Introducing Revelio Public Labor Statistics (RPLS)

How our alternative labor market data fills the gaps in BLS statistics

Following recent events at the Bureau of Labor Statistics (BLS), Revelio Labs is introducing Revelio Public Labor Statistics (RPLS), a set of monthly labor market indicators that are designed to provide timely, granular, and nationally representative insights into the US labor market to complement the Bureau of Labor Statistics' Employment Summary and JOLTS data releases.

RPLS leverages data from hundreds of millions of public professional profiles and job postings to produce four key measures: level of non-farm employment, hiring and separation statistics, job openings, and salaries from new job openings.

RPLS data are highly correlated with BLS-published statistics, showing a weakening of the labor market in terms of both employment growth, job openings, and wage growth.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

In a dramatic move following this month’s Jobs Friday report, which showed weaker-than-expected job gains and steep downward revisions to the prior months, President Trump fired the Bureau of Labor Statistics (BLS) commissioner, accusing her of “rigging” the numbers to smear his administration. The firing sent shockwaves through the economic and business community, with critics warning that politicizing statistical agencies risks eroding public trust in vital economic data. Adding to the uncertainty, Trump nominated E.J. Antoni to the BLS commissioner position. Mr. Antoni has repeatedly criticized the BLS as unreliable and even suggested suspending the monthly jobs report altogether. These developments cast doubt on the future of one of the most closely watched economic indicators and highlight the need for reliable alternatives.

The private sector is well positioned to help fill the gap created by the administration. Alternative data sources have proven their value as complements to official statistics, offering advantages of timeliness, scale, and granularity. During the pandemic, when the economy shifted week by week, employment data from firms like Indeed and consumption data from credit card companies gave policymakers and researchers an early view of the downturn and recovery, well before official releases. These examples show how the private sector, motivated by commercial interests, can still produce data that functions as a public good, providing critical visibility in real time when government statistics are delayed or under pressure.

While the BLS remains indispensable for foundational statistics like labor force participation and unemployment rates, the agency has been struggling with deeper methodological issues. Its core employment measures rely on surveys of households and businesses, but response rates for both have been falling steadily in recent years, raising concerns about coverage and representativeness. Funding shortfalls have also limited the agency’s ability to modernize its data collection methods, leaving it dependent on statistical adjustments that may be less effective in today’s rapidly changing labor market. These structural challenges, alongside the growing political pressure, make private-sector datasets a necessary complement for timely and accurate employment statistics.

At Revelio Labs, we collect data from hundreds of millions of public professional profiles and job postings, then standardize it using advanced models to make it comparable over time and across industries. This allows us to track total employment and job gains, hiring and separations, and the demand side of the labor market through job postings. We also capture trends in wages for new hires, providing a more complete view of the labor market in real time. That’s why our insights are trusted across the market, from hedge funds to HR and talent intelligence teams, academic researchers, and even economists at the Federal Reserve.

As such, Revelio Labs is launching Revelio Public Labor Statistics (RPLS): monthly data updates that will be released the day before Jobs Friday and the day before the JOLTS releases, respectively. These statistics aim to close the growing information gap and contribute to a fuller, more accurate view of the U.S. workforce. In this newsletter, we’re excited to reveal a preliminary view of all four data series and briefly explain our methodology and how we compare to the respective BLS releases.

Employment

To measure total employment in the US, Revelio Labs leverages its individual level data collected from online professional profiles. The sample includes data on all private and public sector full time and part time workers, excluding military personnel, interns, self employed and proprietor workers, and workers who are on leave or sabbatical. Revelio Labs employs sophisticated models to produce nationally representative measures of real-time employment that adjust for the lags in reporting, and ensures that the distribution of the workforce in Revelio Labs data resembles the national distribution of employment across industries and occupations. Finally, we correct for seasonal patterns in the data.

The BLS tracks changes in employment via two main surveys. The establishment survey (which surveys approximately 121,000 businesses and government agencies, representing approximately 631,000 individual worksites) is the source of the monthly “headline” change in payroll jobs. The household survey (about 60,000 households) captures different employment trends including payroll jobs, self-employment, and multiple jobholding. Together, the two surveys offer complementary snapshots of the labor market.

