Two Retail Economies are Emerging This Holiday Season

As consumer spending diverges, so does retail hiring

Rising income inequality is creating a split retail economy: Affluent households are driving strong holiday spending, while overall consumer sentiment plummets under higher costs. This divide is reflected in retail hiring, where luxury retailers have seen far smaller declines than budget retailers, which face mounting pressure from cost-constrained consumers.

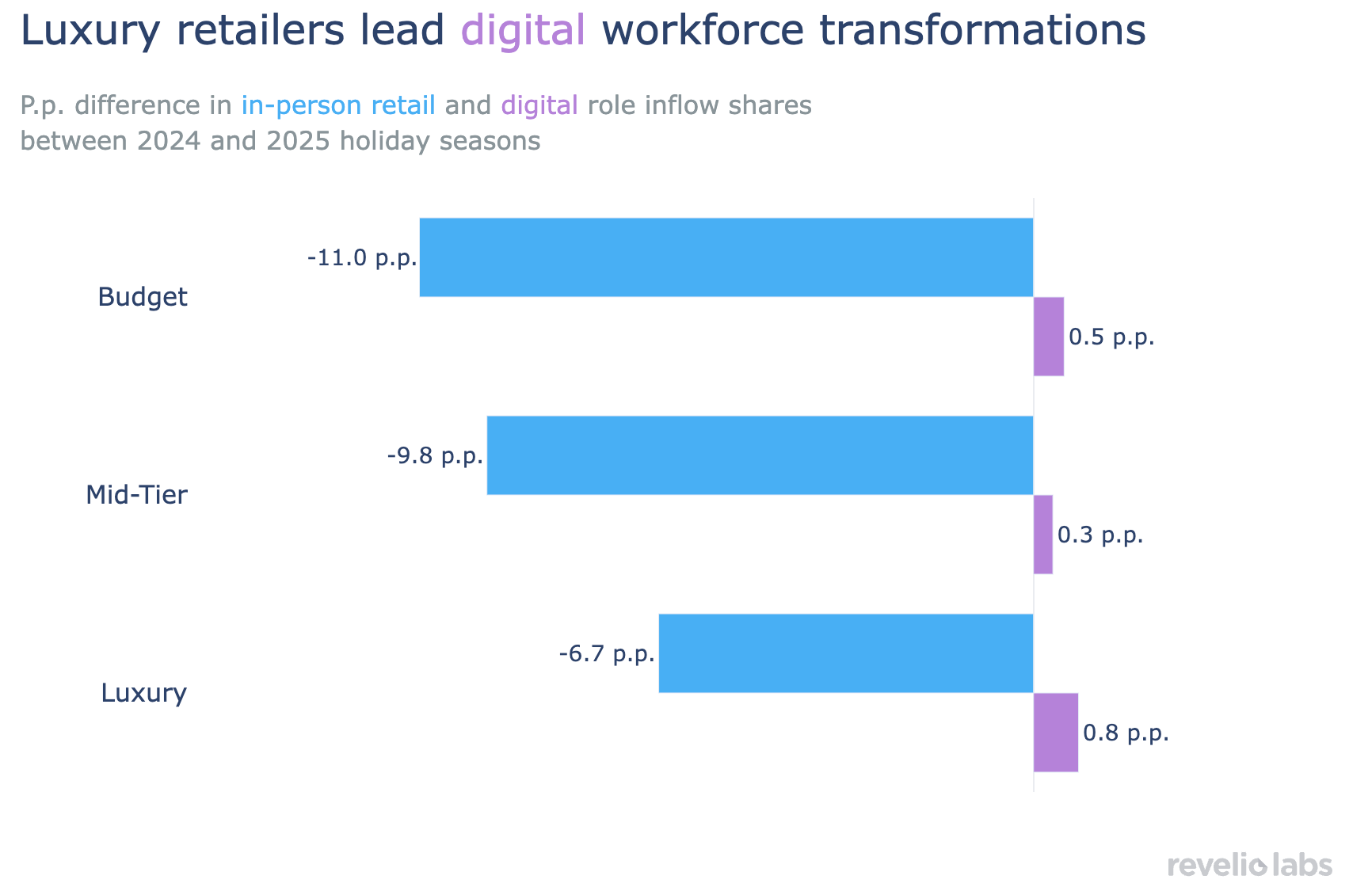

In-store retail hiring has fallen most sharply at budget retailers, even as all retailers expand digital roles to support automation and growing online demand. Luxury retailers are leading this shift, reflecting confidence in continued spending from wealthier consumers.

