Companies Are Hitting the Reset Button

A deeper dive into the workforce

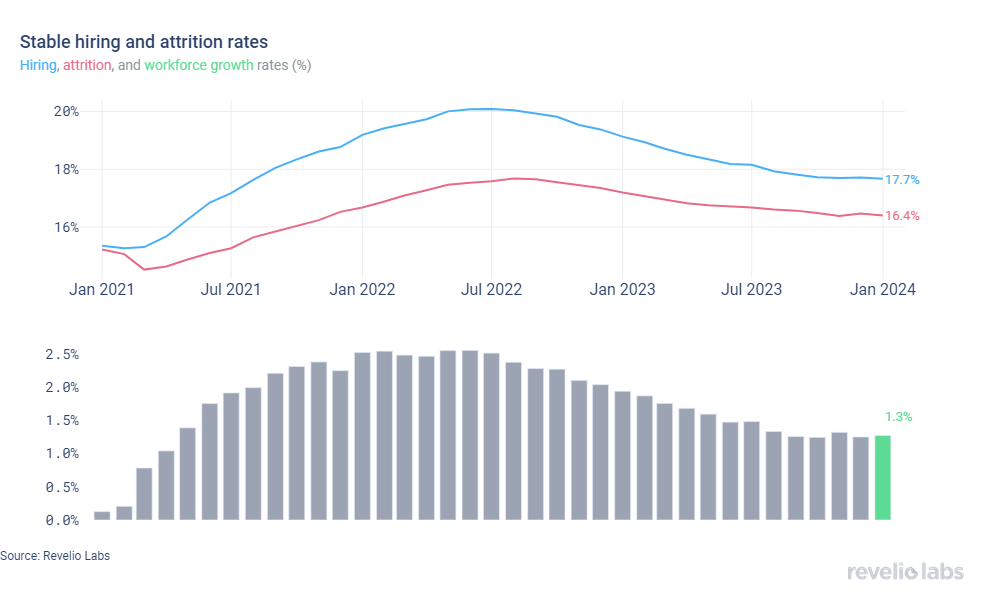

⬆️ 1.3% workforce growth rate in January 2024. This is slightly higher than in December (1.2%). The slight increase in the growth rate is a combination of a stable hiring rate and a slight decrease in the attrition rate.

