Workforce Digest: Is the Job Market Converging to a New Normal?

A deeper dive into the workforce

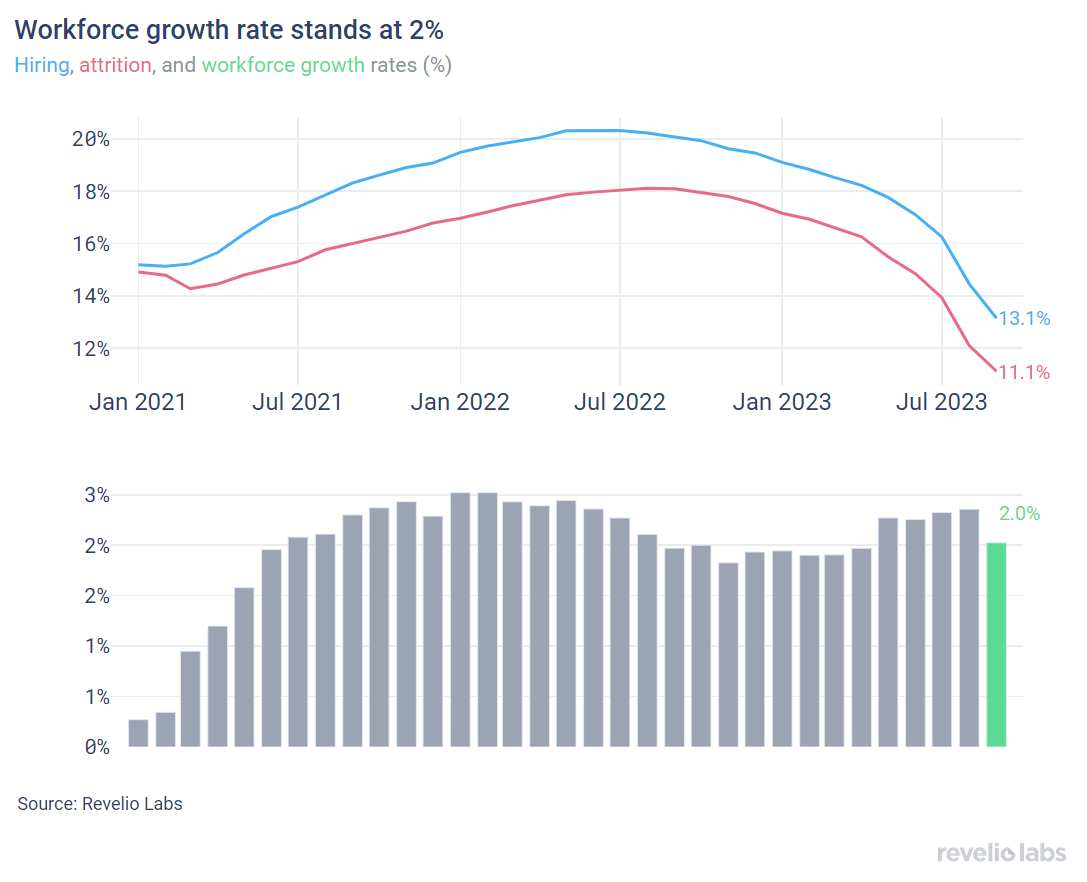

⬇️ 2% workforce growth rate in September 2023. This is lower than in August (2.4%). The decrease in the growth rate is a combination of a decline in the attrition rate and a larger decline in the hiring rate.

⬆️ 42.3% of workers who started a new job in September transitioned to a new role and 68.9% transitioned to a new industry. Education had the largest increase in the share of workers coming from other industries.

⬇️ 4.4% decrease in active job listings from July. Demand for workers decreased across all industries and most roles.

