Jobs Outlook July 2025

A steady but stagnant labor market presents difficulties for new entrants

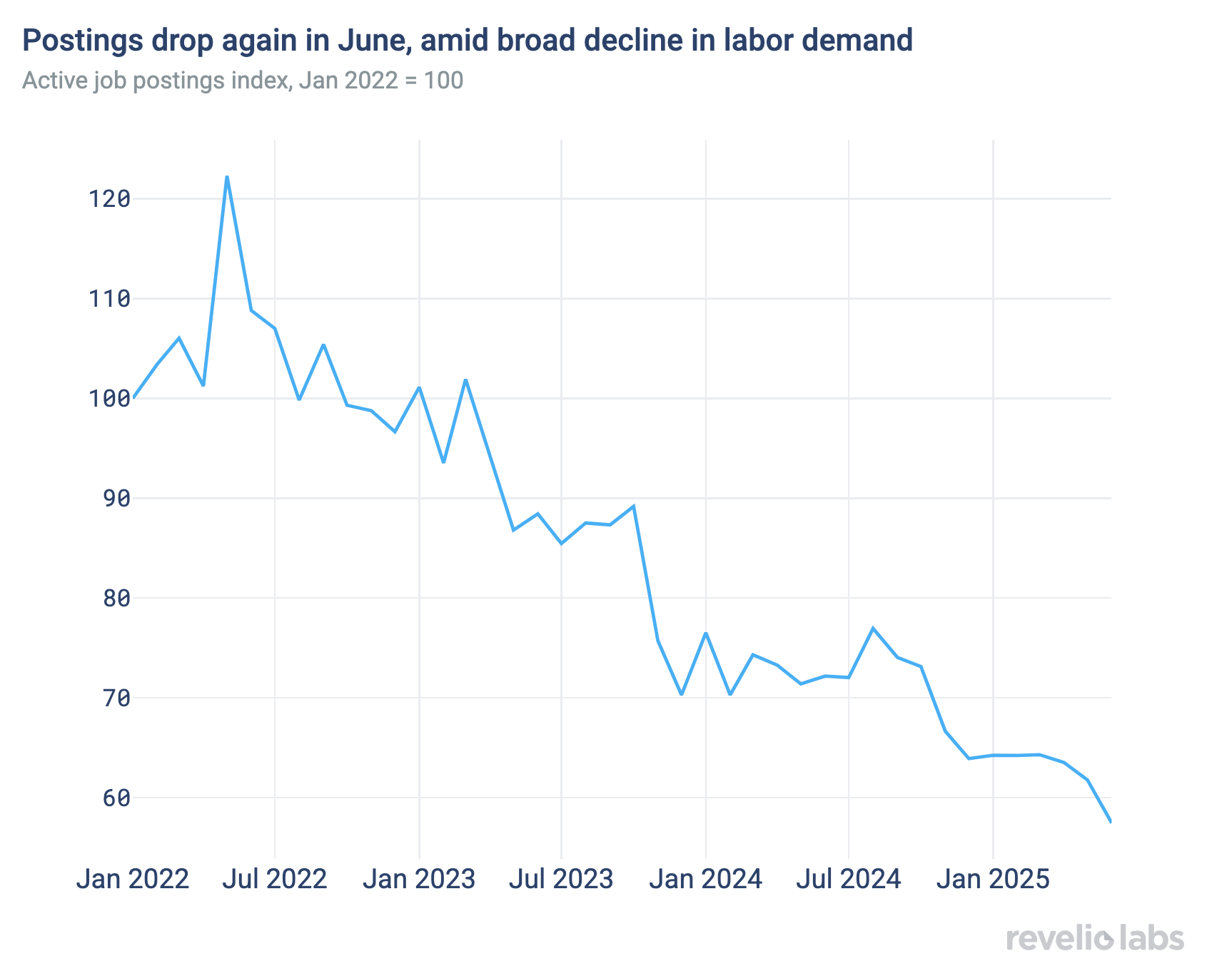

Labor demand continues to cool. Despite headline job gains, private sector hiring was modest in June and Revelio Labs’ data shows active job postings declined again.

