Is This the Great Leveling-Off?

A deeper dive into the workforce

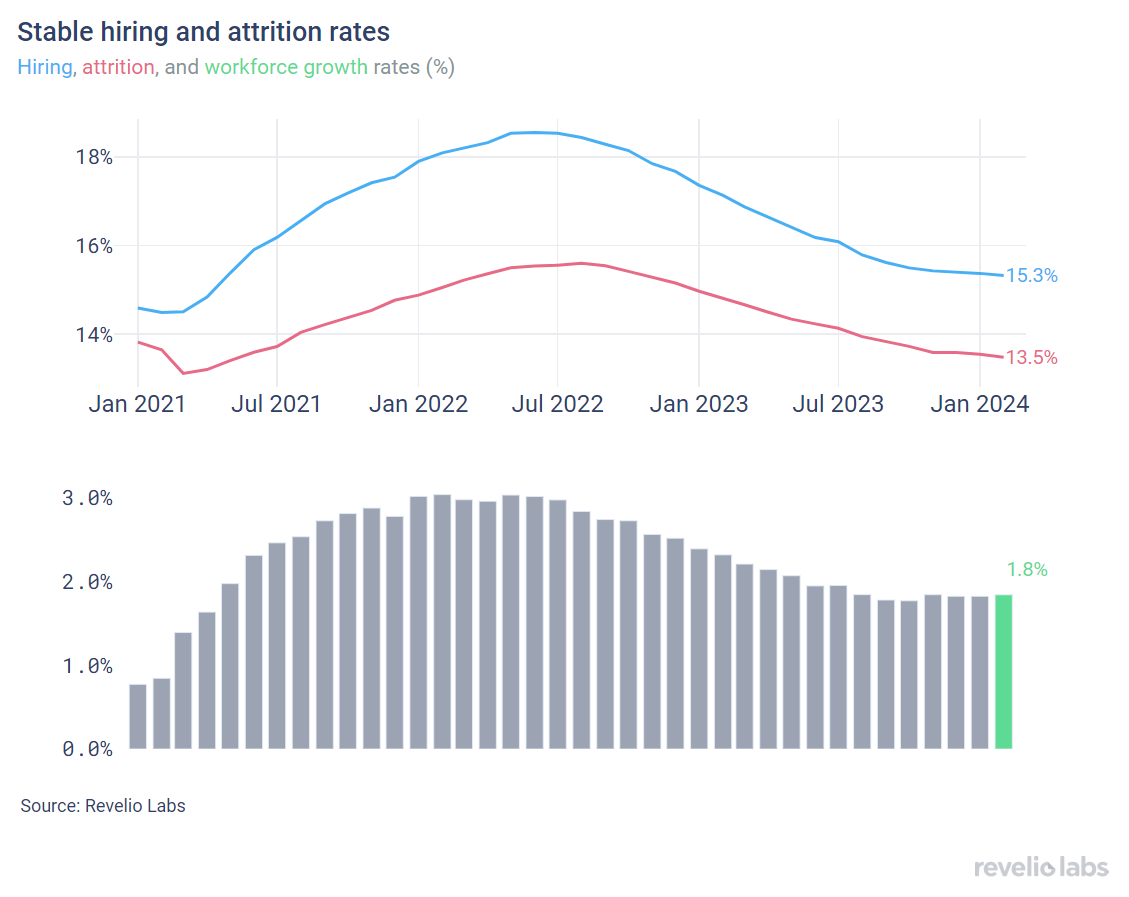

⬇️1.8% workforce growth rate in February 2024; unchanged from the growth rate observed in January. The unchanged workforce growth rate reflects highly stable hiring and attrition rates.

