Workforce Digest: Cautious Optimism for the 2024 Labor Market

A deeper dive into the workforce

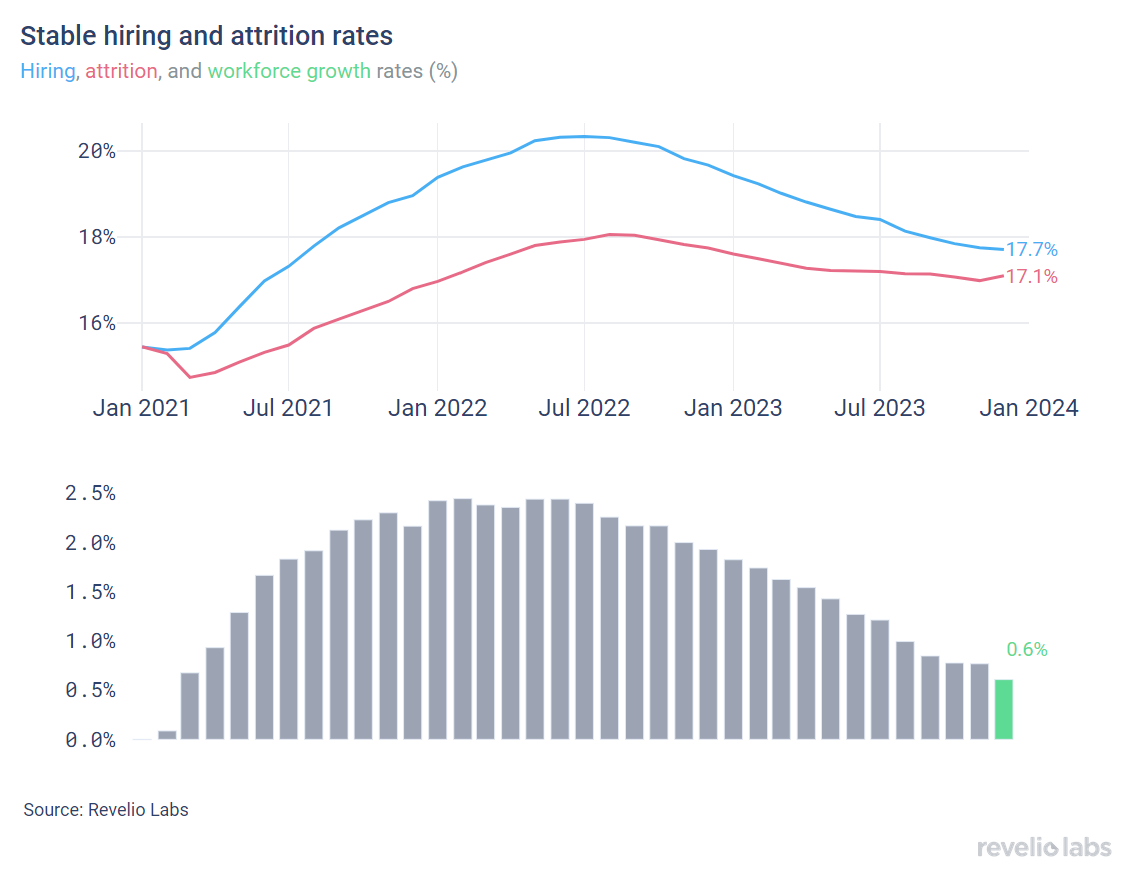

⬇️ 0.6% workforce growth rate in December 2023. This is lower than in November (0.8%). The decrease in the growth rate is a combination of a stable hiring rate and a slight increase in the attrition rate.

⬇️ 41.6% of workers who started a new job in December transitioned to a new role and 67.6% transitioned to a new industry. Professional Services had the largest increase in the share of workers coming from other industries.

⬇️ 5.9% decrease in active job listings in December from November. The decrease in demand for workers was widespread across all industries and roles, with the largest affected being Real Estate and IT specialists, respectively.