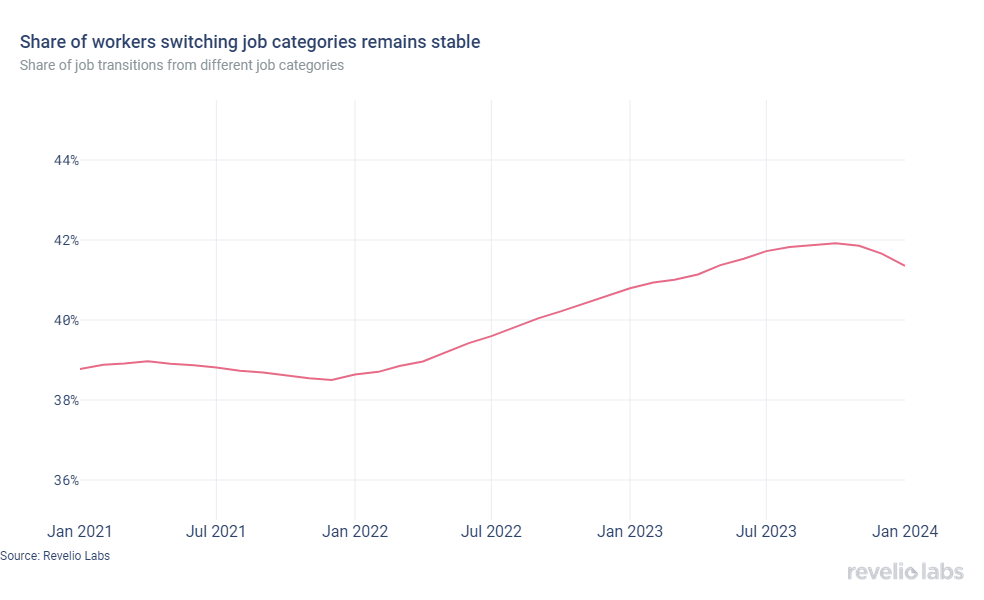

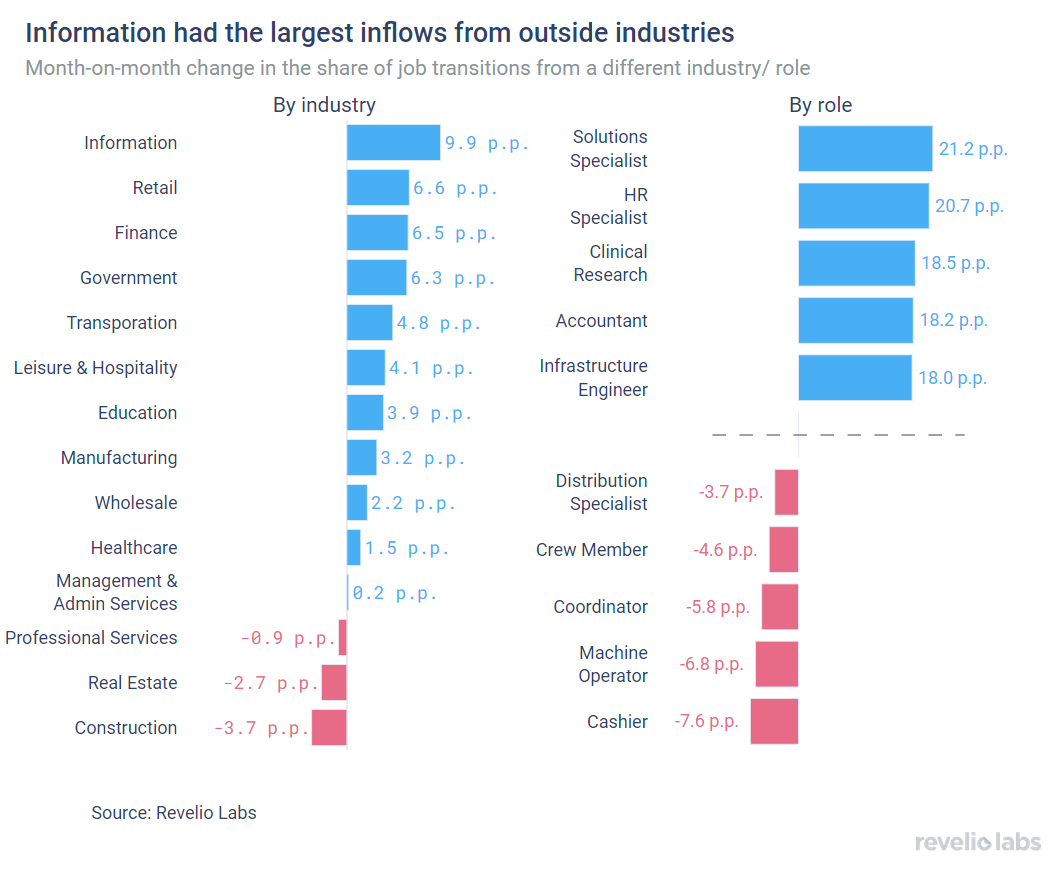

⬇️ 41.4% of workers who started a new job in January transitioned to a new role and 69% transitioned to a new industry. Information had the largest increase in the share of workers coming from other industries.