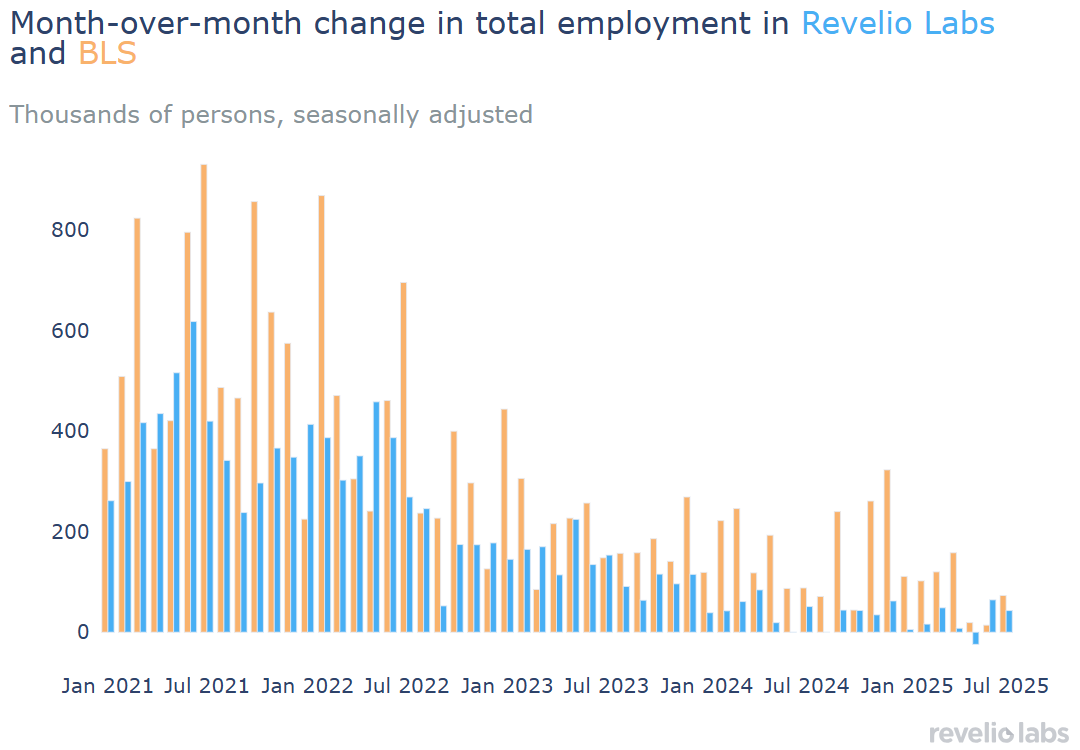

The figure below shows the change in total employment (employment gains) from Revelio Labs’ estimates compared to the Current Employment Statistics (CES) reported in the establishment survey. Revelio Labs’ estimates move in tandem with official data, capturing the same broad trends while offering a more timely and flexible measure of employment changes.