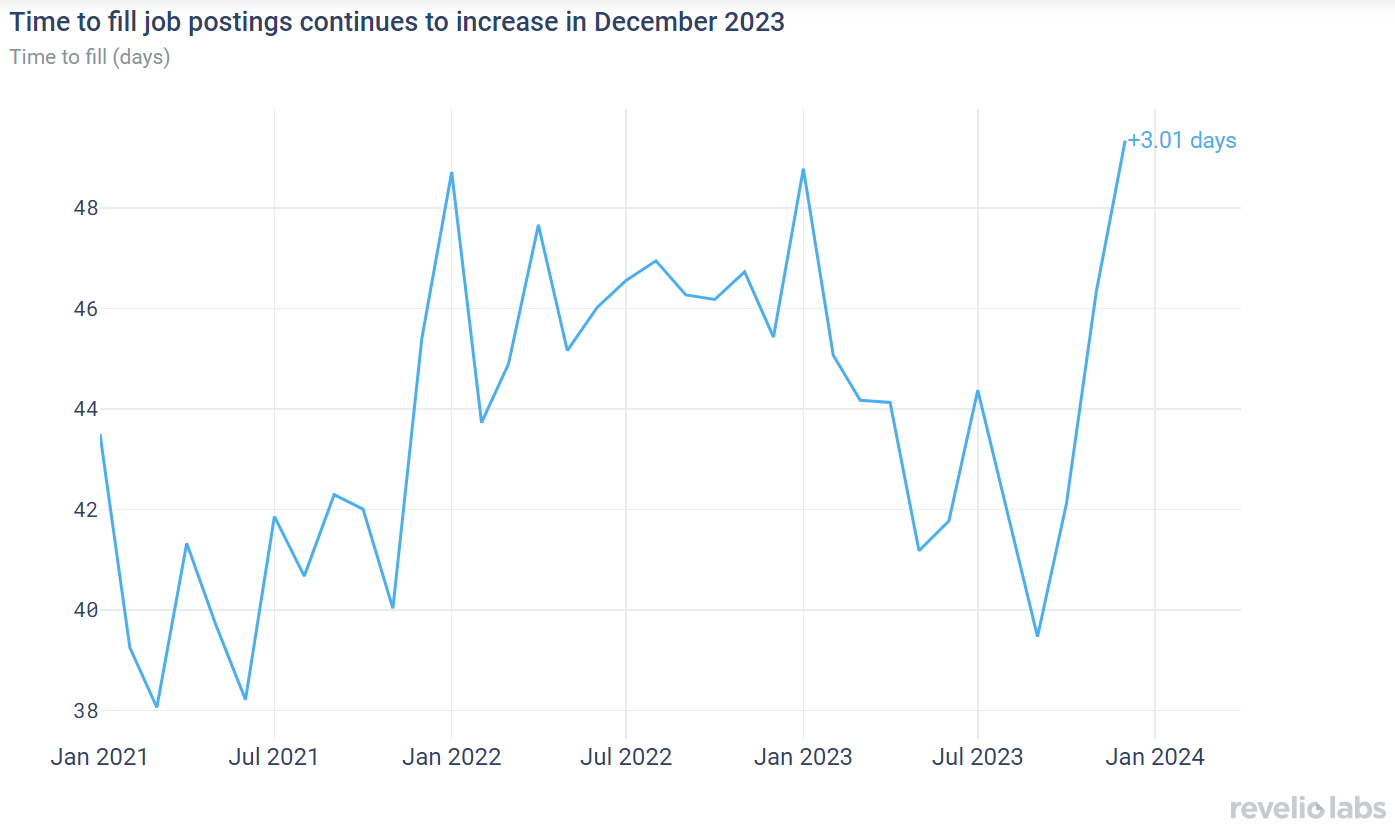

⬆️ 49.3 days to fill job openings. This is 3 days more than in November 2023 and 3.9 days more than in December 2022.

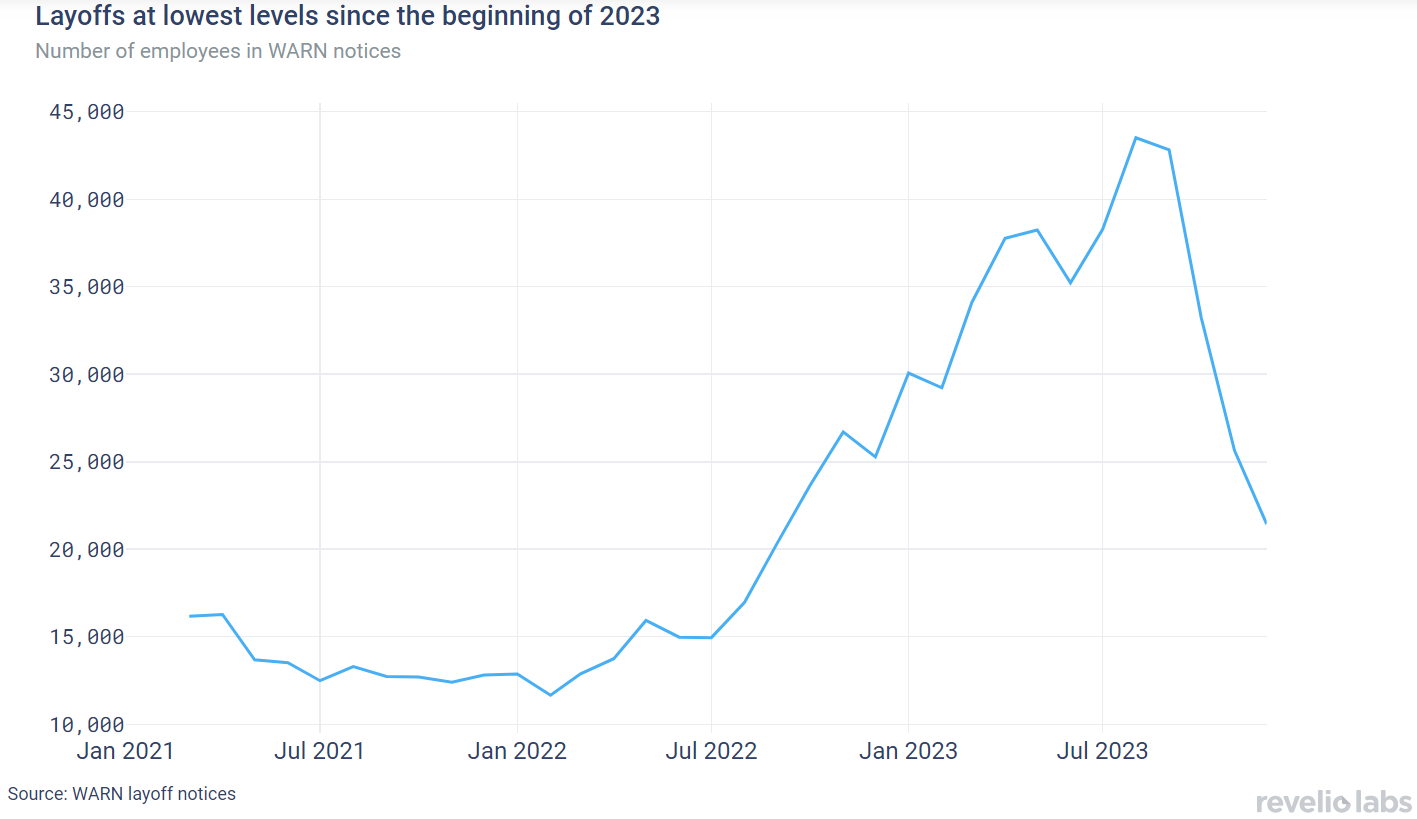

⬇️ 16% decrease in the number of employees notified of layoffs under the WARN Act compared to November 2023.

