A Strong Spring Report But Workers Are Still Feeling Gloomy

A deeper dive into the workforce

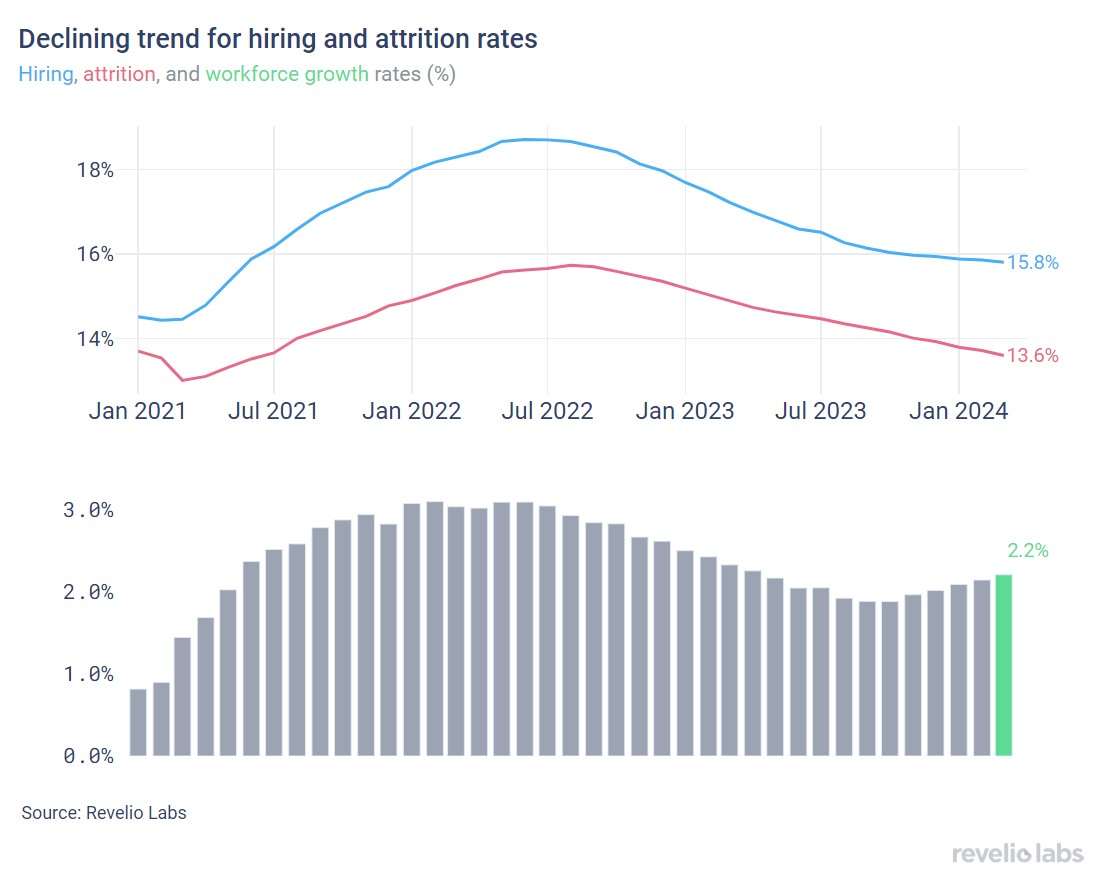

⬆️2.2% workforce growth rate in March 2024; slightly higher than the growth rate observed in February. The increasing workforce growth rate reflects higher hiring than attrition rates, even though both are on the decline.