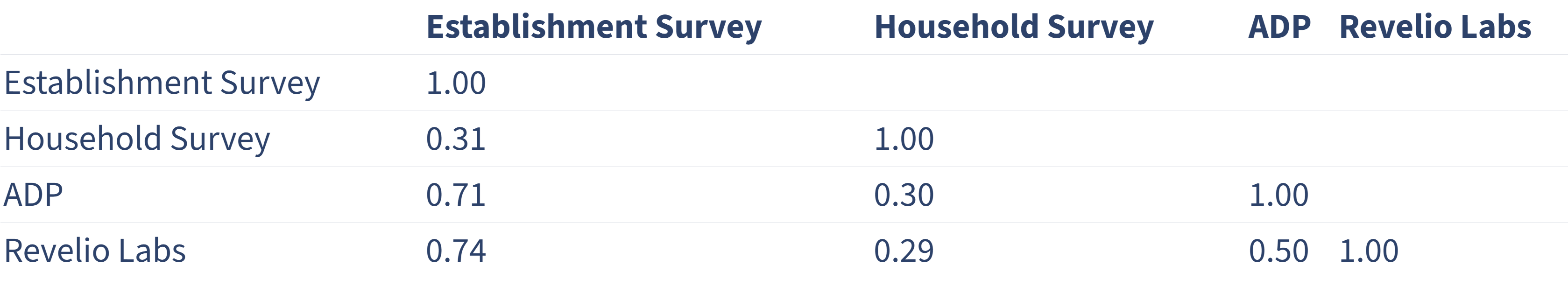

The table below shows the correlations between monthly changes in employment from January 2021 to July 2025 between Revelio Labs, the establishment survey, the household survey, and ADP private employment data. ADP collects payroll data representing 25 million private-sector employees. The correlation between the establishment survey data and the household survey data is modest at 0.31, reflecting different concepts and coverage. By contrast, Revelio Labs tracks the establishment survey most closely with a correlation coefficient of 0.74. Meanwhile, Revelio Labs' change in employment has a relatively modest correlation of 0.31 correlation to the household survey. ADP’s private-payroll series also correlates with the establishment survey (correlation of 0.71), but its scope is narrower as it only measures private payroll employment. Our employment series is the most correlated with the main BLS series and offers the most reliable proxy for monthly payroll dynamics.

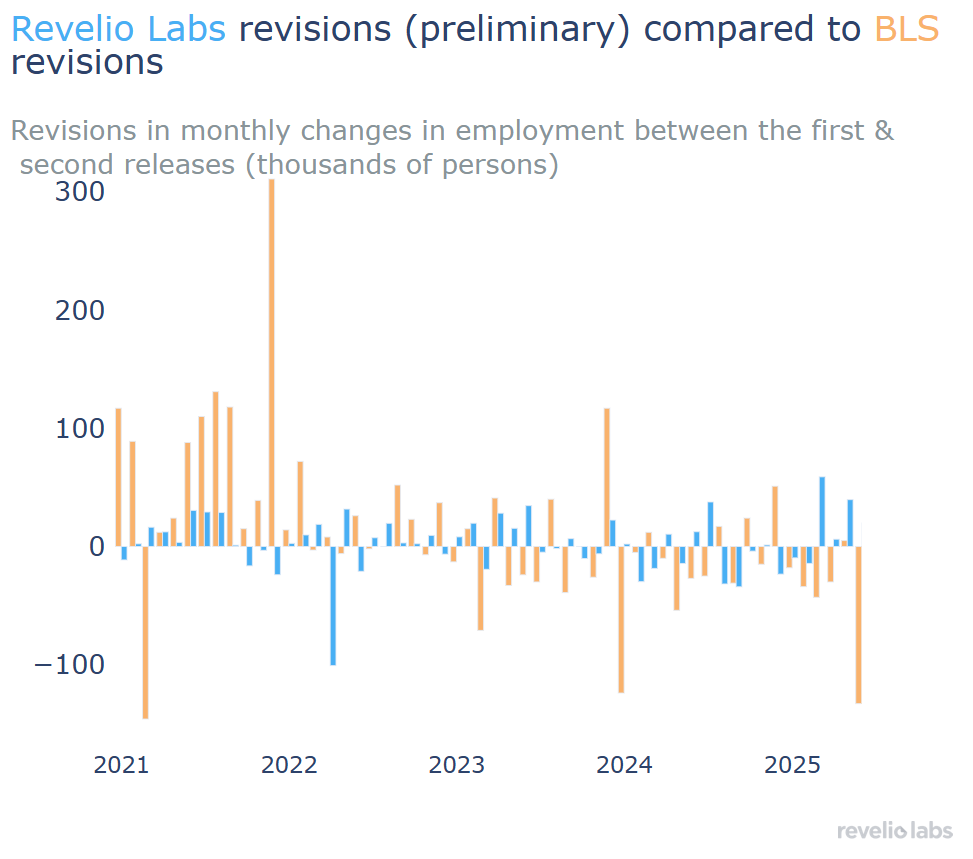

Data revisions are a normal part of statistics, and they matter when policy and markets rely on the numbers. The BLS has faced criticism for sizable revisions in prior months’ employment figures, revisions that fueled controversy over the reliability of its data. Revelio Labs also updates historical estimates as new information comes in, but preliminary analysis of our revisions shows that over the past four years our revisions have been roughly half the size of the BLS’s. One of the other main criticisms for the BLS revisions is that they are highly pro-cyclical and serially correlated. In other words, if the economy is performing well, BLS data revisions are more likely to be positive and vice versa. In addition, if BLS revisions are positive in one month, they are more likely to stay positive for the next months, due to the nature of data collection process from the Establishment survey. Revelio Labs data is less prone to these concerns. Our revisions are less pro-cyclical and less serially correlated compared to BLS’ revisions.

