Jobs Outlook August 2025

Warning bells are ringing after surprisingly weak BLS report

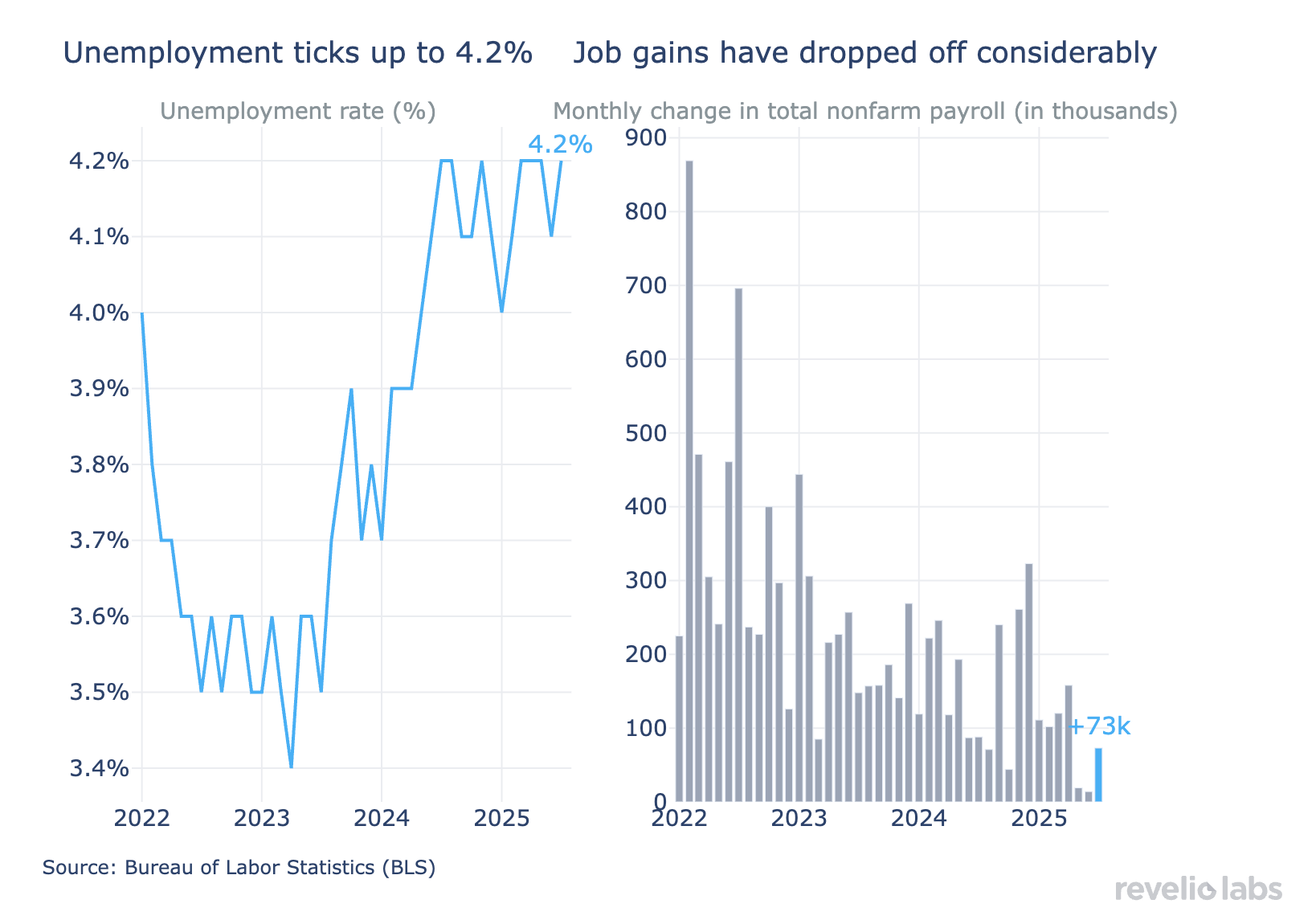

The BLS reported only 73,000 jobs gained in July, and major revisions to May and June tallies mean the US economy is now creating jobs at the weakest pace since 2020.