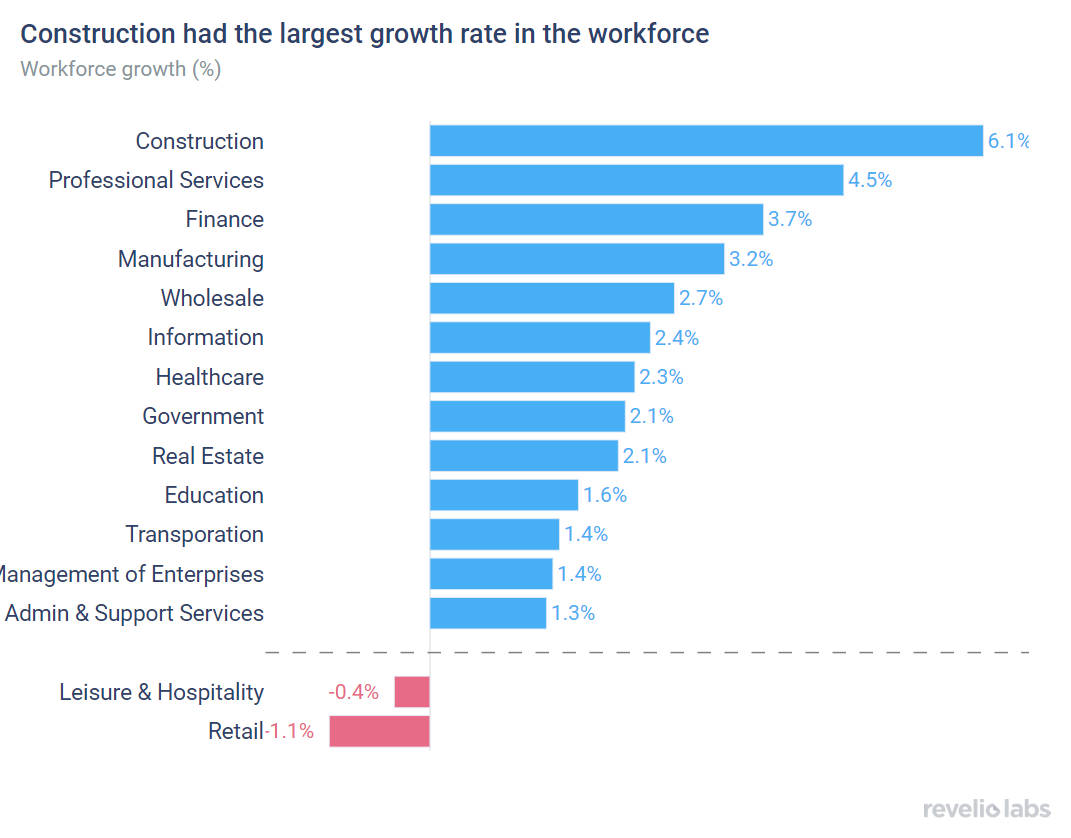

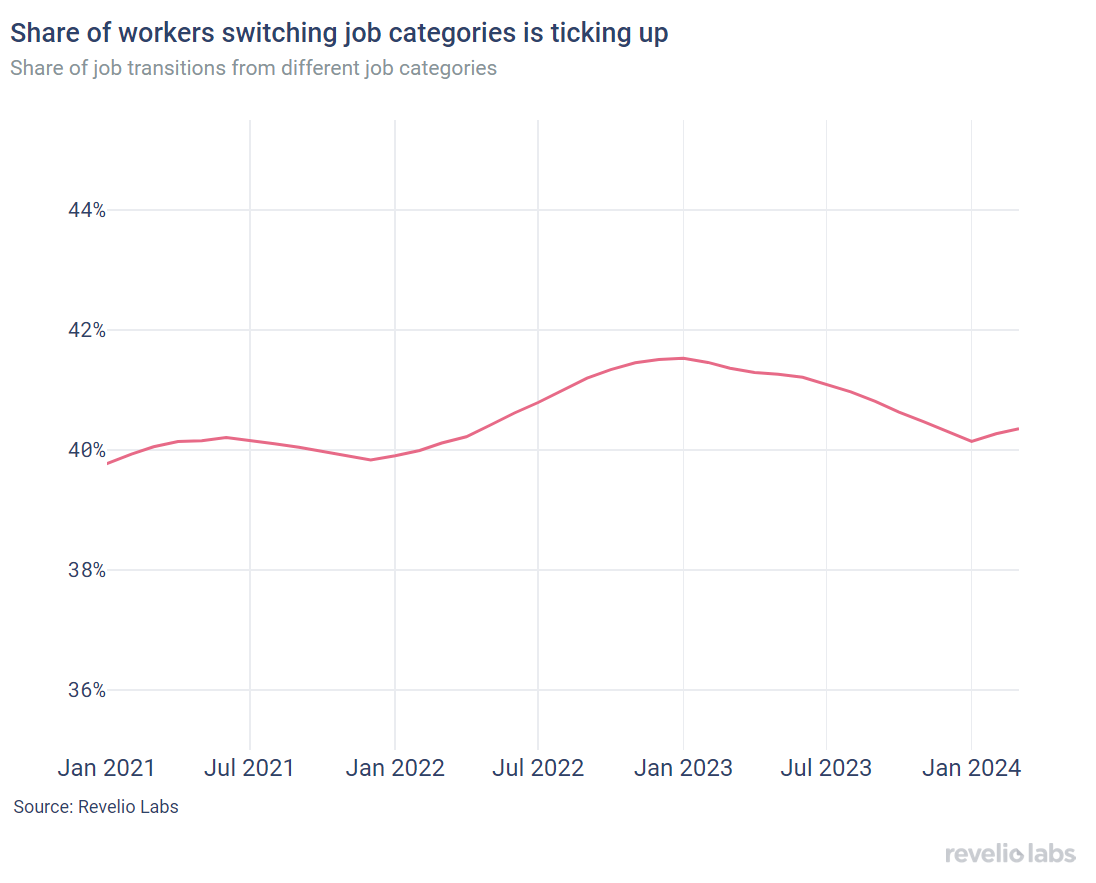

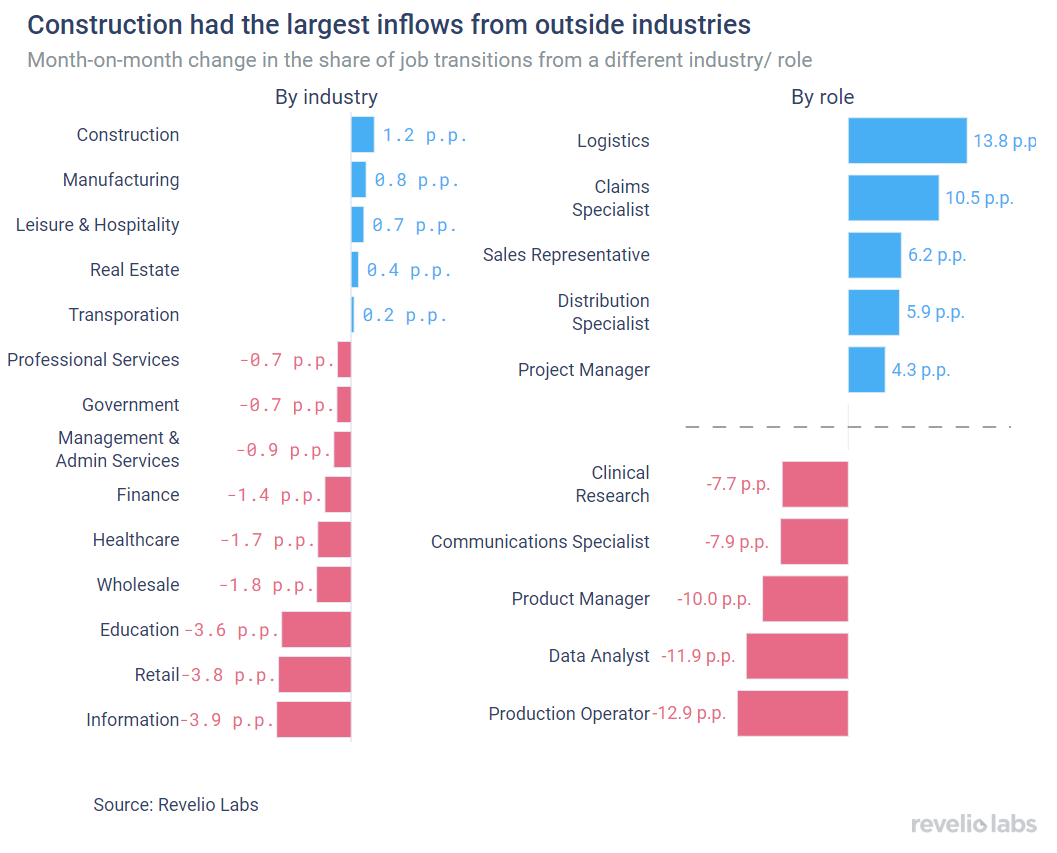

⬆️ 40.4% of workers who started a new job in March transitioned to a new role and 67.9% transitioned to a new industry. Construction had the largest increase in the share of workers coming from other industries.