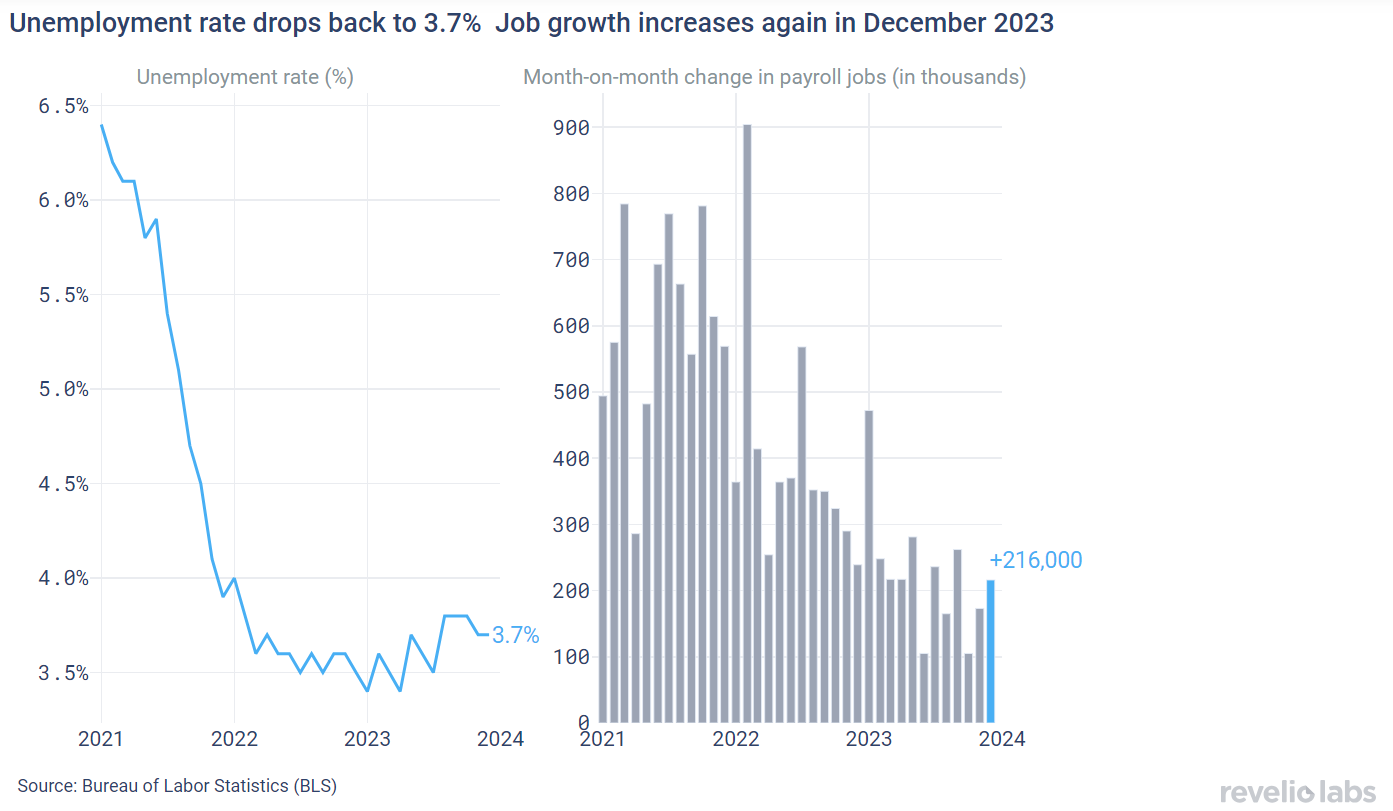

December's Jobs Report confirmed the resilience of the labor market through 2023

The December Jobs Report was one more piece of proof for the resilience of the 2023 labor market. Amid four interest rate hikes in 2023, the unemployment rate stood at a solid 3.7% in the final month of the year, unchanged from November. The US economy added new jobs every month in 2023: In December, the economy added a solid 216,000 jobs. Employment continued to increase in government, health care, social assistance, and construction. Interestingly, transportation and warehousing lost jobs around the holidays.

What does the granular workforce intelligence data from Revelio Labs have to say about the health of the labor market, and what do they signal about the labor market in the near future? Read our detailed labor market analysis below.

Stable hiring and slightly increasing attrition rates

Revelio Labs’ workforce intelligence data show that hiring and attrition rates were moving in opposite directions in December. The hiring rate stood at 17.7% (unchanged from the rate observed in November). Meanwhile, the attrition rate stood at 17.1% (slightly higher from the 17% recorded in November). The workforce growth rate (difference between hiring and attrition rates) stood at 0.6% (0.1 percentage points less than November on a m.o.m basis).

