Inaugural RPLS Release Reveals Where the Slowdown Is Hitting Hardest

First release of new public labor market statistics shows a broad weakening in the labor market

RPLS makes its debut: Our first release of the Revelio Public Labor Statistics (RPLS) shows employment rising by just 50,000 jobs in August, coming in below expectations and confirming the broad decline in job growth reported by the BLS (+22k).

Wage gains were modest and uneven: Salaries from new postings rose 0.6%, led by the Information sector (+1.1%) and Washington state (double-digit gains), while several industries and regions saw declines.

Hiring strength remains concentrated: Healthcare, Education, and Professional Services drove job growth, while government jobs and many Southern and Midwestern states held back momentum.

This month we published the first installment of Revelio Private Labor Statistics (RPLS), and the numbers are in: total employment rose by 50,000 jobs in August. That’s lower than expectations, more than the Bureau of Labor Statistics’ estimate of +22,000, and about the same as ADP’s count of +54,000. Our number points to a labor market that’s rapidly losing steam. This week, we’re digging deeper into the details that RPLS can uncover: which sectors and which states are still adding jobs, and which are holding back growth.

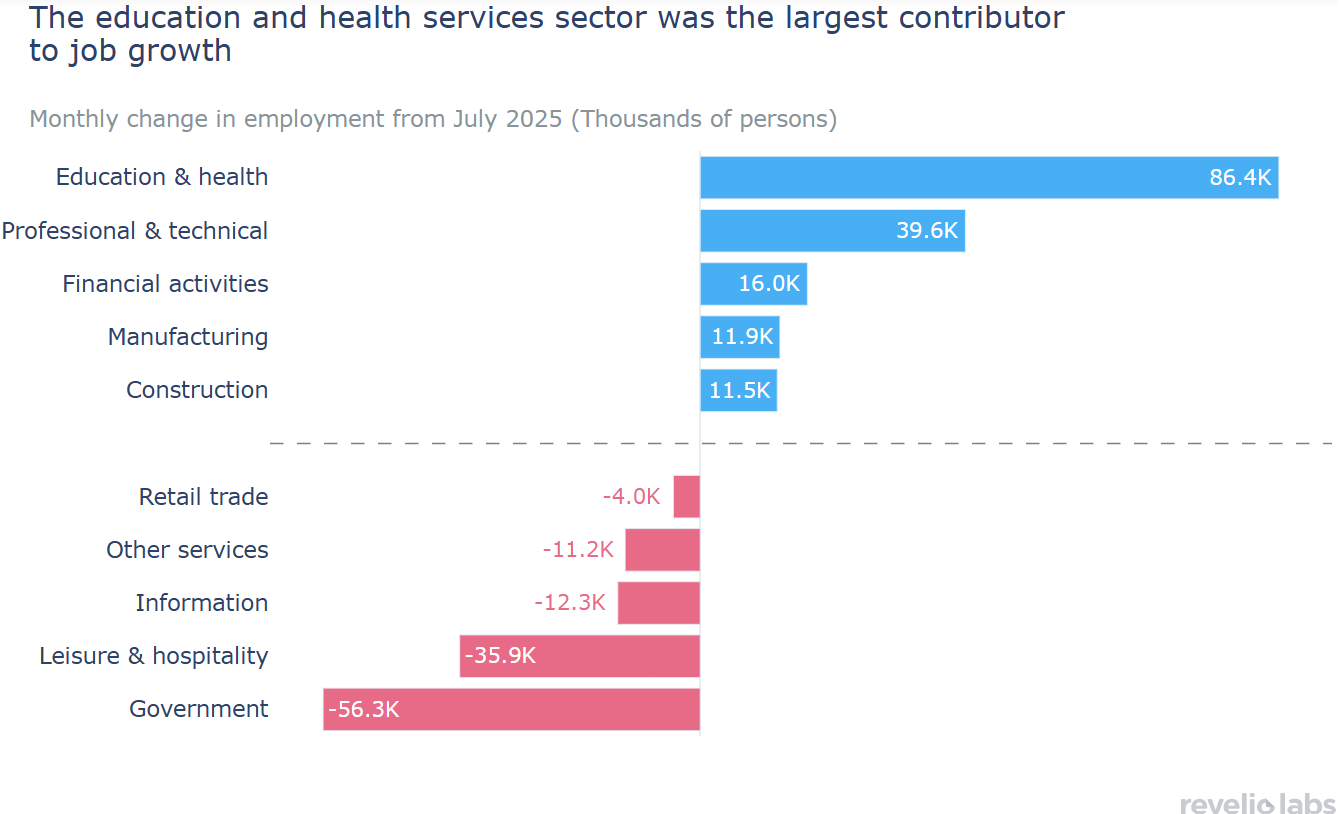

Zooming in by industry, the biggest contributors to job growth in August were the Healthcare & Education and Professional & Business Services sectors. These sectors have been holding up well as demand for services remains steady; hospitals, clinics, and schools continue to hire, while firms in professional services are adding staff to keep up with client needs. In fact, Healthcare & Education are the only areas consistently adding jobs in recent months, and RPLS data aligns with the BLS in confirming this trend. On the flip side, the Government sector saw the largest decline in jobs in August. This drop seems to stem from a wave of forced leave for federal employees that won’t resolve until September.

