2025 Workforce Insights Wrapped

Our key genres were employee sentiment, immigration, AI, and labor market inequality

Welcome to the last newsletter of 2025! As we look back on the year, a few trends and themes have come up frequently and shaped the conversation around workforce news over the last year. In this newsletter, we highlight these themes: employee sentiment, immigration, AI, and inequality.

Employees value company culture as sentiment picks up

Employee sentiment is ending 2025 on a strong footing. After nearly three years of steady decline, overall sentiment bottomed out in spring 2024 and has been climbing throughout this year. The improvement in sentiment is occurring in a tough labor market that is unusually static: The unemployment rate is rising, job openings continue to decline, and hiring and attrition rates are at historic lows. With fewer outside options, workers are staying put. These conditions are closely linked to employee sentiment. When unemployment increases, job hopping slows, and outside options disappear, employees rate their workplaces highly. We observe a broad-based improvement across different categories of sentiment, most notably compensation and benefits, career opportunities, and business outlook.

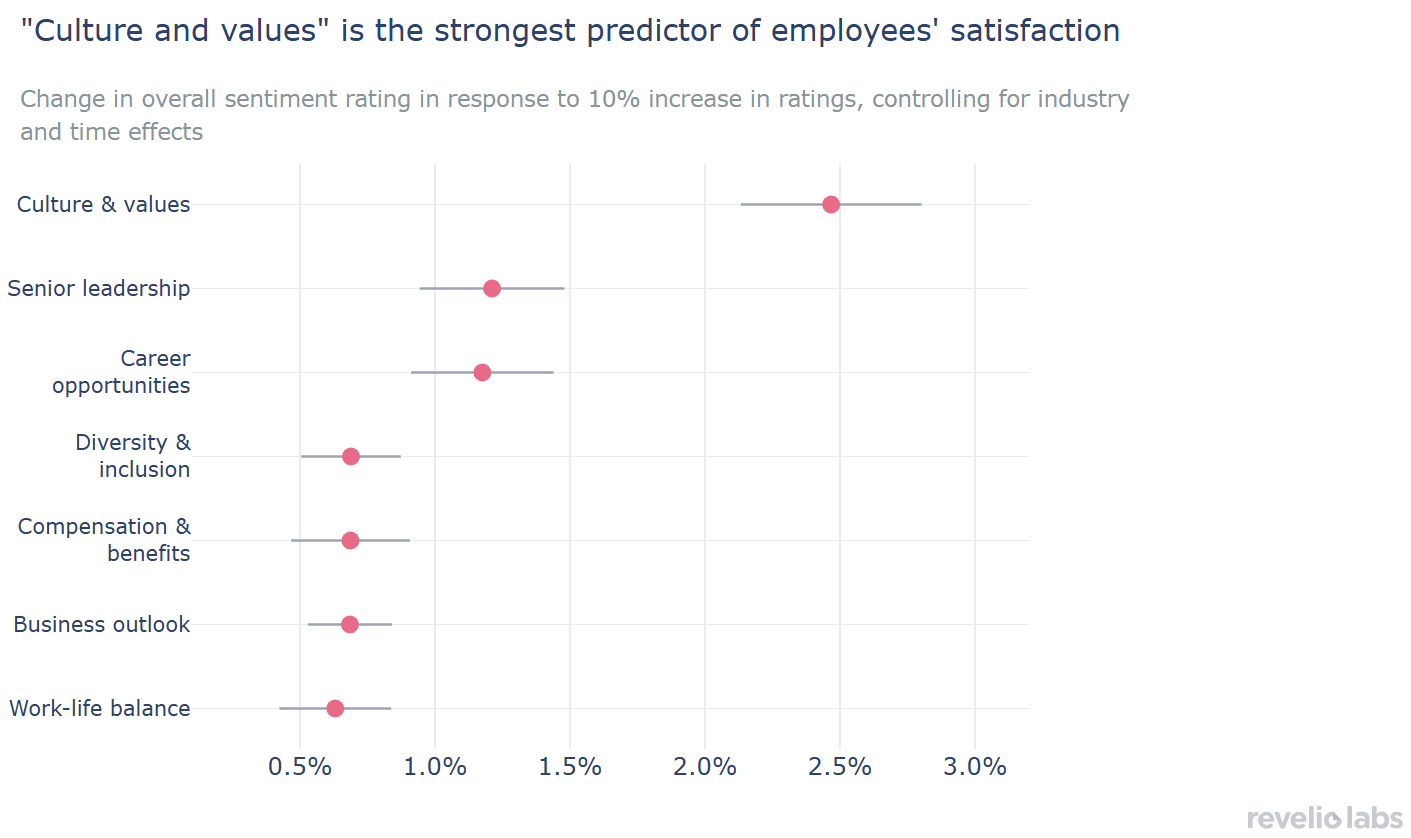

What stands out the most for employees when rating their companies is company culture, particularly in a labor market characterized by low dynamism. Culture and values remain the single most important driver of overall sentiment. When morale was falling, employees still highly valued the culture of their workplaces, and it weighted heavily in their assessment. That holds especially true in a cool labor market. Now that employee morale is recovering, culture and values is still the top defining feature of how workers rate their workplaces.

