Jobs Outlook May 2025

Economic uncertainty is leading many to shelve hiring plans

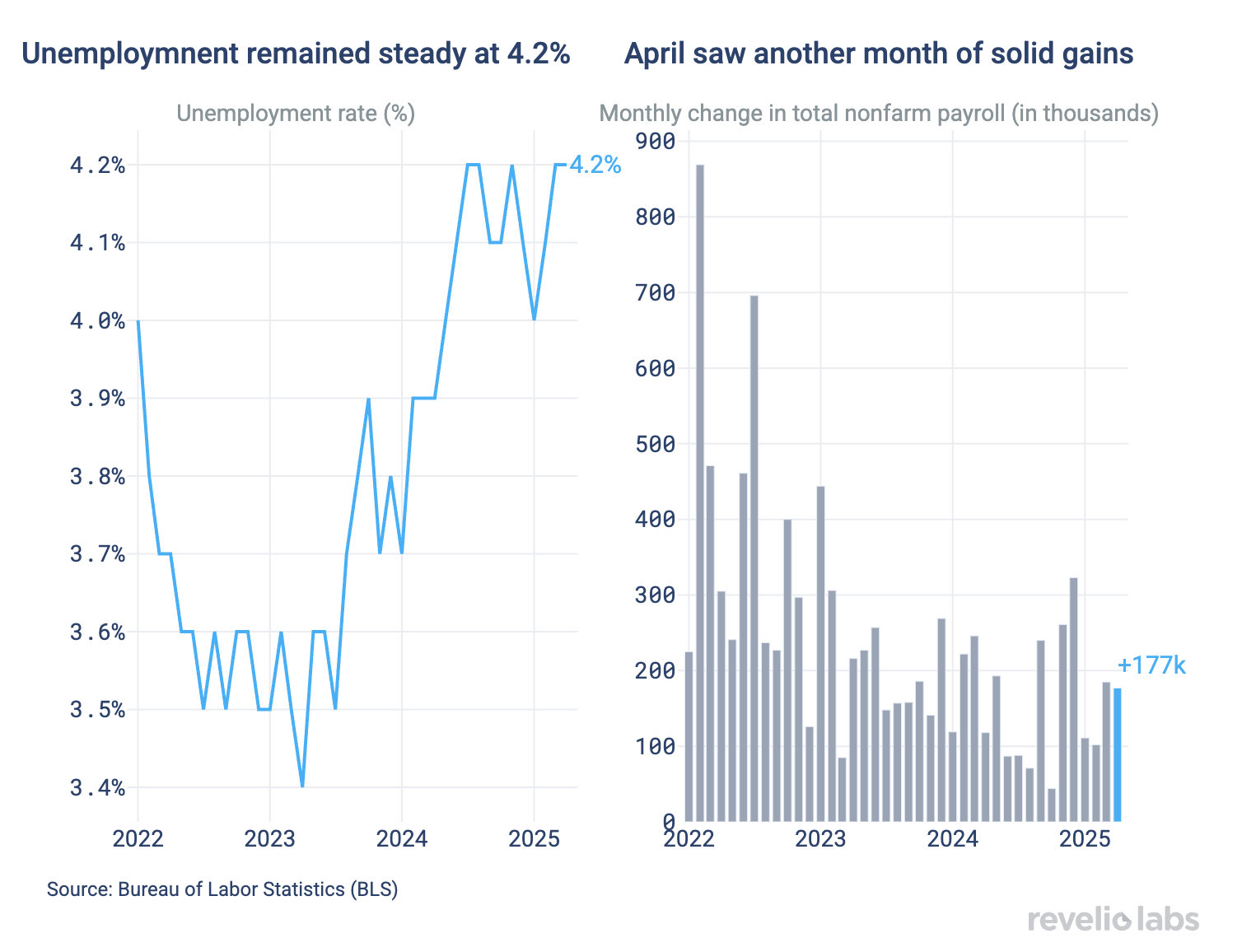

The US economy saw another solid job gain in April, adding 177,000 jobs. However, this increase comes with downward revisions to previous increases amid a broad softening of the labor market.