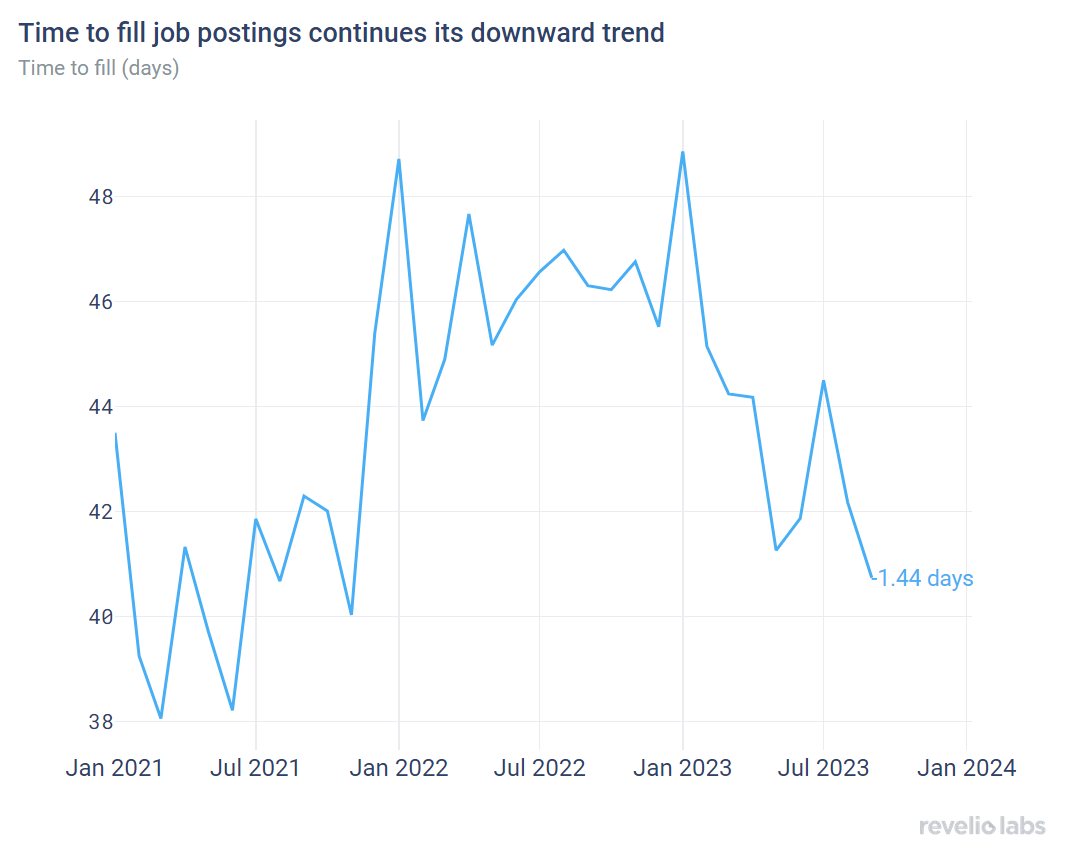

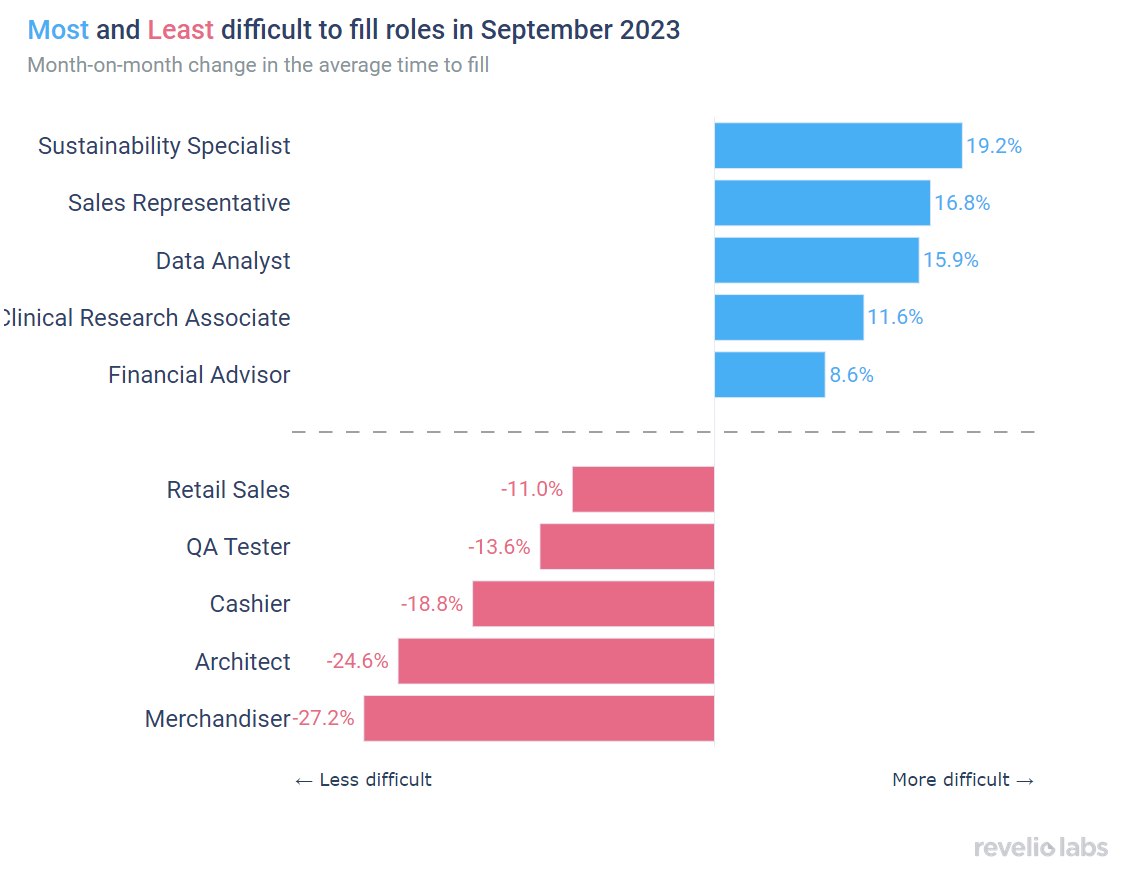

⬇️ 40.7 days to fill job openings. This is 3.8 days fewer than in August 2023 and 5.6 days fewer than in August 2022. Retail-related roles were the hardest to fill in September.

