 2 billion US dollars in the Philippines.

Conclusion

Our read of the latest jobs report, along with insights from our job report, points to stronger signals of soft landing in the US economy. With a slightly higher unemployment rate that is driven by higher labor force participation rates, and job growth that aligns with expectations, the labor market seems to be cooling down at a healthy rate. The slower hiring and attrition we observe in our data are to be expected given the decline in the demand for workers in response to interest rate hikes. Looking further into the future, we find the sizable increase in job postings in August quite interesting, although this increase in job postings does not necessarily indicate a real increase in the demand for workers.

Please view our data and methodology for this job report here and our recent research on the international freelancing market here