After a Three-Year Slide, Employee Sentiment Has Finally Turned a Corner

A (cautiously) happier workforce enters 2026

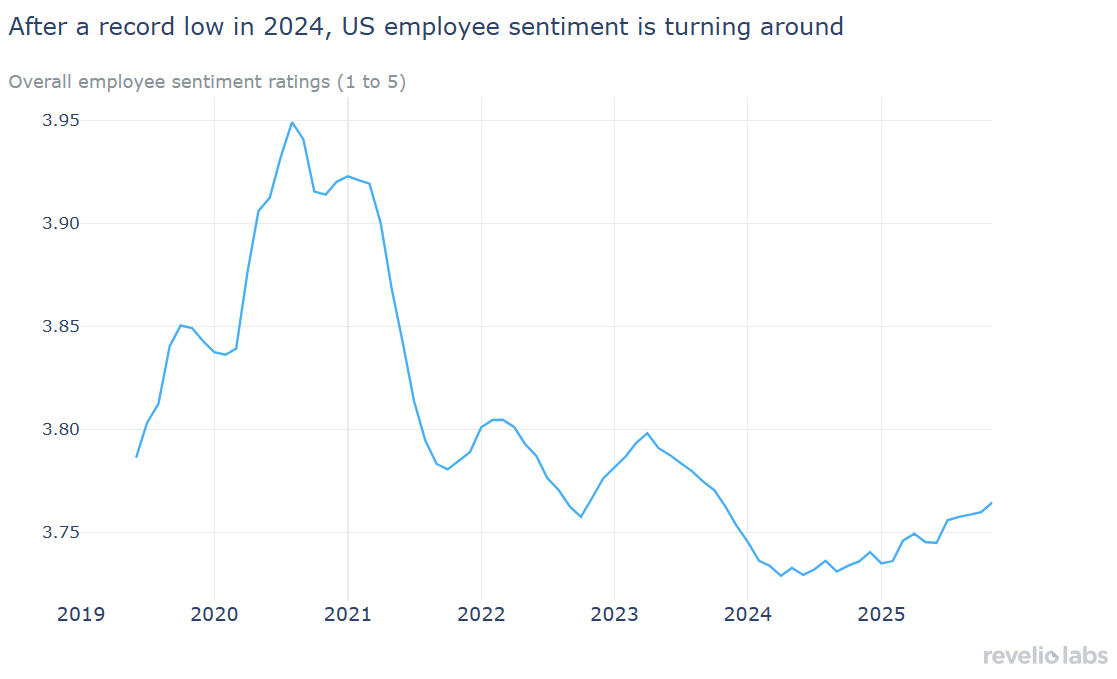

Despite the slowdown in the labor market in 2025, we can still end 2025 on a positive note. The downward trend in employee sentiment that started in the second half of 2020 has finally been reversed. In mid 2024, overall employee sentiment rebounded and continued to strengthen throughout 2025.