The rebound in sentiment this year is not a sudden pivot but a slow recovery that unfolded in stages. It began with work-life balance and career mobility before strengthening around culture. As we head into 2026, it is important for leaders and human resource teams to understand the drivers of sentiment. In a static labor market, what keeps workers motivated is not the breadth of opportunities outside the firm, but the strength of their experience in it.

Immigration still powers US job growth and innovation

Immigration has always played a key role in the American economy and has remained especially topical in policy discussions throughout 2025. This year, we examined not only the prevalence of immigrants in the US workforce but also their backgrounds, contributions, and implications of recent policy changes on their future.

One key channel through which foreign workers enter the US is education. The share of international graduate students in US programs rose from around 18% to 24% between 2021 and 2024. Entering as a student may be a particularly attractive option, as foreign workers who attended school in the US receive higher pay on average than those who do not.

A US education not only yields benefits for students themselves but also serves as a pipeline for talent that contributes to the US economy as a whole. In our Revelio Public Labor Statistics data, we estimate that foreign workers who moved to the US to pursue higher education or career opportunities account for about 6% of the US workforce in 2025, and have contributed disproportionately to net job gains, especially after the pandemic. This suggests that foreign labor helps to buffer the US economy even in periods when native-born hiring stagnates, boosting employment rates and job creation.

