It’s Hot Then It’s Cold. May’s Job Market Sends Mixed Signals

A deeper dive into the workforce

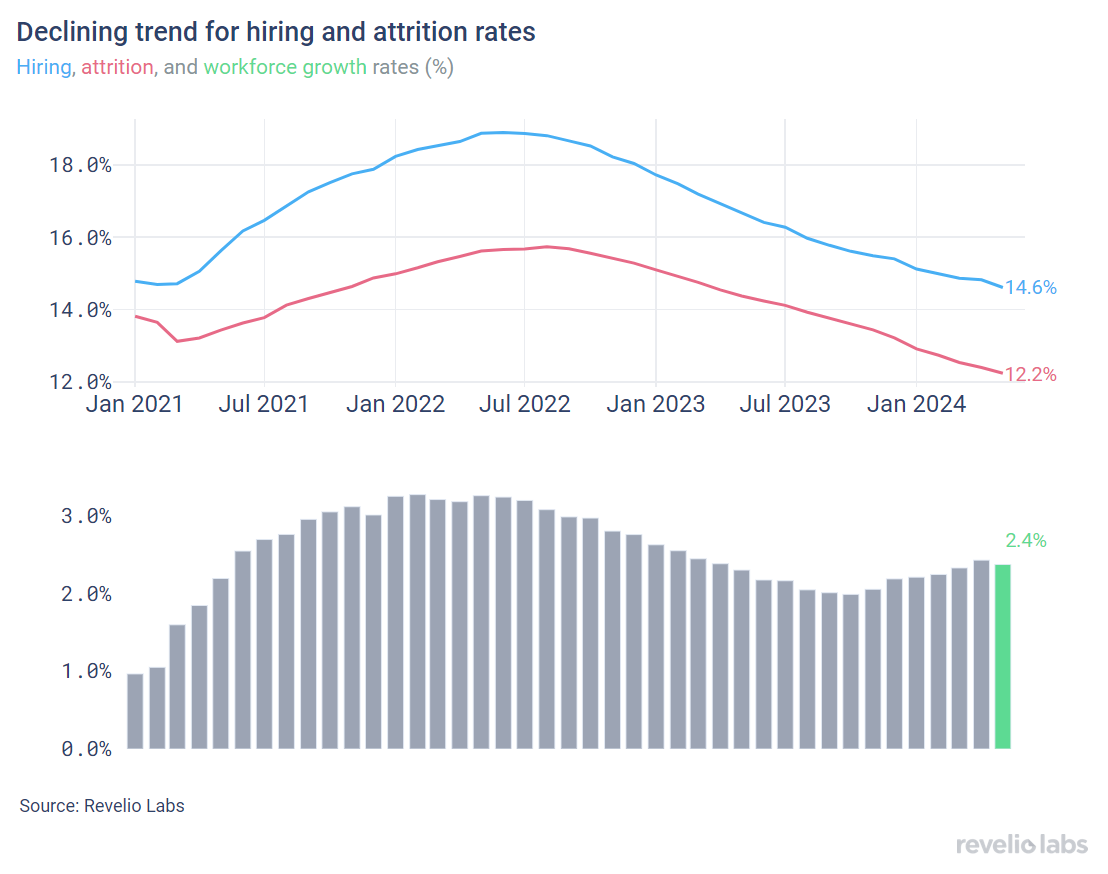

⬇️ 2.4% workforce growth rate in May 2024; slightly lower than the growth rate observed in April. The positive workforce growth rate comes amid the declining hiring, and the still rapidly declining attrition rate.