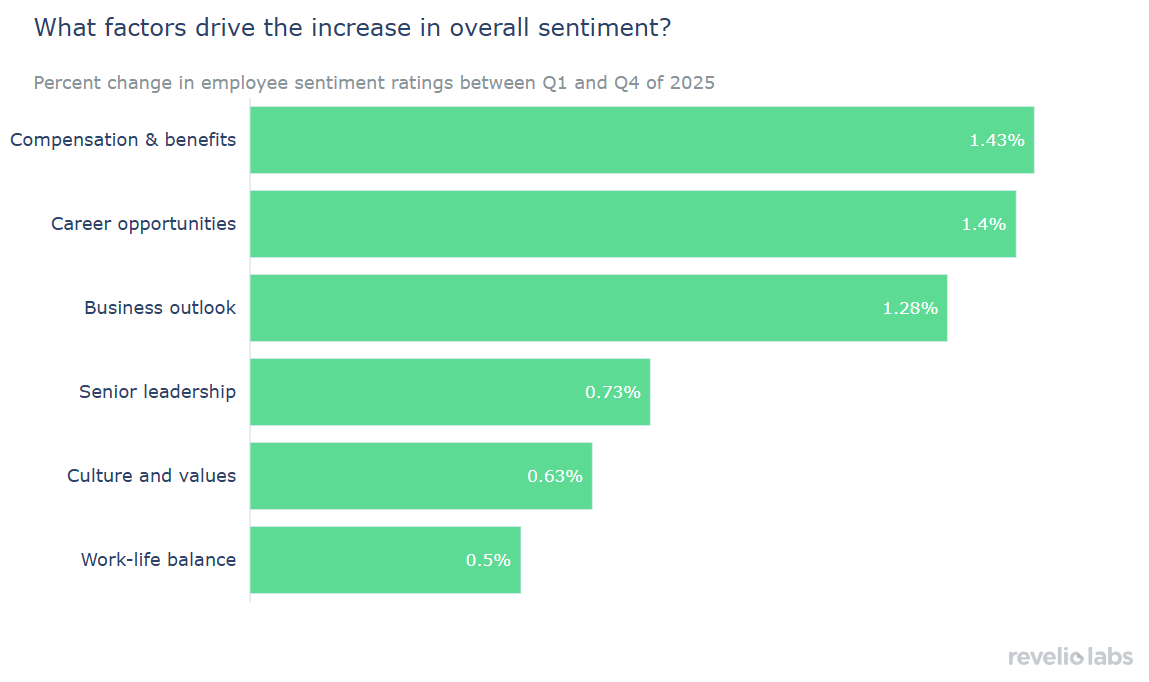

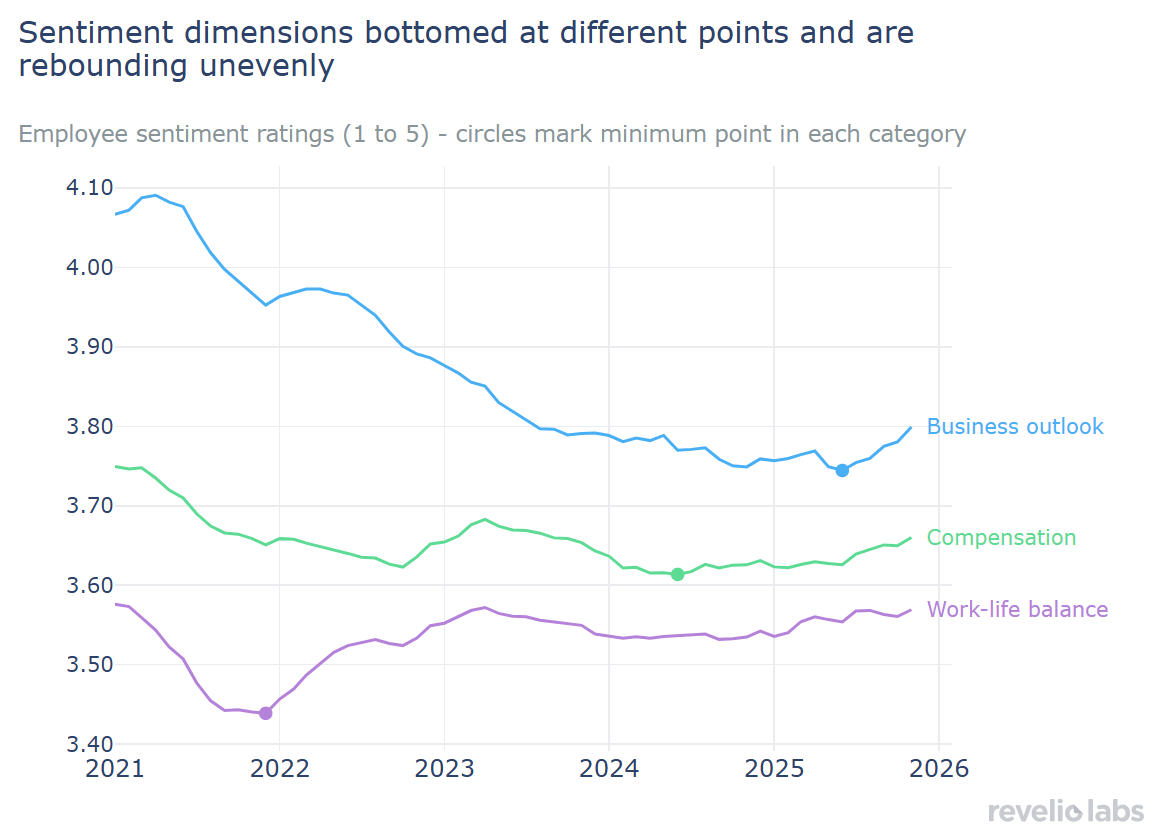

The rebound in overall employee sentiment is broad-based: All categories of sentiment have increased in the fourth quarter of 2025 relative to the first quarter, with sentiment around compensation and benefits and career opportunities leading the increase. The fall and rise of different employee sentiment categories did not also all happen at the same time; rather they unfolded in stages. These staggered inflection points suggest that employees care about improvements in their day-to-day activities and financial wellbeing before caring about the business outlook.