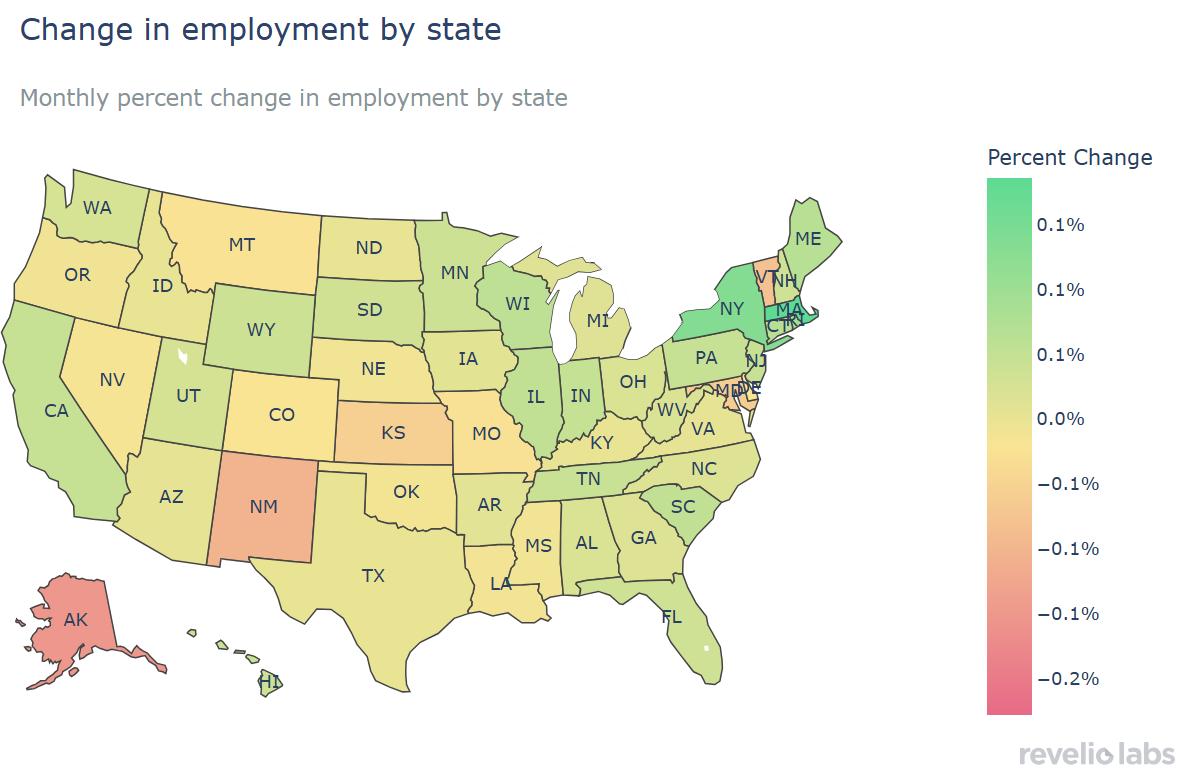

Looking at the state level, job growth in August was concentrated in a handful of high-population states. New York, California, and Massachusetts led the way, adding over 290,000 jobs combined, fueled by strong hiring in tech, professional services, and healthcare. Other states seeing solid gains included Illinois, Florida, and Pennsylvania, each adding tens of thousands of jobs. Meanwhile, some states experienced slight declines or stagnation, including Maryland, Washington D.C., and Kansas saw month-over-month drops of up to 0.07%, reflecting temporary slowdowns in government.

While net job creation has cooled, unemployment remains low by historical standards, as most employers have been reluctant to shed workers. In this environment, both hiring and attrition have slowed, leaving the labor market outwardly stable but far less dynamic beneath the surface.

RPLS data shows that weaker job growth is being driven less by layoffs, and more by a pronounced pullback in hiring. Attrition is also falling, with fewer workers leaving jobs voluntarily or involuntarily, resulting in a more stagnant market that is especially difficult for new entrants or anyone seeking a new role. Opportunities are scarcer, mobility is limited, and the lack of churn makes the labor market harder to navigate. Yet the absence of widespread layoffs, paired with resilient demand in sectors like Healthcare, has provided some support for wages, setting the stage for the pay trends we highlight below.