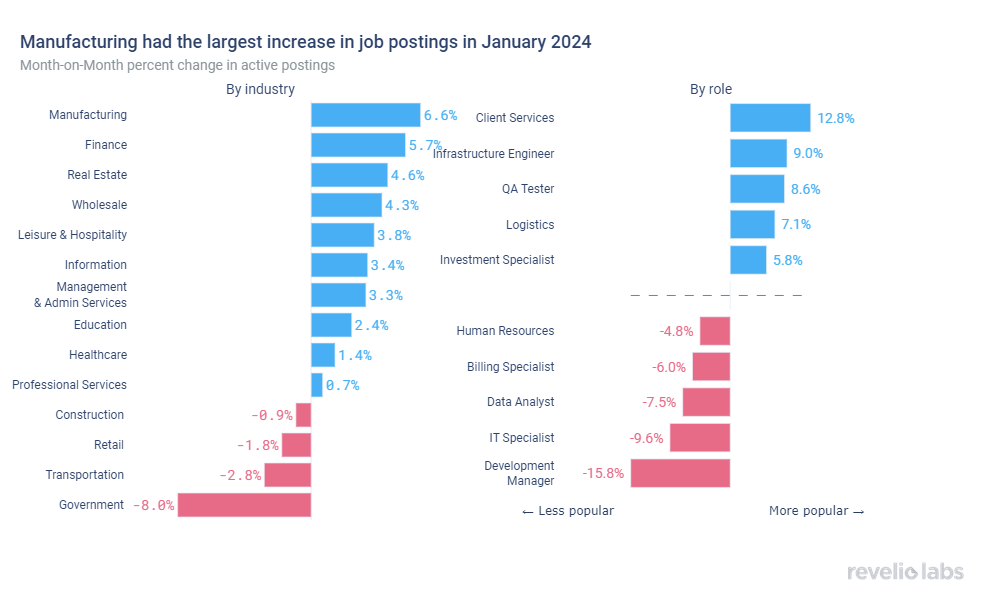

⬆️ 1.13% increase in active job listings in January. The Manufacturing sector had the largest increase in active job postings.

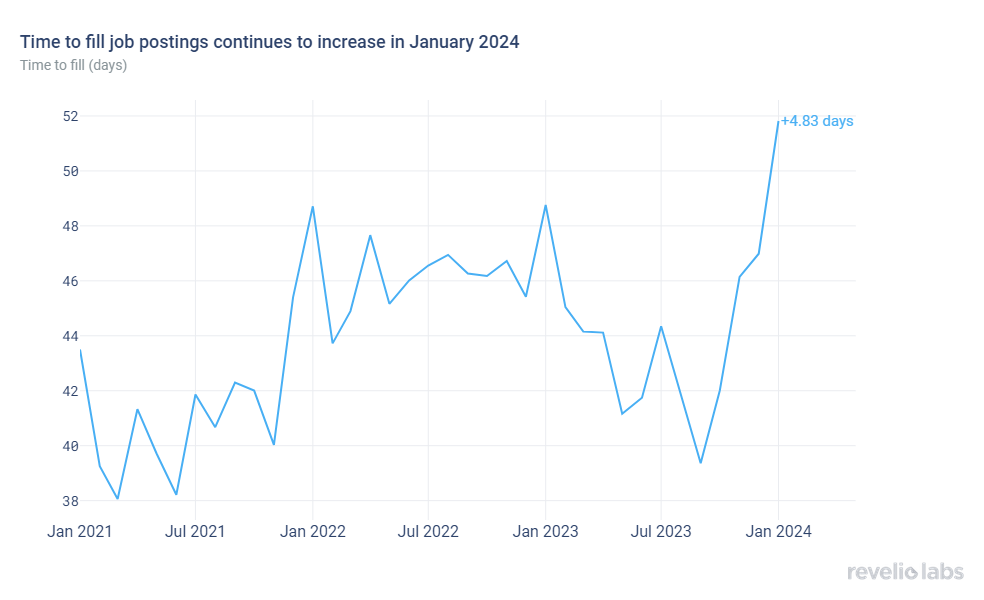

⬆️ 51.8 days to fill job openings. This is 4.8 days more than in December 2023 and 3 days more than in January 2023.

