Tech Brother, Where Art Thou?

How tech’s slowdown fueled a new talent boom

The wave of tech downsizing that began in the summer of 2022 triggered a surge in transitions to non-tech companies, allowing traditional, non-tech industries to absorb newly available high-skilled tech talent.

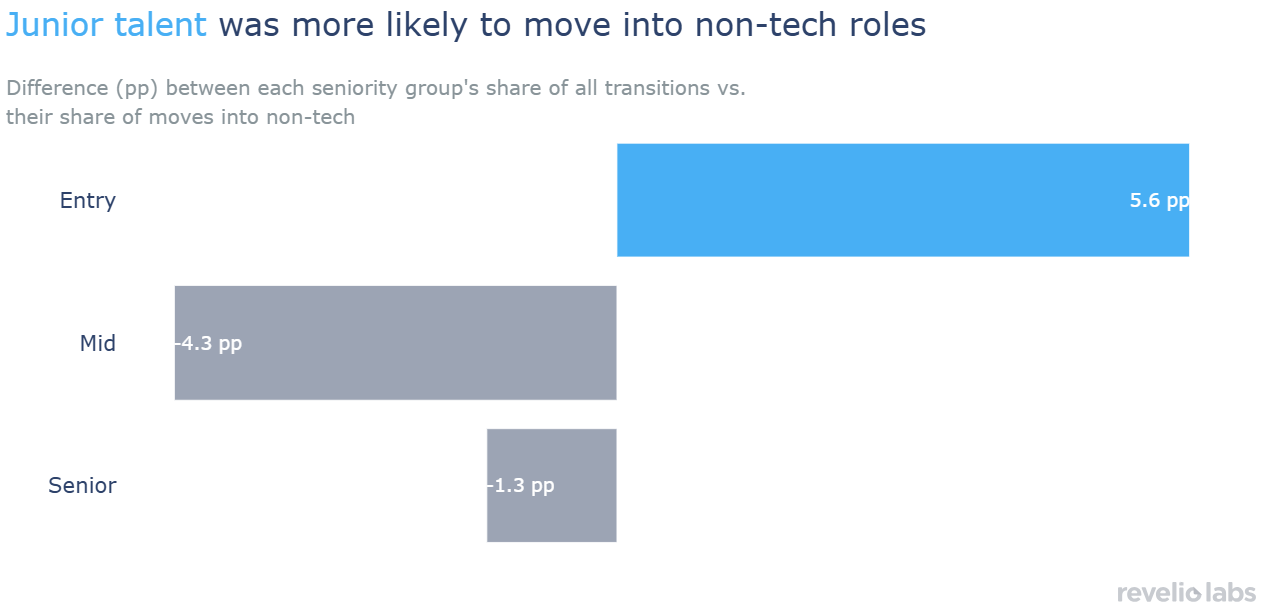

Entry-level employees were overrepresented among the employees who left tech to non-tech industries, suggesting senior staff were more reluctant to make the jump.

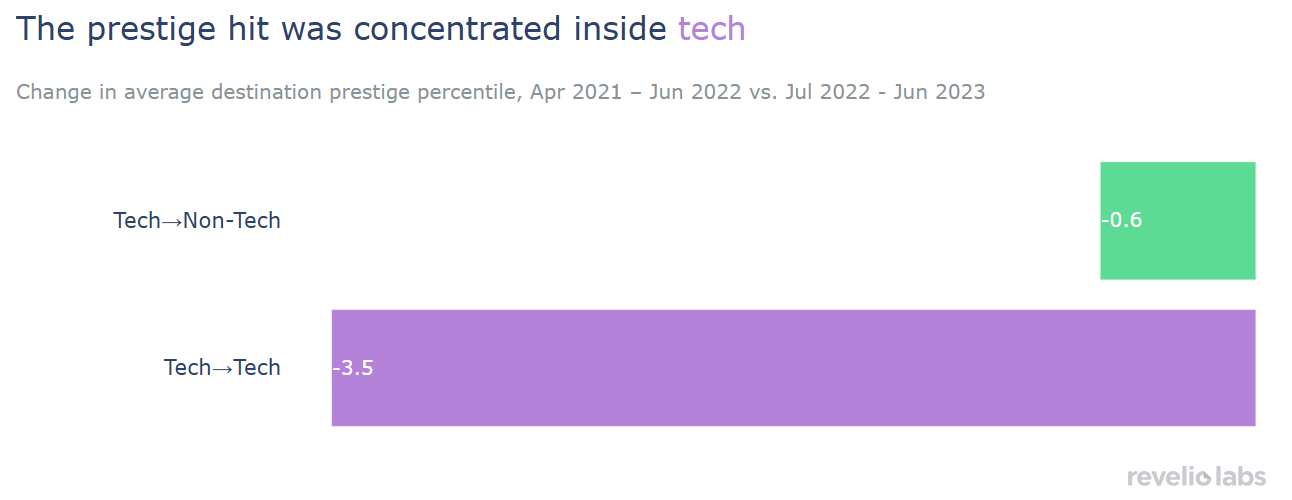

Employees who made transitions to non-tech were able to transition to companies with similar prestige compared to earlier job switchers, while those staying within tech took a hit in terms of the prestige of companies they were able to land in. On the other hand, tech-to-tech transitions were still rewarded with higher salary premia.