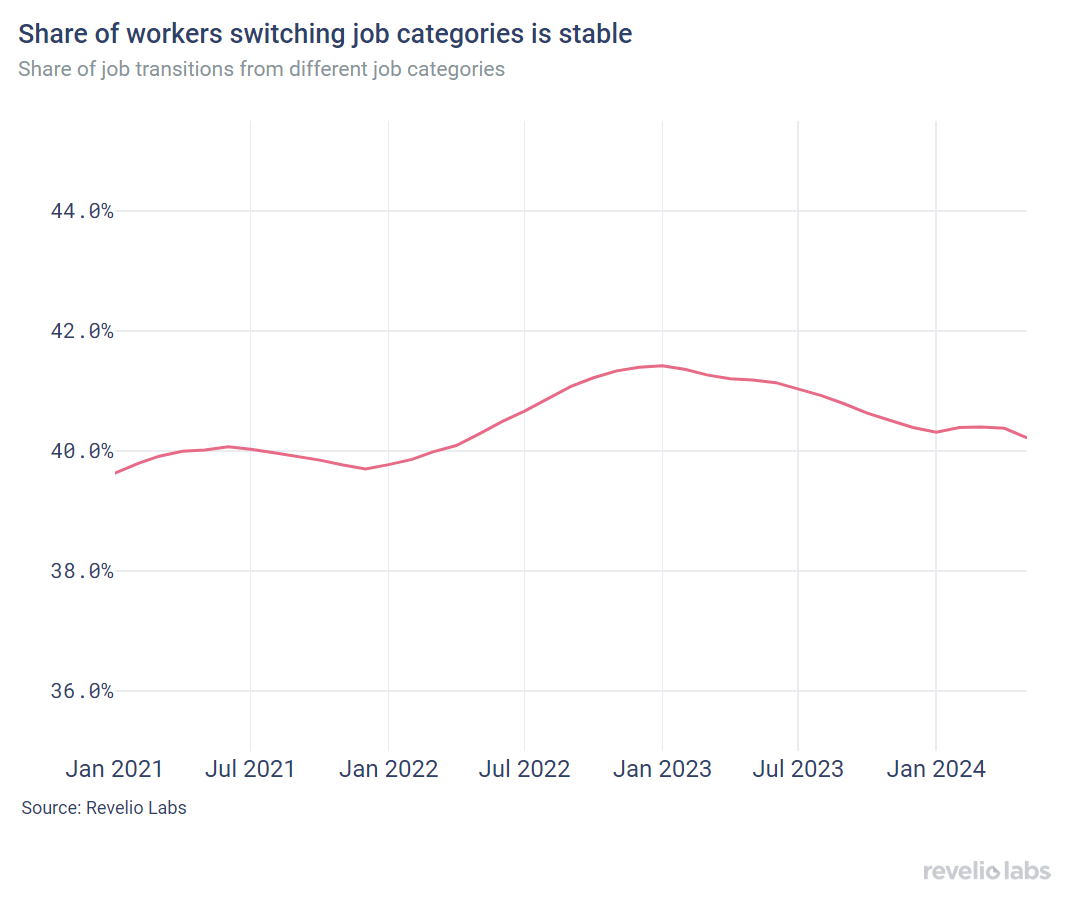

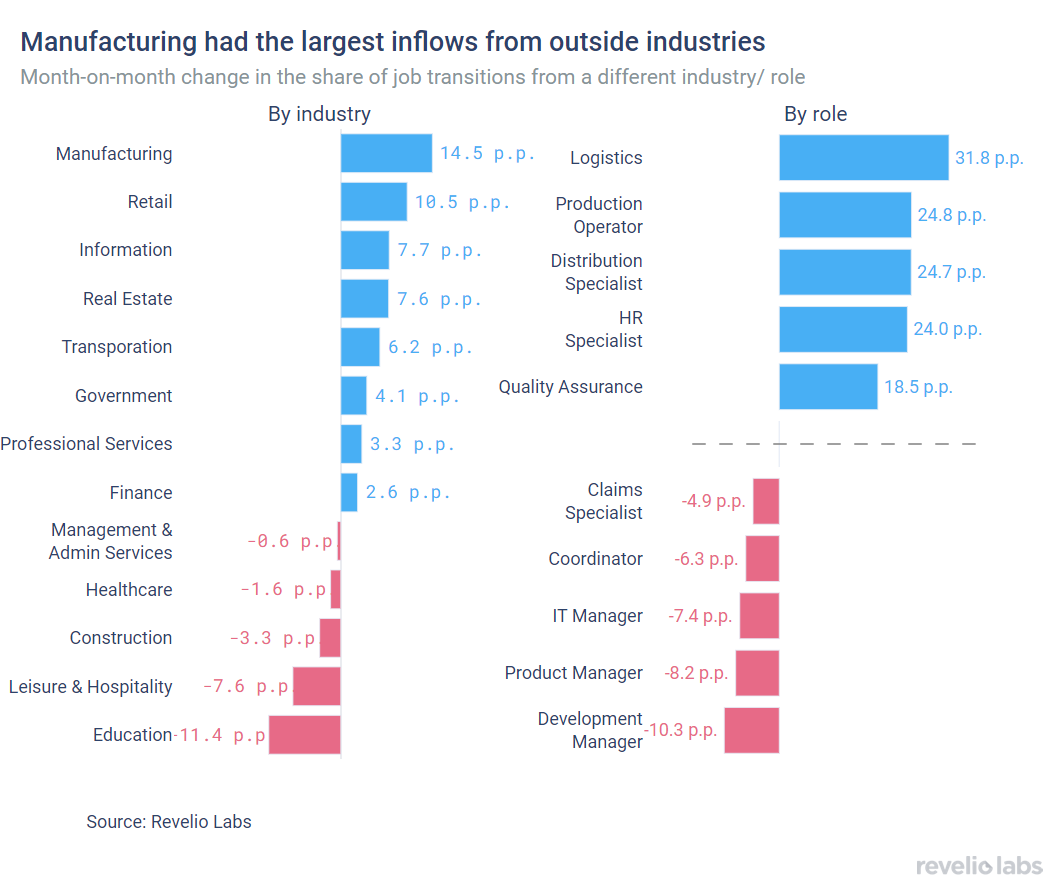

⬆️ 43% of workers who started a new job in May transitioned to a new role and 69.4% transitioned to a new industry. Manufacturing had the largest increase in the share of workers coming from other industries.