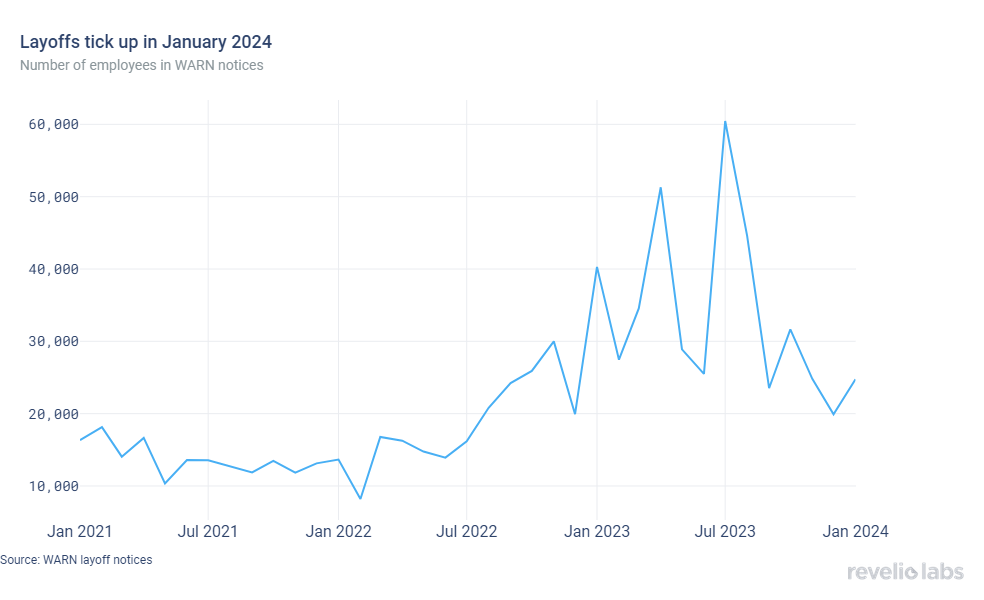

⬆️ 24% increase in the number of employees notified of layoffs under the WARN Act compared to December 2023.