The mass tech layoffs of 2022–2023 led to an unprecedented reshuffling of high-skilled labor. Meta, Google, Amazon and Microsoft laid off around 70,000 people alone at that time. This meant that thousands of engineers, analysts, and designers suddenly entered the job market at once, raising a natural question: where did all that talent go? In this week’s newsletter, we trace the movements of tech workers over time to see how this shock reshaped the workforce.

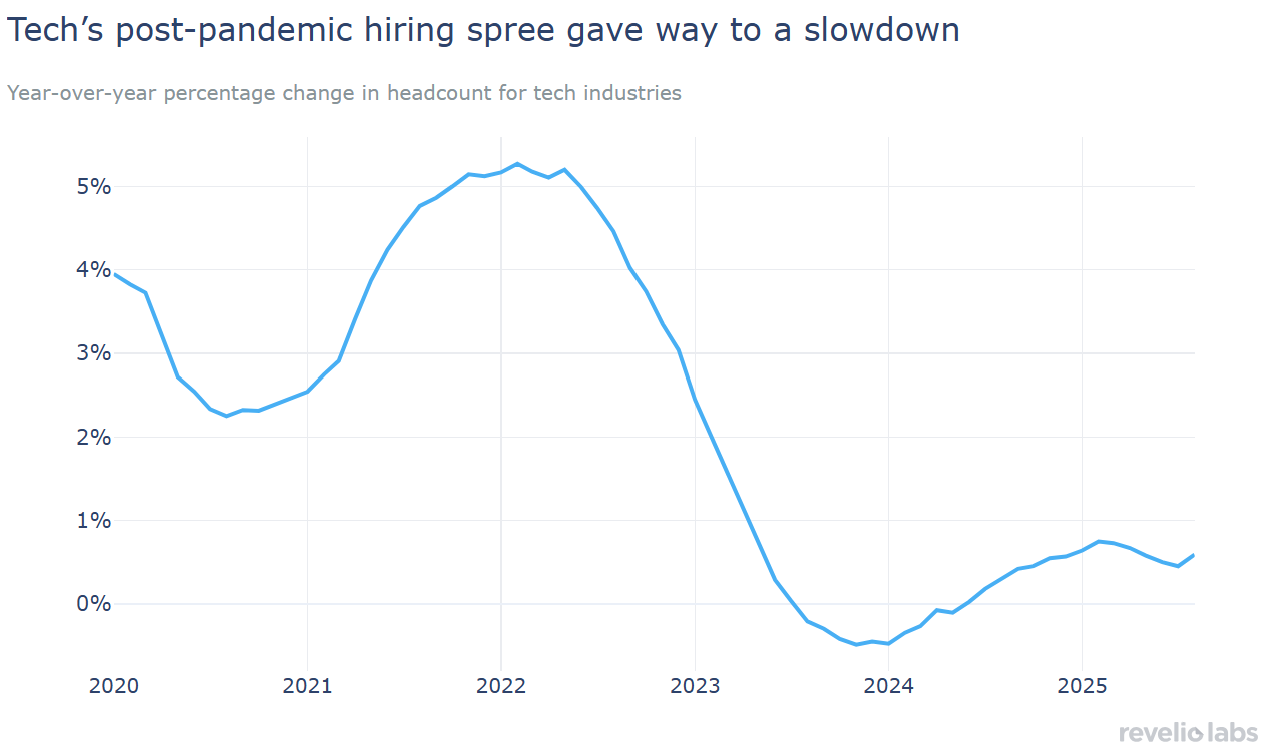

Headcount growth in the US tech sector accelerated during the Great Resignation with year-over-year headcount growth peaking above 5%, it then took a sudden hit starting late 2022 as companies reined in hiring and shed staff throughout 2023. By early 2024, employment growth in tech had effectively flatlined, marking the lowest point since the pandemic recovery began. The modest rebound seen in 2025 suggests a stabilization phase rather than a new growth cycle, as firms focus on efficiency, automation, and selective hiring rather than the broad-based expansion of prior years.