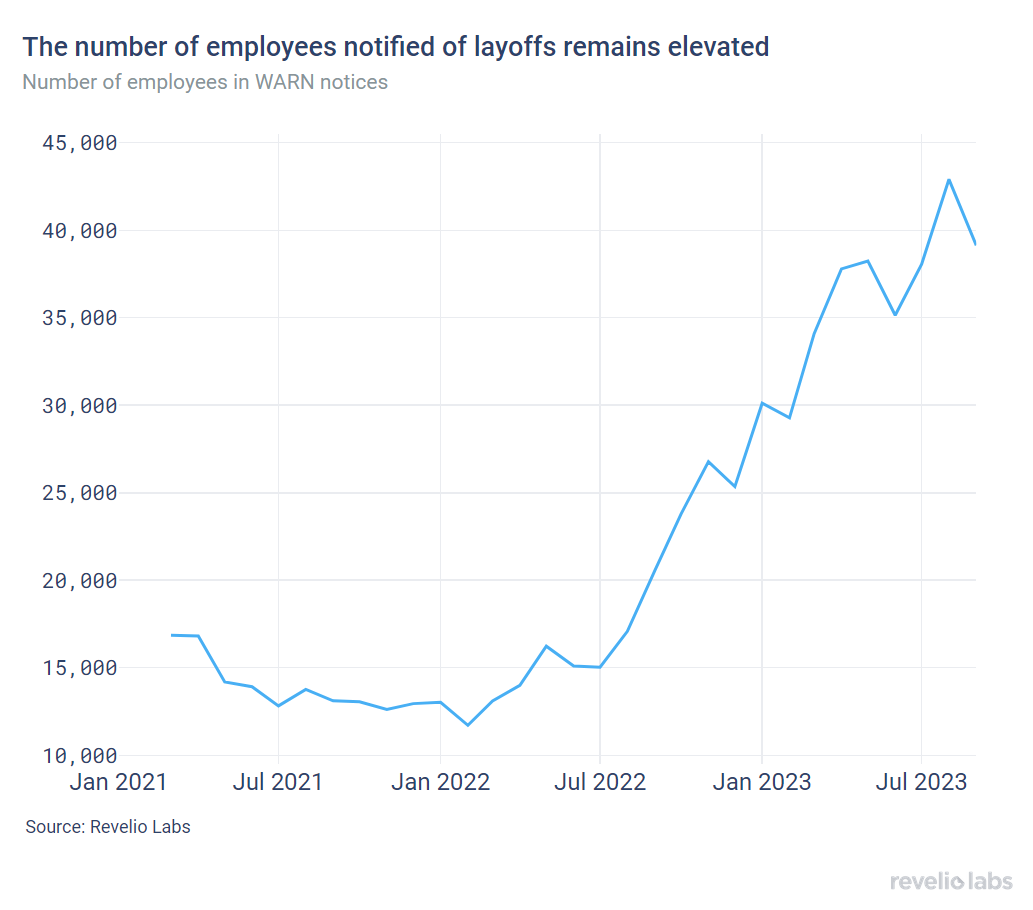

⬇️ 8.8% decrease in the number of employees notified of layoffs under the WARN Act compared to August 2023.