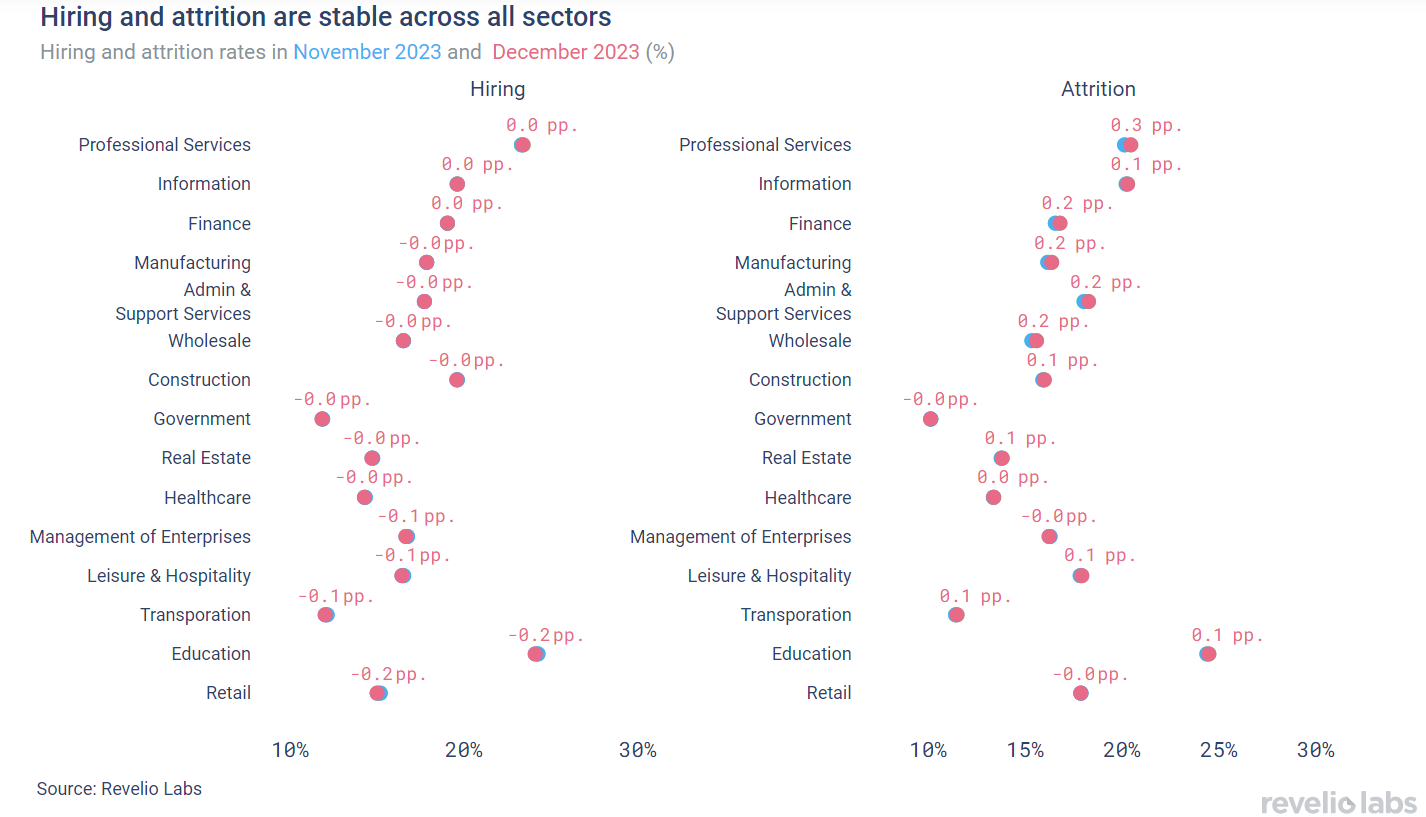

As overall hiring remains largely constant, most sectors did not expect any change in hiring from last month. Retail and Education had a decrease in hiring in December relative to November. The decline in hiring in education is expected due to school closure around the holidays. Retail also experienced a decrease in hiring in December relative to November, which may be expected if workers were hired in November in anticipation of the holiday season. However, attrition increased in December in a number of sectors, with the highest increase being in Professional Services (+0.3 pp). The increase in attrition is expected in December, as many people leave their jobs to start a new position at the beginning of the year.