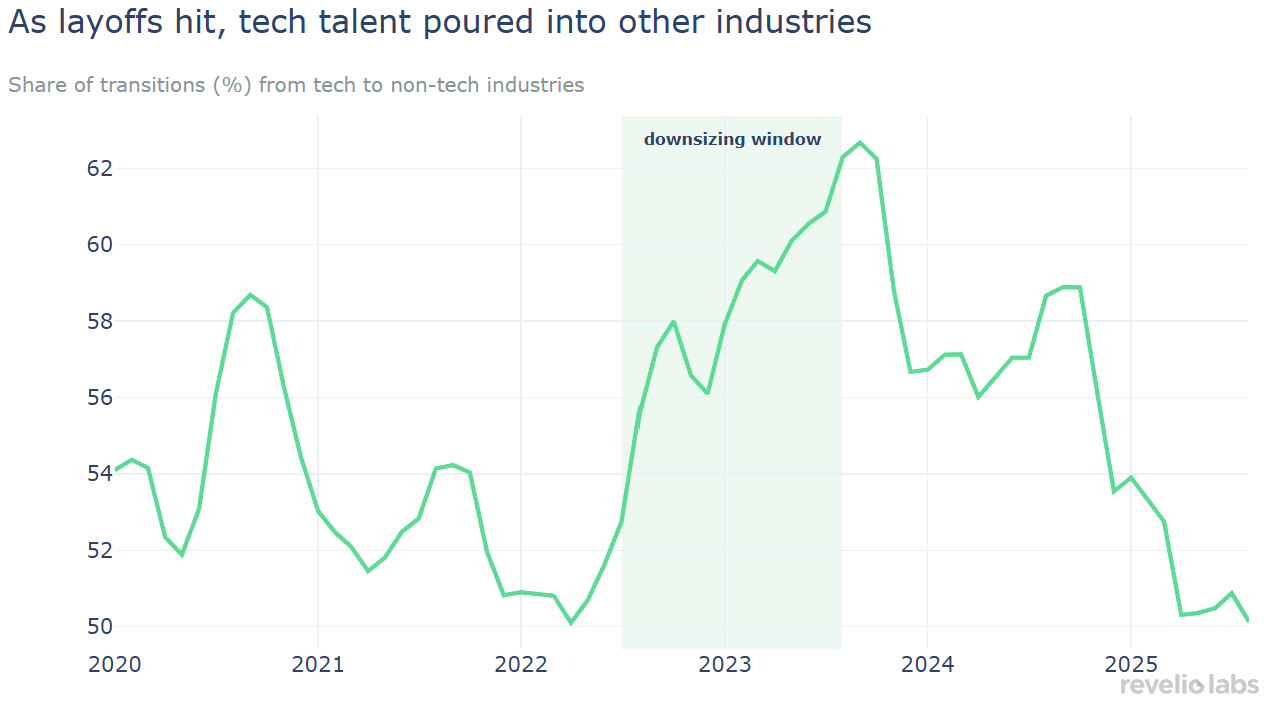

Tech downsizing set off a massive reallocation of talent. As layoffs intensified, the share of tech workers moving into non-tech industries surged. Before mid-2022, roughly half of all tech employees changing jobs in a given month stayed within the industry; by mid-2023, more than 60% of movers were taking roles outside traditional tech. For many non-tech companies, this period represented an opportunity to attract high-skilled talent that had long been concentrated in big tech firms.