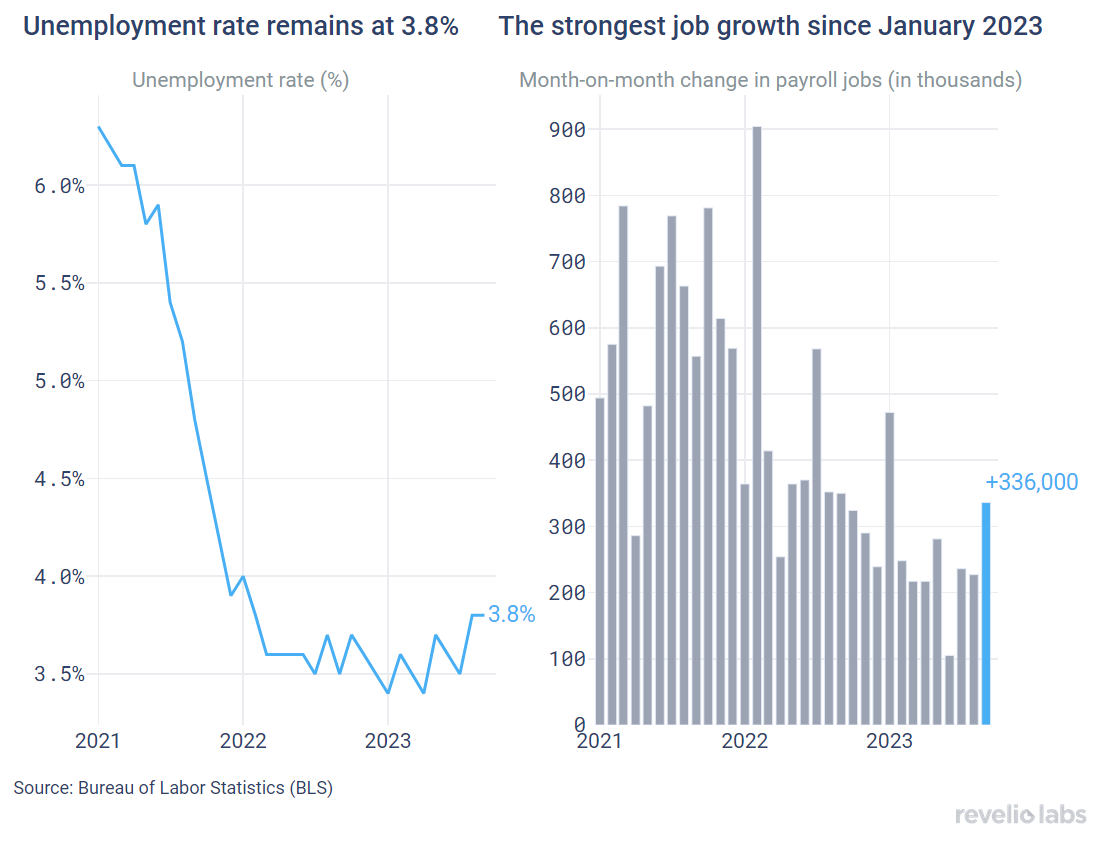

October's Jobs Report brings in some solid news

The US economy added 336,000 jobs in September, the highest gain in payroll since January 2023. All industries recorded job gains in September with growth continuing to be driven by the Leisure and Hospitality and Government sectors. The unemployment and labor force participation rates remained constant at 3.8% and 62.8%.

What does the granular workforce data from Revelio Labs have to say about the labor market, and what do they signal about the labor market in the near future? Read the rest of our job report to find out.

Hiring and attrition rates continue their declining trend

Despite the increase in nonfarm employment, Revelio Labs’ data show that hiring rates have continued to decline through September. In September, the hiring rate stood at 13.1% (compared to 14.5% in August). Attrition rates have also continued to decelerate but at a slower pace than hiring. In September, the workforce attrition rate stood at 11.1% (compared to 12.1% in August). The workforce growth rate (difference between hiring and attrition rates) stood at 2% (0.4 percentage points less than in August on a m.o.m basis).

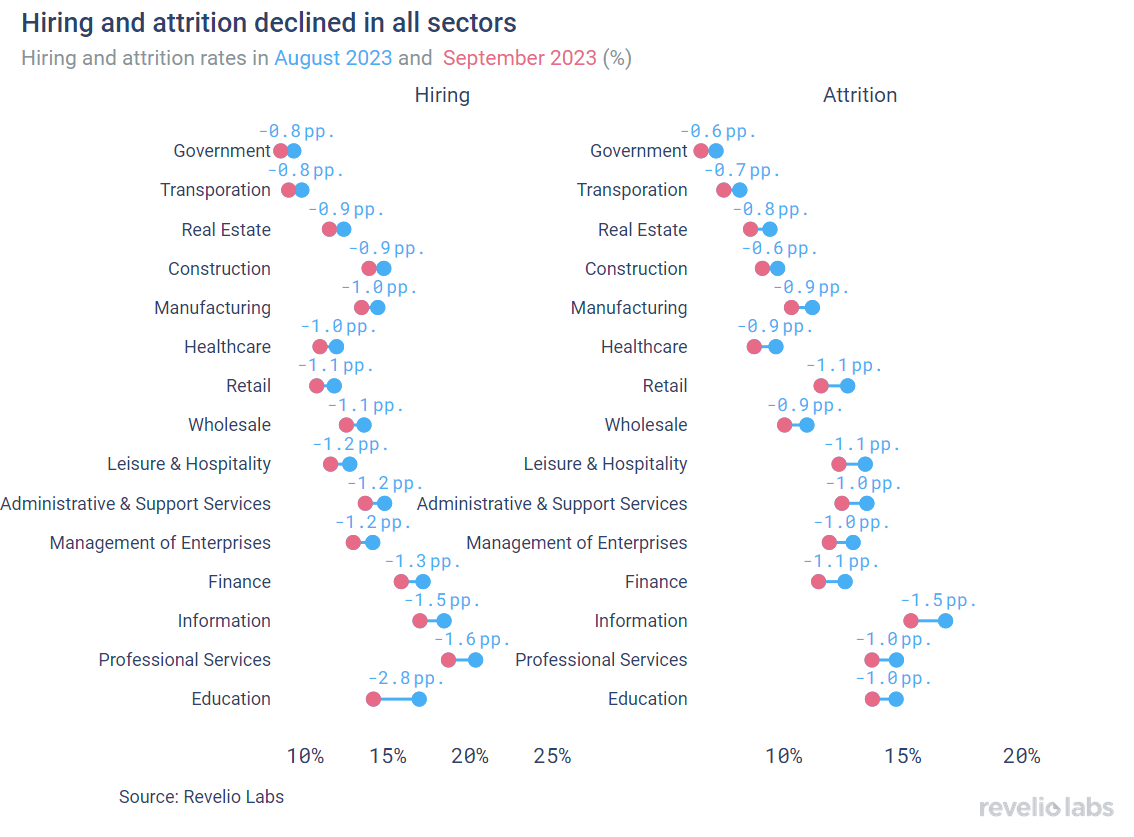

Hiring and attrition have continued to slow down in all sectors, although the degree of slowdown varies across sectors. Compared to August 2023, the Education sector experienced the largest decline in hiring (-2.8 pp), while the government sector had the smallest decline in hiring. The information sector had the largest decline in attrition relative to August (-1.5 pp).