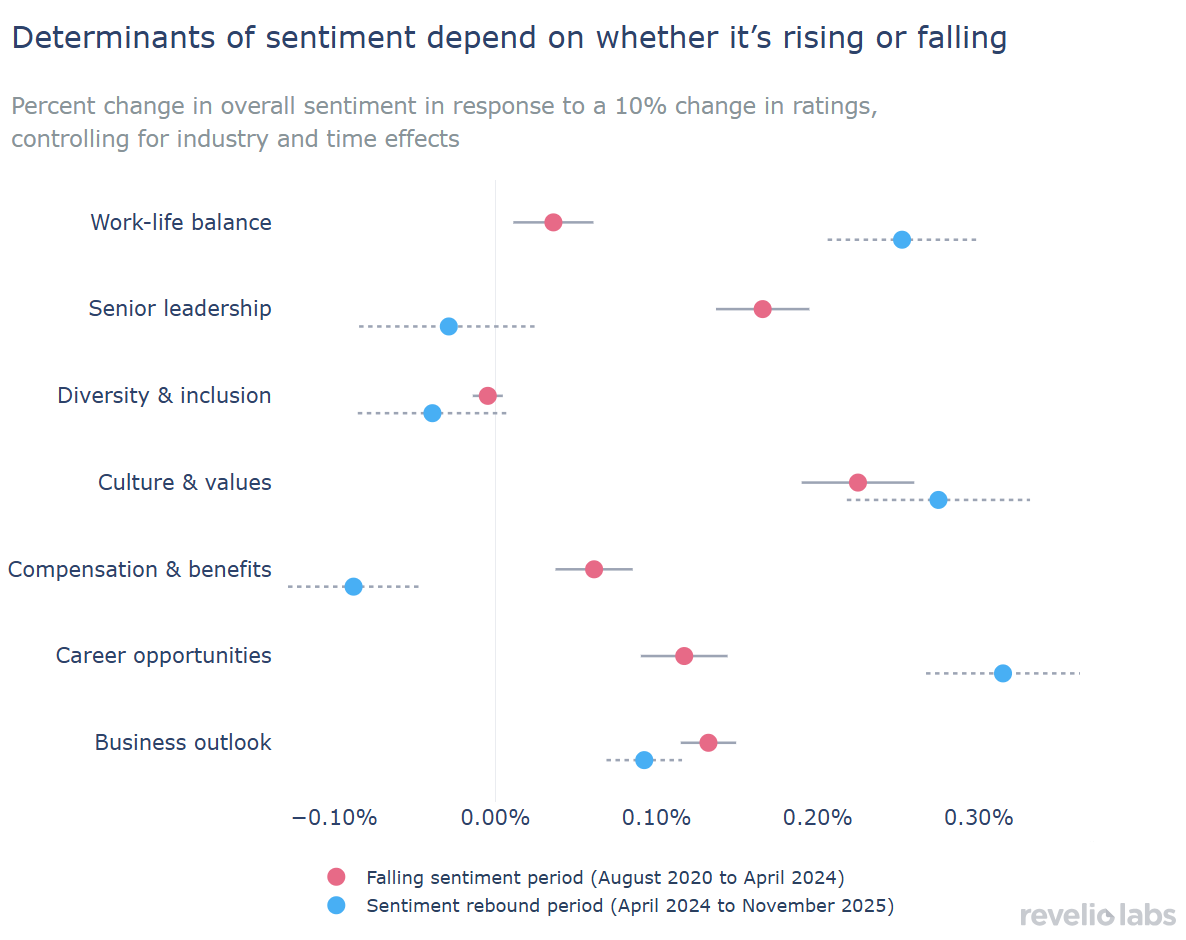

What drives overall sentiment depends on the direction in which sentiment is headed. In a time of falling sentiment, culture and values, senior leadership, and business outlook were the strongest predictors of overall ratings. In the rebound period, sentiment around culture gains even more importance. In addition, work-life balance emerges as a key contributor to overall sentiment.

