Introducing the Revelio Labs Workforce Confidence Pulse

A forward-looking signal of what workers expect

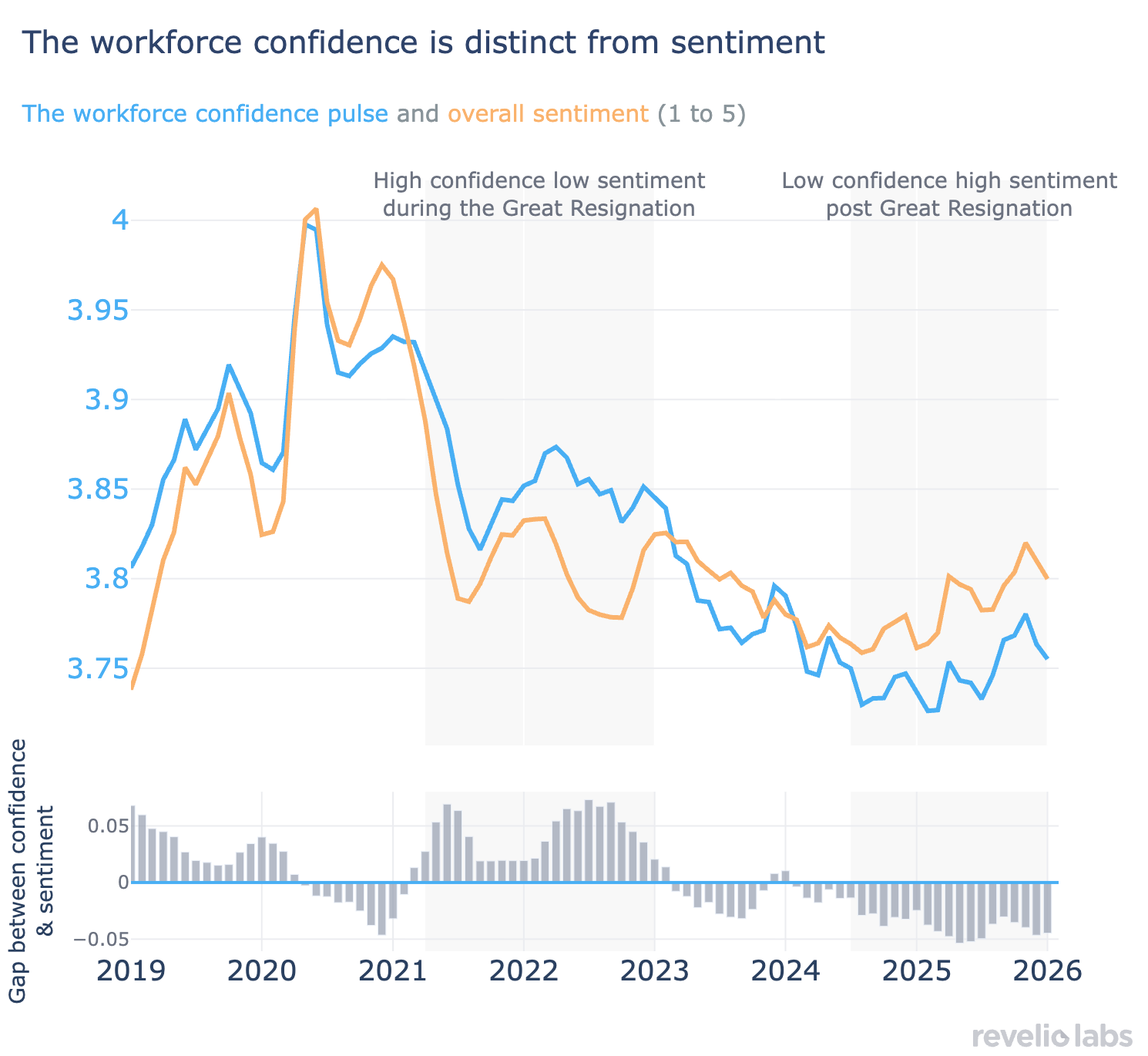

We introduce the Revelio Labs Workforce Confidence Pulse, a measure that captures forward-looking signals about the future of their company. Worker confidence is distinct from sentiment, as it reflects workers’ expectations about the future of their company and leadership, not just their satisfaction with current conditions. While the two metrics often move together, they diverge during different phases of the labor market. For example, during the Great Resignation, confidence ran high while satisfaction declined, consistent with the behavior of workers seeking outside options. More recently, as the market has cooled, overall sentiment has rebounded faster than confidence, suggesting employees feel comfortable today while remaining uncertain about the future of their company’s business.