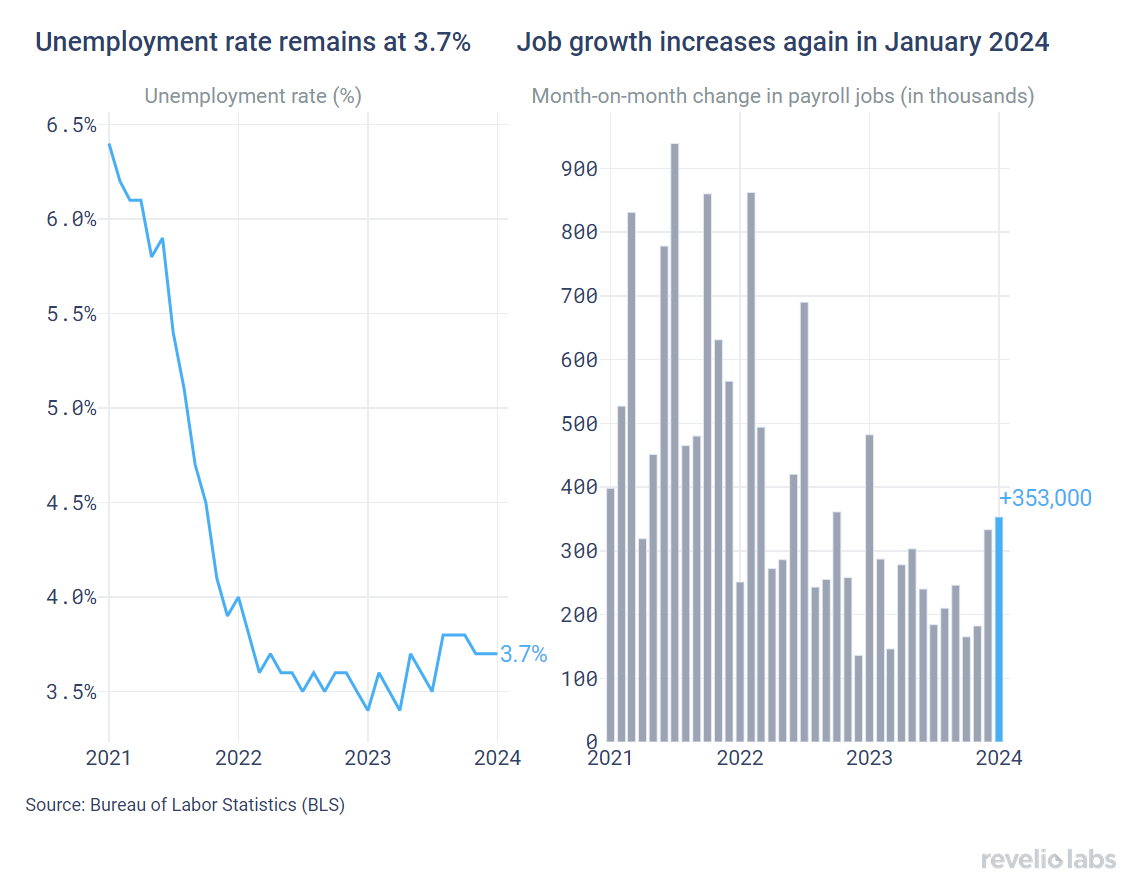

January's Jobs Report signals a strong start in 2024

January’s Jobs Report came in signaling a strong start for 2024. The unemployment rate remained unchanged from December, standing at 3.7%. The US economy added 353,000 new jobs, surpassing all expectations. Employment gains in January occurred in professional and business services, health care, and retail trade sectors.

What does the granular workforce intelligence data from Revelio Labs have to say about the health of the labor market, and what do they signal about the labor market in the near future? Read our detailed labor market analysis below.

Stable hiring and attrition rates

Revelio Labs’ workforce intelligence data show that hiring and attrition rates remained stable in January. The hiring rate stood at 17.7% (unchanged since September 2023). Meanwhile, the attrition rate stood at 16.4% (slightly lower than the 16.5% recorded in December). The workforce growth rate (difference between hiring and attrition rates) stood at 1.3% (0.1 percentage points higher than December on a m.o.m basis).

Construction experienced a the largest increase in hiring in January relative to December (+0.3 p.p.), while education experienced the largest decline (-0.4 p.p.). The decline in hiring in education is expected due to school closure in the winter break. Leisure and Hospitality also experienced a decline in hiring in January, which is expected after the end of the holidays. Attrition hardly changed in any sector, with the most notable decreases in attrition in the Management of Enterprises and the Information sectors (-0.3 pp).

Of those who started a new job in January, 41.4% have transitioned to different roles and 69% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our labor market analysis shows that 41.4% of workers who started a new job in January did so by switching their broad job categories; this is lower than the rate observed since December (41.7%). Furthermore, 69% of workers who started a new job in January started jobs in different industries - slightly higher than the rate of switching in December. The share of employees switching roles has recently started to decline, signaling lower confidence in the labor market.

The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to December 2023. Notably, the Information sector had a substantial increase in the influx of workers from other industries. 74.3% of workers who started a job in Information in January 2024 came from other industries (+9.9 percentage points from the share in December). Contrarily, the Construction sector experienced the largest decline in the share of workers joining the industry from other industries. 75.6% of workers who started a job in Construction in January 2024 had backgrounds in other industries, relative to 79.4% in December 2023 (a 3.7 percentage-point decrease).

The right panel shows the difference in the share of workers who started a new job in a different role in January 2024 relative to December 2023. Solution specialists roles exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while a number of retail roles witnessed the largest decline.

Job postings tick up after 4 consecutive months of decreasing

The active job postings index increased slightly in January 2024 after it has been declining steadily through the Fall of 2023. Job listings saw a modest increase of 1.1% compared to the previous month after a series of declines that ranged from 2% to 5.5% on a monthly basis. New job listings increased by 14%, while removed postings also increased by 10% month-on-month.

The increase in job listings in January was reflected in multiple industries; mainly driven by Manufacturing that recorded the largest increase in active postings (6.6% increase in active postings compared to December 2023). Some industries saw a decline in active postings in January, most notably Public Administration (8% decline in active postings compared to December 2023). The increase in labor demand was driven by client services, logistics and engineering roles.

The time-to-fill for open listings has continued to increase further, signaling a tightening labor market. Average days-to-fill stood at 51.8 days in January, up from 47 days in December 2023 (+4.8 days).