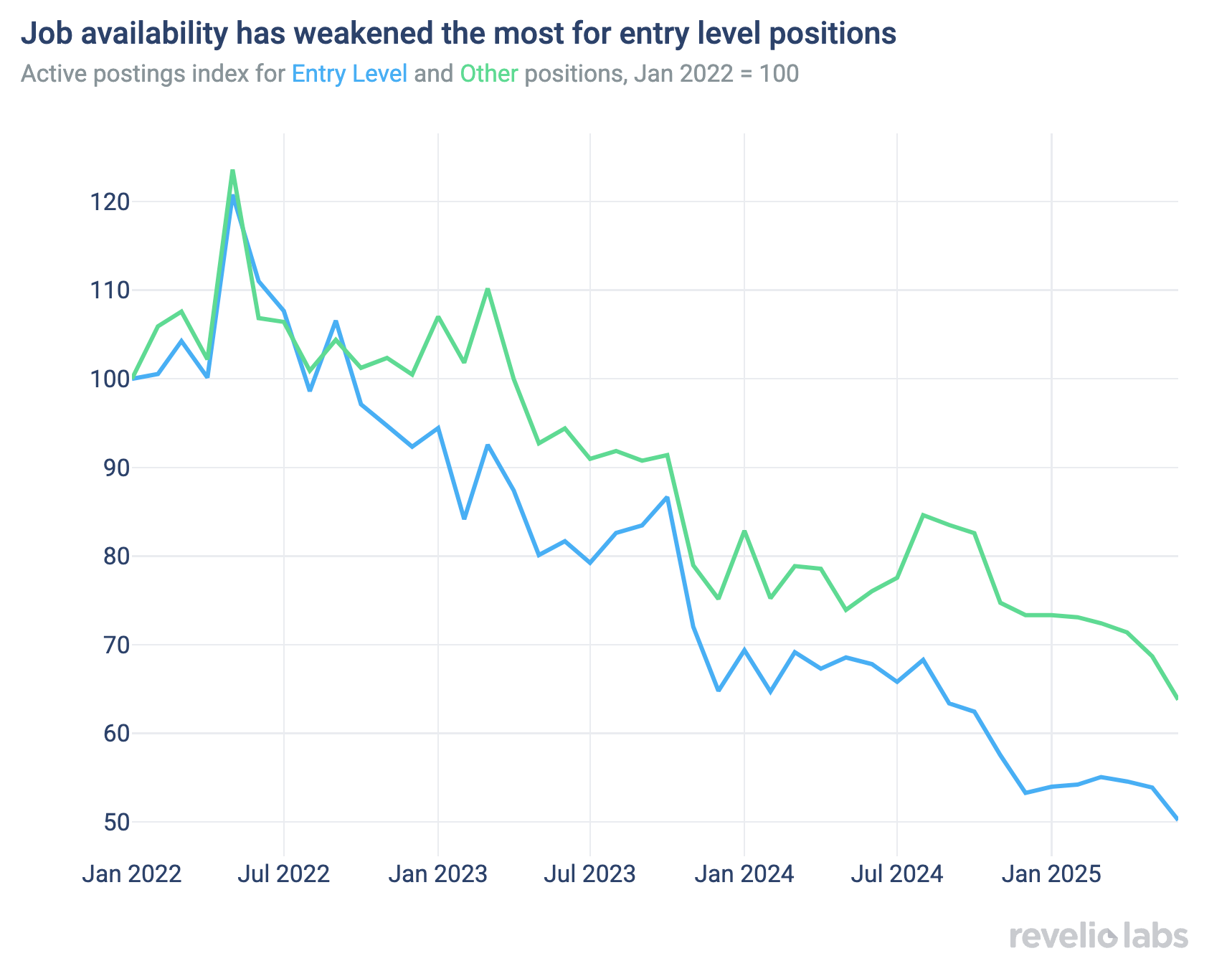

The slowdown in labor demand is broad-based, with entry-level roles hit hardest. Most industries and role types saw fewer postings, and demand for entry-level jobs is now 50 percent lower than it was at the start of 2022.

Along with policy uncertainty, the labor market continues to be impacted by the reverberations of the pandemic. Hiring and attrition have both slowed as workers stay put and employers remain hesitant to let people go following the post-panemic hiring boom, leading to a steady but stagnant job market.