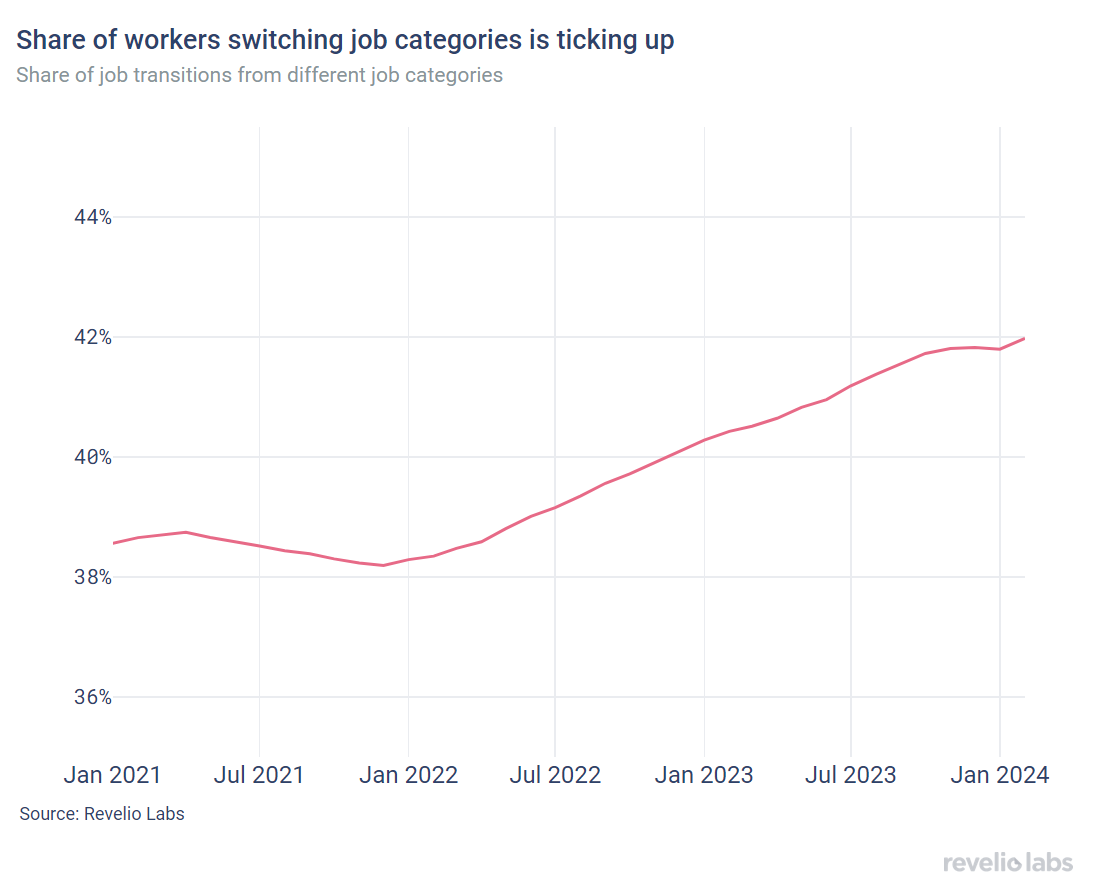

⬇️ 42.1% of workers who started a new job in February transitioned to a new role and 67.7% transitioned to a new industry. Information had the largest increase in the share of workers coming from other industries.