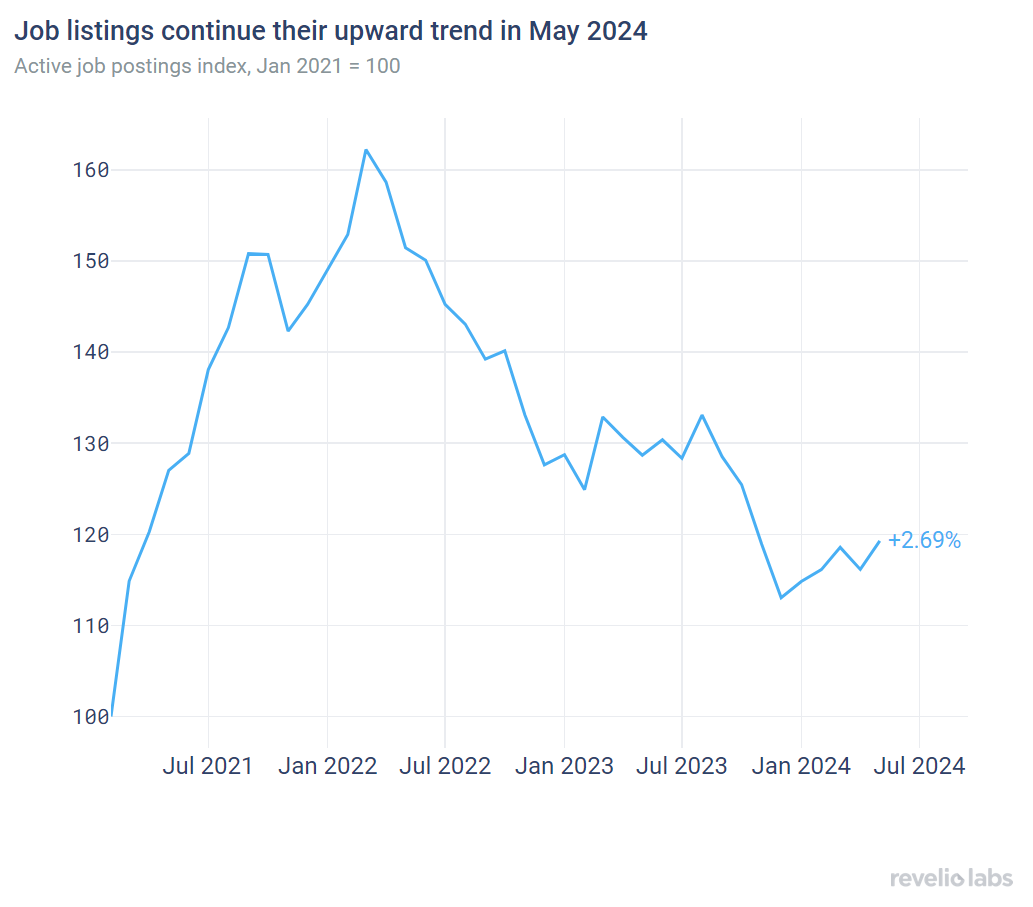

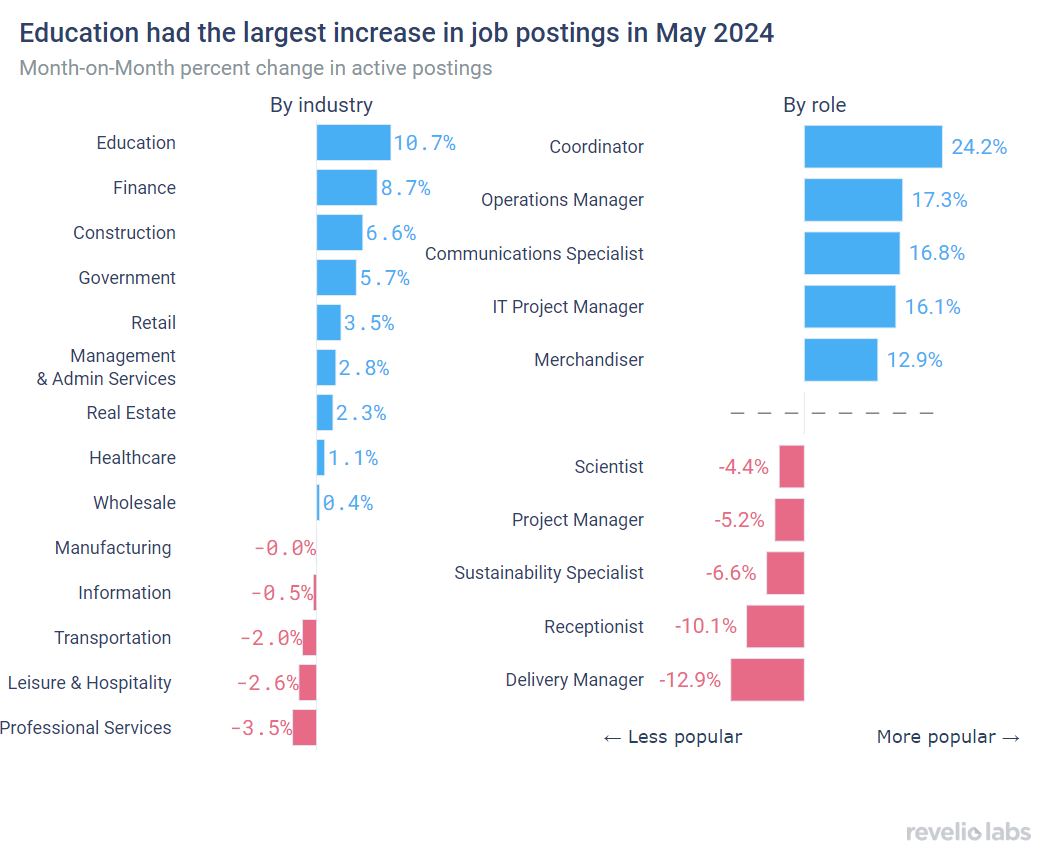

⬇️ 2.7% increase in active job listings in May from April. The Education sector had the largest increase in the demand for workers (11% increase in active listings in