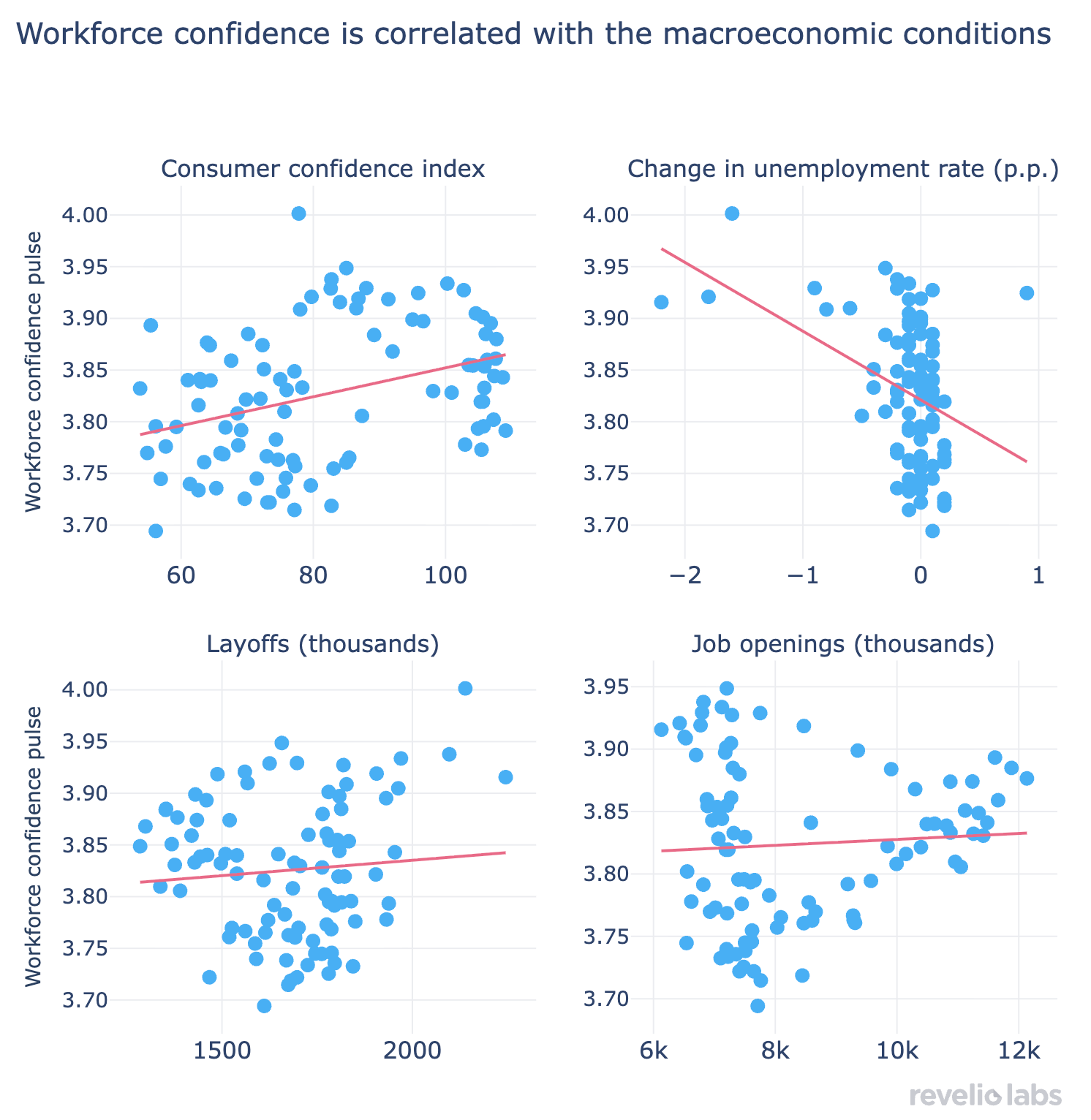

Workforce confidence is shaped by the macroeconomic environment, as workers view their employers’ actions alongside broader economic conditions. Our workforce confidence pulse correlates with macroeconomic variables such as consumer confidence and the unemployment rate.