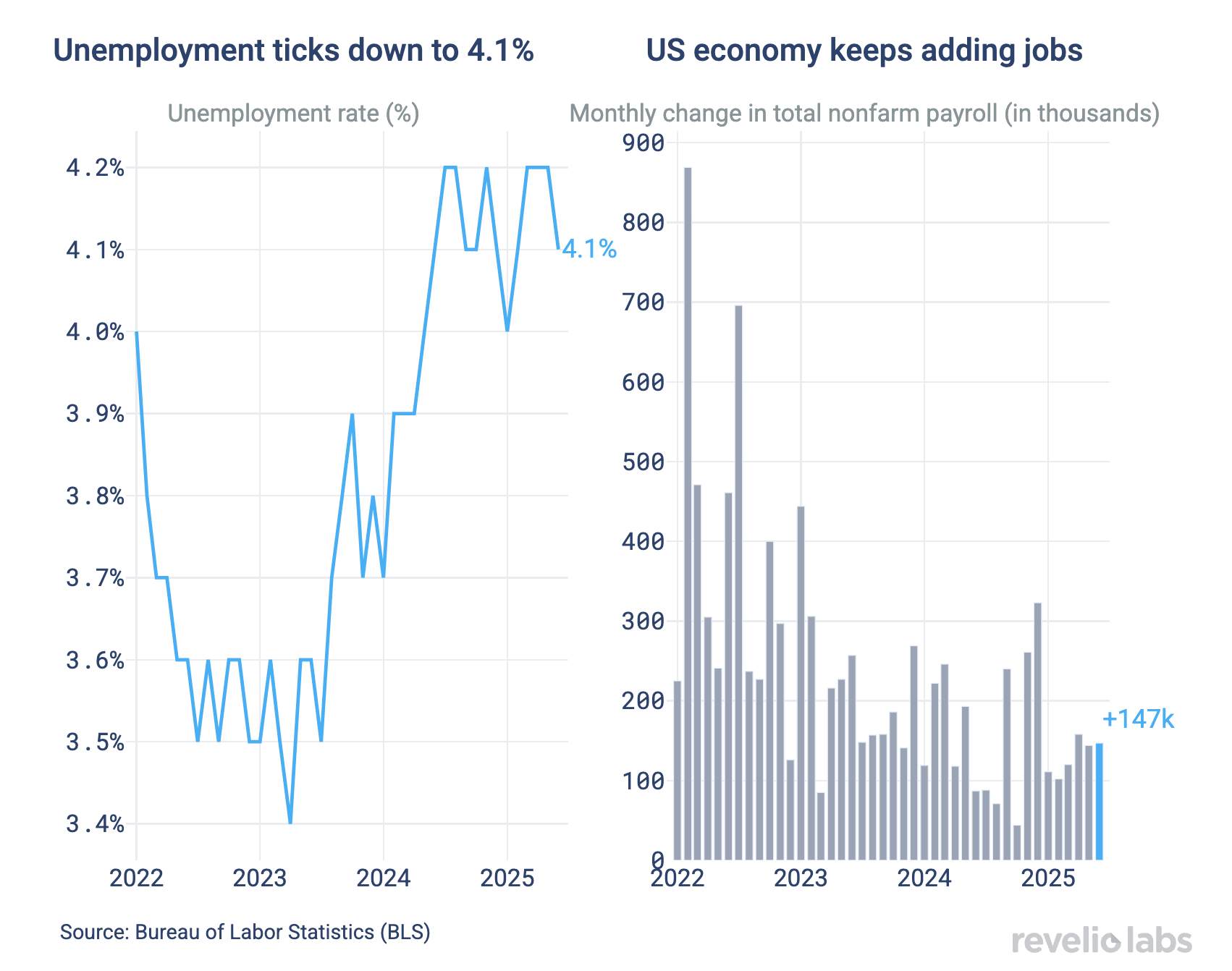

The US economy added another 147,000 jobs in June according to the BLS, marking another solid month of job growth. But, if you’re feeling confused about the US labor market right now, you’re not the only one. It’s been a weird week for labor data. First, JOLTS data showed a surprise increase in openings for May. Then, ADP reported its first negative job growth reading since 2023. And now, the BLS reports an increase of nearly 150,000 jobs.

Despite the volatility and surprise readings this week, the labor market is still clearly slowing. Looking beyond the headline numbers in the BLS report, the private sector only accounted for 74k of the net jobs added, with 73k of increase attributable to state and local government education hiring—likely just a blip related to school year timing. Additionally, JOLTS opening gains in May were concentrated in leisure and hospitality.

Looking at Revelio Labs’ job postings data, which continues through the end of June, we can see that the downtrend in labor demand remains firmly in place. Active job postings in the US fell 7.0% month-over-month in June, marking the third month of consecutive declines.

