White-Collar Workers Are Getting the Blues

In a slowing labor market, white-collar jobs are stagnating

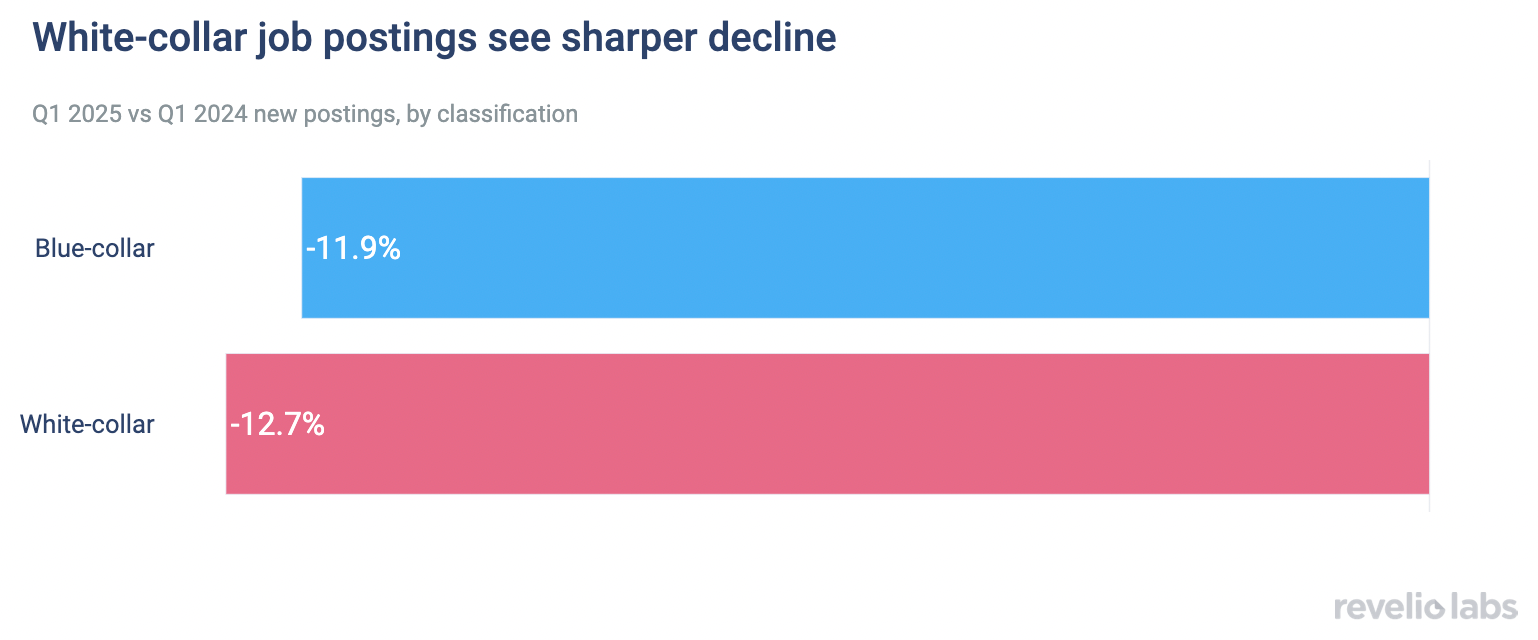

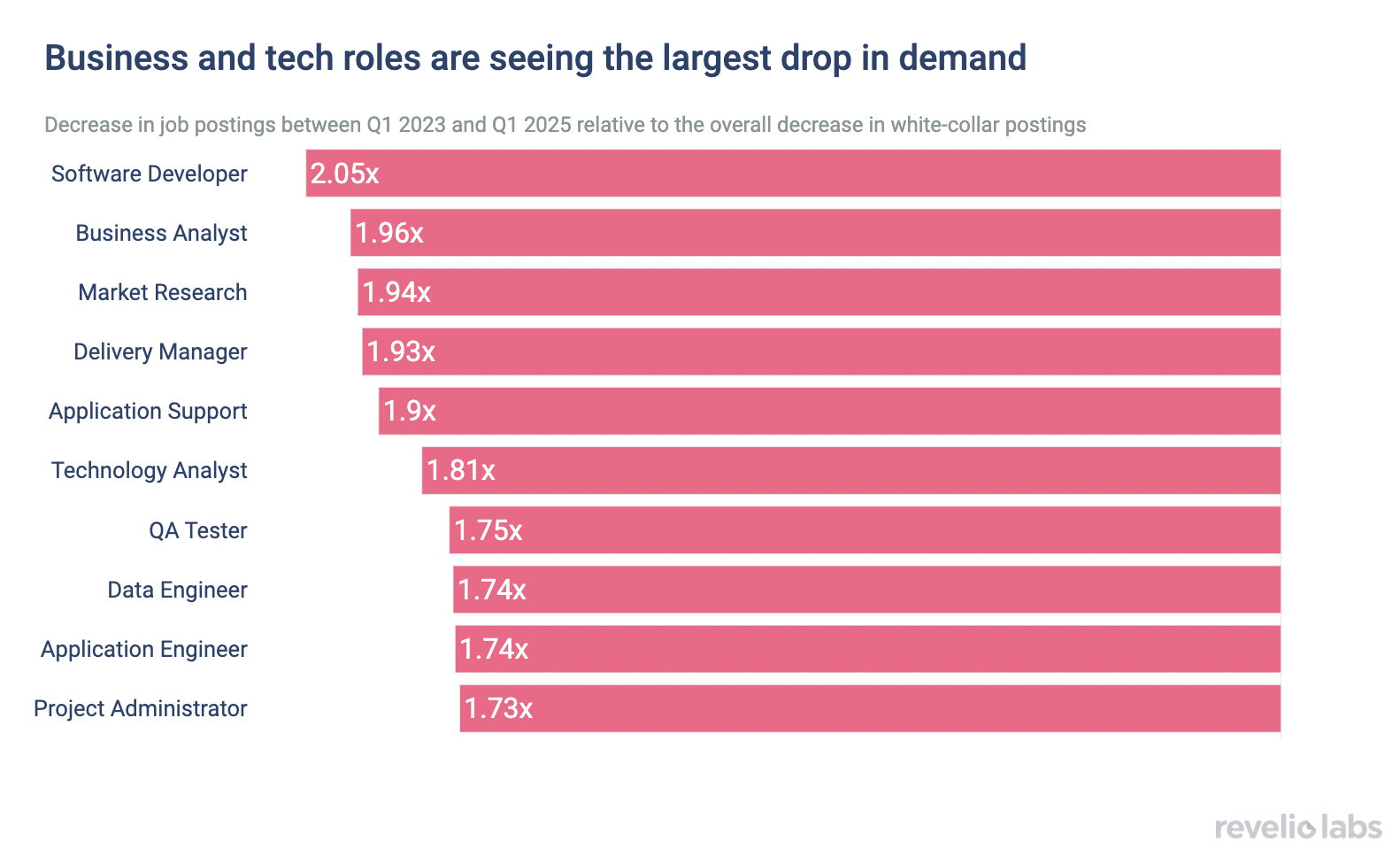

New job postings for white-collar roles decreased by 12.7% from Q1 2024 to Q1 2025, with demand for roles like Software Developer and Business Analyst falling more than twice as fast as the overall white-collar average over the past two years.