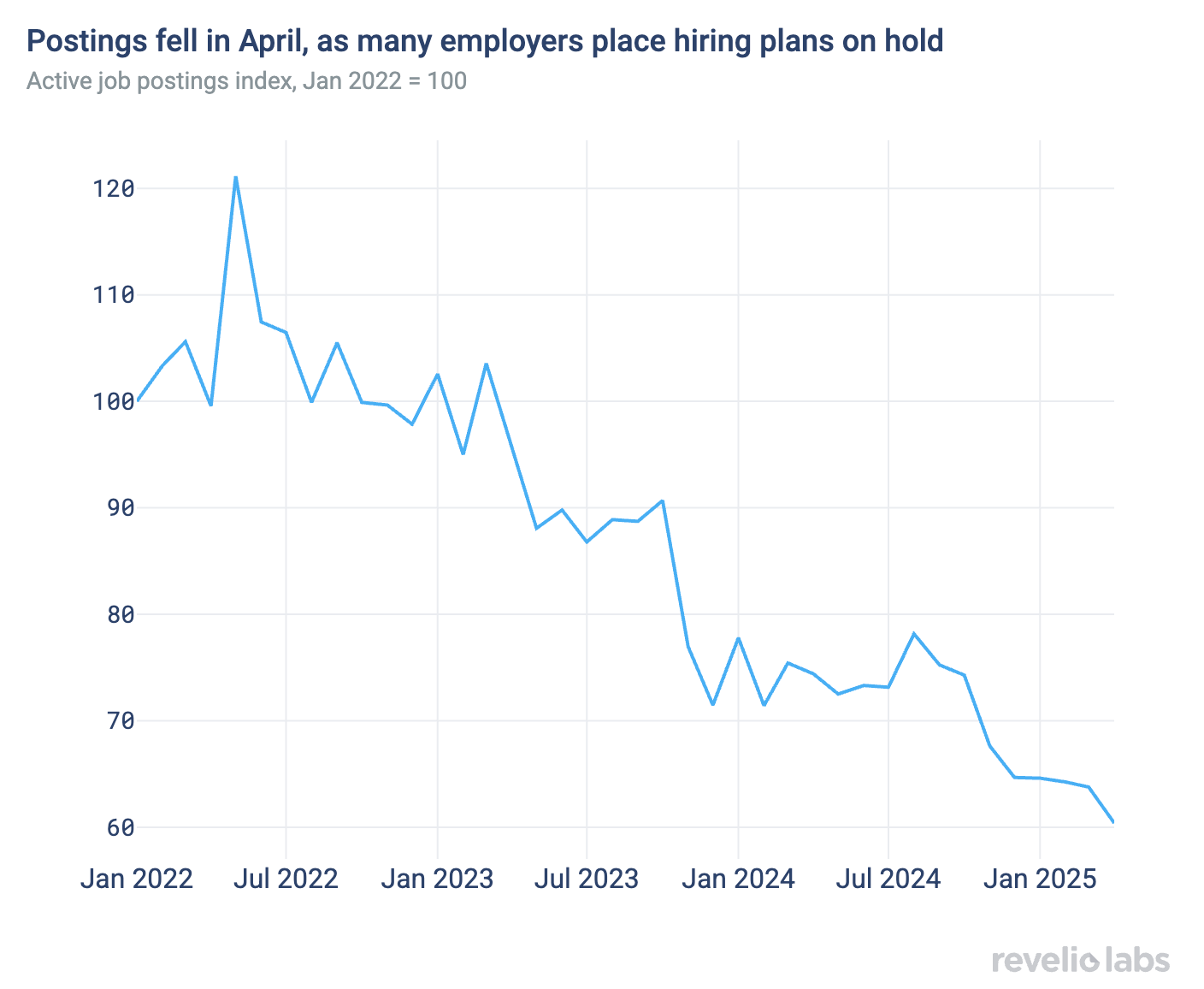

Looking ahead, weaker demand for labor bodes ill for future job creation. This week's JOLTs report showed a sharp downturn in job openings in March, confirming what we have been seeing in our data for some time, with Revelio Labs’ data showing active job postings fell again in April.

All but one industry saw decreases in job postings last month, as many employers put hiring plans on pause amid increased economic uncertainty. Rapid policy shifts continue to cloud the economic outlook, with emanating inflationary risks and labor market cooling potentially putting the Fed in an awkward position.

Today, the BLS reported another month of solid job growth, with a better-than-expected 177,000 jobs added in April. However, there is still plenty to be concerned about, as hiring rates remain quite low and economic uncertainty is causing many employers to pull back on hiring plans.

The US labor market has yet to be derailed by the trade war, posting solid gains in the first reading since the April 2nd announcement of wide-ranging duties on imports by the Trump administration. Along with the headline job gains, unemployment remained near historic lows at 4.2%, and prime-age employment bounced higher. However, government employment continued to decline amid Federal payroll cuts, and job gains remain concentrated in key sectors, like healthcare and transportation and warehousing.

Looking ahead, labor demand continues to cool rapidly. We saw in the JOLTS report on Tuesday that job openings in March dropped off considerably, consistent with what we reported last month using Revelio Labs’ job postings data. Job postings remain a concern, as active job postings dropped further in April. Active job postings are now roughly 40% lower than where they were at the start of 2022.

The drop in job postings wasn’t isolated to a few sectors, but was nearly universal. All but one industry (Information) saw month-over-month declines in active postings. Sectors like Transportation, Professional Services, and Government posted the largest drops. On the role level, high-skill and management titles were especially hard-hit, with Development Managers, Sustainability Specialists, and Infrastructure Engineers all seeing double-digit percentage declines. In contrast, some front-line retail roles saw modest gains.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

On-again, off-again tariff policy and ensuing market volatility are prompting many companies and would-be employers to take a wait-and-see approach to major investments, including hiring decisions. While the labor market continues to show momentum, job growth is slowing, especially in key sectors. With this trend already in place, the decline in active job postings bodes ill for future job growth at a time when hiring rates are already quite low. Rapid shifts in economic policy will likely put the policymakers at the Federal Reserve in a difficult position. Tariffs have the potential to add to inflationary pressures, while ensuing economic uncertainty will likely weigh on employment, tugging on both ends of the Fed’s dual mandate.