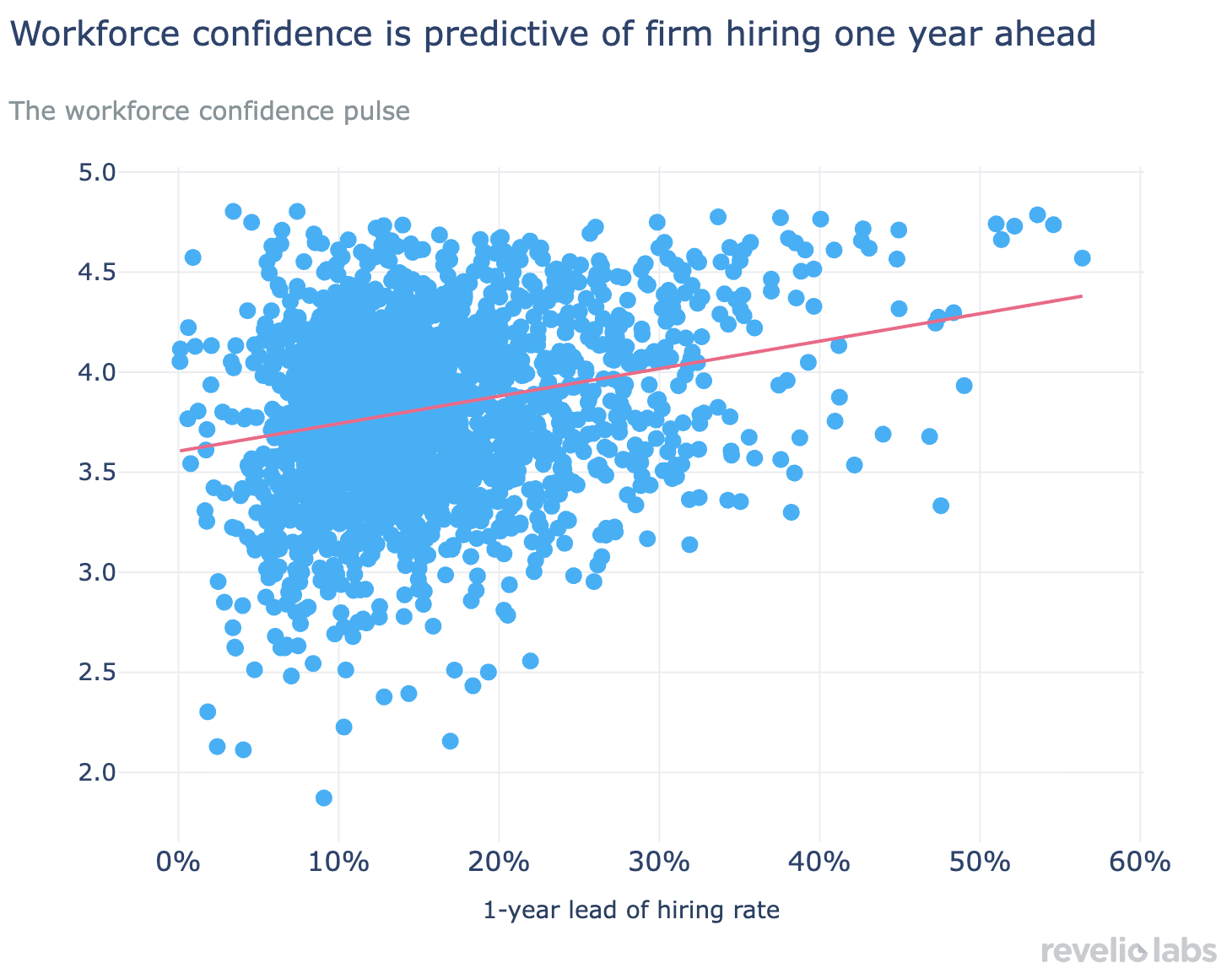

The Workforce Confidence Pulse contains forward-looking information about firm behavior. Firms with higher confidence in a given year tend to hire more in the following year. Employees pick up on internal momentum and leadership signals that precede observable hiring activity.

Labor market statistics are centered around trends like hiring, attrition, job openings, layoffs and new jobs added, but behind all these metrics are workers who make decisions about their labor supply and career movements. Employee decisions are based on their degree of confidence in their employers–that is, how they assess the future of their employers and how they perceive their own career prospects within these companies.

Despite its importance, employee confidence has not been measured in a systematic way. To our knowledge, the main existing measure is Glassdoor’s Employee Confidence Index, which defines confidence as the share of employees who report a positive six-month business outlook for their employer. While useful, this approach is narrow, as employee confidence encompasses more than just business outlook. Factors such as confidence in senior management or the CEO, as well as the perceptions of career opportunities or growth of employees within the company, also play an important role in determining confidence.

To fill this gap, we construct Revelio Labs Workforce Confidence Pulse using data on employee sentiment from current US employees. Our goal is to capture forward-looking signals from employee reviews. It is built on five components that capture different dimensions of confidence:

- Business outlook, which directly captures employees’ expectations about the future of their company

- CEO approval, a measure of trust in strategic direction

- Senior leadership, a measure of trust in leadership

- Career opportunities, capturing beliefs about internal advancement and long-term fit

- Recommend to a friend, which captures employees’ willingness to endorse the firm