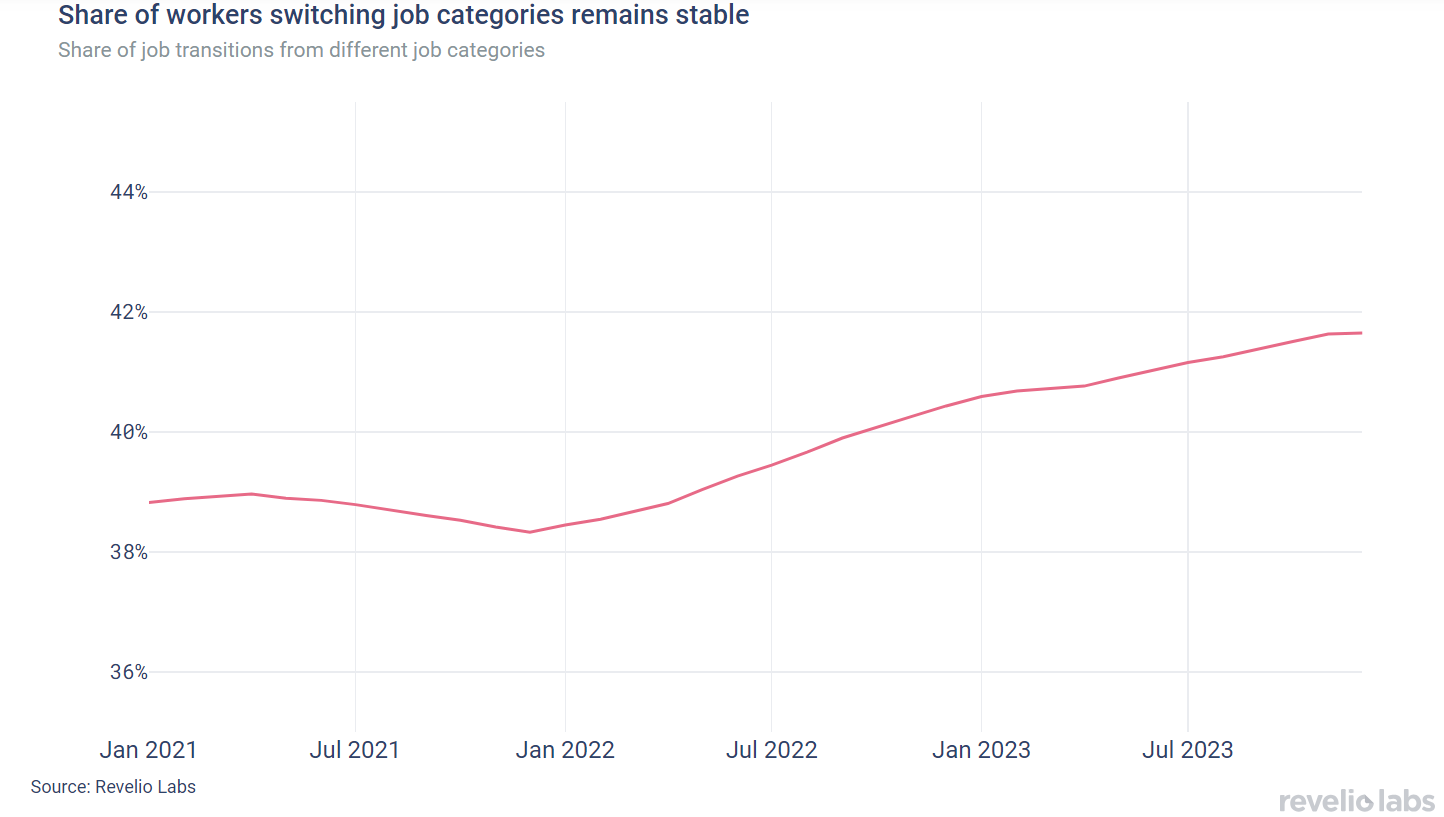

Of those who started a new job in December, 41.6% have transitioned to different roles and 67.6% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 41.6% of workers who started a new job in December did so by switching their broad job categories; this is unchanged from the rate observed since November. Furthermore, 67.6% of workers who started a new job in December started jobs in different industries - slightly lower than the rate of switching in November. The share of employees switching roles has largely stagnated since July, signaling ongoing but slightly cooling confidence in the labor market.

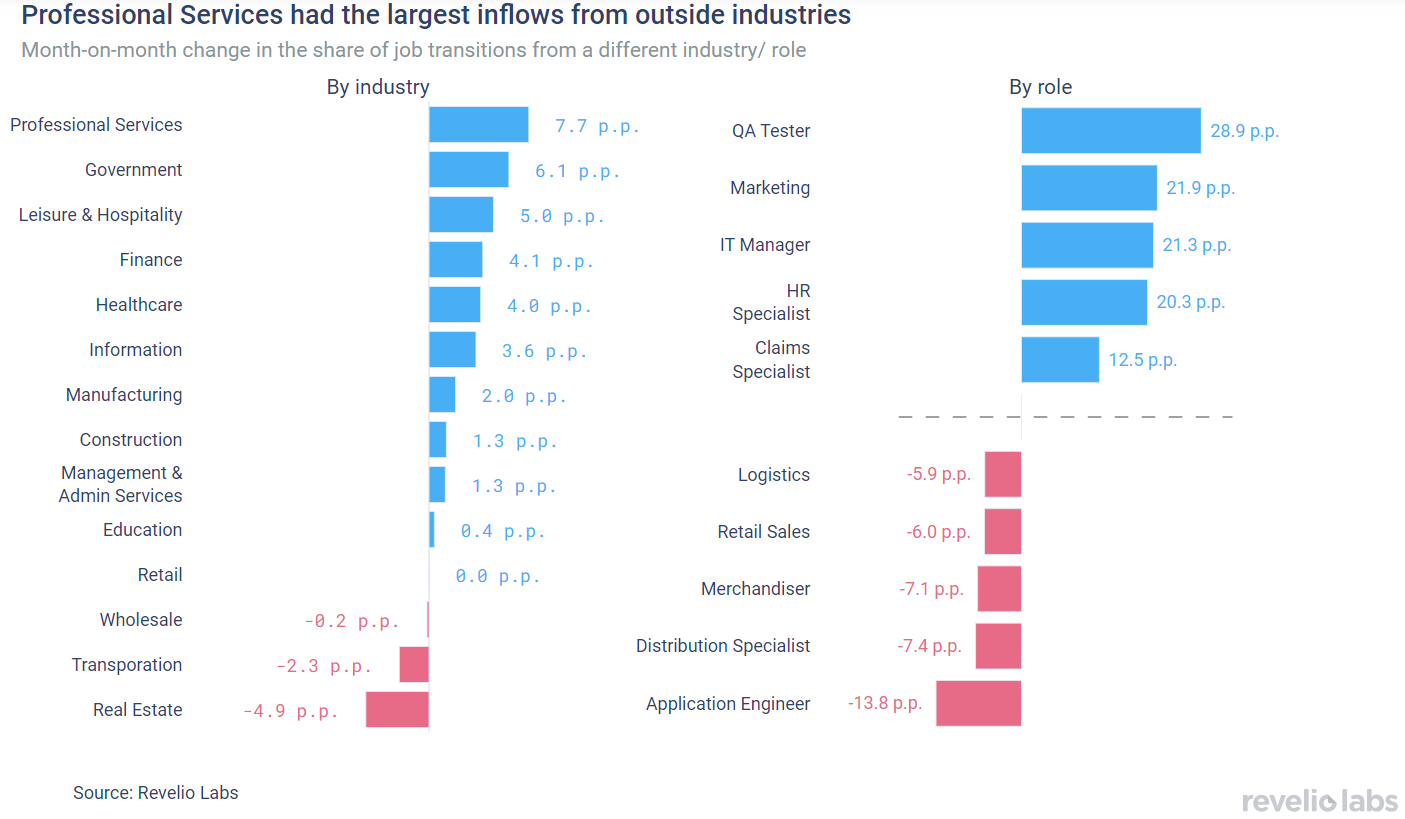

The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to November 2023. Notably, the Professional Services sector had a substantial increase in the influx of workers from other industries. 80% of workers who started a job in Professional Services in December came from other industries (+7.7 percentage points from the share in November). Contrarily, the Real Estate sector experienced the largest decline in the share of workers joining the industry from other industries. 72.7% of workers who started a job in Real Estate in December had backgrounds in other industries, relative to 77.6% in November 2023 (a 4.9 percentage-point decrease).

The right panel shows the difference in the share of workers who started a new job in a different role relative to November 2023. Quality Assurance roles exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while a number of retail roles witnessed the largest decline.