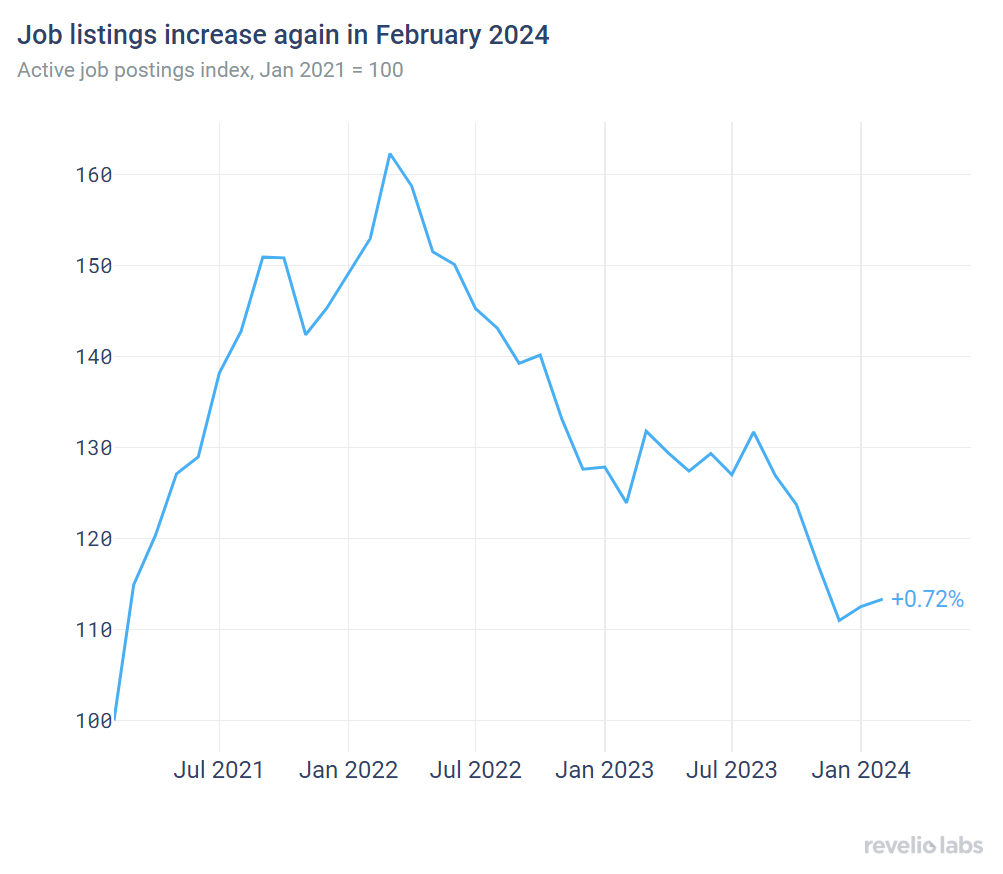

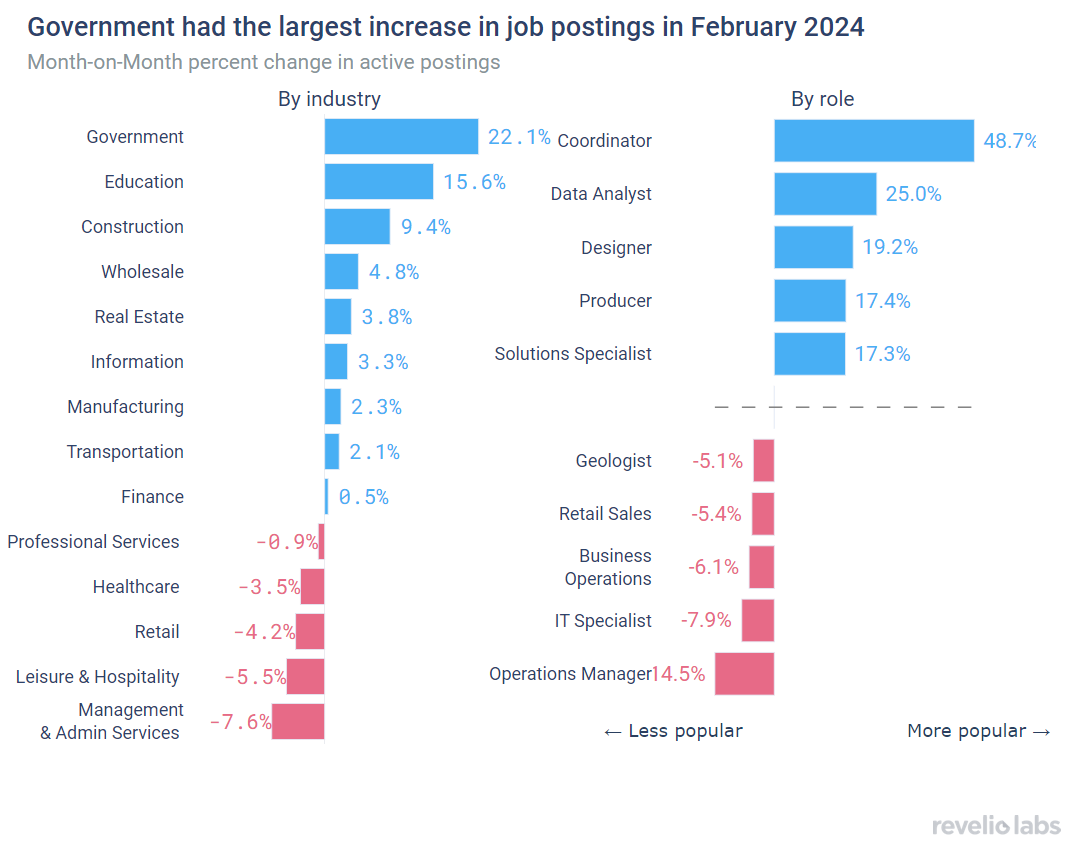

⬆️ 0.72% increase in active job listings in February from January. The Public sector had the largest increase in the demand for workers (22% increase in active listings in February), while Management and Administrative services had the largest decline in active job postings (-7.6% decline in February).