Salaries from new job openings

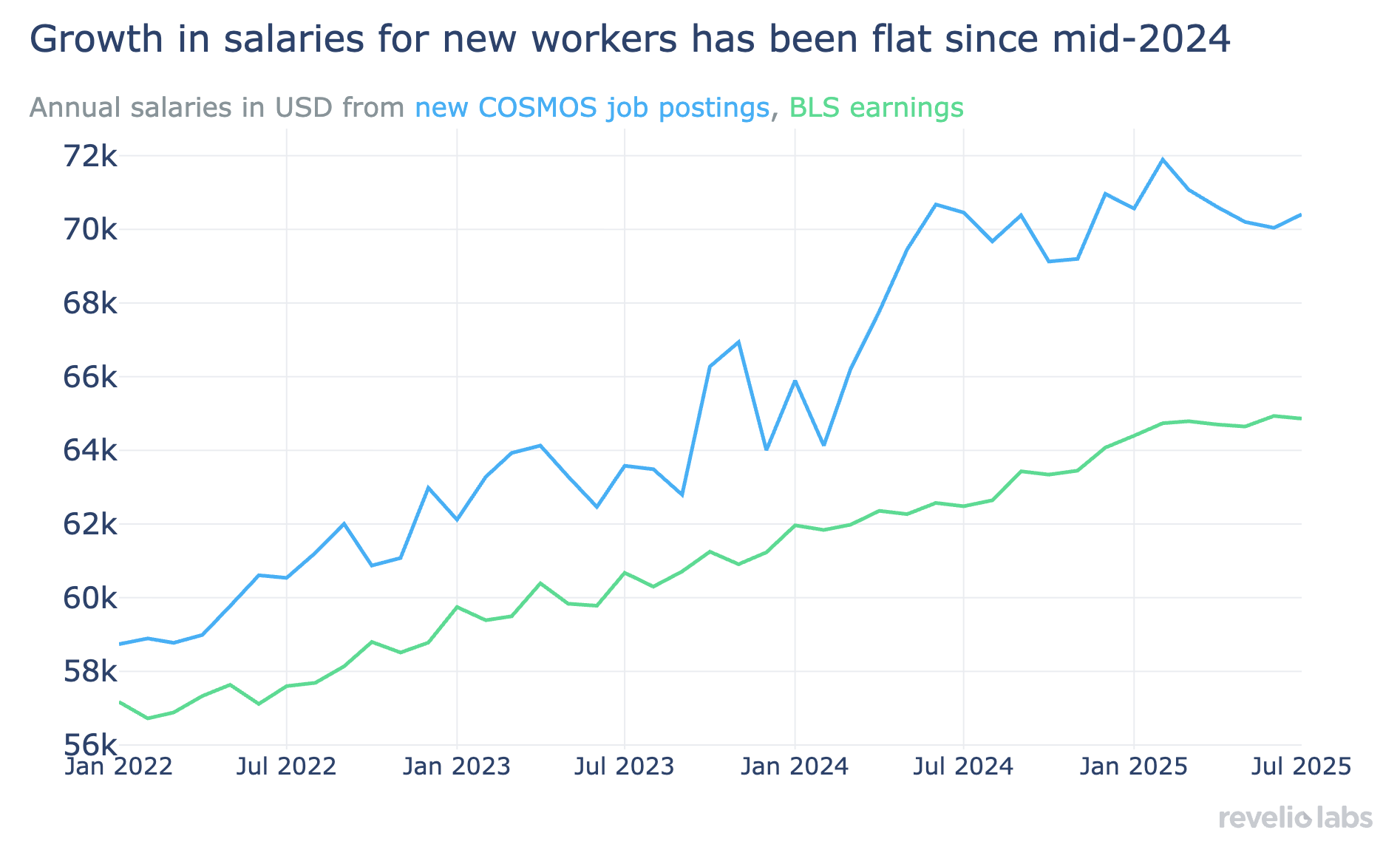

Online job postings provide a rich source of salary information, indicating how much companies are willing to pay future hires. The BLS reports earnings gained by workers currently employed, providing a measure of how much workers are earning on average across the economy. But salaries from new job postings give a forward looking view of both the direction and speed at which average salaries are changing. It is useful to think of salaries from job postings as a flow measure, while earnings in the Establishment Survey represent a stock measure.

Using our unified and deduplicated COSMOS job postings data, we collect raw salaries as they appear in job postings, converting them to nominal annual base salaries. Where a range is reported, we take the midpoints. In order to obtain average salaries from new job postings representative of the economy, or if all sectors were hiring evenly every month, we construct sampling weights for job postings to represent the distribution of the workforce across sectors and occupations. Additionally, we seasonally adjust the data series, removing expected seasonal patterns from the data.

We compare changes in average earnings growth from the BLS (annualized by assuming the average weekly hours worked of 34.4) to average salaries from new job postings. The plot shows that while salary growth from new job postings has outpaced wages earned since 2022, growth in salaries from new job postings has essentially been flat since mid-2024 and even declined since the beginning of 2025. This trend is consistent with the Atlanta Fed wage tracker showing that salaries for job stayers have grown faster than for job switchers since the beginning of 2025. It truly is a good time to have a job and a bad time to be looking for one.

Job Postings

Job openings are a critical signal for understanding the health of the labor market and designing effective policy. Unlike employment figures, which reflect the current state, job postings can serve as a leading indicator, showing where hiring is expected to increase, which industries are expanding, and where labor demand is shifting.

Revelio Labs collects data on job postings from sources including company career pages, job boards (e.g., LinkedIn, Indeed, regional aggregators), and staffing firms. We then deduplicate these postings to create a holistic view of labor demand. Accordingly, Revelio Labs’ job postings data can help predict where employment is likely to grow, highlight tightening labor markets, and identify sectors with rising demand. Revelio Labs releases data on aggregate active postings in the US economy.