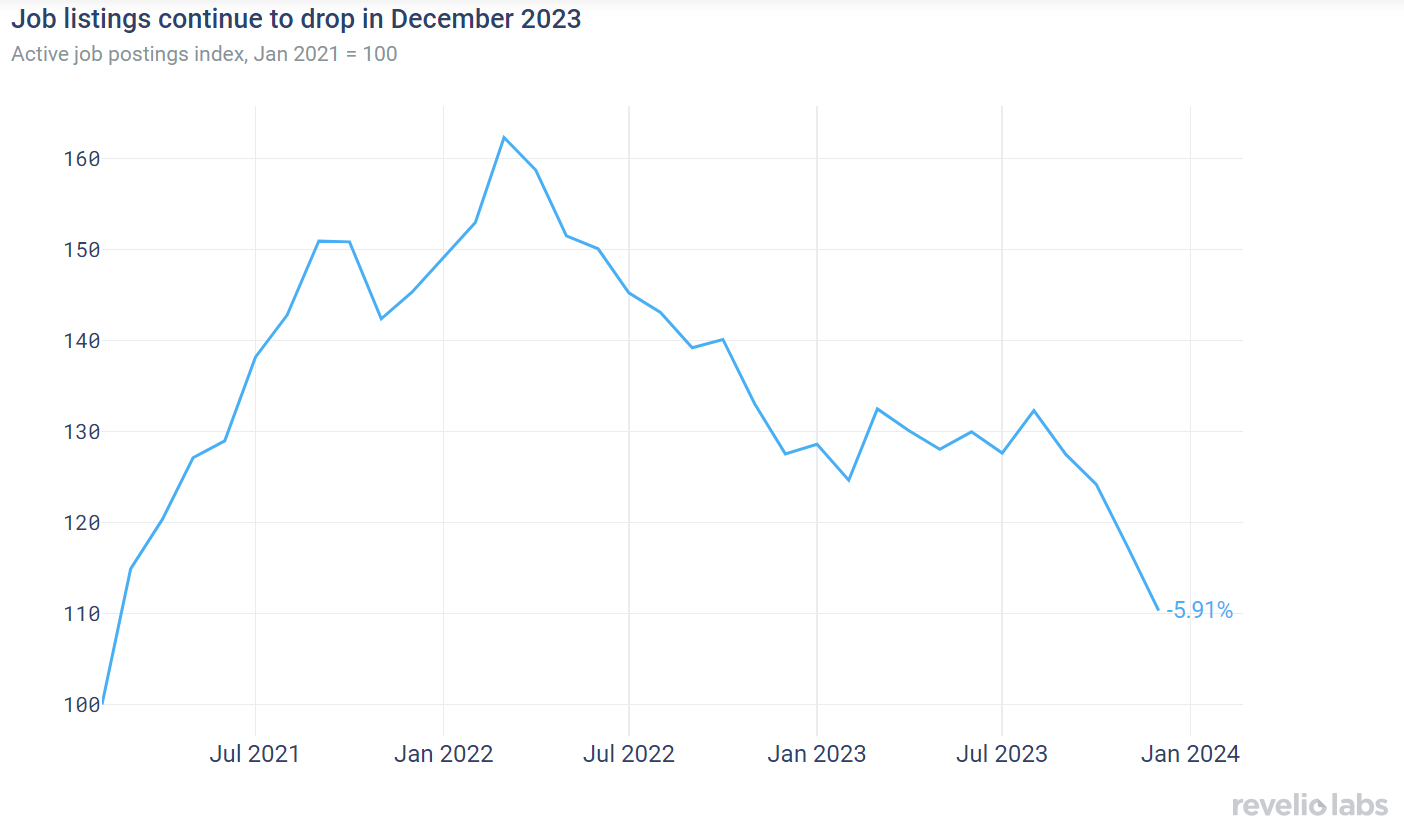

Job postings continue to decrease further

The active job postings index continued its downward trend for the fourth month in a row. Job listings saw another 5.9% decrease compared to the previous month, following a 5.6% decrease in November and a 2.6% decrease in October. New job listings declined by 9% month-on-month.