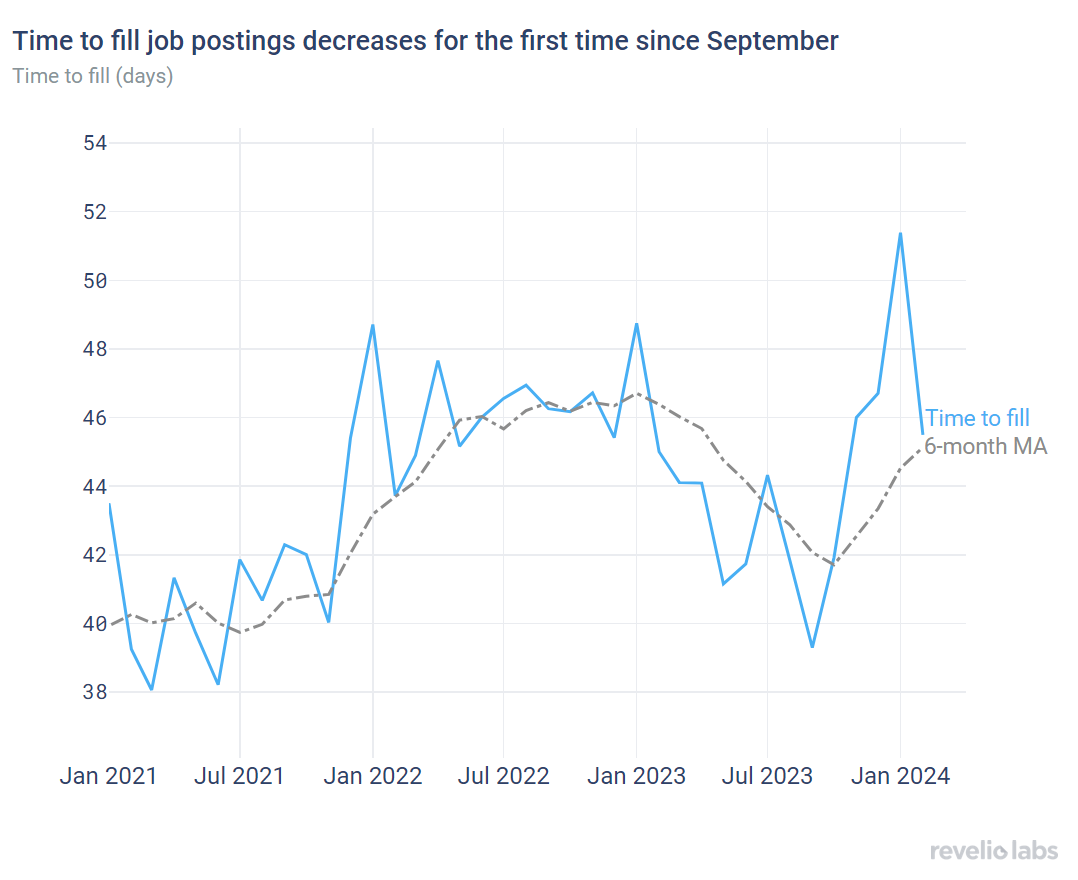

⬇️ 45.5 days to fill job openings in February. This is 5.9 days less than in January and 0.5 days more than in February 2023.