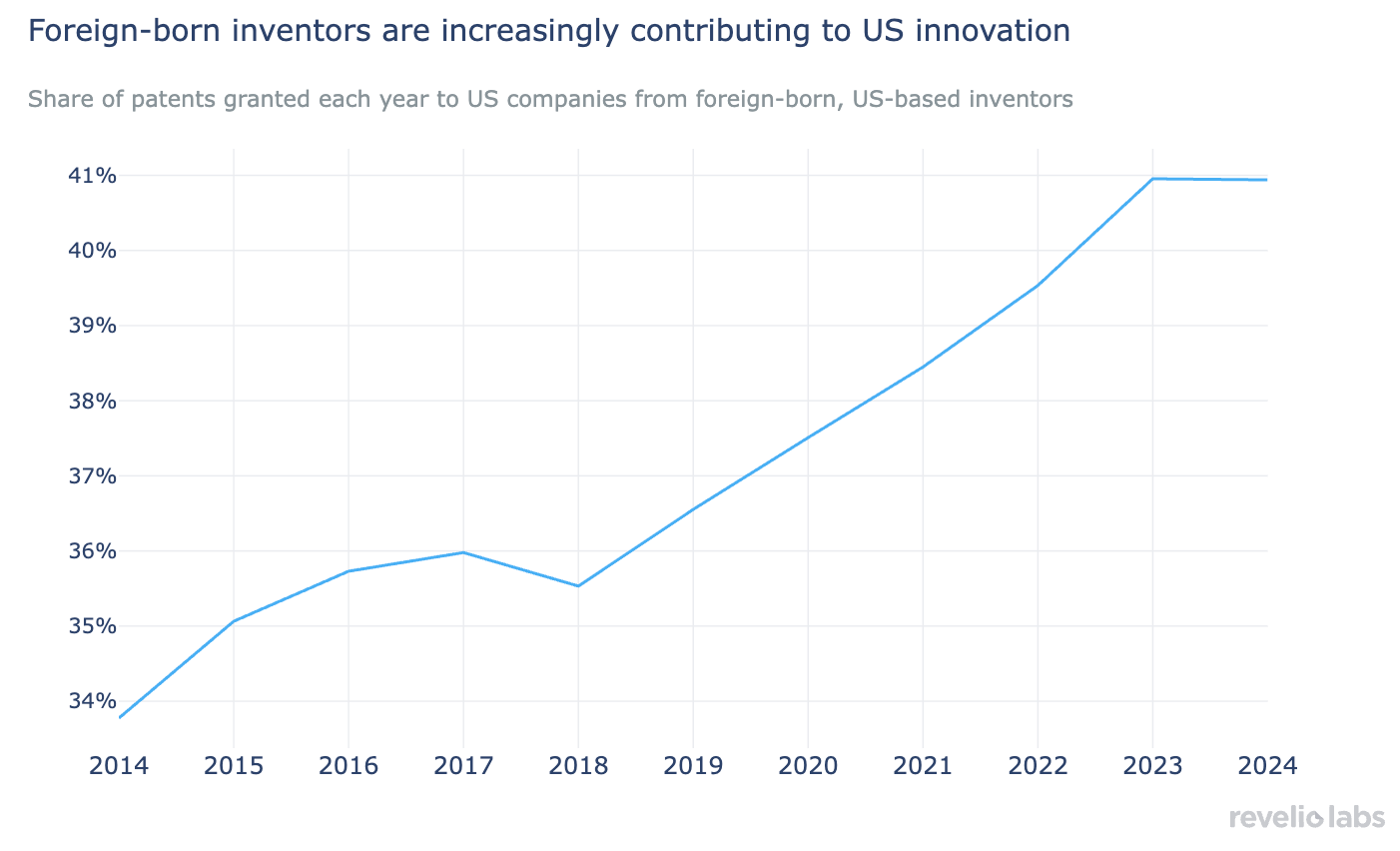

Immigrants play an outsized role not only in employment but also in innovation: Using our new Employee-Linked Patents data, we find that 41% of patents granted to US-headquartered companies in 2024 had at least one immigrant inventor. Nearly 60% of these immigrant inventors received degrees from US universities, especially from top programs such as Stanford and MIT. Immigrant inventors also produce more patents on average than their US counterparts and are especially active in critical fields such as software, semiconductor manufacturing, and AI.

However, recent policy changes related to immigration and higher education could have far-reaching implications for the future of the US economy. While the foreign workforce in the US has historically grown faster than the native workforce (4% on average year-on-year compared to 1.2% over the past 3 years), growth has also slowed notably in 2025–a reduction that coincides with changes in immigration policy from the Trump administration. Funding cuts for US universities and research institutions may further limit opportunities for international students. Finally, the new H1-B visa fees act as a distortionary tax on employment, leading to increased labor costs, potentially hurting the domestic labor market, and reducing America’s ability to compete on the global stage. As we move into 2026, we will continue to follow the effects of immigration policy on the US economy.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

AI is already transforming the labor market

AI is changing what firms hire for, who they hire, and how many people they hire.