May), while Professional services had the largest decline in active job postings (-3% decline in May).

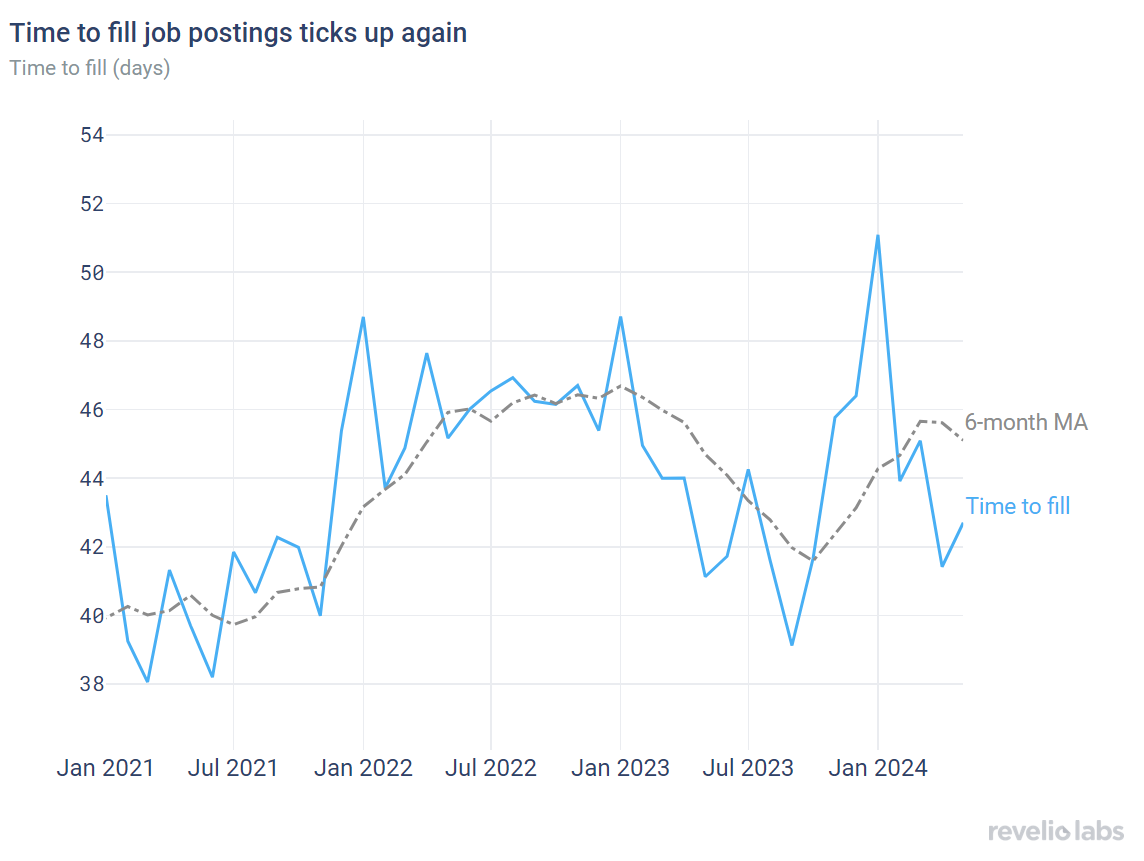

⬆️ 42.9 days to fill job openings in May. This is 1.5 days more than in April and 1.8 days more than in May 2023.