Each component is standardized and combined into a single measure at the review level. The standardized overall confidence measure is later converged to a scale from 1 to 5 for interpretability. We restrict the sample to reviews given by employees who were employed at the time of the review to ensure that the index reflects active, forward-looking workforce beliefs rather than retrospective evaluations from former workers.

We aggregate the Workforce Confidence Pulse to look at the trends in employee confidence in the US over time. Workforce confidence rose steadily in the years leading up to the pandemic, peaking in mid-2020. It is interesting to note that even when the economy was hit by the Covid shock, employees continued to have confidence in their workplace, likely as they did not get laid off and were protected with remote work policies. Beginning in 2021, employee confidence started to decline. The decline in confidence accelerated through the cooling labor market in 2023 and 2024, as uncertainty about the economy, firm performance, and longer-term career prospects increased amid slowing hiring. Workforce confidence reached a trough in early 2025 and has been modestly recovering since then.

We compare the Workforce Confidence Pulse with Glassdoor’s overall rating, a proxy for employee sentiment and job satisfaction. While both series are derived from employee reviews, they measure fundamentally different concepts. Overall ratings primarily reflect current workplace conditions and how satisfied employees are with pay, benefits, and day-to-day experiences. Confidence, by contrast, reflects expectations about the future: whether workers believe their firm is on the right trajectory, whether leadership can navigate a more uncertain environment, and whether staying invested makes sense. In other words, workers may report being satisfied with their jobs even as their confidence in their employer’s future erodes, or can show confidence in the future of their company, even when they are unsatisfied about their experience in the company.