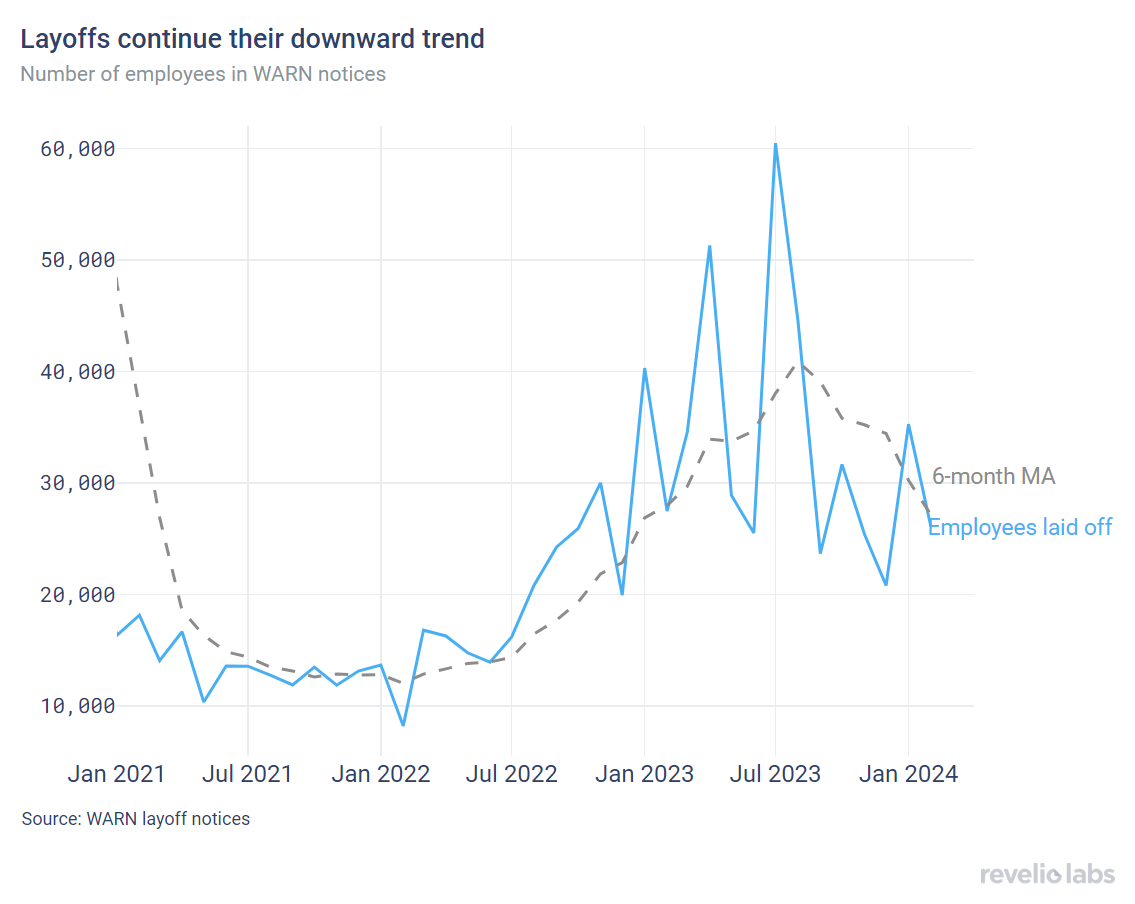

⬇️ 10.2% decrease in the number of employees notified of layoffs under the WARN Act compared to January 2024.

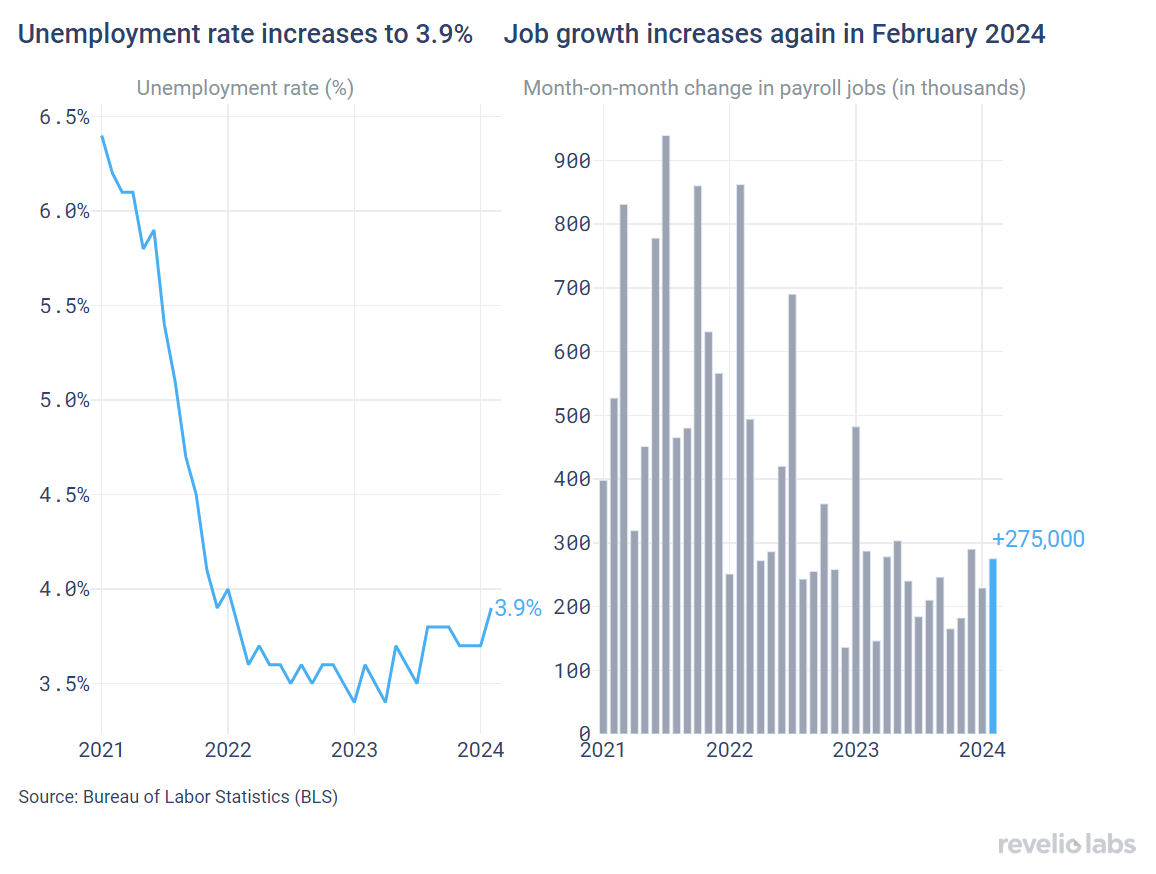

February's Jobs Report surpassed expectations again

February’s Jobs Report signals the continued resilience of the labor market. Despite a slight uptick in the unemployment rate in February, the US economy added 275,000 new jobs. Employment increased in health care, government, and food services. It is worth noting that jobs added in January were revised down to 229,000 jobs from 353,000 reported initially (-124,000 jobs). Overall, this remains a historically strong labor market.