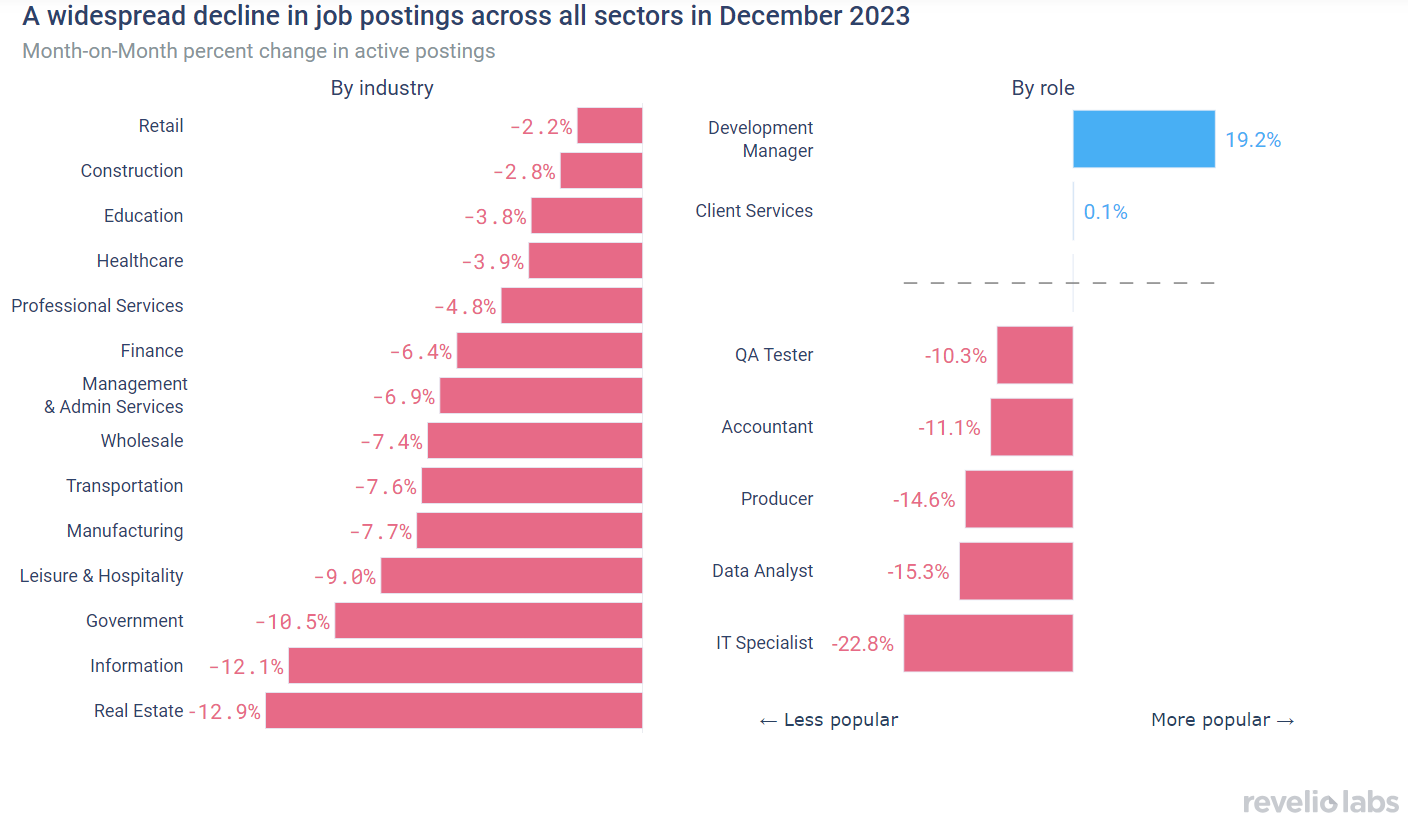

The large decline in job listings in December was driven by a widespread decrease in labor demand across all sectors. Real Estate recorded the largest decline in active job postings (12.9% decline in active postings compared to November 2023). The decline in labor demand was also widespread across roles. Only two roles had a modest increase in active job listings in December: Development manager (+19.2% increase in active postings compared to November) and Client Services (+0.1% increase in active postings compared to November).

The time-to-fill for open listings has continued to increase for the third month in a row. Average days-to-fill stood at 49.3 days in December, up from 46.3 days in November 2023 (+3 days). In December, open positions took longer to fill than any other month in 2023, signaling a move back to a tight labor market.

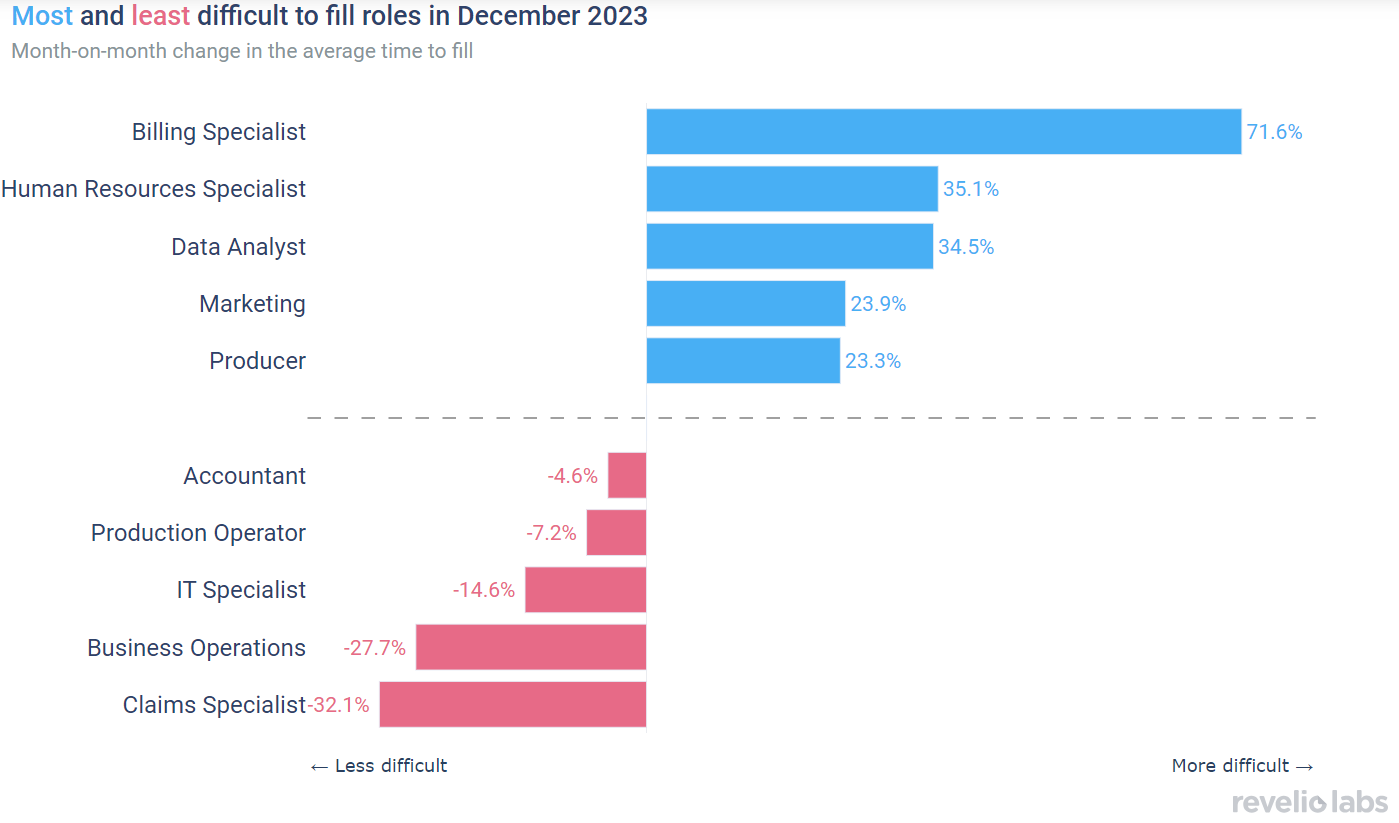

Time-to-fill for Sales roles in data analysis, HR and marketing increased notably compared to November, while time-to-fill for roles in accounting, claims and business operations has declined compared to November.