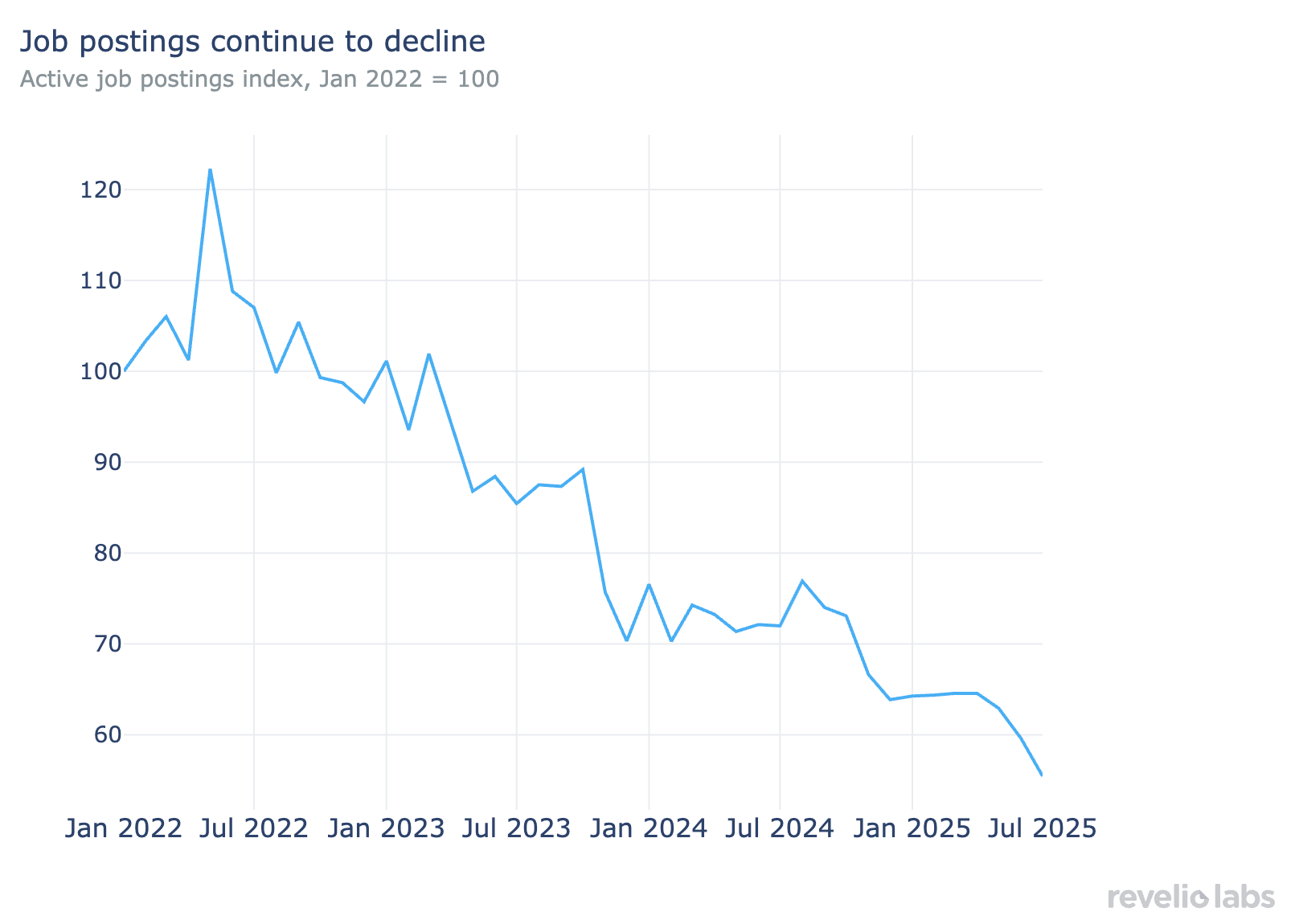

Revelio Labs job postings data has long been showing substantial cooling in labor demand, with fewer job openings likely indicating continued weakness in hiring going forward.