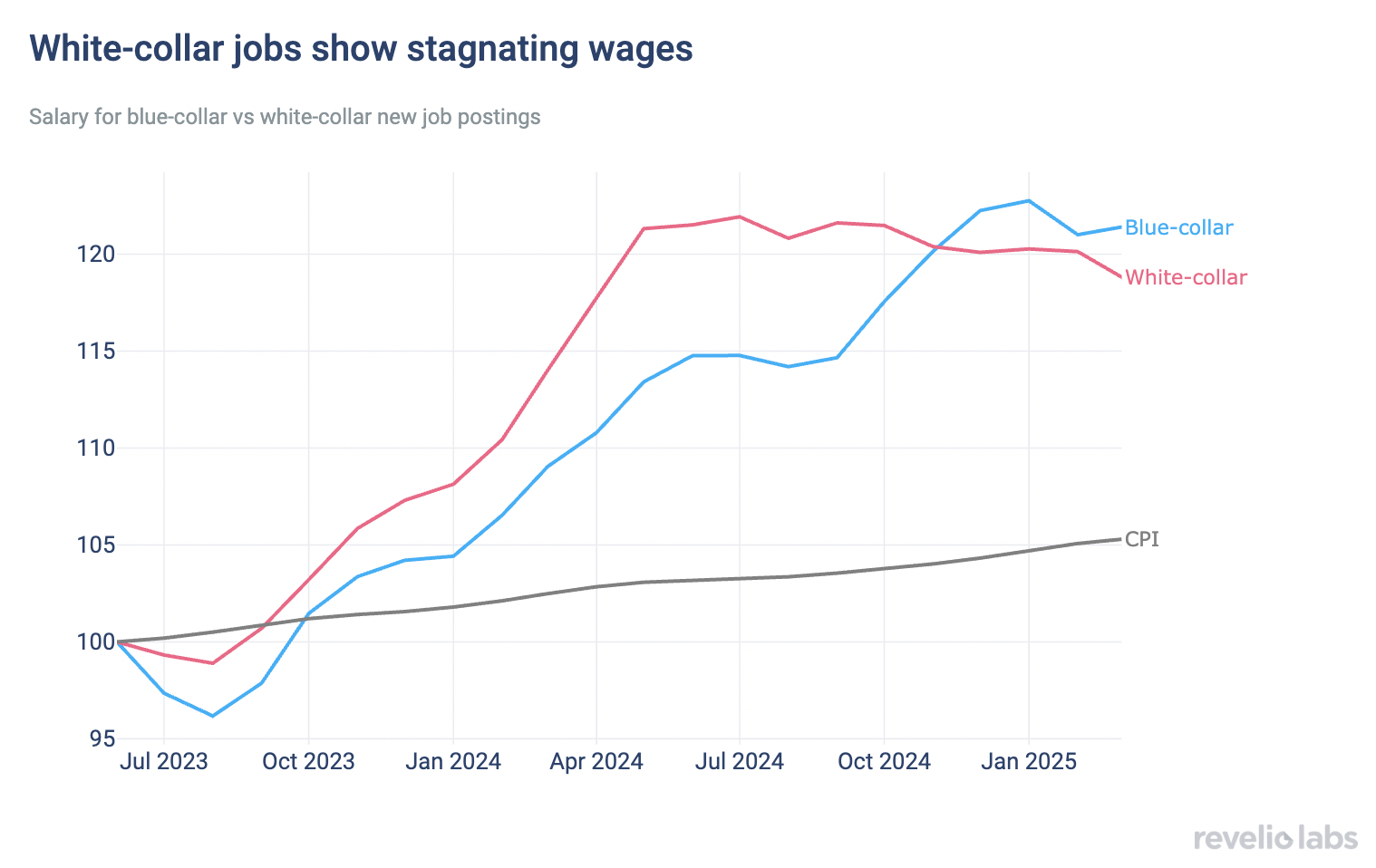

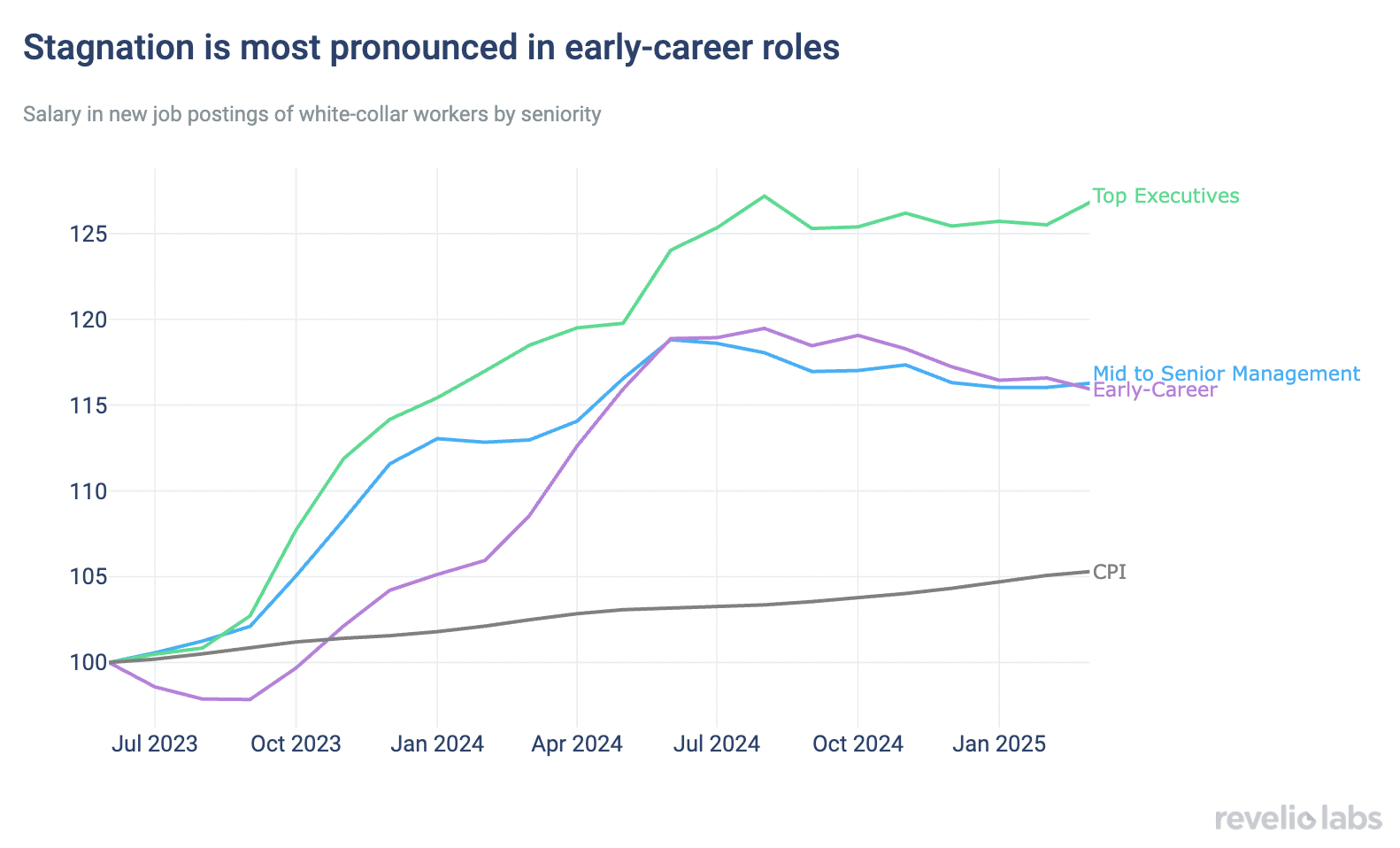

Unlike rising blue-collar pay, salaries offered in new job postings for white-collar roles have remained flat since mid-2024. Early-career roles have experienced the most significant stagnation in listed pay, while salaries in top executive job postings have increased.