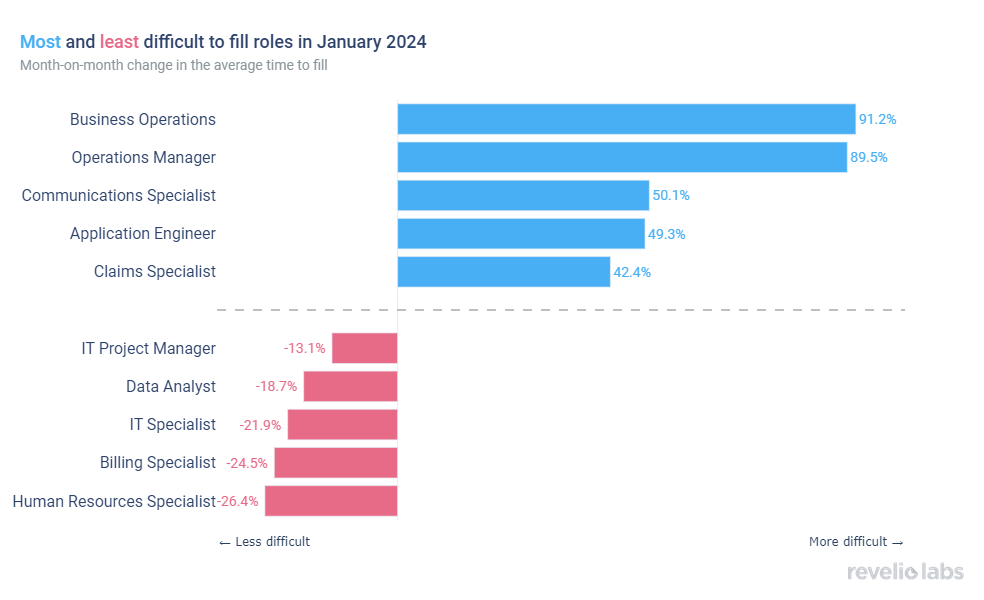

Time-to-fill for operations roles increased notably compared to December, while time-to-fill for roles in human resources and IT-related roles has declined compared to December.

Layoff notices increased in January

The number of employees receiving layoff notices under the WARN Act ticked up in January 2024, although layoffs have been following a declining trend that started at the end of the summer. The number of layoffs remains elevated compared to the Fall of 2022, although it has reached very low levels. Historically, layoffs increase in January as companies embark on restructuring their workforces at the beginning of the year.

What are workers in America talking about this month?

By examining thousands of employee reviews posted in January, we picked the most common topics that appeared in positive and negative reviews relative to the previous month. In January, workers continued to be positive about flexibility. They were also positive about supportive coworkers. However, employees were concerned with management and leadership.

Highlight of the month: Do companies ever recover from mass layoffs?