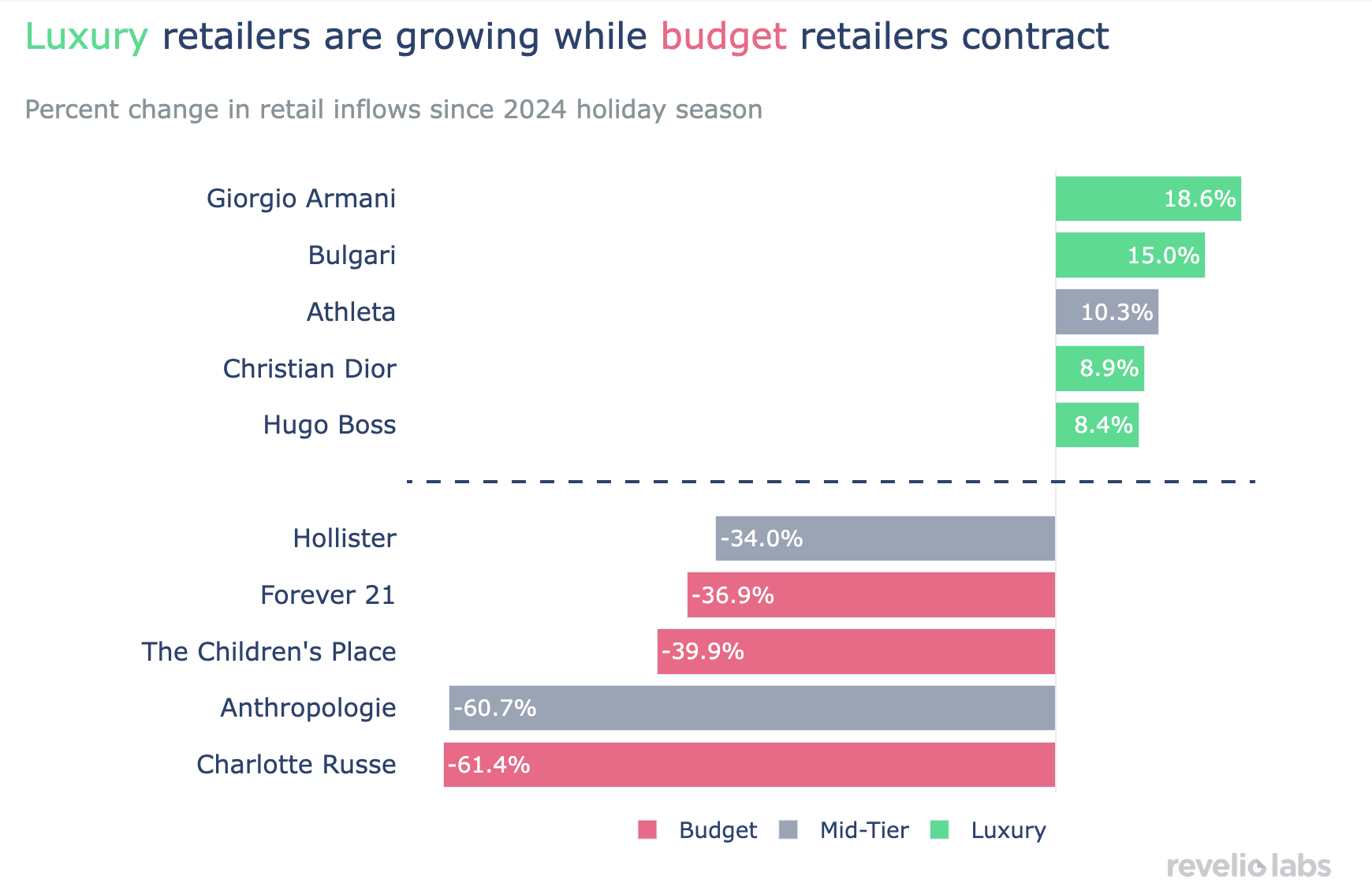

Luxury brands are driving hiring growth in 2025, with Giorgio Armani, Bulgari, and Dior among the top-growing. Budget retailers like Charlotte Russe, The Children’s Place, and Forever 21 have seen the largest declines, signaling strain from changing consumer patterns.

The holiday season is in full swing, and as shoppers head to stores to buy gifts for their loved ones, two very different economic realities are unfolding. In a year marked by a widening income gap, driven by uneven labor markets and rising costs of living, the top 10% of earners are responsible for nearly half of all consumer spending, breaking records for early online holiday shopping on Black Friday. Yet despite these signs of prosperity at the top, overall consumer sentiment is approaching all-time lows, as tariffs continue to push prices higher and consumers and retailers alike are bearing the brunt.