In general, confidence and sentiment move closely together, yet examining the differences between the two series reveals interesting patterns. In the years leading up to the pandemic, both sentiment and confidence were rising, although confidence was generally higher than sentiment. That is because the stable labor market at the time gave workers optimism about their firms’ prospects and their own career trajectories, even when day-to-day frustrations about pay or work-life balance remained. During the pandemic, sentiment was generally higher than confidence, as workers were uncertain about the future, yet they reported strong sentiment thanks to remote work policies that not only protected their employment, but also improved their work-life balance. During the Great Resignation, company performance remained solid, keeping confidence elevated. However, sentiment deteriorated quickly as workers realized they had attractive outside options and began to reassess whether their jobs still matched their expectations around pay, flexibility, and career progression. The tides have shifted as the labor market cooled and entered the current stagnation phase. Employee sentiment has started to rebound faster than confidence. With fewer outside opportunities, workers are coming to peace with their current jobs, rating culture and compensation and benefits more favorably. Yet, they are skeptical about their employers’ long-term growth and leadership direction as the economy is going through a squeeze.

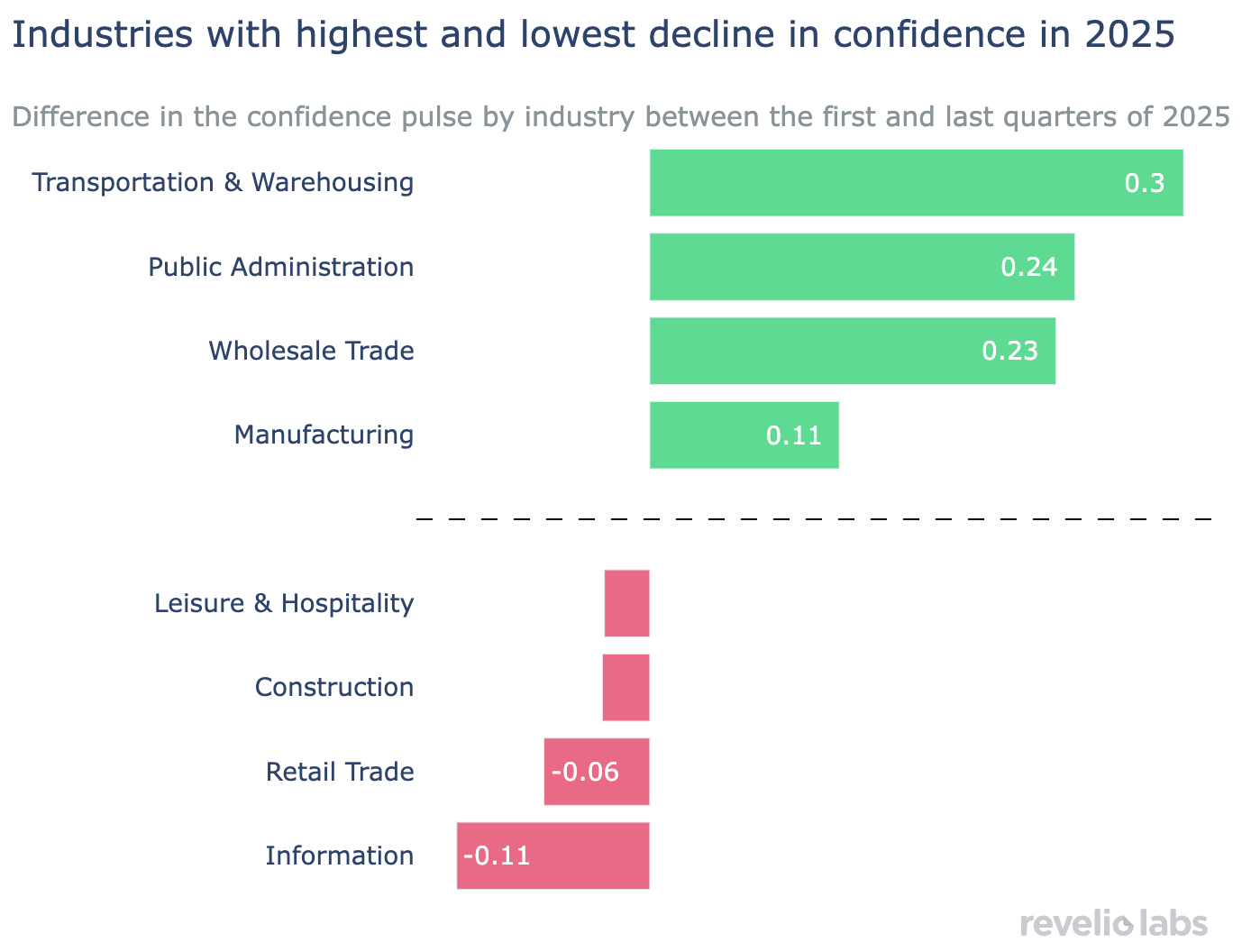

We examine the change in confidence in 2025 by sector to understand which industries are driving the recent recovery. Confidence increased in most sectors, with the strongest gains in Transportation and Warehousing, Public Administration, and Wholesale Trade. The improvement in Public Administration is striking but generally understandable. Confidence of government workers reached a low point in early 2025 following the announcement of DOGE reforms, return-to-office mandates, and anticipated federal layoffs. By the end of the year, much of the adjustment had already occurred, and remaining workers faced more stability. In contrast, confidence declined most sharply in the Information sector, where uncertainty around tech layoffs and the impact of AI on jobs contribute to negative workers’ expectations. Retail also saw a notable drop in confidence, reflecting ongoing employment losses. These patterns highlight how confidence responds not only to current conditions but to perceptions about where each sector is headed.