Layoffs continued to decrease in December

The number of employees receiving layoff notices under the WARN Act continued to decrease further in December, following a declining trend that started in September. While the number of layoffs remains elevated compared to the Fall of 2022, companies issued fewer layoff notices in December than any other month in 2023. The trend in layoffs is very uncertain at the time of this writing, as 2024 started with Unity’s announcement of a massive layoff of 25% of its workforce in the first few days of the new year.

What are workers in America talking about this month?

By examining thousands of employee reviews posted in December, we picked for this job report the most common topics that appeared in positive and negative reviews relative to the previous month. In December, workers continued to be positive about culture, flexibility and their teams. However, employees remain worried about hours and balance. They were also particularly worried about their salaries in December in anticipation of the upcoming year.

Highlight of the month: Corporations are actively supporting female employees' fertility decisions

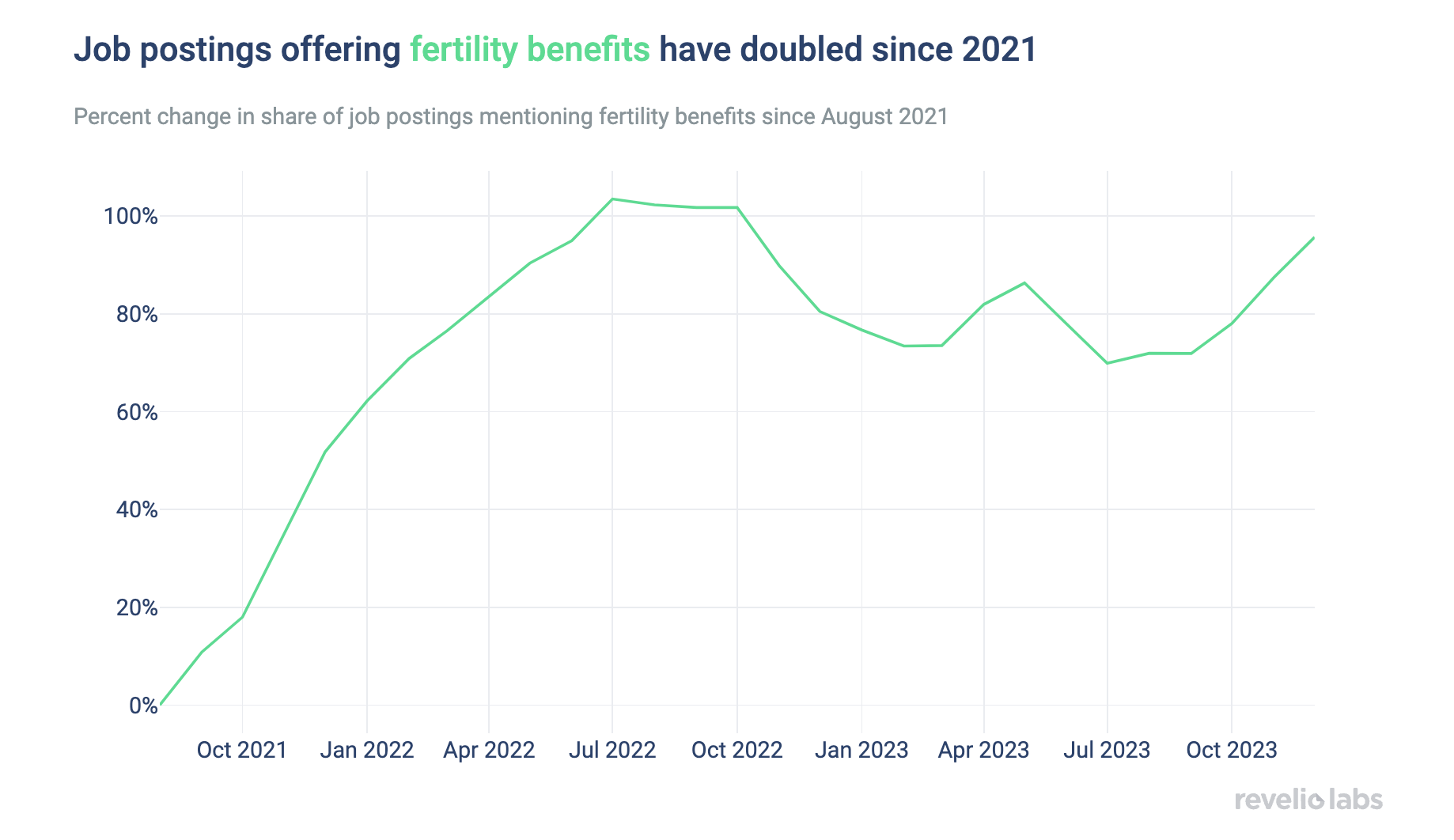

With the increasing female labor force participation, especially among women between 20 and 44 years old, the demand for fertility services has been surging. Companies have noticed this heightened demand and have reacted by offering more fertility benefits. Our recent research shows that about 0.6% of US job postings in October 2023 specifically mention fertility benefits. Although seemingly small, the current share of job postings mentioning fertility benefits reflects a remarkable increase of 94% compared to the share two years earlier. Unsurprisingly, large corporations (those with more than 500 employees) are more likely to offer these benefits as the cost of these benefits can be relatively high. Our research shows that female employees particularly appreciate this kind of employer support. Companies that offer fertility benefits are more highly rated by female employees than companies that do not, particularly in regards to culture and diversity.

Conclusion

The US labor market withstood many shocks during 2023 but still ended the year on a strong note. While the hiring rate has generally declined throughout 2023, the economy successfully added new jobs every month, ending the year with a larger workforce. While 2024 started off with some large layoff announcements, so did 2023 - a year that ended up being very solid for the labor market. Our team continues to track the hiring and attrition rates very closely, hoping for a continued healthy labor market.

Please view our data and methodology for this job report here and our recent newsletter on fertility benefits here.