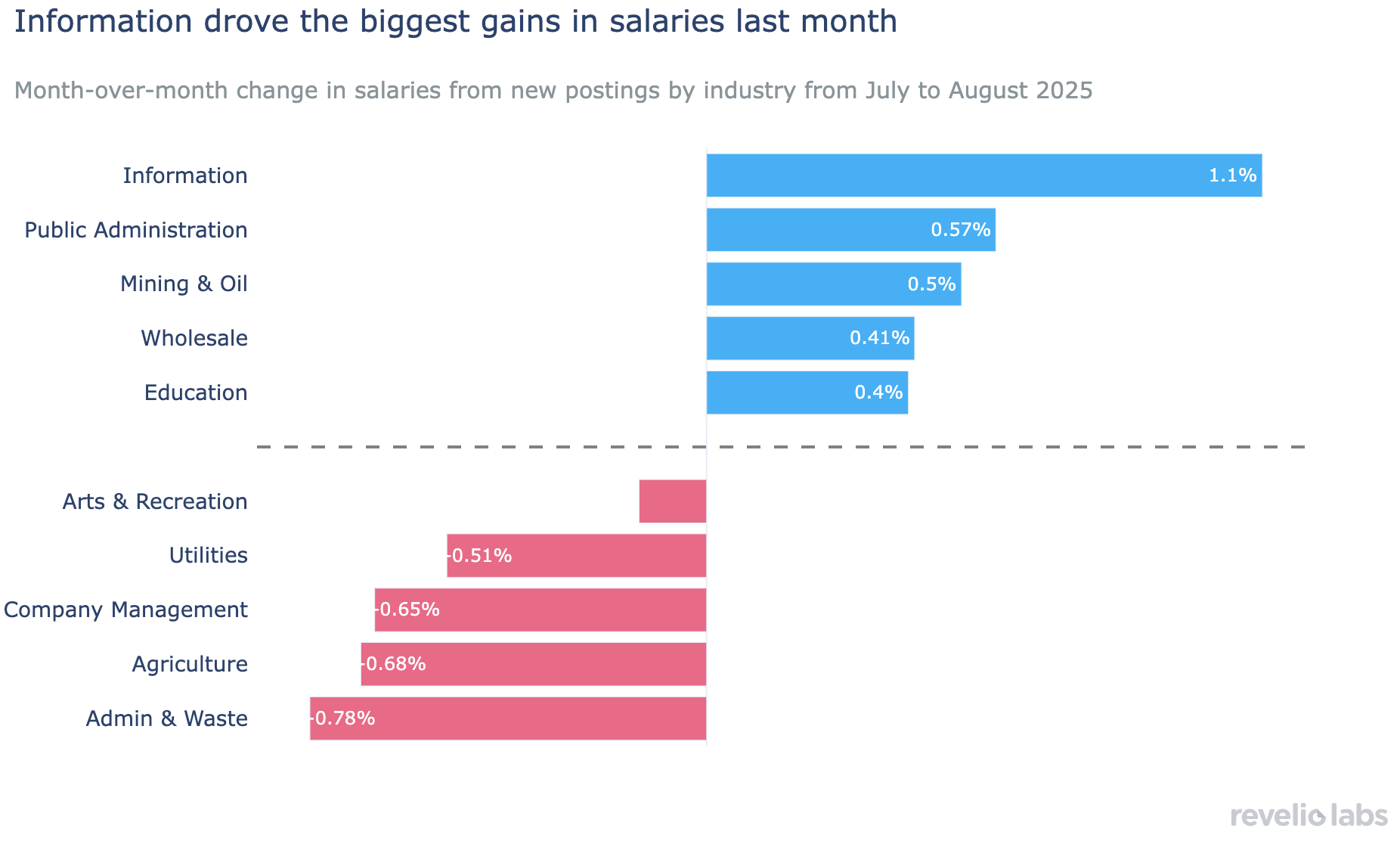

Salaries from new job postings ticked up 0.6% in August, pointing to modest but broad-based gains in advertised pay. The largest increases came from the Information sector (+1.1%), where competition for tech and media talent continues to push wages higher. Public Administration and Mining & Oil also saw above-average gains, while Education and Wholesale posted smaller but steady increases. At the other end of the spectrum, salaries fell most sharply in Administrative & Waste Management (-0.8%), Agriculture & Forestry, and Company Management, suggesting that employers in those industries are pulling back on pay offers.