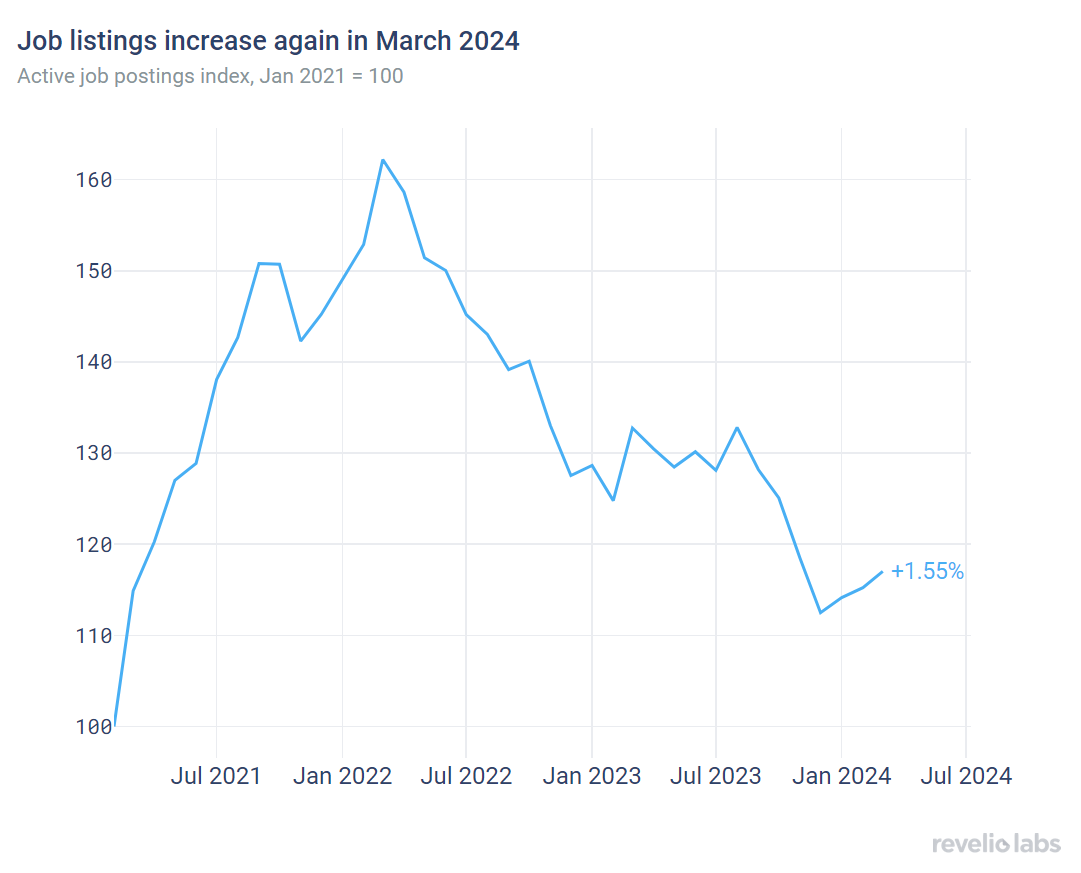

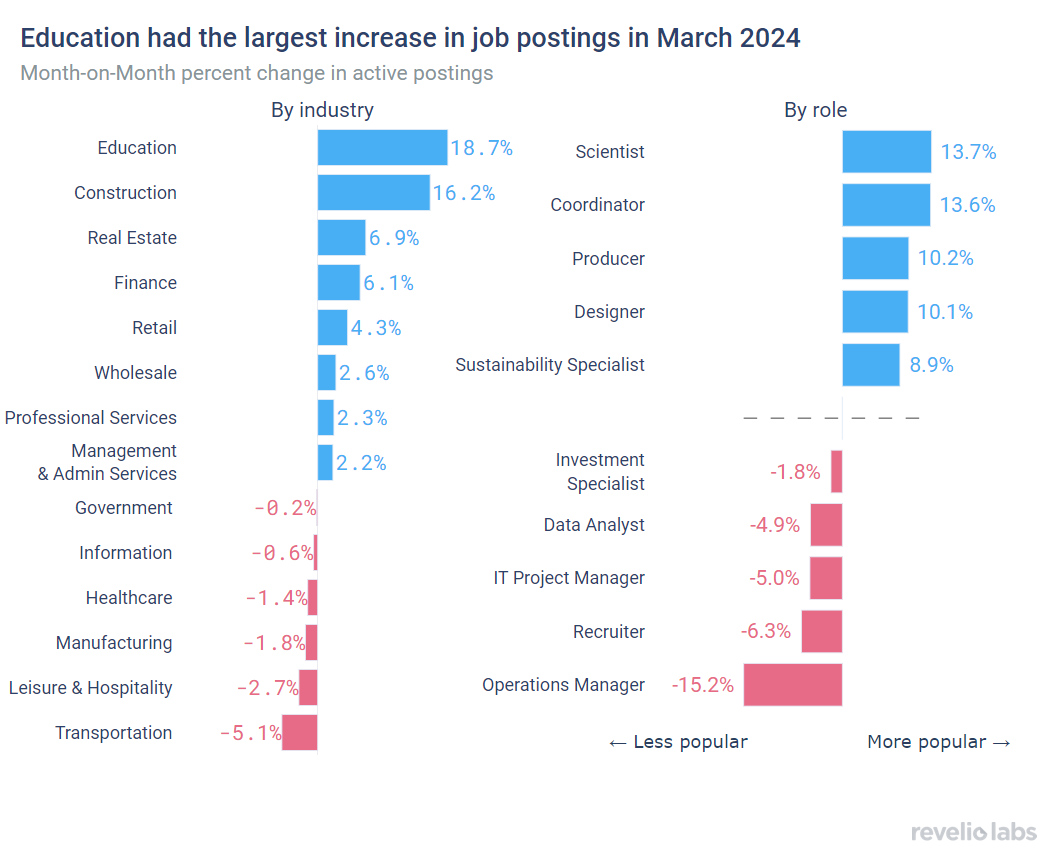

⬆️ 1.6% increase in active job listings in March from February. The Education sector had the largest increase in the demand for workers (18.7% increase in active listings in March), while Transportation had the largest decline in active job postings (-5.5% decline in March).

⬆️ 45.8 days to fill job openings in March. This is 1.2 days more than in February and 1.8 days more than in March 2023.