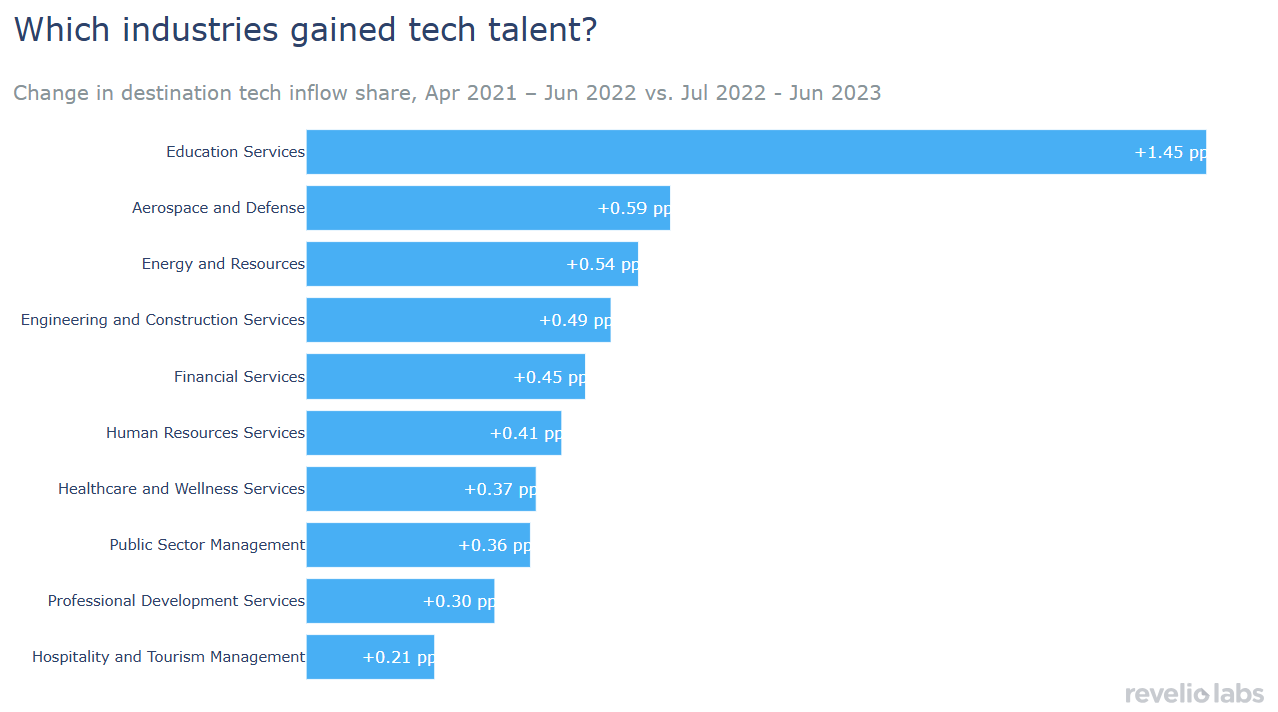

Who took advantage of this redistribution? When we compare destination industries of former tech talent during the downsizing window against the post-pandemic boom, several non-tech sectors stand out. Education Services emerges as the biggest winner, increasing its share of tech inflows by more than a full percentage point compared to the pre-layoff baseline. Aerospace and Defense, Energy and Resources, and Financial Services also saw meaningful gains, suggesting broader diversification of where tech expertise is being deployed. These sectors, which are traditionally slower-moving and less obviously attractive to younger talent than big tech, previously struggled to compete with FAANG-level compensation and perks. With the layoffs, they had access to engineers, data scientists, and product managers eager for stability or mission-driven work.

The workers most likely to venture outside the tech sector were those just starting out. Entry-level employees were overrepresented by about 5.6 percentage points among those who moved to non-tech industries, meaning their share of transitions into non-tech was 5.6 points higher than their overall share of all tech transitions. Mid-level and senior employees were underrepresented by 4.3 and 1.3 points, respectively. In other words, early-career workers were disproportionately the ones leaving tech altogether. For non-tech employers, these junior professionals offered a rare opportunity to bring in adaptable, tech-literate talent. Meanwhile, more experienced tech workers may have preferred to stay within the industry, waiting for conditions to stabilize rather than trading their established career capital for an unfamiliar environment.

Compared to peers who switched jobs within tech during the 2021–2022 boom, those who stayed in the sector ended up at less prestigious firms, moving to companies roughly 3.5 percentile points lower in prestige. Those who left tech for other industries, by contrast, saw only a modest 0.6-point decline. This shouldn’t come as a surprise: top-tier tech companies were still expanding aggressively post-pandemic. As hiring froze at major tech firms, many laid-off employees likely found new roles at smaller or less established companies such as startups, mid-size SaaS firms, or regional players. Meanwhile, those moving into non-tech industries may have joined more established corporations with steady reputations, like financial services or aerospace, resulting in a softer prestige drop even amid the downturn. Despite these prestige losses, pay held strong. Our analysis shows that workers who stayed in tech saw average salary gains of 18.6%, while those who moved to non-tech industries earned 12% more than before. Smaller or mid-size tech firms likely seized the moment to attract newly available high-skilled talent with higher pay, underscoring how resilient and valuable technical expertise remains across the economy.

The 2022–2023 layoffs were less a collapse than a redistribution of human capital, one that continues to shape the post-pandemic labor market. The demand for tech talent never truly disappeared, rather the insatiable appetite for talent among big tech during the hiring boom masked the broader underlying demand across the rest of the economy. Once big tech began to downsize, companies in other industries eagerly absorbed the newly available talent. What began as a wave of layoffs has blurred the boundaries of “tech.” As AI transforms how companies build, hire, and compete, where tech talent ends up may define the future of work.