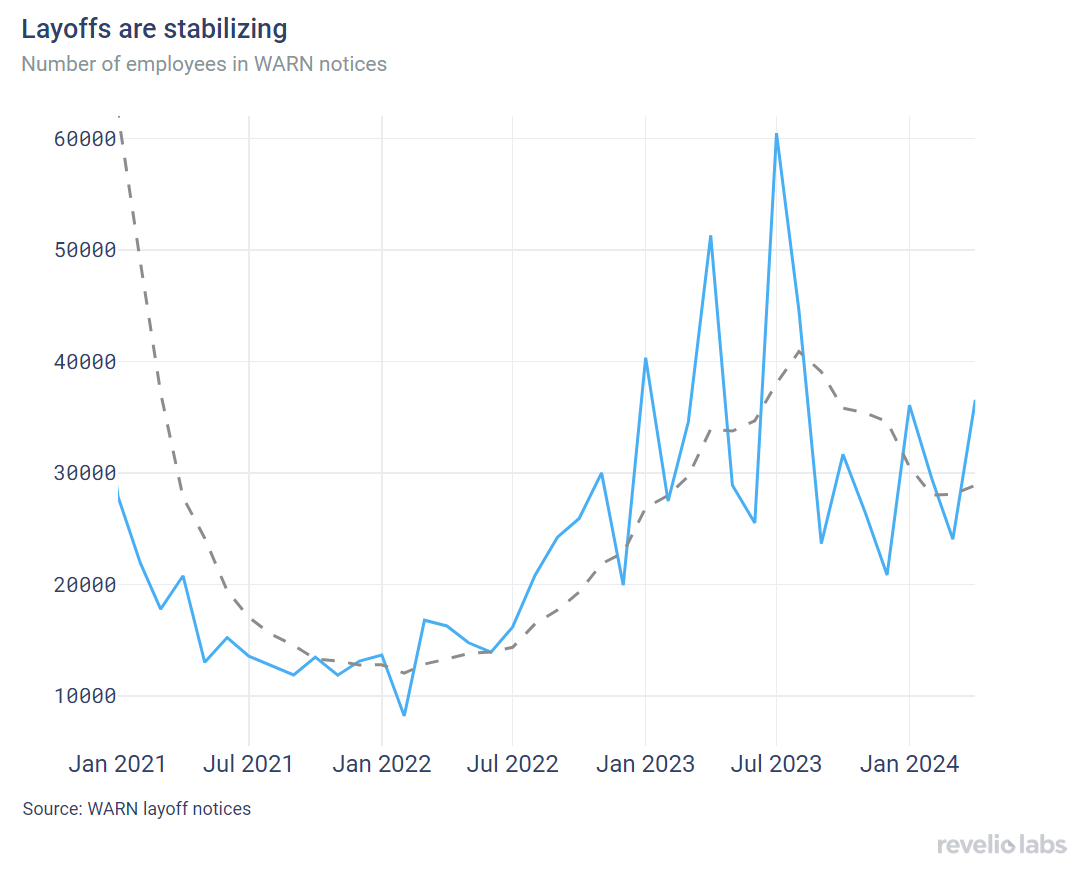

⬇️ 5.8% decrease in the number of employees notified of layoffs under the WARN Act compared to April 2024.