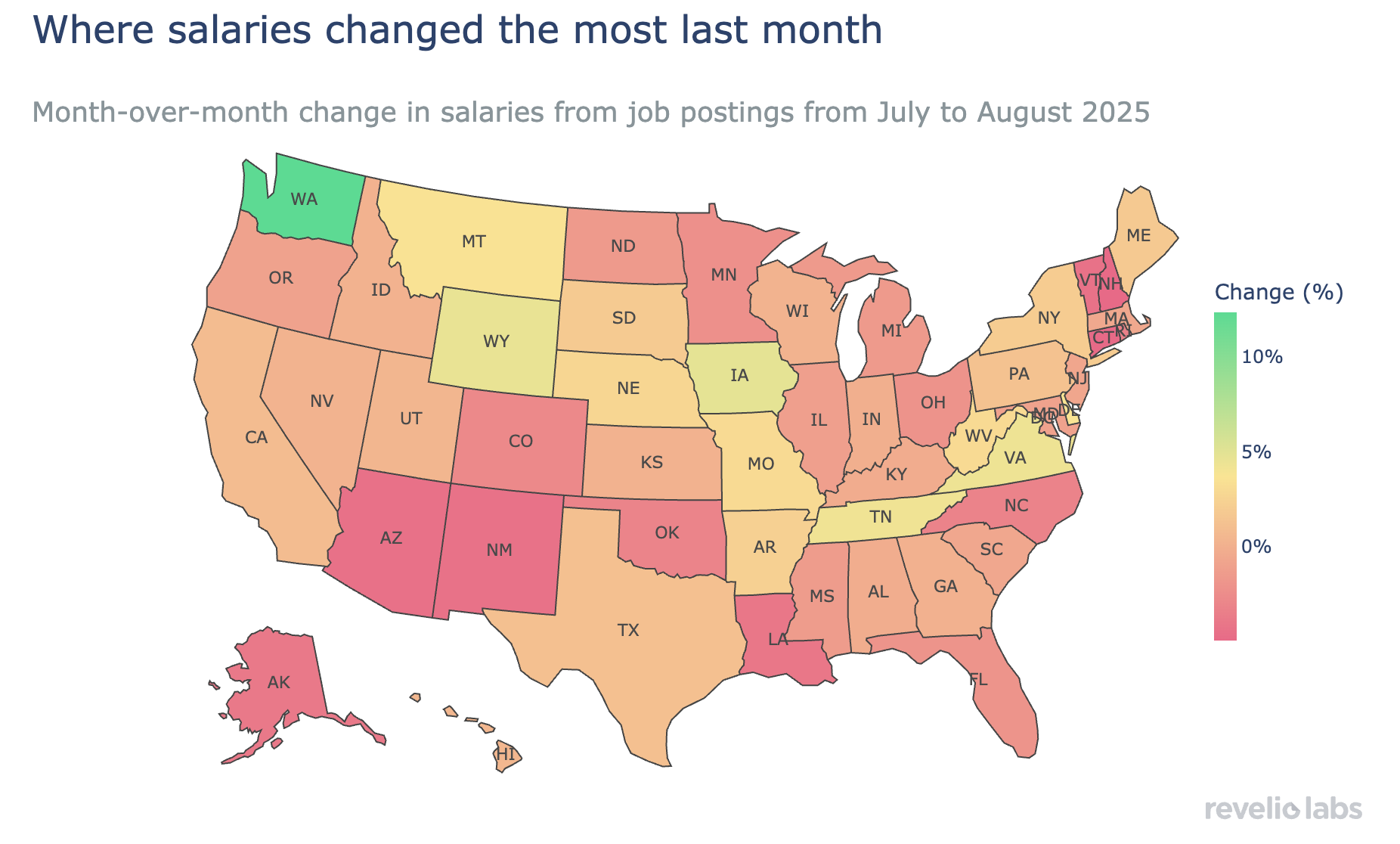

Geographically, the picture was highly uneven. Washington state stood out with double-digit increases in advertised salaries, driven by these big increases in Tech we saw above. Parts of the Mountain West (Wyoming, Montana) and Mid-Atlantic (Virginia, Maryland) also recorded strong gains. In contrast, salaries in much of the South and Midwest softened, with declines most pronounced in states like Louisiana, New Mexico, and North Carolina. The regional divergence highlights how local labor market pressures—ranging from industry mix to cost-of-living adjustments—continue to shape wage setting.

Taken together, the data show that there was modest wage growth, the forces driving it are highly concentrated. Information is pulling ahead, both sectorally and geographically, while several industries and regions are under pressure. As we track salaries in coming months, the question will be whether these gains broaden out and whether new salaries from job postings can stay above salaries for the existing workforce. They currently are, but only just.