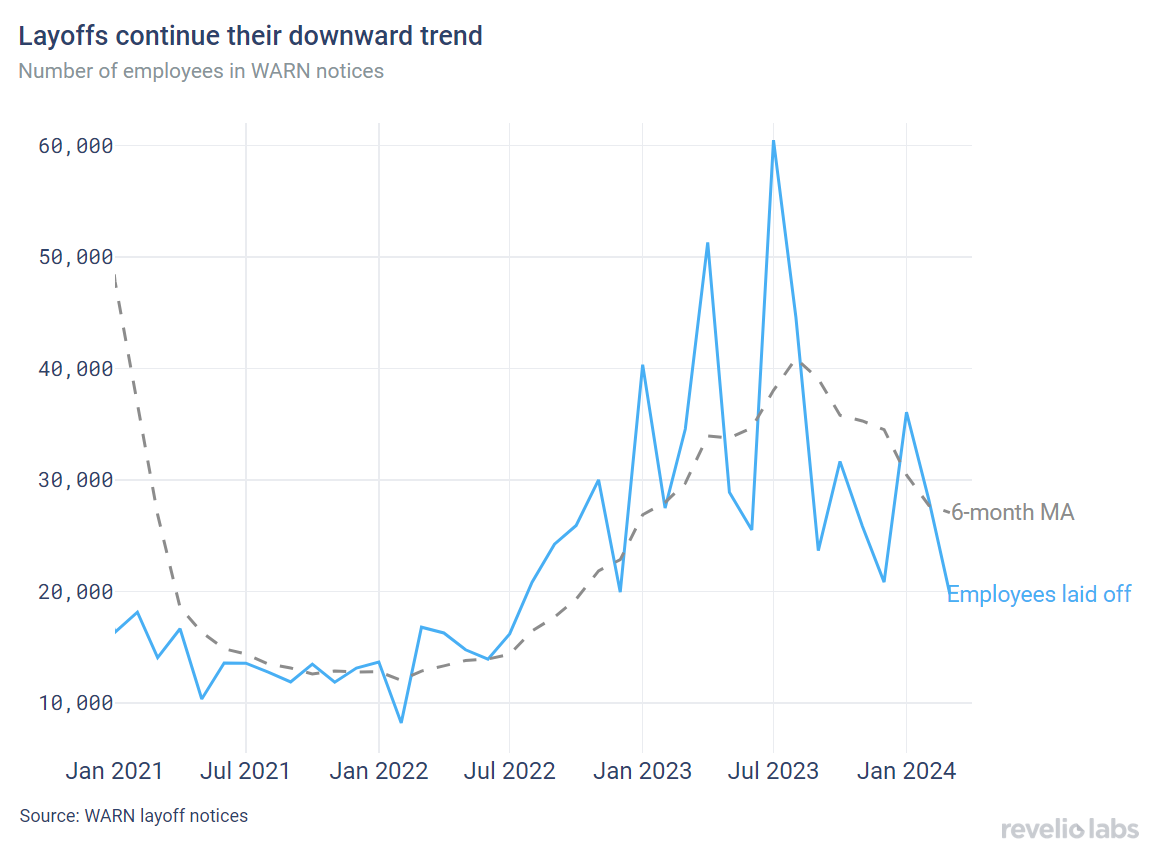

⬇️ 2.3% decrease in the number of employees notified of layoffs under the WARN Act compared to February 2024.

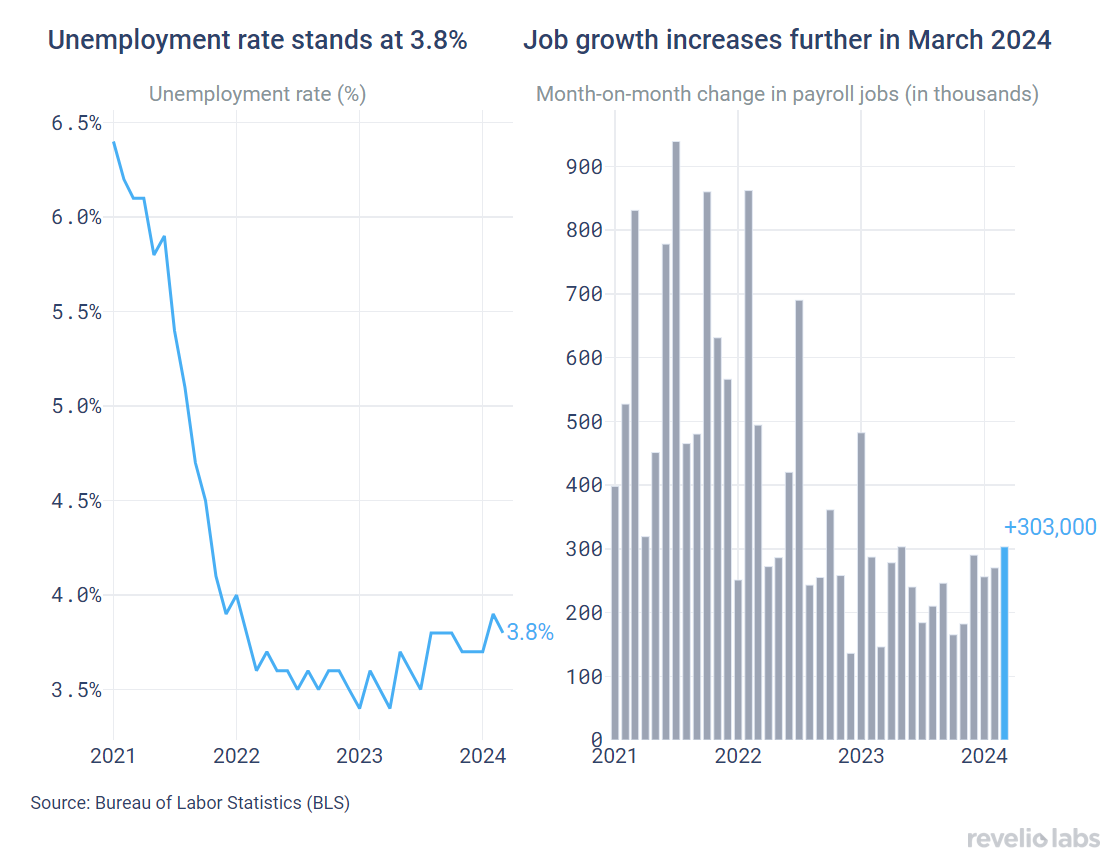

March’s Jobs Report surpassed expectations again

March’s Jobs Report signals the continued strength of the labor market. The unemployment rate decreased slightly to 3.8%. The US economy added 303,000 new jobs in March. Employment gains continue to be dominated by the Health care and Government sectors, which have been the main driver for job gains in the past few months.

What does the granular workforce data from Revelio Labs have to say about the labor market, and what do they signal about the labor market in the near future?