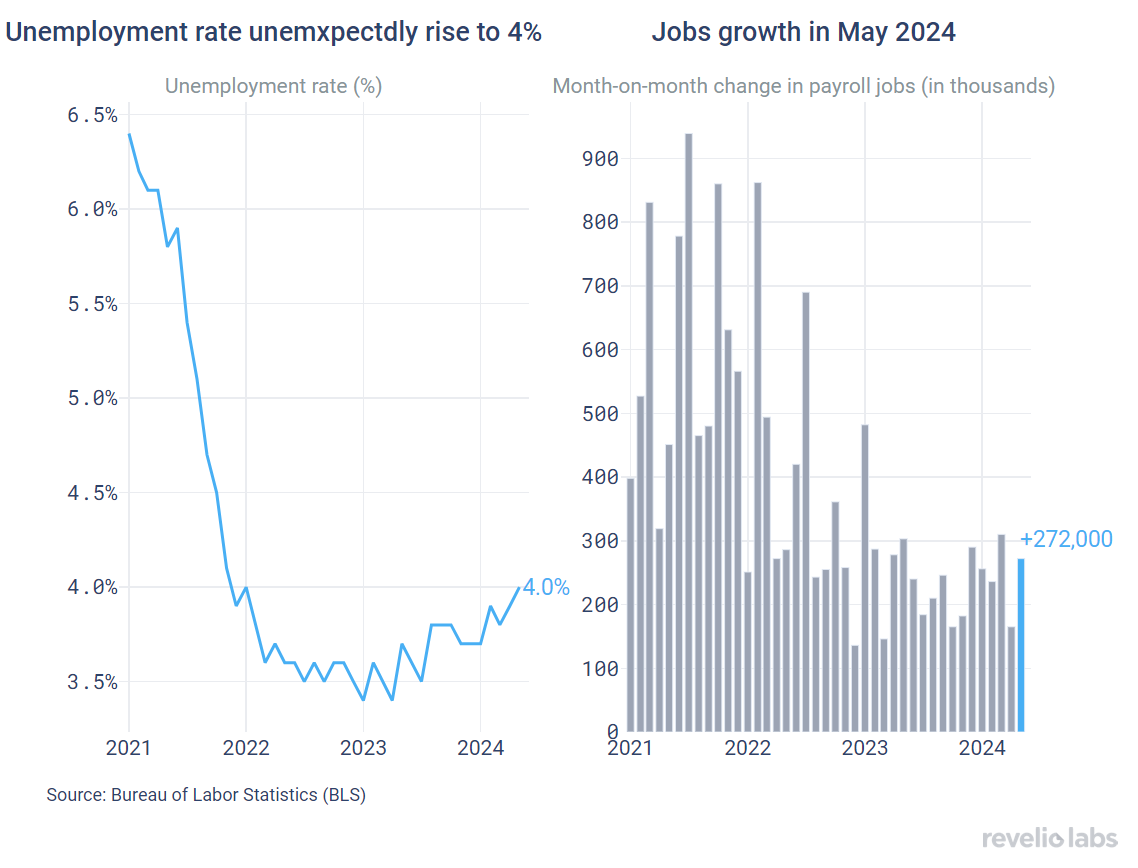

Mixed signals in May’s jobs report: Strong job growth, but unemployment is slightly up

The unemployment rate unexpectedly rose to 4%, although the economy added 272,000 jobs in May; higher than expected. Employment gains continue to be dominated by the Healthcare sector, which have been the main driver for job gains in the past few months, followed by Leisure & Hospitality as the summer approaches.

What does the granular workforce data from Revelio Labs have to say about the labor market, and what do they signal about the labor market in the near future? Read the rest of our job report to find out.

Hiring and attrition continue their declining trend

Revelio Labs’ workforce intelligence data show that hiring and attrition rates have continued their declining trend, with attrition declining at a much faster rate, leading to an increase in the growth rate of the workforce. The hiring rate stood at 14.6% (decreasing only slightly from the 14.8% hiring rate recorded in April). Meanwhile, the attrition rate stood at 12.2% (slightly lower than the rate of 12.4% recorded in April). The workforce growth rate (difference between hiring and attrition rates) stood at 2.4% (higher than the growth rate in April on a m.o.m basis).

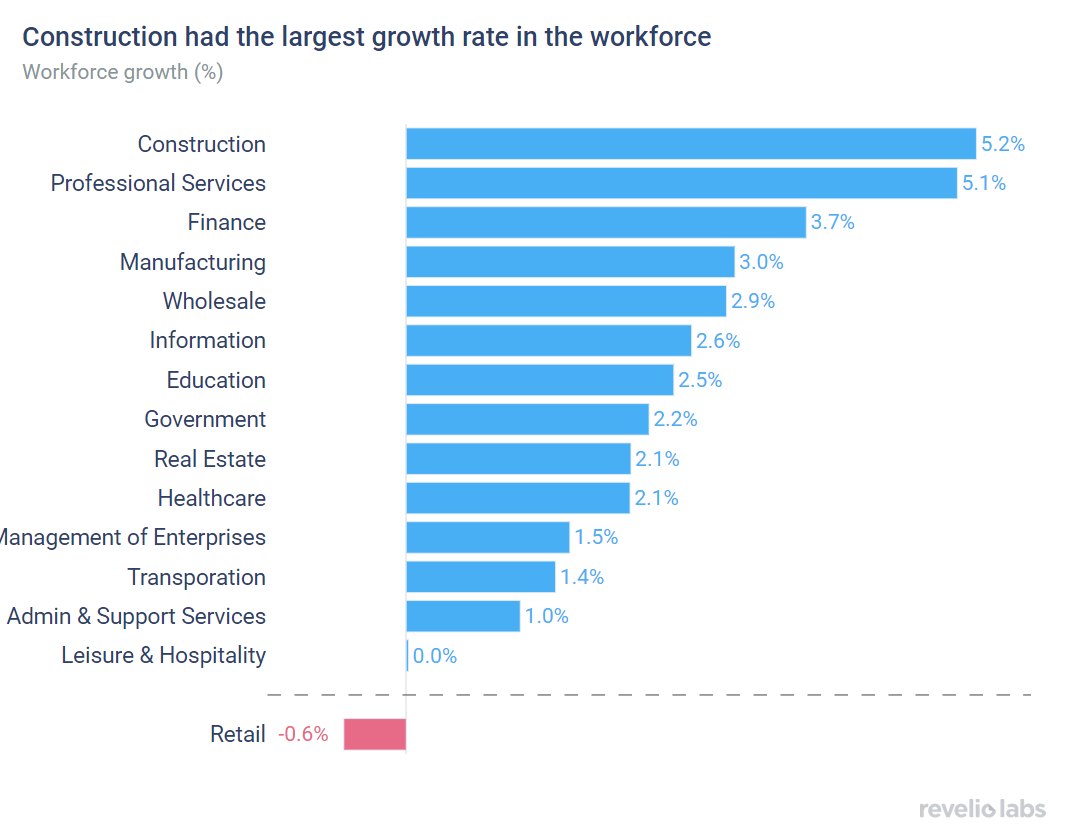

Sectoral hiring and attrition changed slightly from April. Overall, most sectors saw an increase in the growth rate compared to the growth rate in April, with the Construction sector continuing to lead the pack. Construction recorded the highest workforce growth rate (5.2% workforce growth in April compared to 5.7% in March). The exception to the workforce growth is in the Retail sector that saw a decline in the workforce (Retail saw a growth rate of -0.6% in April).