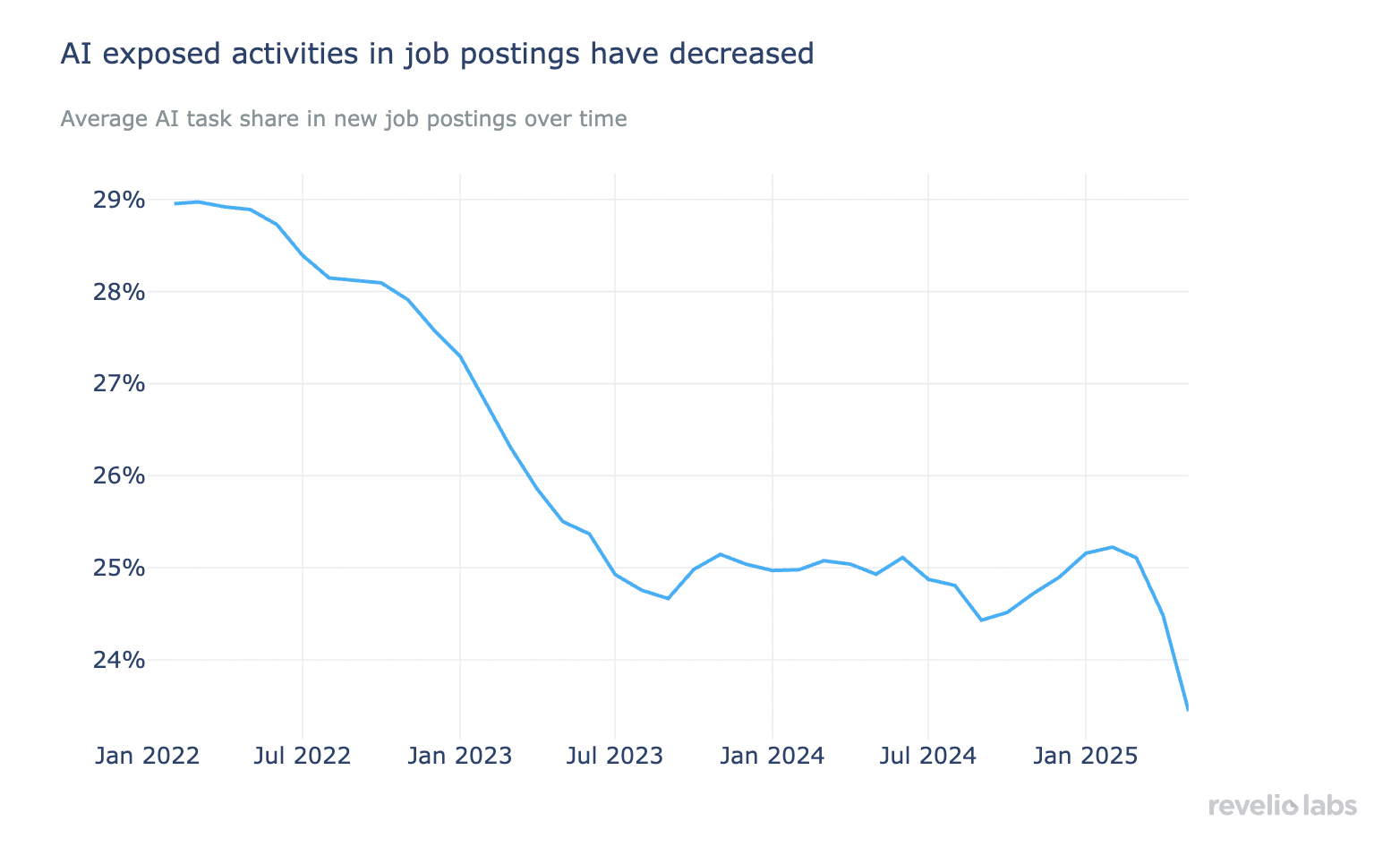

At the core of this shift is a change in task content. The share of AI-exposed tasks listed in job postings has fallen from 29% in early 2022 to 25.5% by early 2025. Companies aren't just shifting which roles they hire; they're actively stripping automatable duties from the jobs they continue to post. Routine, rules-based tasks like processing financial transactions, managing insurance and tax paperwork, and balance-sheet reconciliations are disappearing from job descriptions. AI is being embedded directly into workflows, reshaping day-to-day work well before those changes appear in employment statistics.

These task-level changes hit entry-level workers hardest as many of the tasks being automated once served as training grounds for junior hires. Highly AI-exposed entry-level roles have declined over 40% since January 2023, steeper than both low-exposure entry-level roles and senior positions. Controlling for industry and time trends, a 10 percentage point increase in AI exposure is associated with an 11% drop in demand for entry-level jobs, but a 7% increase in demand for non-entry-level roles in the same occupations. Meanwhile, entry-level postings are far less likely to require AI tools, suggesting firms are automating junior work without using AI to upskill new hires.

Startups illustrate this shift clearly. Series A tech startups now raise over $320,000 per employee, double the $160,000 typical in 2020. Median headcounts have shrunk from 57 to 44. Even after funding rounds, hiring remains muted compared to past cycles, consistent with a model in which AI allows firms to scale output without scaling headcount.

Taken together, AI is reorganizing work from the inside out: raising productivity while narrowing entry-level pathways and increasing reliance on smaller, more senior teams. As we head into 2026, the key challenge is whether firms and training pipelines can adapt fast enough to preserve accessible entry points into the labor market.

The labor market slowdown and AI automation drive up inequalities

The overall state of the labor market in 2025 is difficult to characterize as it has been neither good, nor catastrophically bad. It has been trudging along, with a slow but steady downward shift toward fewer jobs added every month. According to our Revelio Public Labor Statistics (RPLS), the economy added 191k jobs in 2025, excluding December, compared to over 1 million jobs over the same months in 2024. In 2025, the base of job gains has been narrow, predominantly driven by jobs added in relatively high paying jobs in very few sectors, most notably Education and Healthcare.