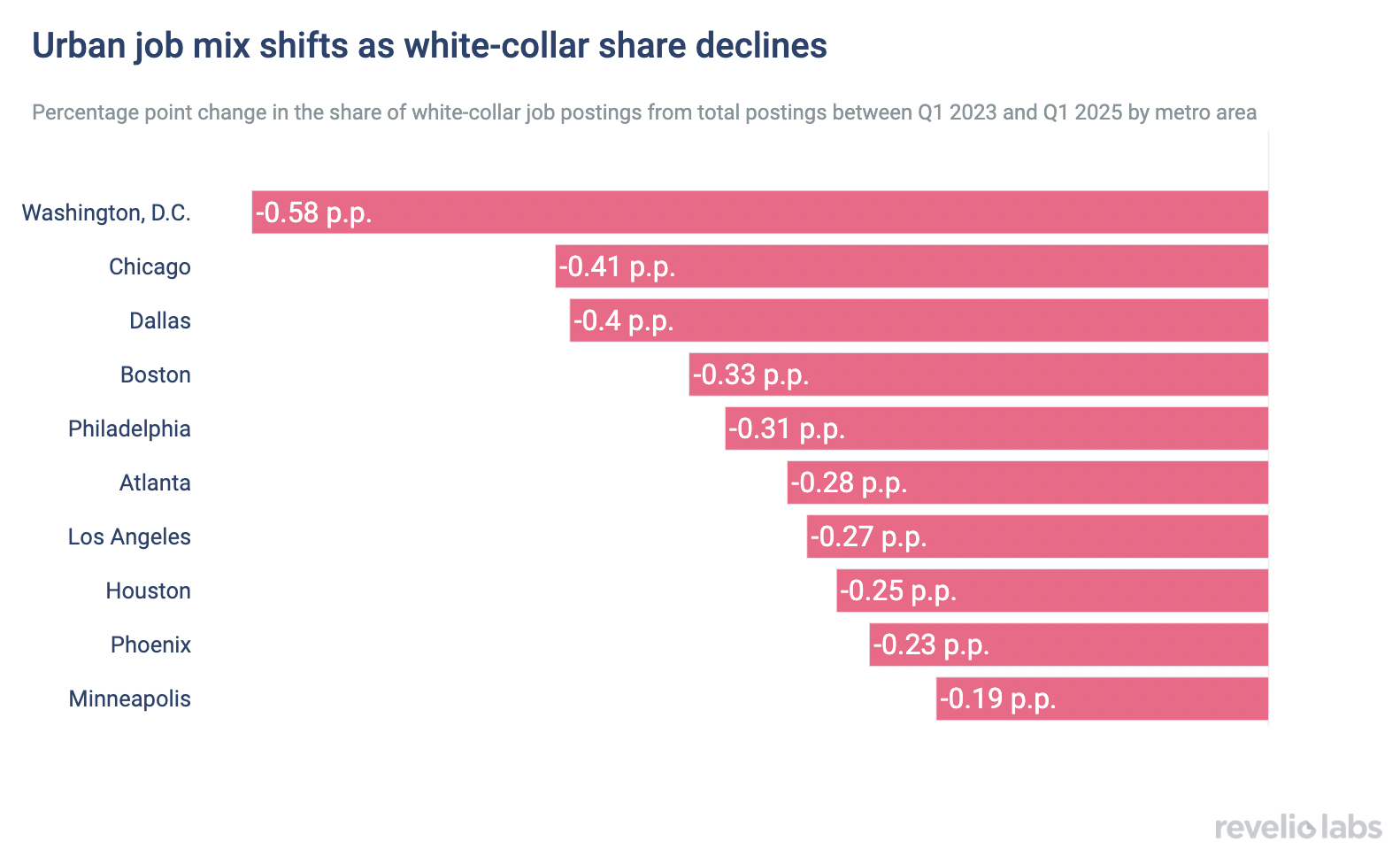

The geographic distribution of white-collar jobs is shifting, with metropolitan areas like Washington D.C., Chicago, and Dallas experiencing a notable decrease in their share of national job postings between Q1 2023 and Q1 2025.

As the broader labor market shows clear signs of slowing, sentiment within the white-collar workforce in particular appears to be shifting towards greater caution and concern. Is this labor market slowdown disproportionately affecting office-based roles? Anecdotes of tech layoffs and hiring freezes hint at a more acute trend within this segment, but deeper analysis is needed to understand the full picture. In this newsletter, we examine recent shifts in job postings and compensation for white-collar workers.

First, data on new job postings indicates that while demand for both white-collar and blue-collar roles faltered between Q1 2024 and Q1 2025. This cooling trend was slightly more acute for white-collar positions (-12.7%) versus blue-collar (-11.9%). New job postings for white-collar positions saw a sharper year-over-year decline (12.7%) compared to blue-collar roles (11.9%) between Q1 2024 and Q1 2025.

Beyond the shrinking number of new job opportunities, wage growth for white-collar jobs has also notably stalled. Analysis of salaries listed in new job postings shows that while white-collar pay initially rose, it has remained flat since mid-2024. Blue-collar wages, however, have continued to increase steadily, without the notable slowdown in recent months. This divergence in trends suggests that the bargaining power for many office-based roles may be waning relative to manual labor positions.

However, the impact of salary stagnation isn't uniform across the white-collar spectrum. We find that it is most acute for those in early-career positions, where growth in advertised wages has lagged significantly. Salaries listed in new job postings for mid-to-senior management roles have fared slightly better, while top executives have seen substantial salary increases offered for similar new positions. These salary trends reflect employers' current willingness to pay for new hires, and the widening gap in offered salaries across seniority levels still points towards a labor market that is prioritizing and rewarding senior leadership while potentially squeezing the terms offered to less experienced professionals entering the job market.

Which specific roles are feeling the pinch most? Between Q1 2023 and Q1 2025, overall job postings for white-collar roles fell by a substantial 35.8%. Against this backdrop, the decline for several key business and technology functions was even more severe, significantly outpacing this average. For instance, postings for Software Developers dropped more than twice as much as white-collar roles overall. Business Analysts, Market Researchers, and Delivery Managers also saw their demand fall at nearly double the overall rate. This indicates an intensified pullback for these specific skill sets within the broader white-collar slowdown.

Geographically, the distribution of white-collar job opportunities is also shifting. Between Q1 2023 and Q1 2025, several major U.S. metropolitan areas saw a decrease in their share of white-collar job postings. Washington D.C. experienced the largest drop in its share (-0.58 percentage points), followed by Chicago (-0.41 p.p.), Dallas (-0.40 p.p.), and Boston (-0.33 p.p.). This relative decline in labor demand suggests that hiring in these urban centers is moving away from hiring white-collar roles compared to other geographic areas.

The data points to a challenging period for many white-collar workers, particularly those starting their careers or working in previously high-demand tech and business roles. The pronounced recent stagnation in white-collar wages, occurring while consumer prices continue to edge upwards, alongside reduced hiring, suggests a fundamental shift in the labor market dynamics for these professions. As companies navigate economic headwinds and evolving technological landscapes, the "white-collar recession" appears to be impacting job availability and compensation across numerous sectors and major cities. Professionals in these fields may need to adapt, potentially by considering roles in different industries or locations or by focusing on skills that remain in high demand.