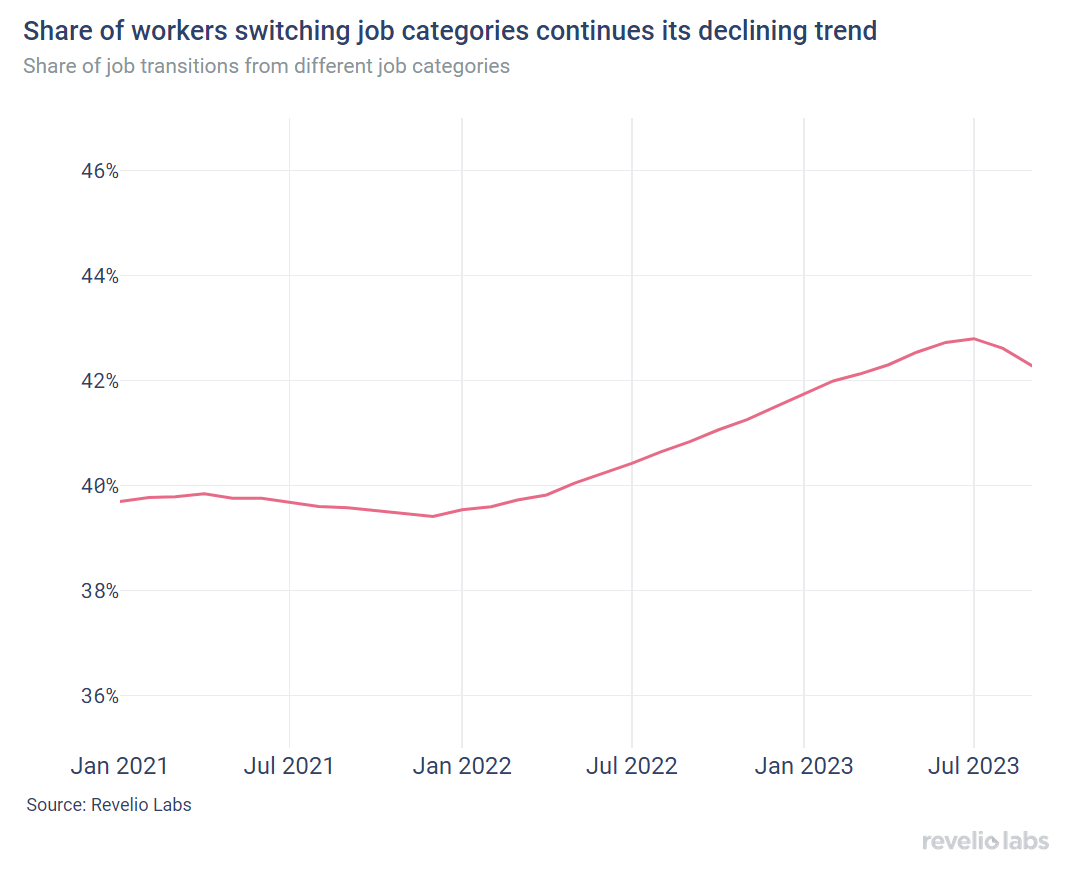

Of those who started a new job in September, 42.3% have transitioned to different roles and 69.9% have switched industries. The decline in mobility signals less confidence in the labor market.

Using Revelio Labs extensive workforce data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 42.3% of workers who started a new job in September, did so by also switching their broad job categories. This is less than the 42.6% job category switch rate observed in August. Furthermore, 69.9% of workers who started a new job in September, found their jobs in different industries. Inflows from other industries can be interpreted as a sign of confidence in the labor market. The consistent decline in the rate of switching industries and job categories signals weaker opportunities for participants in the labor market since the beginning of 2023.