On the aggregate, employee confidence is affected by overall macroeconomic trends. Workers interpret their own firms through the lens of the broader economic environment: mortgage rates, daily living expenses, headlines about layoffs, and the overall expectations about the business cycle. It is therefore not surprising that Revelio Labs Workforce Confidence Pulse moves closely with major macroeconomic indicators. The workforce confidence pulse rises alongside consumer confidence, as households' optimism transfers into optimism about the workplace and shapes how employees interpret their prospects. It falls when unemployment begins to climb, as outside options are weakening. Yet, we observe a puzzling positive correlation between confidence and layoffs. While it might seem counter intuitive, layoffs happen during periods of restructuring as firms are investing in future growth. Employees may read such moves as evidence of dynamic restructuring of the firm. These relationships highlight why confidence is different from employee sentiment. Satisfaction is driven by current pay and working conditions, while confidence is anchored in expectations about the future.

Are workers’ instincts about their firm’s future informative? To test this, we compare a firm’s average workforce confidence pulse over a given year with its hiring activity in the following year, using actual hiring as a proxy for firm expansion. We find a positive correlation between the workforce confidence pulse and next year’s hiring, suggesting that employees absorb signals from their managers about growth prospects and internal momentum that later materialize as new hiring. In this sense, employee confidence contains meaningful forward-looking information about firm behavior.

The health of the labor market is typically described through hard facts: Jobs created, quits, openings, and layoffs. Yet behind these aggregates are workers’ expectations that determine whether they leave or stay. Revelio Labs Workforce Confidence Pulse is a way to quantify employee expectations, helping explain why macroeconomic changes produce different workforce outcomes. Incorporating confidence into labor market analysis can improve how we interpret company-specific trends and the impact of corporate decisions on workers. Employee confidence is the missing link between firms’ plans and workers’ behavior, making it a useful leading indicator for how firms manage their workforces.