Declining hiring and attrition rates

Revelio Labs’ workforce intelligence data show that hiring and attrition rates have continued their declining trend. The hiring rate stood at 15.8% (decreasing only slightly from the 15.9% hiring rate recorded in February). Meanwhile, the attrition rate stood at 13.6% (slightly lower than the rate of 14.7% recorded in February). The workforce growth rate (difference between hiring and attrition rates) stood at 2.2% (higher than the growth rate in February on a m.o.m basis).

Sectoral hiring and attrition saw some notable changes during March. Overall, most sectors saw an increase in the growth rate compared to the growth rate in February. Construction continues to lead the sectors in terms of having the highest workforce growth rate (6.1% workforce growth in March compared to 6% in January). The exception to the workforce growth is in the Retail and Leisure and Hospitality sectors (Retail saw a growth rate of -1.1%, compared to -1.2% in February).

Of those who started who started a new job in March, 40.4% have transitioned to different roles and 67.9% have switched industries

Using Revelio Labs extensive workforce data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 42.3% of workers who started a new job in September, did so by also switching their broad job categories. This is less than the 42.6% job category switch rate observed in August. Furthermore, 69.9% of workers who started a new job in September, found their jobs in different industries. Inflows from other industries can be interpreted as a sign of confidence in the labor market. The consistent decline in the rate of switching industries and job categories signals weaker opportunities for participants in the labor market since the beginning of 2023.

The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to February 2024. The Construction sector had a notable increase in the influx of workers from other industries. 83.2% of workers who started a job in Construction in March came from other industries (+1.2 percentage points from the share in February). In contrast, the Information sector experienced the largest decline in the share of workers joining the industry from other industries. 69.9% of workers who started a job in Information in March had backgrounds in other industries, relative to 73.8% in February 2024 (a 3.9 percentage-point decrease).

The right panel shows the difference in the share of workers who started a new job in a different role relative to February 2024. Logistics roles exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while research and data analysis roles witnessed the largest decline.

Job postings increase slightly more in March 2024

The active job postings index continued its modest uptrend that started in January after 5 consecutive months of decline in job postings. Job listings increased by 1.55% compared to the previous month. New job listings increased by 0.9% month-on-month, while removed job postings also increased by 10.4% from their level in February.

The increase in job listings in March was driven by a large increase in active job postings in the Education sector (18.7% increase in active postings compared to February 2024). Meanwhile, the Transportation sector saw a 5.1% decline in the number of active job listings in March. Interestingly, Science and design roles saw the largest increase in active job postings in March; operations and IT-related jobs saw a notable decline.

The days-to-fill for open listings has ticked up again after a sizable decrease in February. Overall, average days-to-fill open positions continue on its increasing trend since Fall 2023. Average days-to-fill stood at 45.8 days in March, up from 44.6 days in February (+1.2 days). The general increase in the number of days required to fill open job postings over the Fall and Winter quarters signals a move back towards a tightening labor market.

Layoffs continue to decrease

The number of employees receiving layoff notices under the WARN Act decreased in March, echoing a downward trend in the number of employees notified of layoffs that started in the Summer of 2023. The number of layoffs remains elevated compared to 2022.