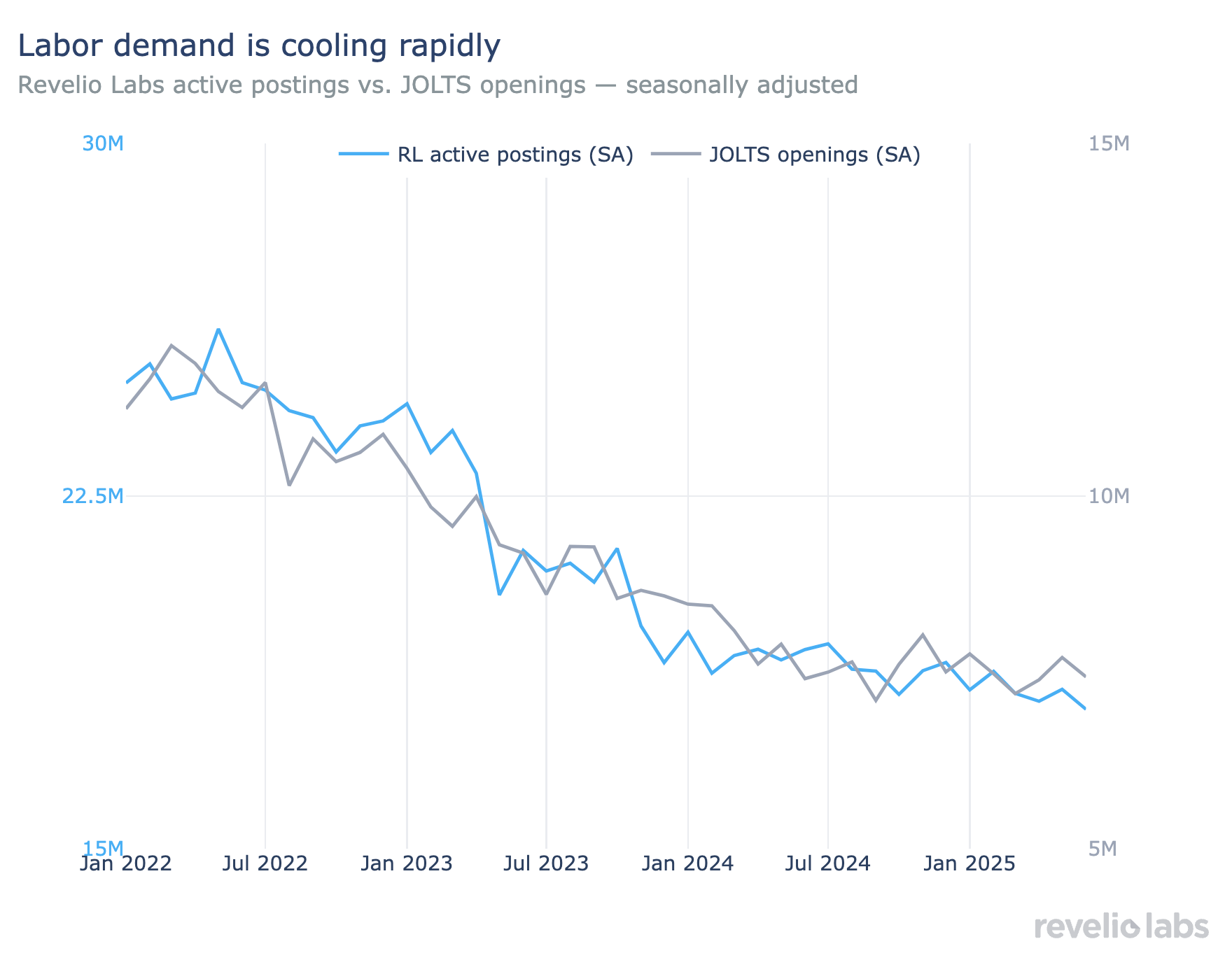

As we have pointed out in multiple editions of our Jobs Outlook, labor demand has been declining notably in recent months, with active job postings falling across almost all sectors tracked by Revelio Labs. Heightened economic uncertainty has led many investors and potential employers to hold off on new endeavors and hiring decisions, undermining labor demand.

Hiring & Attrition

Hiring and attrition rates are calculated based on Revelio Labs’ estimates of employment data that also help us extract inflows and outflows of workers into different sectors and occupations. We also adjust for lags in reporting and ensure that the distribution of the workforce in Revelio Labs data resembles the national distribution of employment across industries and occupations. The hiring (attrition) rates are annualized rates, calculated as the sum of inflows (outflows) to (from) a given industry over the last year divided by the average counts over the last year.