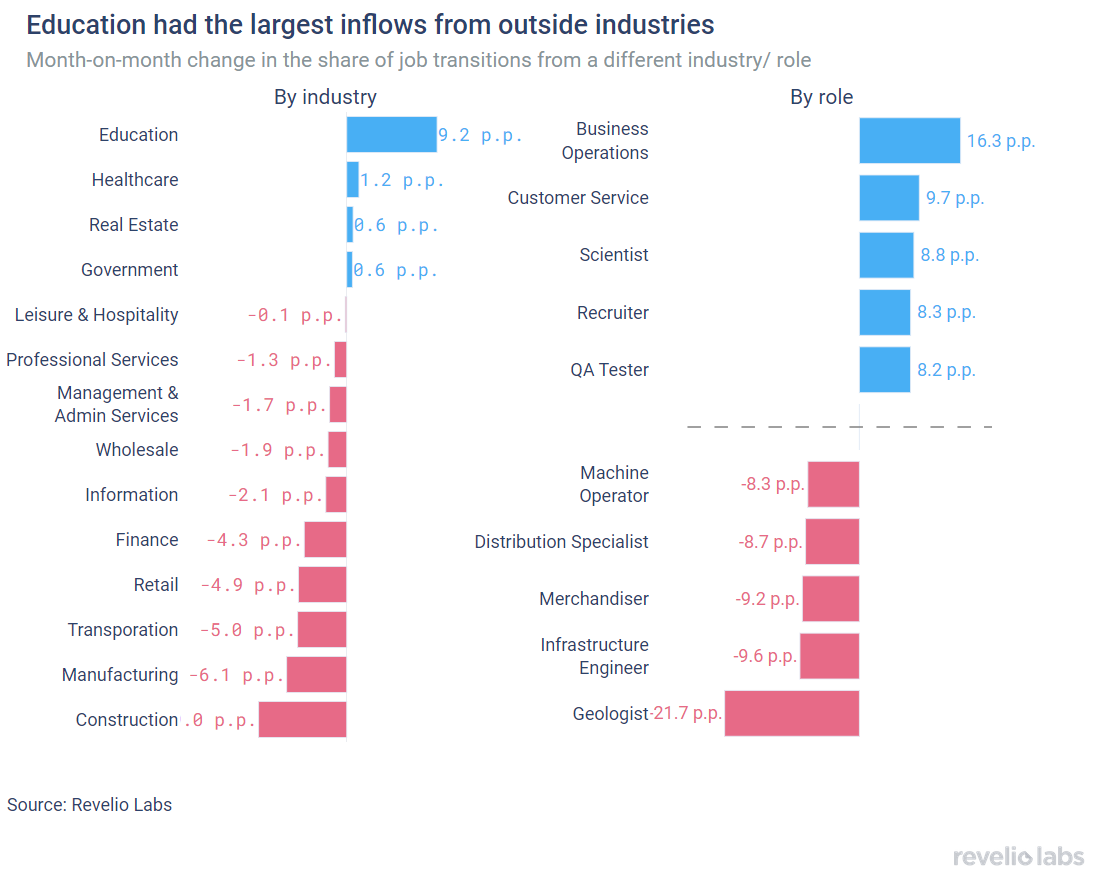

The left panel shows the difference in the share of workers who started working in an industry different to the industry they left, relative to July 2023. Notably, Education had a substantial increase in the influx of newcomers from other industries. In September 2023, 79.5% of workers who started a job in Education had backgrounds in other industries, relative to 70.3% in August 2023 (+ 9.2 percentage points). This is unsurprising as September is the start of the school year, where many teachers and full time students are starting their jobs in education. The Construction industry experienced a decline in the share of workers joining the industry from other industries through August 2023.

The right panel in the figure below shows the difference in the share of workers who started a new job in a different role relative to August 2023. Business Operations exhibited the largest increase in the share of workers transitioning from different roles relative to August 2023, while Geology witnessed the largest decline.

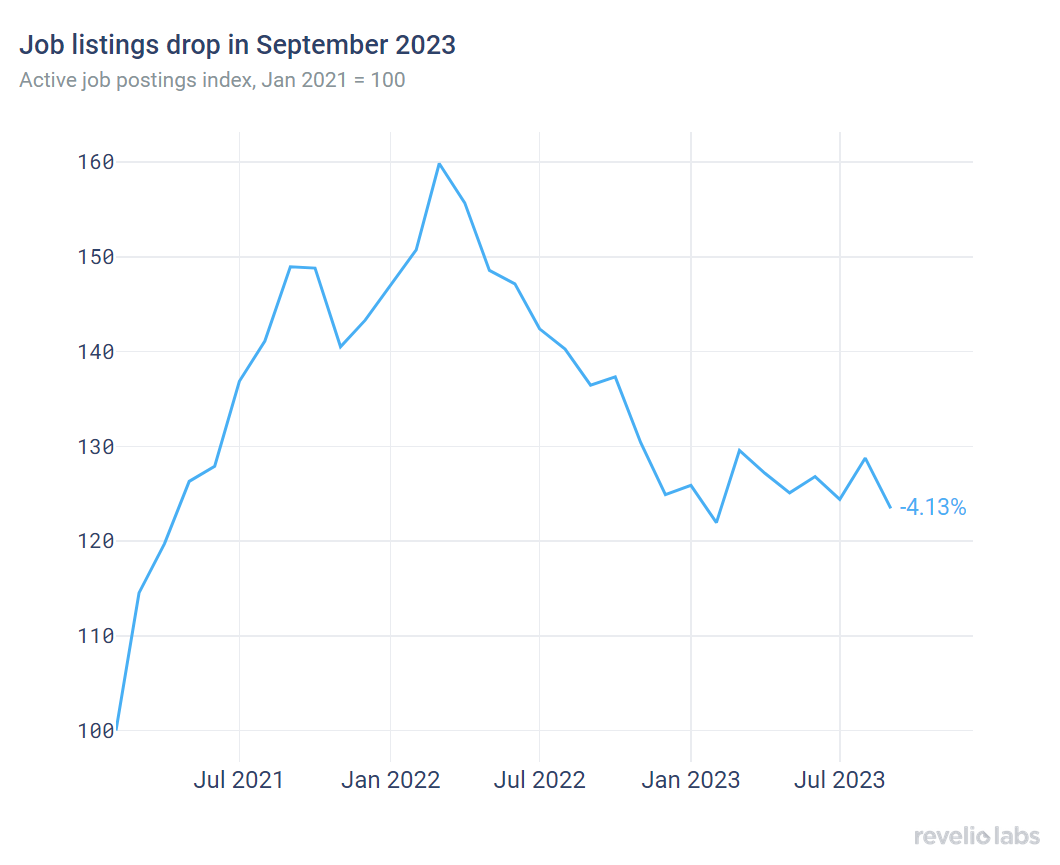

Job postings decreased notably in September and the time-to-fill continues to decrease