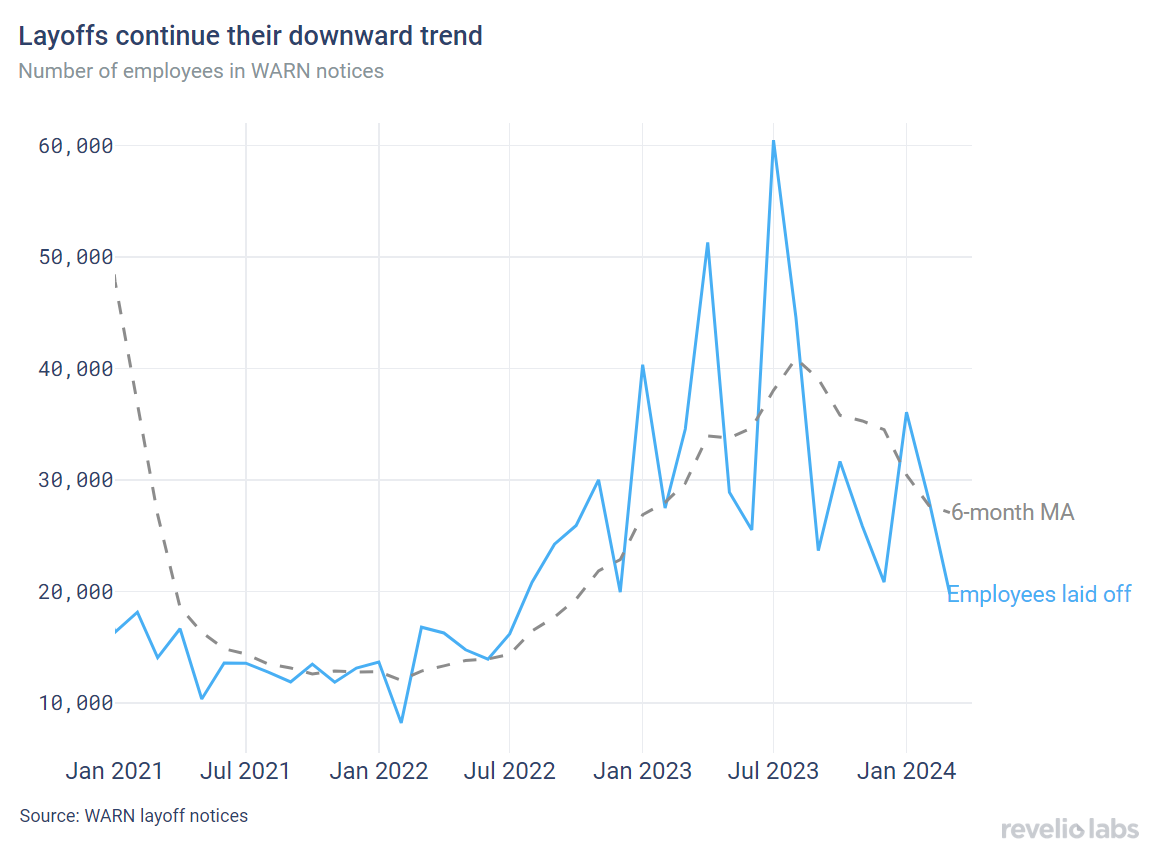

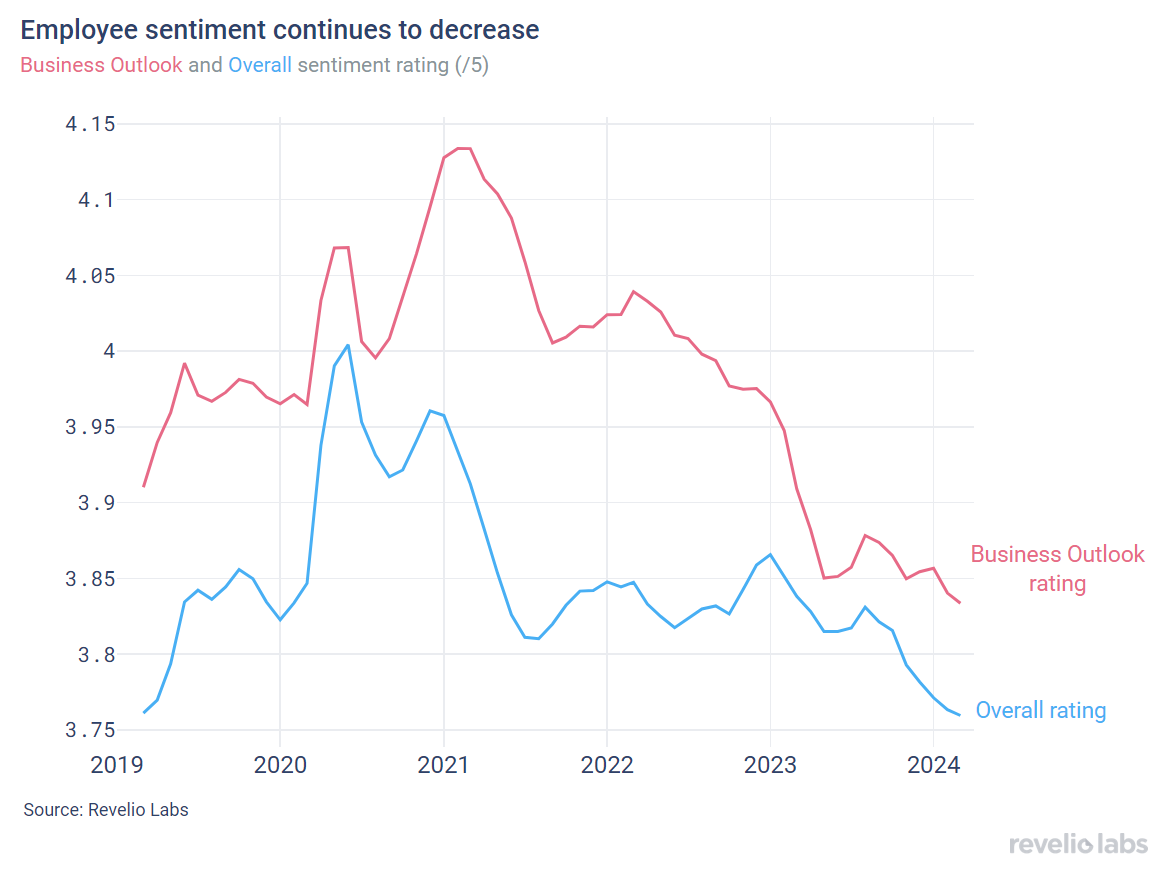

Quarterly highlight: Employee sentiment is at an all time low

In our previous research, we have shown that employee sentiment, particularly business outlook sentiment, serves as a leading indicator for negative events in a company, such as mass layoffs or the crypto collapse. We analyze overall average employee sentiment in the US. We find that both overall employee sentiment and business outlook sentiment have been continuously decreasing since they peaked in March 2021. As of March 2024, overall rating is back to the same level it was before the pandemic, while Business Outlook sentiment is at an all time low - lower than the pre-pandemic level. Low employee morale can be indicative of companies' poor performance and culture, and can be an early sign low productivity and high turnover.