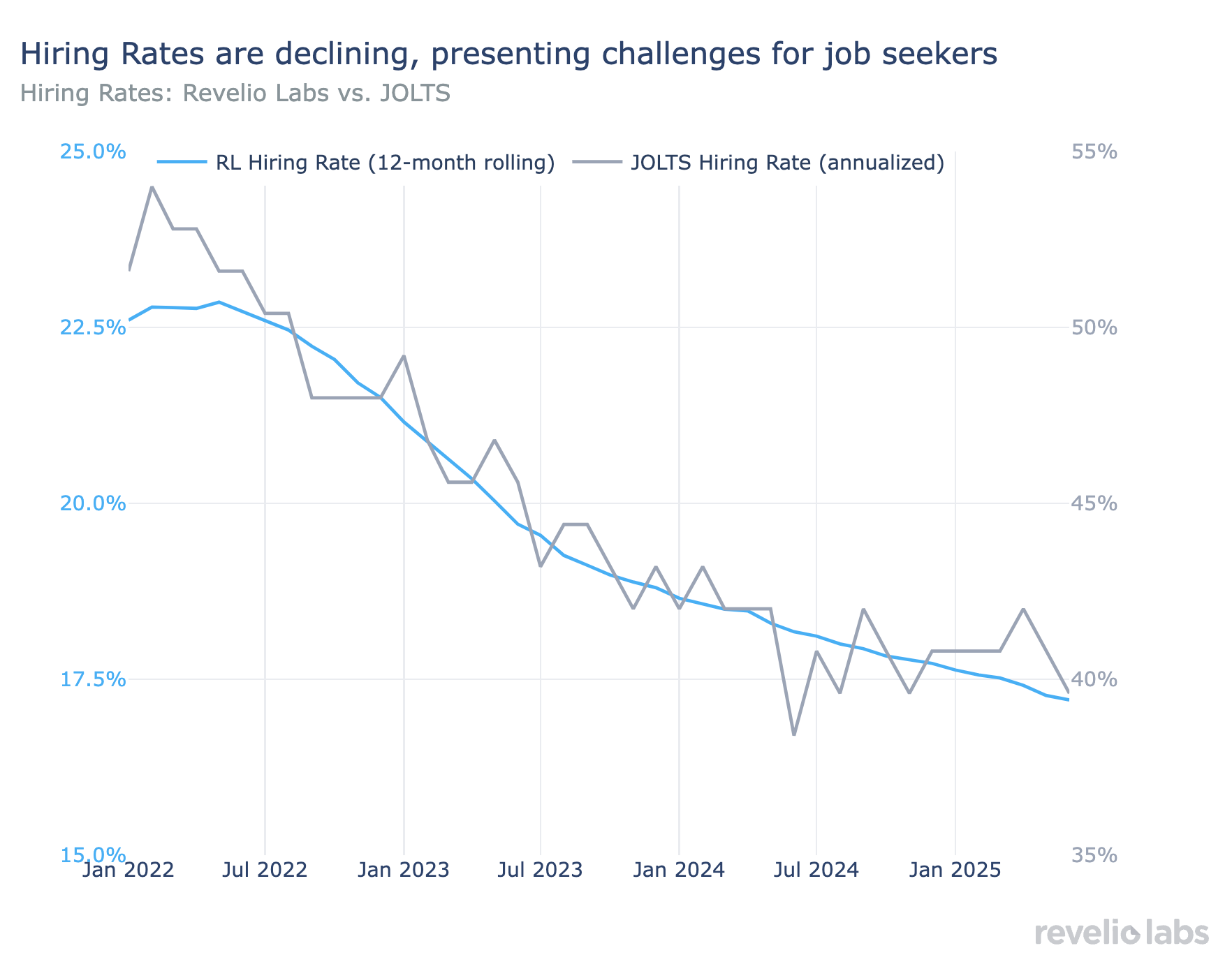

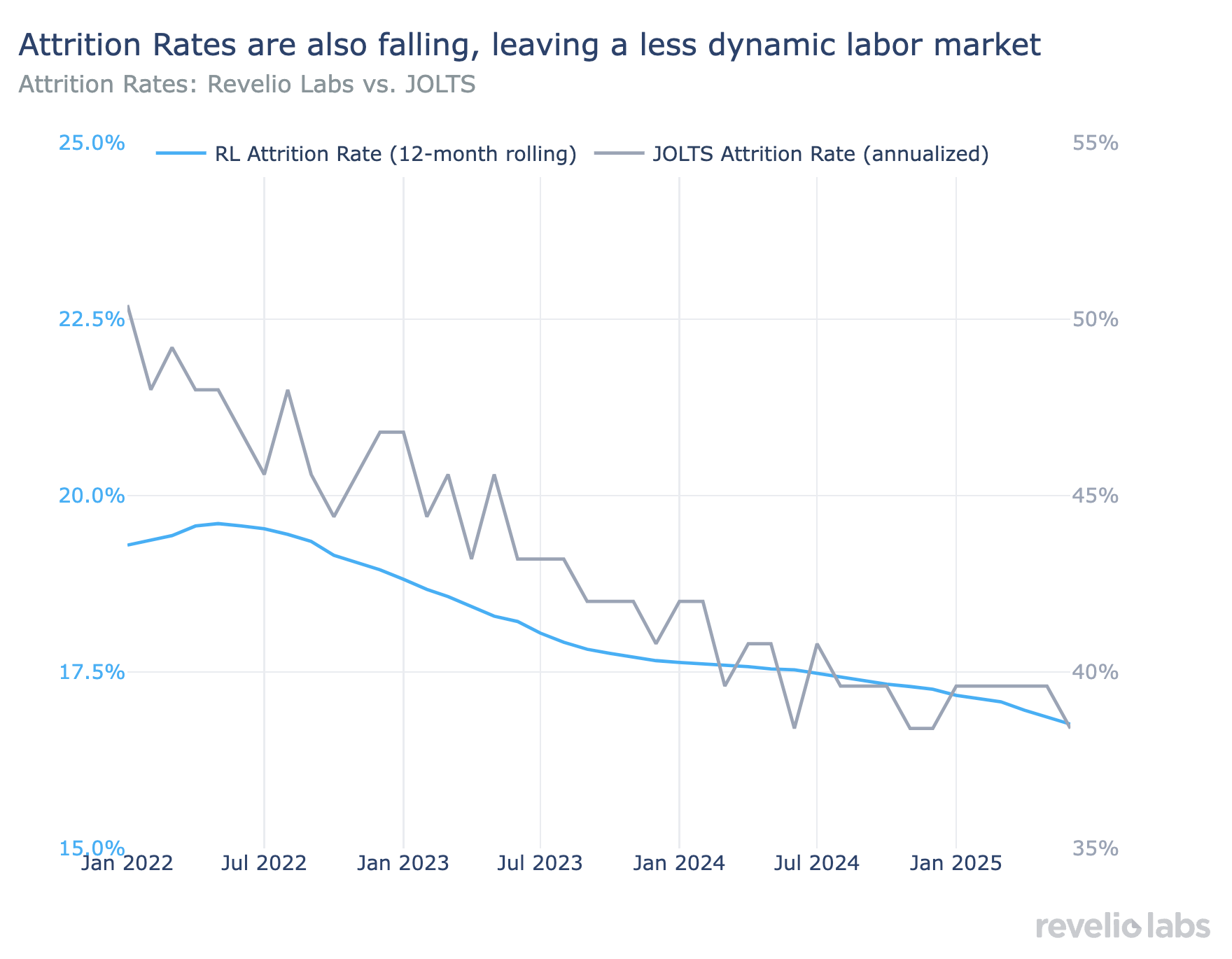

Revelio Labs data shows a steady decline in hiring and attrition rates in recent years, as both have fallen in tandem as the labor market cooled after the post-pandemic hiring boom. Both of these measures track closely with BLS JOLTS data, but with major differences in the level of hiring and attrition.

These differences stem from the fact that Revelio Labs data focuses on permanent hiring and attrition among full-time, professional workers, as opposed to JOLTS which is more heavily influenced by seasonal and temporary hires. Additionally, JOLTS data is derived from establishment-level data that can include within company transitions, leading to higher hiring and separating rates. As such, Revelio Labs’ data consistently shows a much lower level of both hiring and attrition rates across industries, rates that would be more consistent with what HR and corporate leaders would expect.

While there exists a sizable gap in levels, the trends are more consistent. Since January 2022, both Revelio Labs and JOLTS data show a steady decline in hiring activity, with both declining nearly 25% since January 2022. However, while JOLTS hiring rate has largely stabilized since mid 2024, Revelio Labs’ data indicates that hiring continues to weaken across much of the US economy.

The story is consistent across both hiring and attrition, with churn slowing dramatically since 2022. While unemployment remains low and layoffs relatively few, companies aren’t hiring like they used to, leaving fewer opportunities for workers to move up, switch roles, or find a new job. The result is a labor market that appears relatively stable and healthy, but that is less dynamic and very difficult to navigate if you are a new entrant or find yourself without a job.

Conclusion

Stay tuned for RPLS data releases! Our first release of hiring and separation rates as well as job postings comes out on September 2nd, the same day as the JOLTS release. Our employment numbers and salaries from new job opening numbers will be released ahead of Jobs Friday on Thursday September 4th at 8:30AM ET, ahead of Jobs Friday.