What does the granular workforce intelligence data from Revelio Labs have to say about the health of the labor market, and what do they signal about the labor market in the near future? Read our detailed labor market analysis below.

Stable hiring and attrition rates

Revelio Labs’ workforce intelligence data show that hiring and attrition rates have continued their declining trend in February. The hiring rate stood at 15.3% (moderating only slightly from the 15.4% hiring rate recorded in January). Meanwhile, the attrition rate stood at 13.5% (unchanged from the rate recorded in January). The workforce growth rate (difference between hiring and attrition rates) stood at 1.8% (unchanged from the growth rate in January on a m.o.m basis).

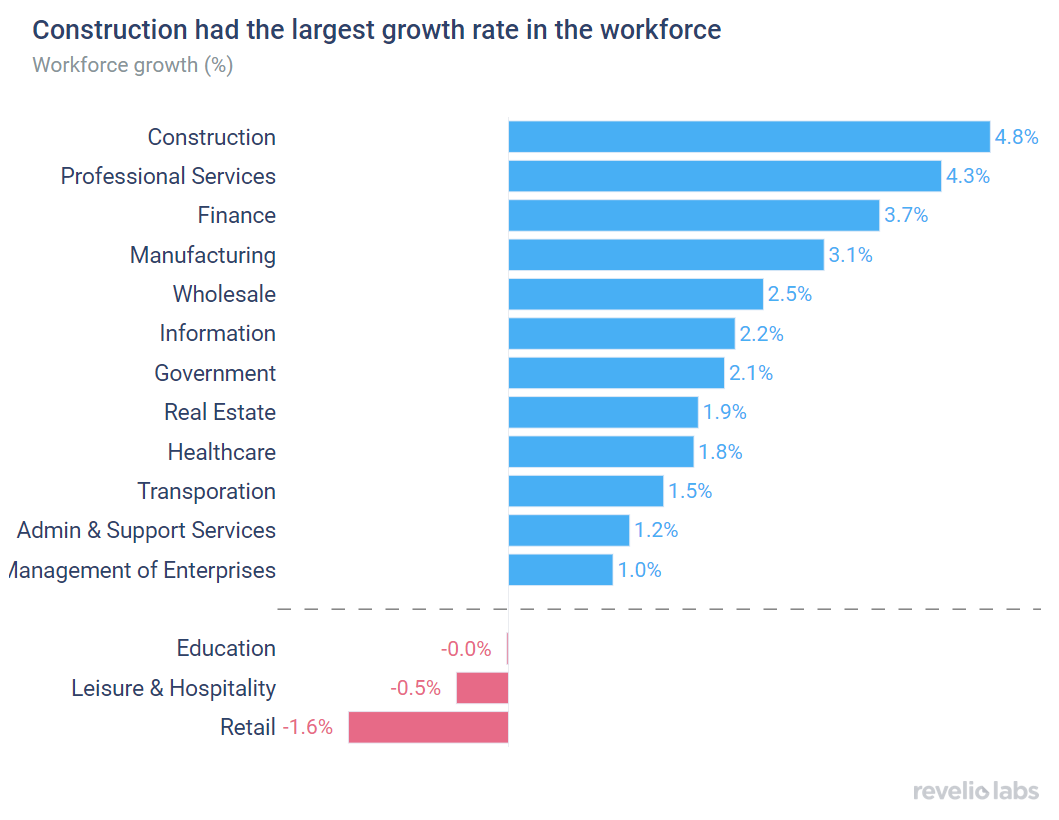

As overall hiring remains stable, within the sector hiring and attrition did not see large changes from last month. When assessing the workforce growth rate by sector, we find that Construction continues to have the highest workforce growth rate (4.8% workforce growth in February compared to 4.6% in January). On the other hand, Retail saw the largest decline in the workforce, with a growth rate of -1.6% (compared to 1.5% in January). The decline in workforce in Retail is expected in January and February as consumer spending grew only moderately in February due to expected seasonality after the holidays.

Of those who started a new job in January, 42.1% have transitioned to different roles and 67.7% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 42.1% of workers who started a new job in February did so by switching their broad job categories; this is unchanged from the rate observed since January. Furthermore, 67.7% of workers who started a new job in February started jobs in different industries - lower than the rate of switching in January (68.4%).