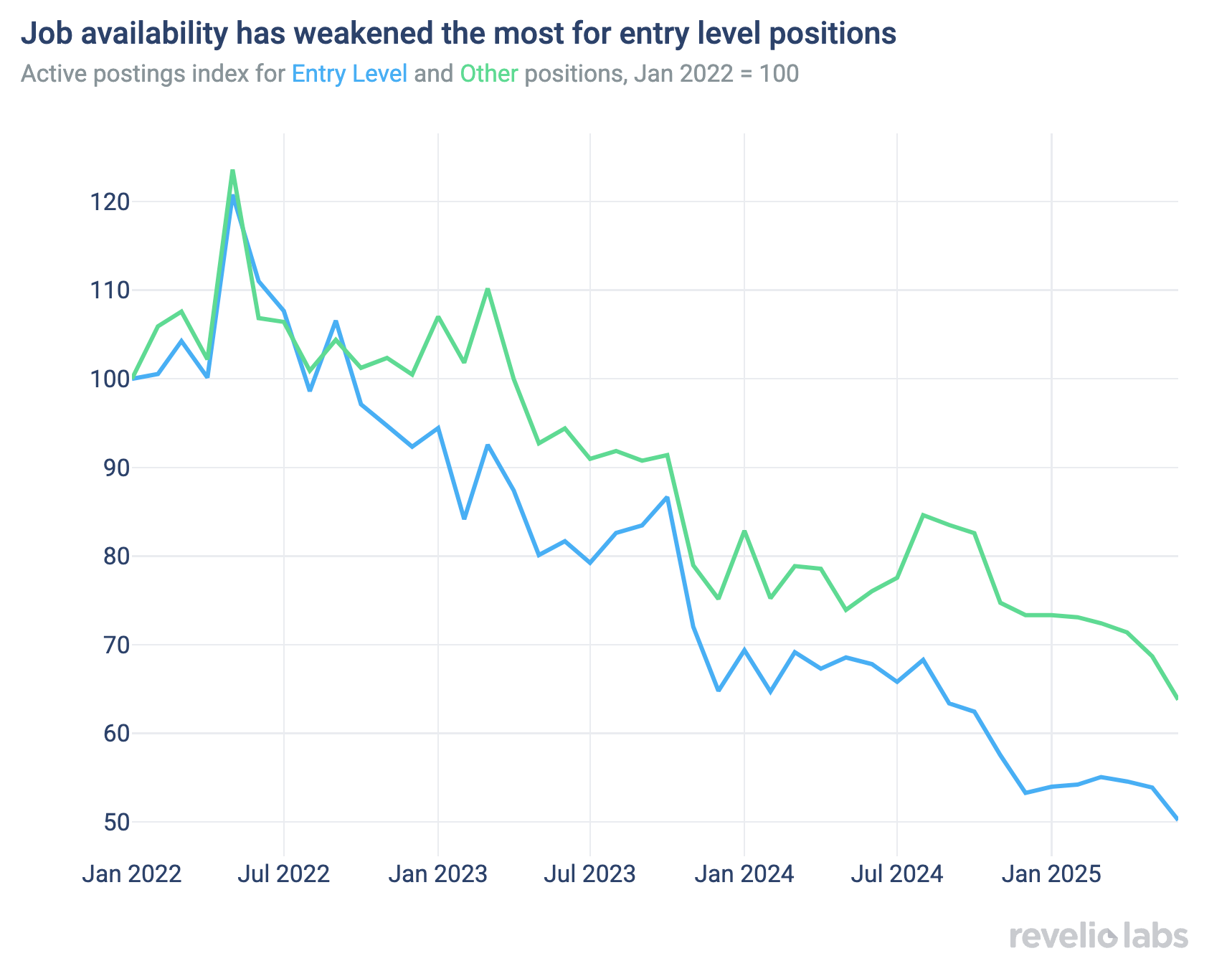

Job availability has weakened especially for entry-level positions. While unemployment remains low overall, it has become an especially difficult time for those looking for work, especially recent grads and new entrants to the labor force.

Just two days after the Federal Reserve opted to hold interest rates steady, the BLS’s July Jobs Report will have cast serious doubts on just how resilient the labor market and the broader economy actually are. The US economy added only 73,000 jobs in July—which alone would be cause for concern—while major revisions reduced May and June gains from a robust 291,000 to a meager 33,000. Overall, the last three months have seen the weakest job growth since 2020.

While unemployment ticked higher, it remains relatively low at 4.2% as labor demand and supply have decreased in tandem. However, if you’re a recent graduate or new entrant to the labor market, times are tough. The BLS reported in July that the number of unemployed among new entrants to the labor force shot up by 275,000 in July, to 985,000, the highest level since 2015.

At Revelio Labs, we have been highlighting the drop off in labor demand in recent months, as we continue to see significant declines in active jobs postings in our dataset. As of July 2025, the overall level of active job postings in the United States is now 45% below where it was at the start of 2022.