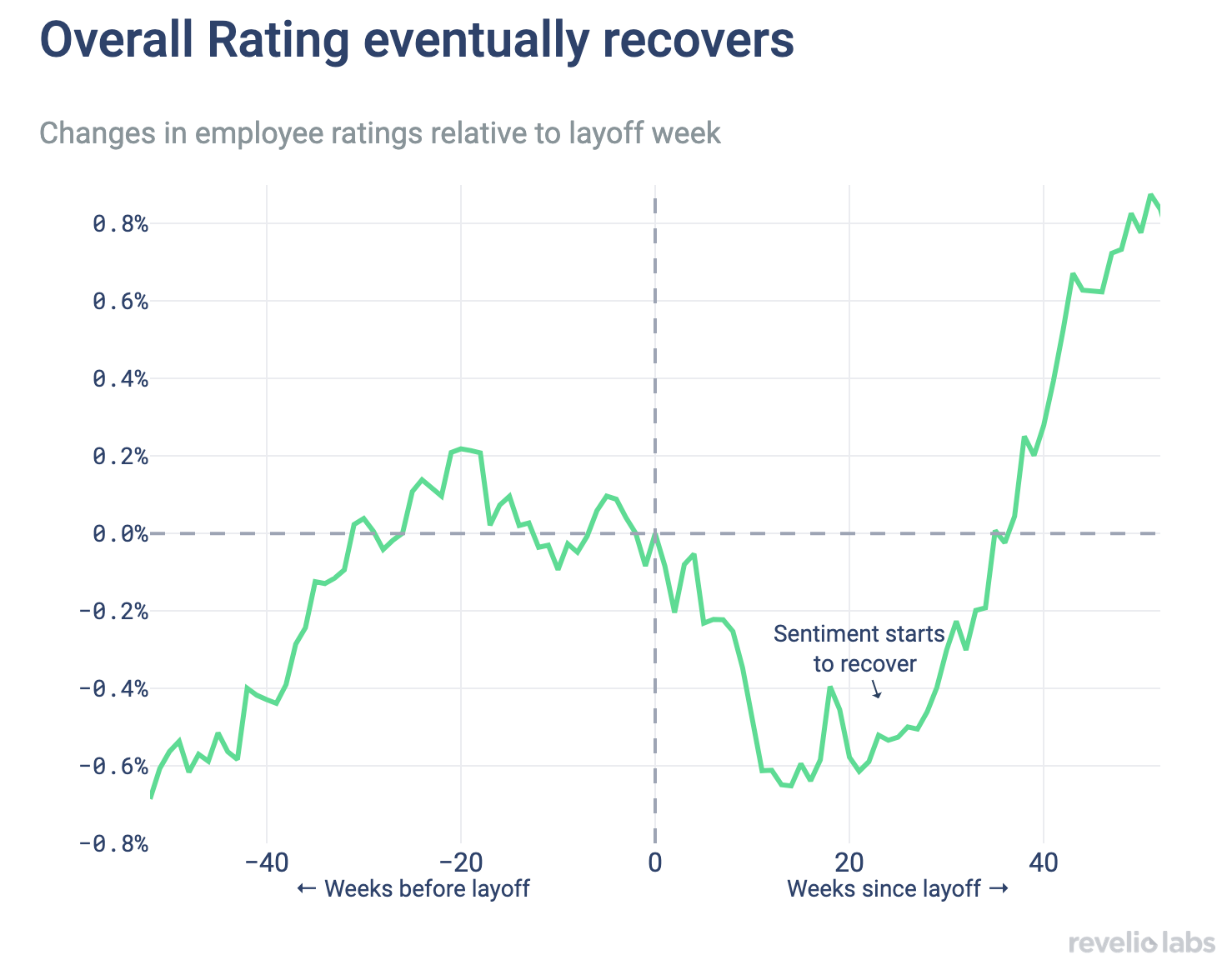

Companies exposed to mass layoffs experience a significant decrease in employee sentiment after the layoff. But eventually sentiment starts to recover. Our recent research shows that it takes about five months of declining sentiment after the mass layoff for sentiment to start bouncing back. Within a year following the layoff, not only do employees’ overall ratings fully recover, but they also surpass their initial levels. While all categories of employee sentiment reverse course in the fifth month following the layoff, not all categories recover equally. Business Outlook and Diversity and Inclusion ratings fully recover within the year following the layoff, but Senior Leadership and Culture and Values ratings never fully recover. In a subsequent research, we used the reviews that surviving employees leave about the company to understand which factors contribute to the recovery of employee sentiment. We found that Six months after the announcement of a mass layoff, surviving employees discuss issues related to benefits, team, and balance in their positive reviews. But it seems that employees never forget the negative effects of layoffs, which they keep discussing in negative reviews six months after the announcement of the layoff.

Conclusion

The first Jobs Report in 2024 came in with very positive news about the status of the labor market in January. At a more granular level, we observe the first increase in job postings in four months, along with an increase in layoff notices. The increase in both job postings and layoffs this January is a déjà-vu from last year, as especially tech companies are cutting labor costs and are hitting the reset button on their workforces. A particularly interesting trend that we observe is the notable increase in the time to fill job postings, which signals a shift back towards a tighter labor market. The almost flat hiring rate in the past few months along with the increasing time to fill and companies prolonging interview periods signal increased caution of employers. Similarly, the observed decreases in the share of workers switching industries and occupations signals increased caution on the side of workers as well.

Please view our data and methodology for this job report here and our recent newsletters on layoffs here.