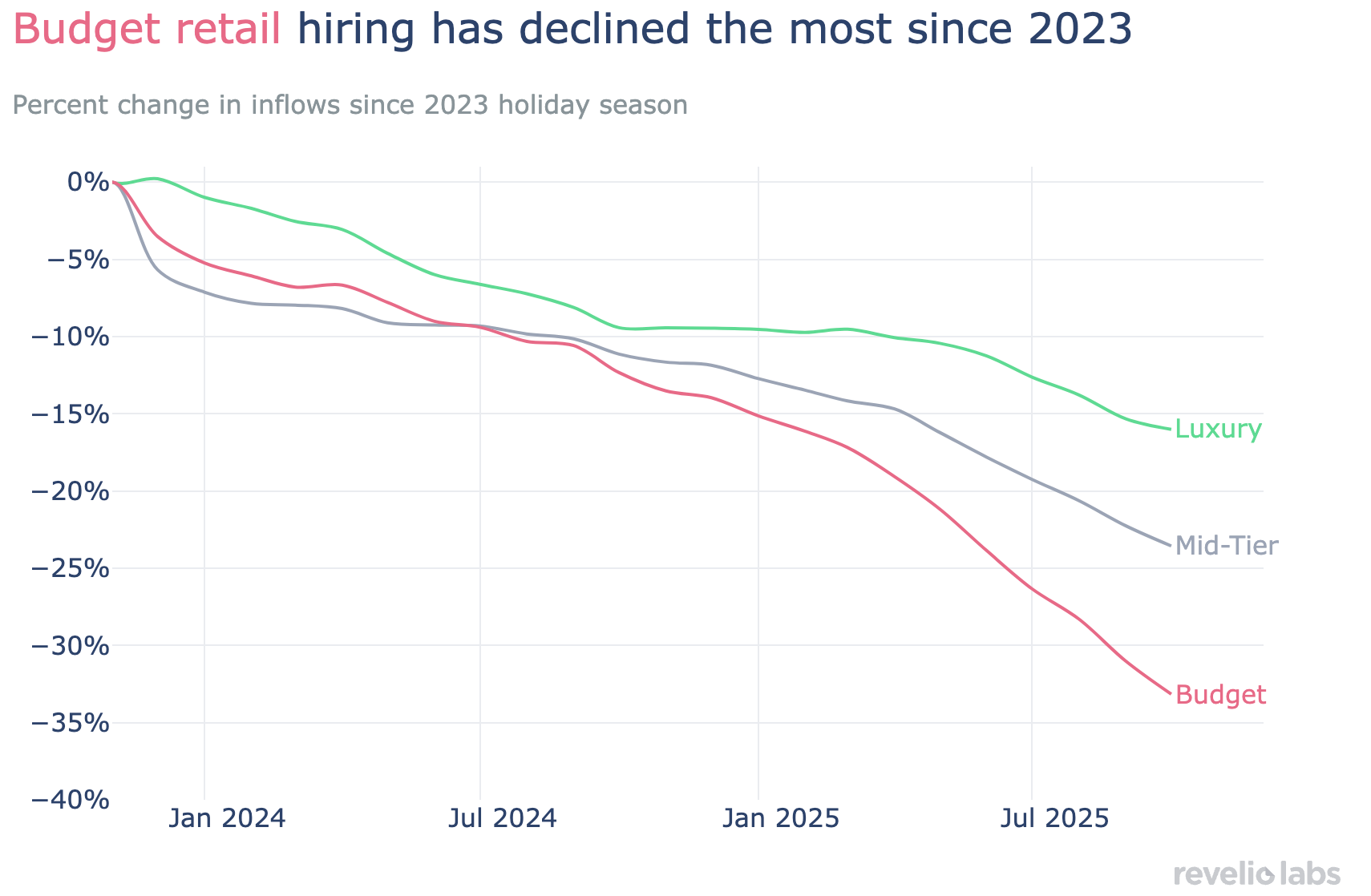

Revelio Labs’ hiring data in the retail industry mirrors this divergent consumer behavior. Overall hiring has declined, likely due to rising input costs from tariffs and rents, as well as increased automation and AI adoption at retailers. Yet luxury retail has experienced the smallest drop—a 16% decrease in inflows since the 2023 holiday season—while budget retailers have seen more than double that decline. This underscores the relative insulation of luxury retailers from broader industry pressures, supported by affluent consumers who are less affected by current economic conditions. Meanwhile, as economic pressures mount for lower-income households, budget retailers have reconsidered their workforce investments.

As retailers navigate this diverging consumer market in 2025, they have shifted their hiring focus from in-person retail sales roles to digital roles that support automation and e-commerce initiatives. While this reflects growing consumer preference for online shopping, it also underscores retailers’ efforts to reduce costs amid tariffs and constrained consumer spending, as evidenced by increased store closures and a rise in vacant retail space early this year. Luxury retailers have experienced the smallest decline in retail sales hiring and the largest gains in digital roles, indicating steadier confidence in the demand from higher-income consumers. Mid-tier and budget retailers have modestly increased digital hiring as well, but have reduced retail sales hiring far more aggressively—budget retailers, for instance, cut retail sales hiring by nearly twice the rate of luxury retailers. This contrast is also shaped by differing automation opportunities: budget retailers can more readily automate standardized sales functions, while luxury retailers continue to rely on relationship-driven sales that are harder to replace.

Zooming in on retailers that expanded their hiring the most this year, the top five are dominated by luxury brands, including Giorgio Armani, Bulgari, and Dior. In contrast, the retailers with the largest hiring pullbacks over the past year sit squarely in the segment most exposed to shifts in consumer spending. Budget retailers such as Charlotte Russe, The Children’s Place, and Forever 21 have posted some of the steepest hiring declines since 2024, reflecting growing strain among cost-constrained consumers.

While some retailers have fared better or worse than others, the overall picture is clear: Affluent consumers are driving spending in 2025, propping up luxury retailers and shielding them from the economic downturn affecting the broader retail sector. Meanwhile, rising costs from tariffs have pushed prices higher, straining discretionary spending for most consumers. These pressures have led many retailers to cut investments in storefronts and workforce, accelerating the shift toward online retail and automation. Consumer spending is being carried by an imbalanced market, making the future of the retail landscape uncertain. However, retailers can still rely on holiday shopping demand—for now.