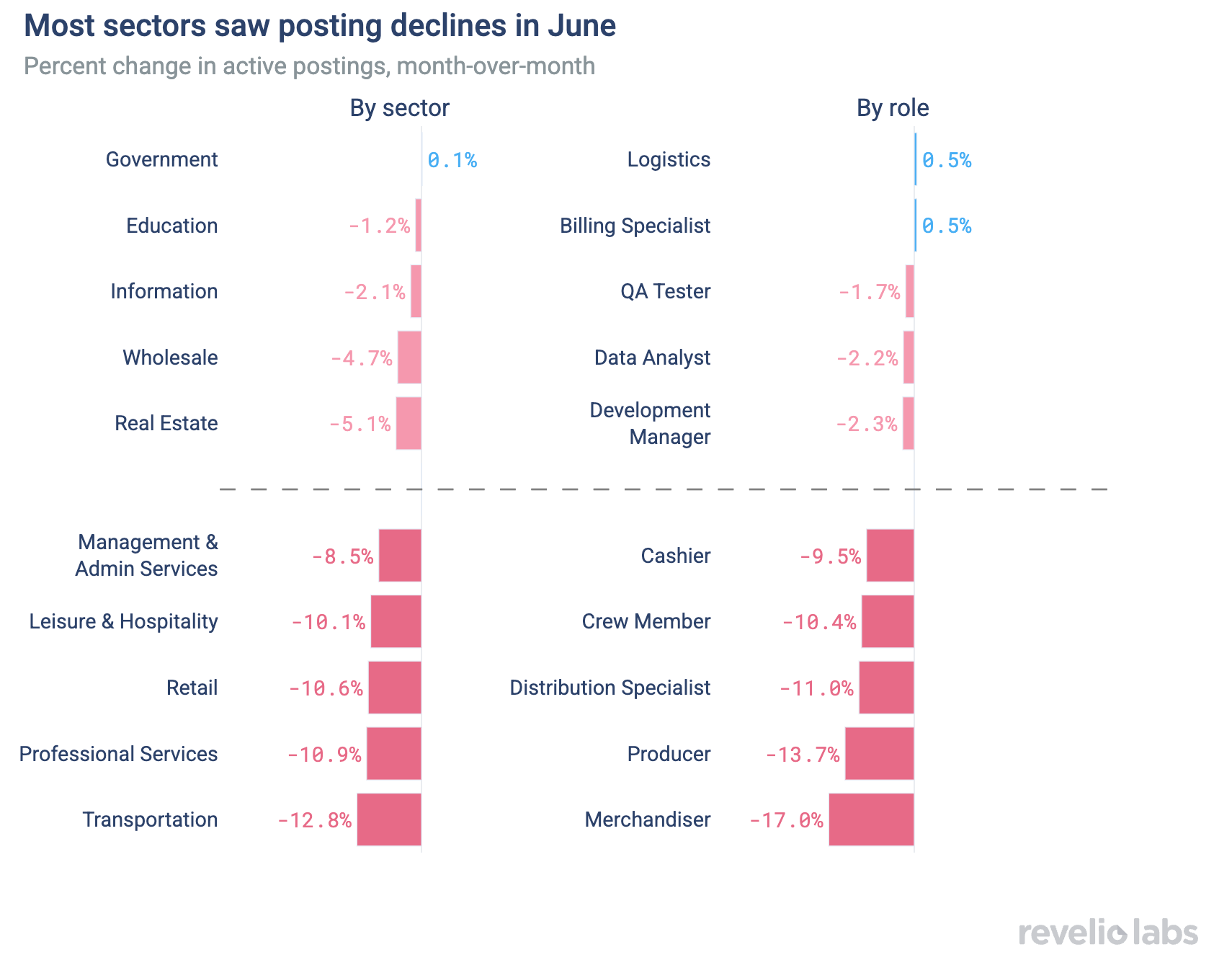

This decline was also broad-based across much of the economy, with every industry aside from the government showing declines in active postings from May to June. Looking across roles, Revelio Labs’ data also shows broad declines in demand. The vast majority of role types saw declines in active postings in June, with postings for merchandiser, producer, and distribution specialists falling the furthest.

Looking at job posting data across seniority levels, we can see that demand for entry-level positions has declined much further than other position types. In fact, active job postings for entry-level roles are now 50% lower than they were at the start of 2022.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

It’s an unusual labor market, not just because of the uncertainty brought on by rapidly shifting economic policy in Washington, but also because we are still feeling the reverberations from the pandemic. The post-pandemic reshuffle and hiring boom have been followed by a major slowdown in both hiring and attrition. Workers—many having recently switched jobs—are now hunkering down, while employers who struggled to find talent during that period are reluctant to let people go.

This parallel slowdown in hiring and attrition has meant that net job growth has remained relatively steady, and so has the unemployment rate. However, the impact is still profound, especially for entry-level roles.

It’s still a great labor market if you have a job, but if you’re looking for a change, or for that first job, times are tough.