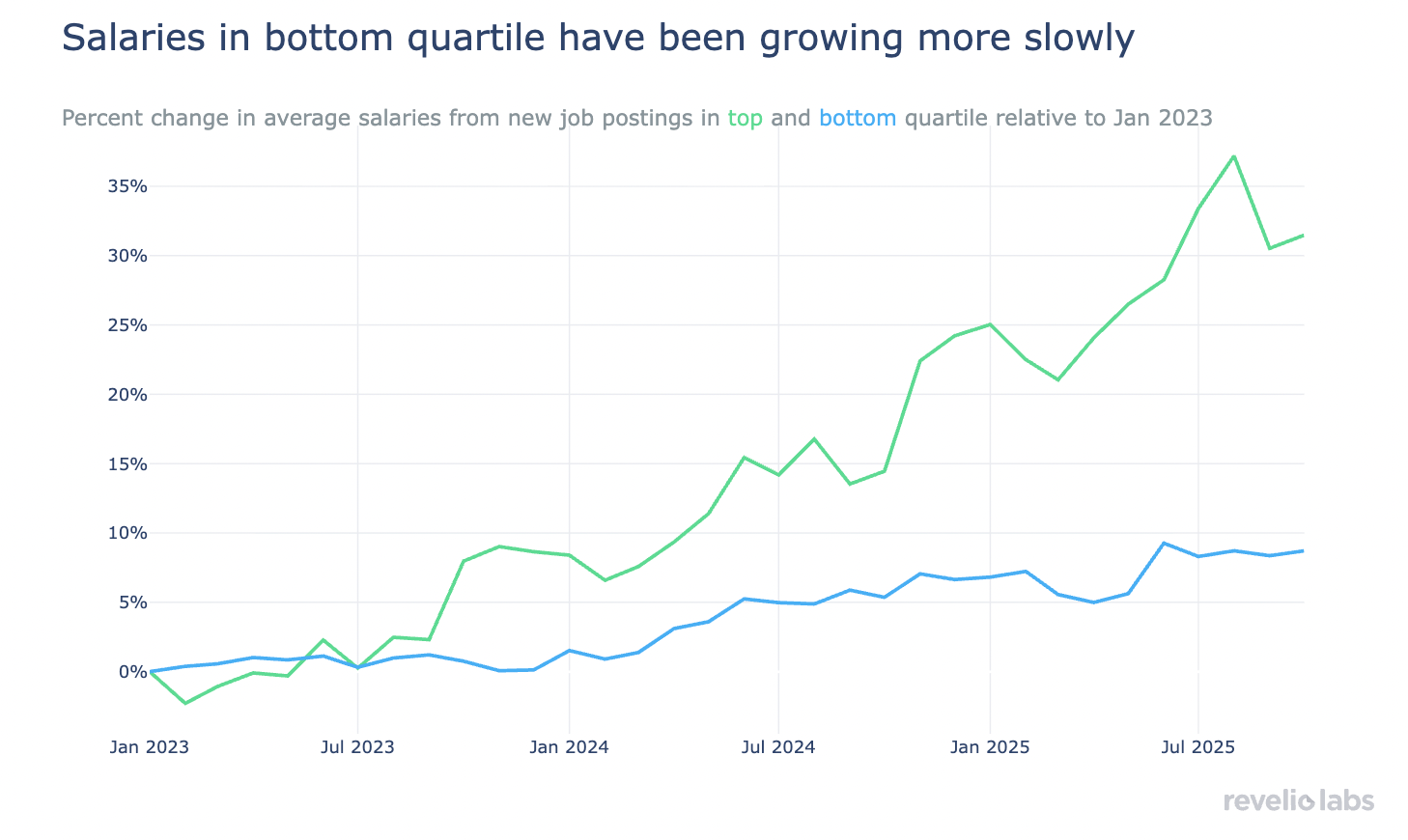

Inequality in the labor market widened meaningfully this year, as both wages and opportunities for high-and low wage-jobs drifted further apart. Wage growth is increasingly concentrated at the top of the distribution: high-paying jobs continue to see strong demand and rising salaries, while low-wage roles have contracted sharply, offering only modest pay gains. This divergence aligns with the spread of AI and automation, which appear to be suppressing wage growth in more routine, lower-paid occupations even as high-skill roles continue to command a premium. The result is a renewed “K-shaped” labor market, where the top continues to climb while the bottom struggles to keep up.

These divides are echoed in access to employment opportunities. Women now make up a majority of entry-level hires, largely because the sectors still expanding—HR, hospitality, retail—tend to be low-paying and female-dominated. Meanwhile, men remain more represented in high-wage entry roles. And as overall hiring slows, Black women face the steepest drop-off in hiring, particularly in care and service jobs where they have historically been overrepresented. Together, these trends show how AI automation and the slowdown in labor market dynamism can reinforce disparities, leaving lower-wage, early-career, and marginalized workers with fewer pathways into higher-quality jobs.

The Economics team at Revelio Labs wishes you a very happy and healthy New Year 2026.