The active job postings index decreased substantially in September, following a consistent downward trend since March. Job listings saw a 4.4% decrease compared to August, bringing the index back to the July level. The decline in active job listings for September was attributed to a decrease in new job postings across most industries.

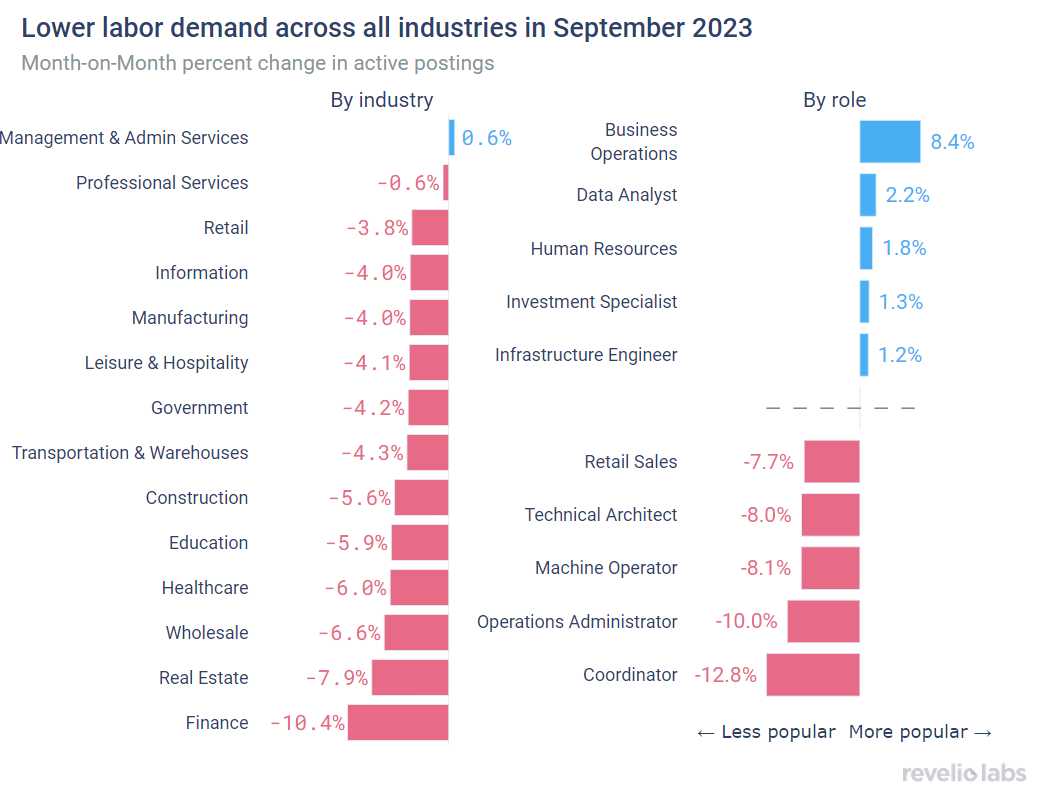

The substantial decline in job listings during September suggests a widespread reduction in workforce demand in different industries. Across the board, there was a decrease in active job postings, except for the Management and Administrative Support Services industry, which experienced a modest uptick in job listings for the month. The Finance sector saw the most significant reduction in active job postings, with a decline of 10.4% during September.

After an upsurge in August, demand for retail roles decreased in September, along with the demand for most other roles. Few roles had weakly higher demand in September. The only role that had an upsurge in demand in August was Business Operations.

The time-to-fill open listings continued its downward trend as the labor market continues to slacken. Average days-to-fill stood at 40.7 days in September compared to 44.5 days in August 2023 (-3.8 days).

In September 2023, sustainability roles had the largest increase in the time-to-fill compared to August (19.2%). Other roles with large increases in time-to-fill include sales representatives and data analysis roles. In contrast, filling retail roles was relatively less difficult, with a 27% decrease in the time to fill compared to August.

Layoffs decreased in September despite remaining highly elevated

The number of employees receiving layoff notices under the WARN Act remains highly elevated, despite decreasing in September. After a notable decrease in layoffs in July and August, the month of September saw a large decline. Yet, the number of layoffs remains highly elevated compared to the beginning of the year and to the Fall of 2022.

What are workers in America talking about this month?

By examining thousands of employee reviews during the month of September, we picked the most common topics that appeared in positive and negative reviews relative to August. While in August employees were more positive about their flexible schedules, last month they were positive about their coworkers and the company staff. Employees were more negative about their hours and about communication. They also remain disappointed with management.