Of those who started a new job in May, 43% have transitioned to different roles and 69.4% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 43% of workers who started a new job in May did so by switching their broad job categories; higher than the rate of 38.1% observed in April. Furthermore, 69.4% of workers who started a new job in May started jobs in different industries - up from the rate in April (67.1%).

The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to April 2024. The Manufacturing sector saw a notable increase in the influx of workers from other industries. 80.9% of workers who started a job in Manufacturing in May came from other industries (+14.5 percentage points from the share in April). In contrast, the Education sector experienced the largest decline in the share of workers joining the industry from other industries. 64.1% of workers who started a job in transportation in May had backgrounds in other industries, relative to 75.4% in April 2024 (an 11.4 percentage-point decrease).

The right panel shows the difference in the share of workers who started a new job in a different role relative to April 2024. Technical roles, such as logistics and operations exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while management roles, such as development manager, product manager, and IT manager witnessed the largest decline.

Job postings continue their upward trend

The active job postings index ticked up to continue the upward trend that started in late 2023, after decreasing slightly in last month. Job listings increased by slightly by 2.6% compared to the previous month. New job listings increased by almost 7% month-on-month, while removed job postings also decreased by 15% from their level in April.

The increase in job postings reflects a widespread increase in postings in many sectors, with the Education sector experiencing the largest increase (11% decline in the number of active job listings in May compared to April). Surprisingly, Leisure & Hospitality experienced the largest decline in active job listings (3.2% decrease in active postings compared to April 2024). Operations roles saw the largest increase in active job postings in May, while delivery management jobs saw a notable decline.

The days-to-fill for open listings ticked up slightly in May. Overall, average days-to-fill open positions have started to decline slightly in the past couple of months. Average days-to-fill stood at 43 days in May, up from 41.5 days in April (-1.5 days). The general increase in the number of days required to fill open job postings over the Fall and Winter quarters signals a move back towards a tightening labor market.

Layoffs are stabilizing

The number of employees receiving layoff notices under the WARN Act slightly increased slightly in May, stabilizing the downward trend in the number of employees notified of layoffs since the beginning of 2024. The number of layoffs remains elevated compared to 2022.

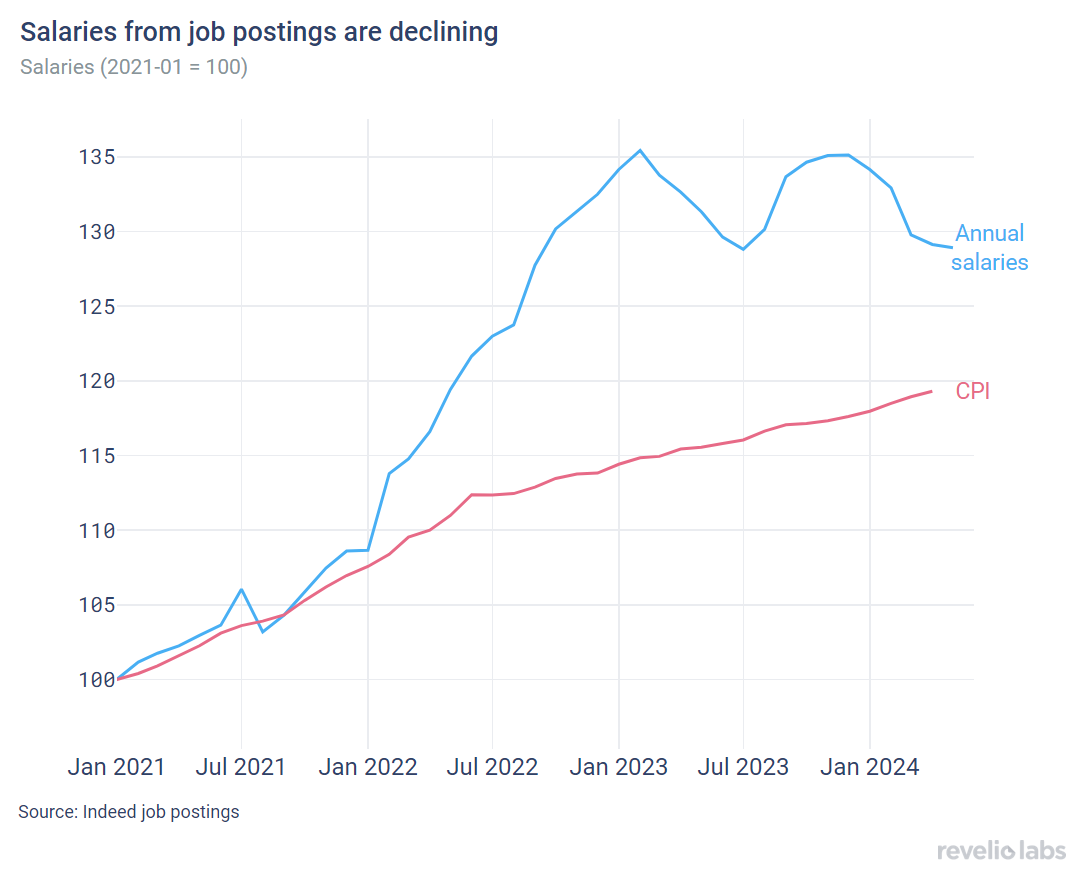

Quarterly highlight: Salaries in job listings

Our analysis of advertised salaries in job postings serves as a leading indicator for economic trends. This data provides insights into employer compensation strategies and anticipated inflationary pressures, unlike reported wage data which reflects past trends. Since mid-2022, annual salary ranges in job postings have exhibited a downward trajectory. This decline continued in the first quarter of 2024, albeit at a slower pace compared to the January-March 2024 period. While the declining advertised salary trend suggests a loosening labor market, the rate of decline appears to be moderating.