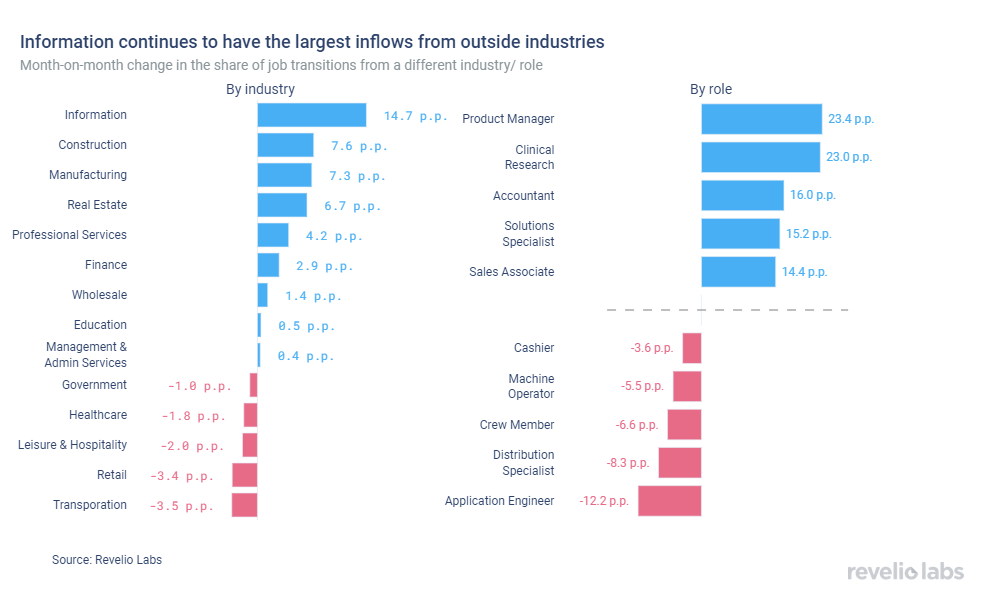

The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to January 2024. The Information sector continues to have a substantial increase in the influx of workers from other industries. 79% of workers who started a job in Information in February came from other industries (+14.7 percentage points from the share in January). The increase in transitions into the Information sector might be related to the increased investment in AI, resulting in more hires. In contrast, the Transportation sector experienced the largest decline in the share of workers joining the industry from other industries. 77% of workers who started a job in Transportation in February had backgrounds in other industries, relative to 80.5% in January 2024 (a 3.5 percentage-point decrease).

The right panel shows the difference in the share of workers who started a new job in a different role relative to January 2024. Product Manager roles exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while a number of retail-related roles witnessed the largest decline.

Job postings increase slightly in February

The active job postings index continued its modest uptrend that started last month after 5 consecutive months of decline in job postings. Job listings increased by 0.7% compared to the previous month. New job listings increased by 3% month-on-month, while removed job postings also increased by 8% from their level in January.

The increase in job listings in February was driven by a large increase in active job postings in the government sector (22.1% increase in active postings compared to January 2024). Meanwhile, the Management and Administrative Services sector saw a 7.6% decline in the number of active job listings in February. Interestingly, data analysis and design roles saw the largest increase in active job postings in February. Meanwhile, operations and IT-related jobs saw a notable decline.

The days-to-fill for open listings has decreased in February, after increasing consistently since September 2023. Average days-to-fill stood at 45.8 days in February, down from 51.5 days in January 2023 (-5.6 days). The general increase in the number of days required to fill open job postings over the Fall and Winter quarters signals a move back towards a tightening labor market.

Layoffs continued to decrease

The number of employees receiving layoff notices under the WARN Act decreased in February, echoing a downward trend in the number of employees notified of layoffs that started in Summer of 2023. While the number of layoffs remains elevated compared to 2022, although it has reached very low levels.