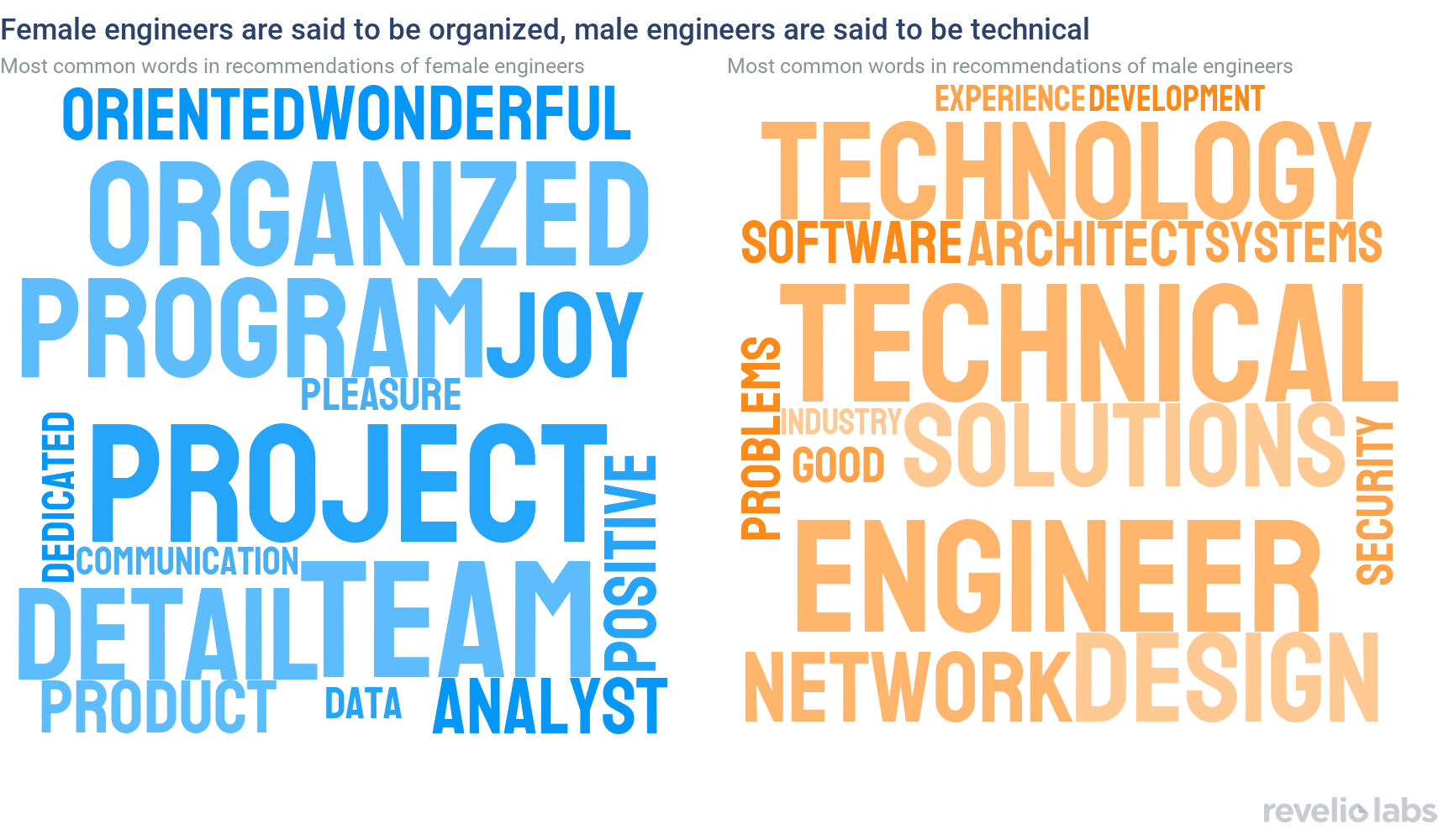

Highlight of the Month: Women Are “Wonderful,” Men Provide “Solutions.”

In our recent research, we highlight another gender gap: the gender gap in recommendations from former employers and colleagues. Public recommendations on professional profiles provide a positive signal to prospective employers, which translate in higher salaries on average. Revelio Labs’ workforce data show that there is a gender gap in recommendations. Not only do men have a higher likelihood of having recommendations on their profile, but also the content of recommendations varies significantly between men’s and women’s profiles, even after controlling for roles. Female engineers are most commonly described as “organized”, and “wonderful” “team players,” while men are often recommended for being “technical” and “solutions-oriented.”

Conclusion

The labor market continues to show remarkable strength at the end of the first quarter of 2024. While the hiring rate continues its downward trend, attrition is also decreasing at a faster rate, indicating heightened uncertainty among employers and workers. The dynamics of hiring and attrition still leave the workforce with a positive and stable growth rate. What is interesting to observe in our analysis are the industry dynamics. The Information and Tech industry saw the biggest decline in new workers starting jobs from outside the industry, as can be expected post layoff rounds. For two months in a row, Revelio Labs’ data shows that the Construction industry has experienced the fastest growth in workforce relative to all other industries. Job listings are also increasing steadily in this sector. BLS data also shows that Construction had a notable increase in job growth relative to last year, even amid the high interest rates. It remains essential for employers to address the declining employee sentiment and carefully design policies to boost employee morale, as the declining employee morale can hurt productivity.

Please view our data and methodology for this job report here and our recent research on employee recommendations here.