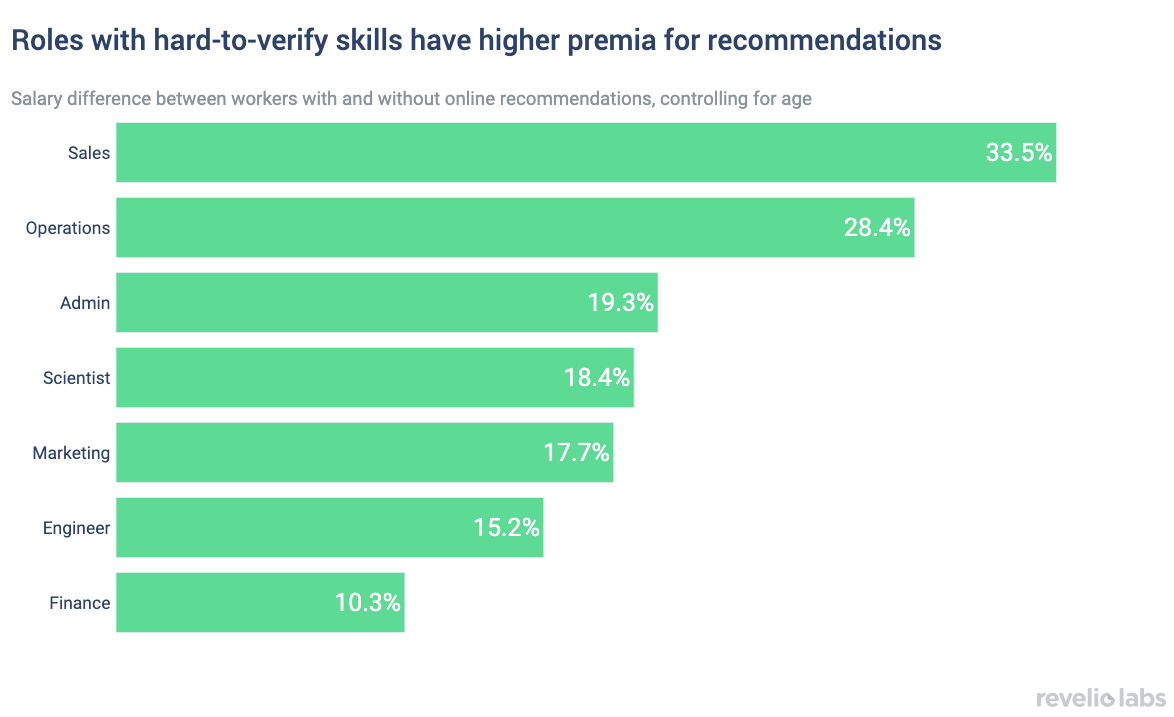

Highlight of the month: The returns to professional recommendations

Our recent research highlights the value of public recommendations for employees: Those with recommendations written by colleagues or previous bosses on their professional profiles tend to earn higher salaries, with the biggest premium benign for roles in Sales and Operations. These occupations often require soft skills like customer relationship management and interpersonal skills, which are difficult to assess through traditional methods. Coding tests effectively evaluate technical skills in engineers, unlike the complexities of soft skills. This highlights the value of recommendations – a form of "word-of-mouth" – for employers seeking candidates who excel in soft skills. Analyzing millions of recommendations, we found successful salespeople are praised for interpersonal and communication strengths like being "strategic," "professional," "driven," and "focused." Conversely, engineers are lauded for their technical expertise, with terms like "analytical," "knowledgeable," and "skilled" frequently used.

Conclusion

After one month of below-expectations jobs reports, the economy is back to exceeding expectations. In May, the economy added more jobs than expected, but the unemployment rate unexpectedly rose to 4%. Is the stronger-than-expected hiring a sign of the economy heating up again as summer starts? Probably not: The strong growth in jobs seems to be a May heatwave. The hiring rate continues to decline. In addition, the household survey actually showed a 408,000 decline in employment. What is also interesting to observe is the declining attrition rate, despite the increase in job postings across all sectors since the beginning of the year, and the slackening labor market, proxied by the declining time to fill active postings. The continued decline in hiring and attrition and the stable job opening rate signal a continuation of the Great Leveling-Off through the Summer.

Please view our data and methodology for this job report here and our recent research on professional recommendations here.