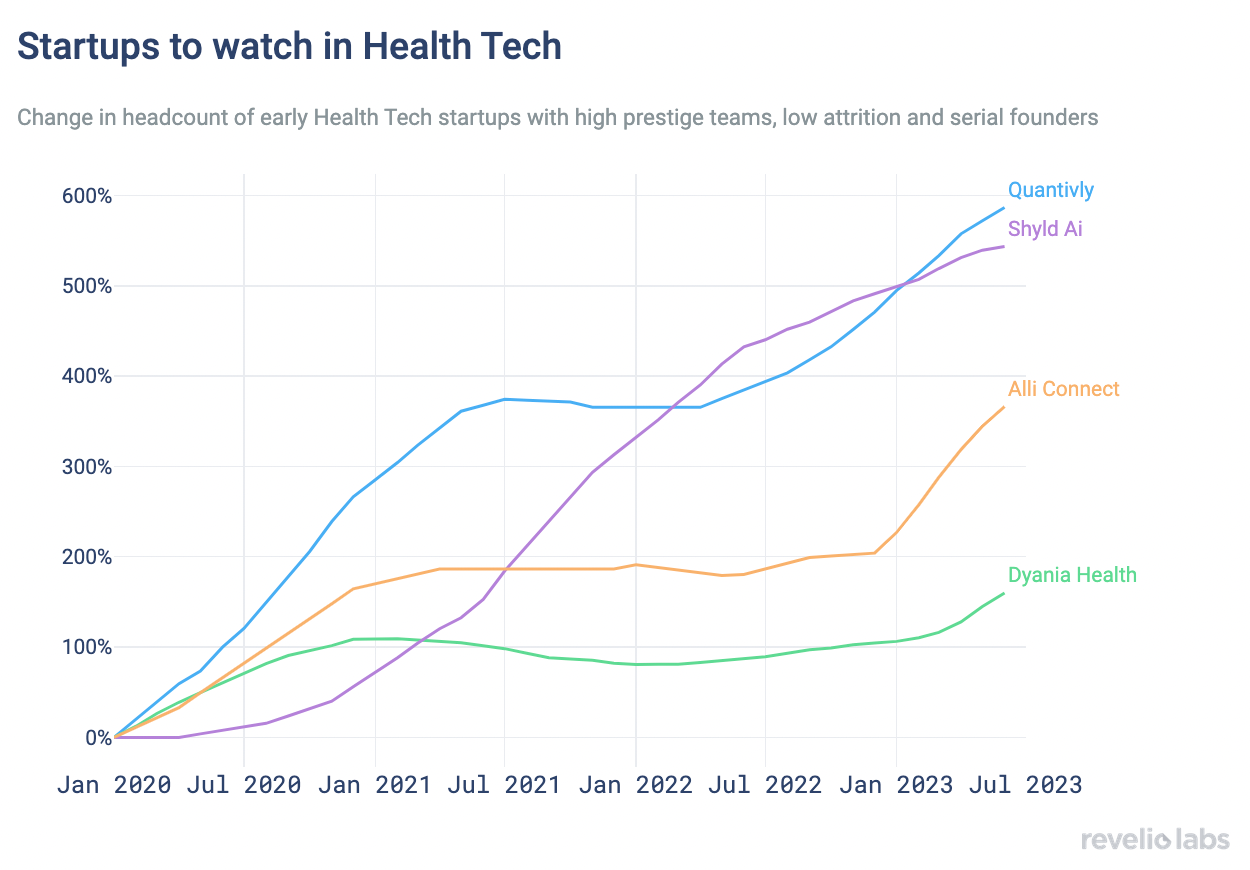

Highlight of the Month: What signs to look for when evaluating startups?

In our recent research, we delved deeper into the world of startups to understand the role early teams play in shaping the success of startups. Fast-growing startups have lower workforce attrition in early years than their counterparts. If the founders managed to have their initial team believe in the product, then they can retain their talent and grow faster. We also find that the credentials of the founding teams matter a lot of the successful trajectory of a startup. Successful startups are more likely to be founded by serial entrepreneurs, who capitalize on their prior experiences in developing their new company. Moreover, the founding teams in fast-growing startups have higher prestige scores than slow-growing startups. Our prestige score takes into account which schools someone attended, as well as the companies they previously worked for. Founding teams with high prestige scores have been exposed to people from prestigious institutions and definitely have more solid connections. We applied our criteria to health tech startups and here is what we found:

Conclusion

Our read of the latest jobs report, along with insights from our data, points to a couple of interesting conclusions: (i) there seems to be fewer job-to-job transitions in the market as evidenced by the declining hiring while the unemployment rate remains stable; and (ii) confidence in the labor market is declining as we observe workers switching occupations and industries at a slower rate. The consistent growth of jobs along with a highly stable unemployment rate leads us to think that this is neither a hot or cool labor market; it is just the new normal. Looking ahead, the decline in job openings signals further declines in hiring and possibly job growth in the months to come.

Please view our data and methodology for this job report here and our recent research on successful startups here.