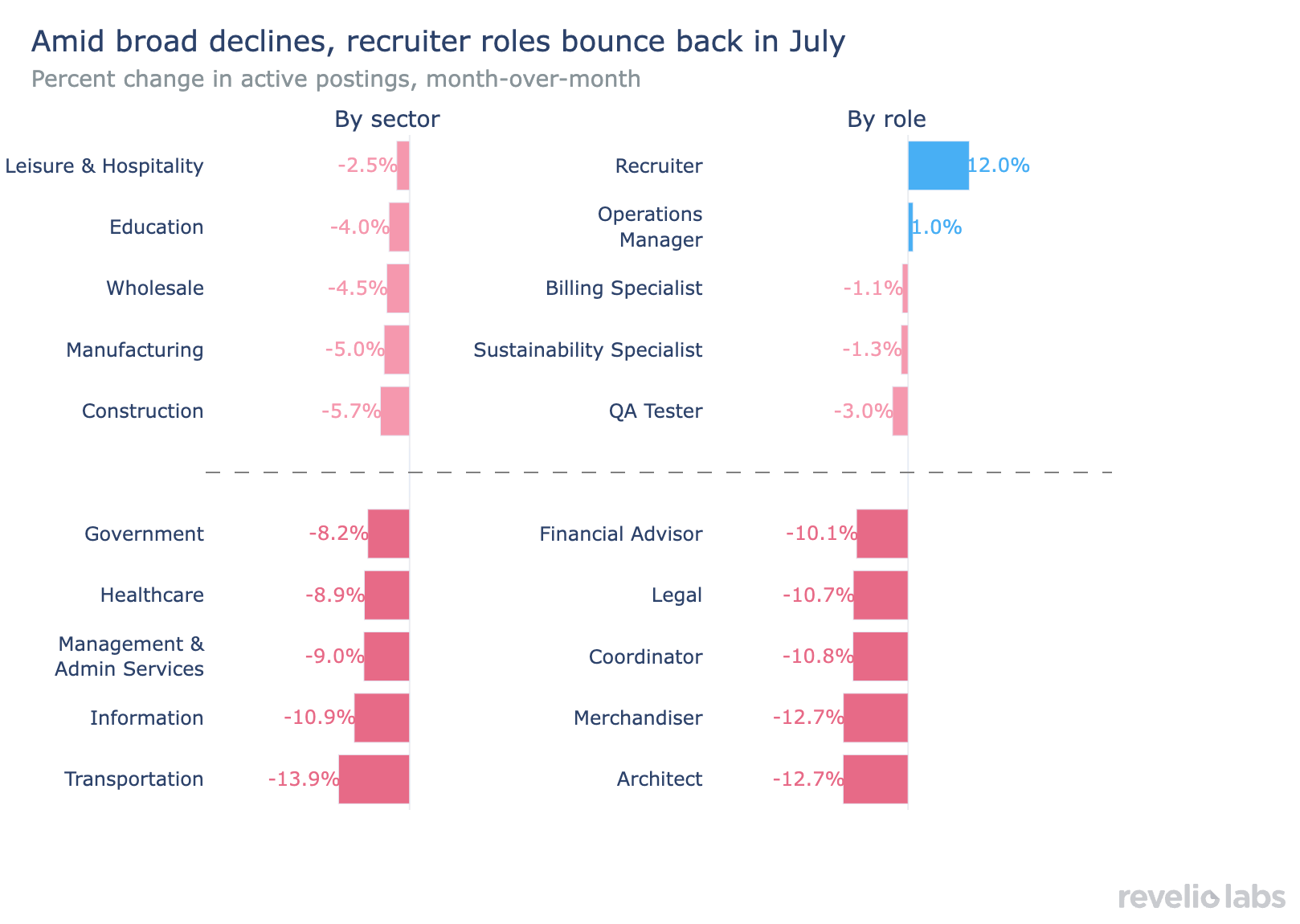

This decline we are seeing in job postings continues to be broadly-based across the economy. This is in line with BLS figures, which show that net job creation has been concentrated in just a few sectors, and predominantly in healthcare, in recent months. Notably, our data shows active job postings are declining even in the healthcare industry. We also continue to see declines in government recruiting activity as the Trump administration cuts back on overall government employment.

One bright spot is a recent uptick in recruiting for recruiter positions, which could be a positive indicator—something we have highlighted in past research.

Weaker demand has led to less hiring, especially for new entrants. While job postings have declined overall, they are especially weak for entry level positions—a point we highlighted in last month’s job outlook. Additionally, our data also shows that 4 out of 5 of the top industries that hire new graduates have pulled back on advertised jobs for this year's cohort. Stay tuned for additional research on this that we plan to publish next Tuesday.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

This month’s BLS report will certainly sound alarm bells for many economists looking for signs of weakness in the US economy, first among these being policymakers at the Federal Reserve. The weaker-than-expected report comes just two days after the Fed opted to hold interest rates steady. The new data will certainly give additional weight to the two dissenting Fed governors that voted for rate cuts during the July meeting.

Looking ahead, Revelio Labs’ job postings data points to additional weakness in labor demand and hiring, as more and more investors and employers are taking a wait-and-see approach amid heightened uncertainty.