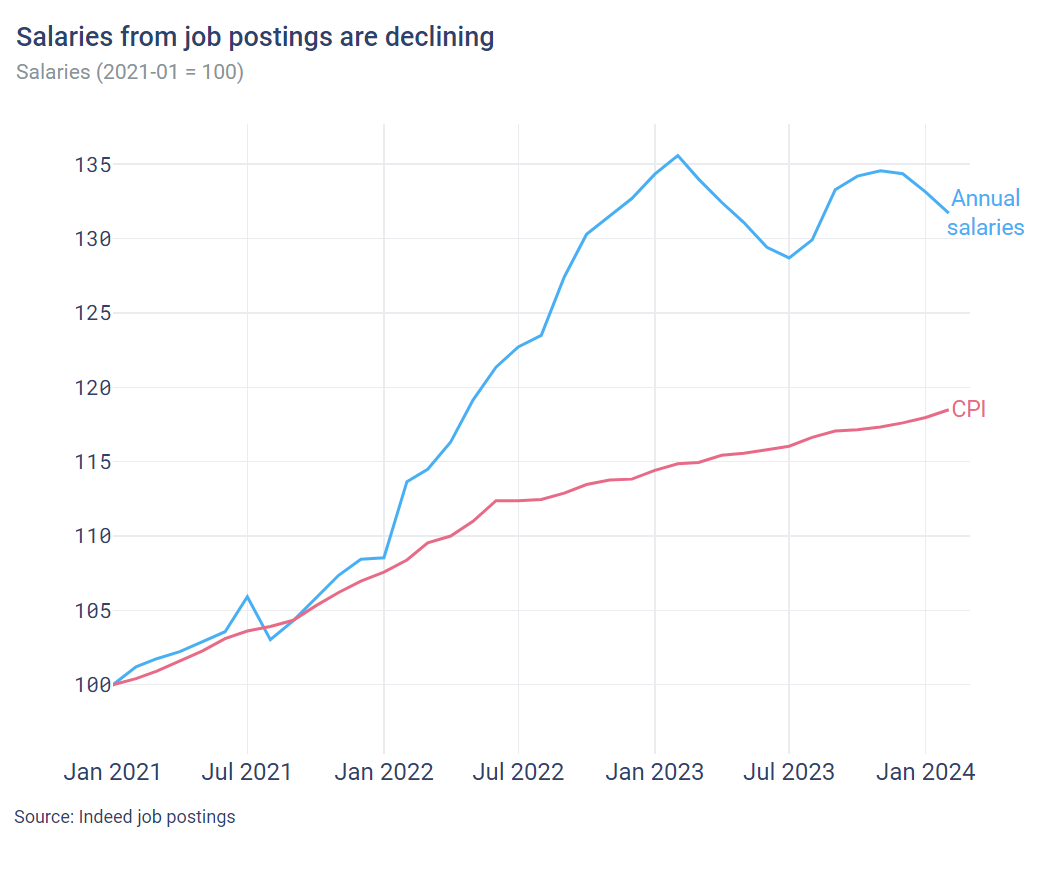

Quarterly Highlight: Salaries in job listings

We analyze salaries stated in job postings in the US. Unlike current wages data, the salary information from job postings offer a forward-looking perspective on the economy. It serves as an indication of employers' anticipated compensation for prospective hires, providing insights into labor market conditions and anticipated inflationary pressures. Annual salaries announced in job postings have exhibited a declining trend since mid 2022, with a notable decline starting in the second half of 2023, aligning with the CPI trend. The declining trend in advertised salaries suggests a slackening of labor market conditions.

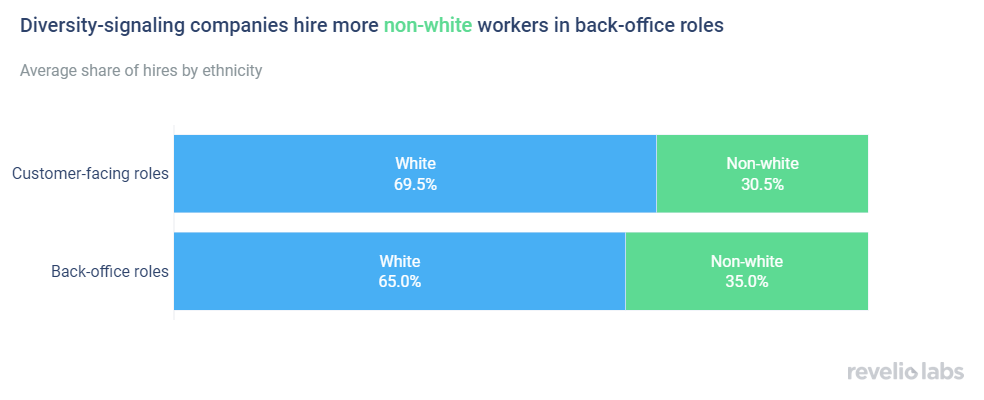

Highlight of the month: Companies are willing to increase diverse hires only in the back office

Do companies that signal commitment to diversity actually fulfill their commitment? Our recent research shows that yes, they do!

To identify these signals of commitment to diversity, we look at hints in job postings. We are particularly interested in Equal Employment Opportunity (EEO) statements, which are voluntary statements that companies add to the job postings to signal to job applicants that they provide a welcoming and inclusive work environment in which they comply with relevant laws and regulations regarding equal opportunity. Companies that include EEO statements in their job postings tend to have more racially diverse hiring practices compared to companies that do not use these signals. Our research also reveals a very interesting fact. Companies that include EEO statements are being selective about which job postings to include EEO statements for. Companies only include EEO statements for back office positions, such as engineering and admin, but do not include them in customer-facing positions. These companies still adhere to their pledge of commitment to diversity, but in the back office.

Conclusion

As we progress through 2024, the labor market remains largely stable, with stable unemployment, hiring, and attrition rates. The notably lower attrition rate signals increased uncertainty among workers, while the flat hiring rate and higher time to fill signals uncertainty among employers. Interestingly, salaries posted in new job postings have been declining since the Fall of 2023, signaling a softening in the labor market.

Please view our data and methodology for this job report here and our recent newsletters on diversity signals here.