A year ago, we documented how employee sentiment had fallen to its lowest level since the pandemic, driven by burnout and a broad cooling of the labor market. The decline appeared persistent, with no obvious light at the end of the tunnel. But that low marked the trough. Since then, the long downward trend has reversed, and employee sentiment has been steadily improving throughout 2025. This week, we revisit employee sentiment to understand the recovery and the factors driving it.

Between the peak in August 2020 and the trough in April 2024, the overall sentiment rating in the US fell by about 5.6%. The decline was broad-based across all industries, with employees in small-size companies experiencing the largest decline. Employees reported weaker career mobility, rising burnout, and dissatisfaction with work-life balance. Sentiment then stabilized through mid-2024 before beginning an upward trend in the second half of the year, and only has strengthened throughout 2025. Between January and November, the overall sentiment rating rose by roughly 1%. For the first time in nearly three years, employees’ perception of their workplaces is improving rather than deteriorating. Interestingly, this recovery is unfolding alongside a rise in unemployment and a steady decline in job openings. This confirms the trends we showed in an earlier newsletter. Employee sentiment tends to improve when outside options narrow. Higher unemployment appears to increase job appreciation, and fewer openings reduce perceived mobility, both contributing to higher sentiment rating of current employers.

The rebound in sentiment in 2025 is across the board. When we look at the change in sentiment rating of different categories, we find that employees’ sentiment around compensation and benefits and career opportunities are leading the recovery, as each increased by about 1.3% since the first quarter of the year. Sentiment around business outlook comes next, suggesting workers are feeling more confident about the direction in which their companies are heading.

The reversal in sentiment across these different dimensions of employee experience didn’t occur all at once. Work-life balance bottomed first; in mid 2021, before slowly improving over the next two years. This pattern reflects the gradual normalization of post-pandemic schedules and the fading of the pandemic burnout period. Sentiment on compensation and benefits reached its trough in mid-2024. Business outlook sentiment, by contrast, declined for the longest time. It reached its trough in mid-2025, and has been rebounding rapidly since then. The pattern of business outlook sentiment shows how workers tend to update their expectations about their company’s trajectory later than they update their views about day-to-day conditions, measured by other dimensions of sentiment ratings. These staggered inflection points show that the 2025 rebound is not a single shock but a phased recovery across multiple facets of the workplace experience.

To further understand the recovery of employee sentiment, we examine how much workers’ sentiment for each of the individual workplace dimensions explains the change in overall employee sentiment. To do so, we run a regression of overall sentiment ratings on sub-categories of sentiment, such as culture and values, career opportunities, and senior leadership, while controlling for industry characteristics and time effects. We previously ran a similar analysis based on the time period January 2021 - March 2025, and found that culture and values is the most powerful driver of overall ratings: a 10% increase in culture and values sentiment rating is associated with a 2.5% increase in the overall rating.

This time, we focus on two distinct periods: The falling sentiment period from the peak of employee sentiment in August 2020 to the trough in April 2024; and the rebounding sentiment period from April 2024 till November 2025. The analysis reveals how the drivers of overall sentiment shift depending on whether workers feel more positive or more negative about their workplaces. During the declining sentiment period, culture and values, senior leadership, and business outlook were the strongest predictors of overall sentiment. In the rebound period, however, the pattern changes: Culture and values become even more influential. In addition, the contribution of career opportunities increases. Sentiment of work-life balance also emerges as a stronger driver of overall sentiment. These shifts suggest that what employees rely on to evaluate their workplaces evolves with the direction of the overall sentiment.

The past five years make clear that employee sentiment is shaped not only by how workplace conditions change, but by what workers prioritize in those conditions. The rebound in 2025 unfolded in stages: work-life balance bounced back first, career opportunities improved next, and expectations about culture and values strengthened only once those foundations were in place. The drivers of overall sentiment shifts dynamically based on whether sentiment is falling or improving. For employers, the implication is straightforward: sustained improvements in sentiment requires investing in company culture. When workers are strained or uncertain, leadership matters a lot. When workers are in high spirits, internal mobility is key for workers' sentiment.