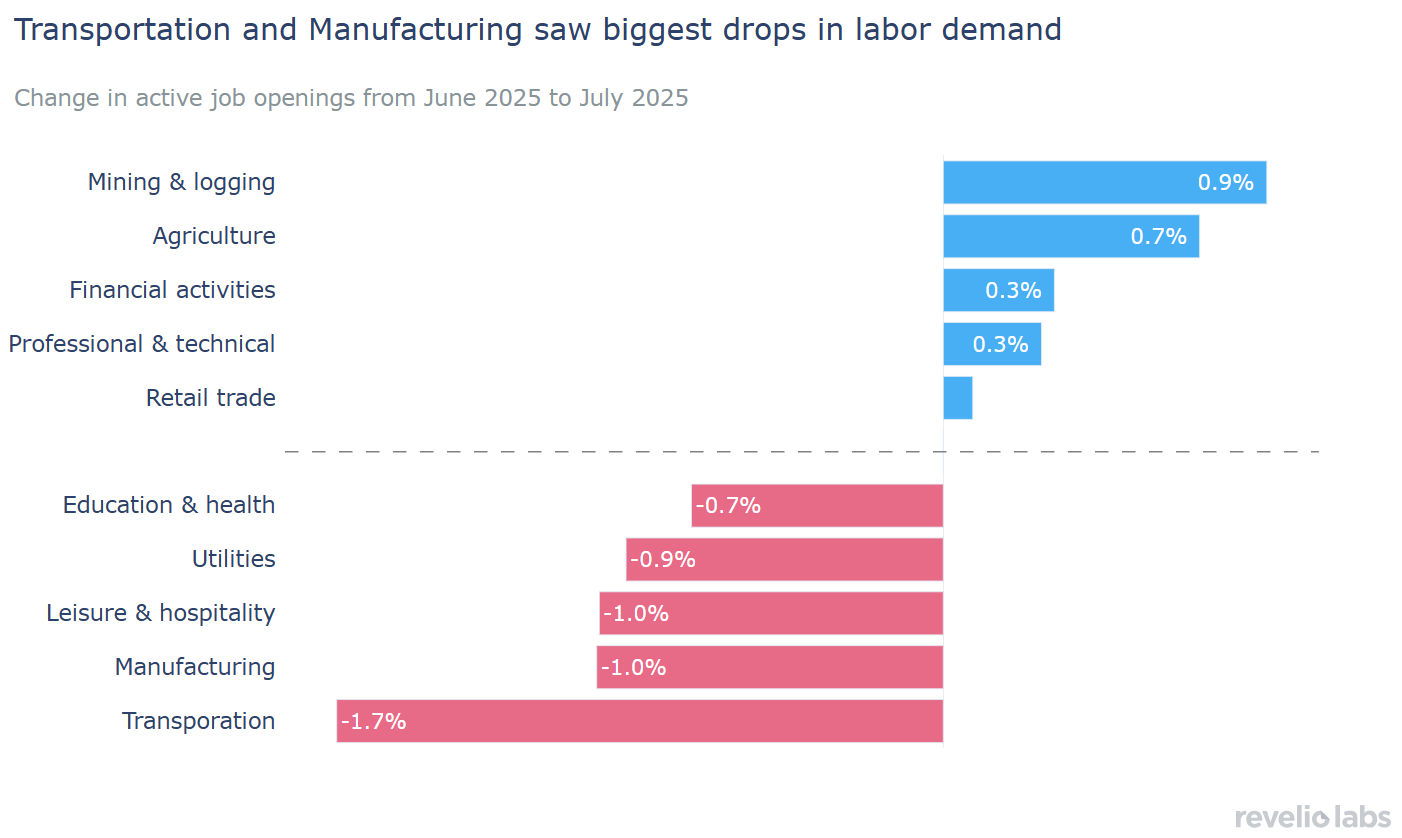

Looking ahead via our job openings dataset, we continue to see a broad decline in labor demand. A few industries like Mining and Logging and Agriculture, Forestry, Fishing, & Hunting saw sizable gains, but most sectors saw fewer active job postings in July, compared to June.

Industries with significant declines include Transportation & Warehousing and Manufacturing, as higher tariffs and on-again/off-again policy shifts disrupt the industry and make long-term planning difficult. These sectors saw declines of 1.7% and 1.0% month–over-month, respectively. We also continue to see a decline for job openings in the Government, amid the Trump administration’s continued push to cut back the footprint of the federal government. In addition, state and local government labor demand will likely be constrained as state governments implement cuts after Federal funding was cut back by the Trump administration’s One Big Beautiful Bill.

Critically, we are also seeing weakness in the education and healthcare services sector, which has been the key contributor to job growth this year. From June to July active job postings in this industry fell 0.7% and are now down 7.3% compared to the same period last year. All in, this does not bode well for job growth going forward.

Geographically, labor demand has been cooling across much of the United States. From June to July, 34 of 51 states (including DC) saw a decrease in the number of active job openings, with Hawaii, Vermont, Oregon, and Rhode Island all seeing declines of greater than 3%. Compared to a year ago, 47 of 51 states experienced a decrease in job openings, with only Indiana, Georgia, South Carolina, and Delaware in positive territory.

Taken as a whole, RPLS data paints a clear picture: the US labor market is cooling fast. Fewer and fewer sectors of the economy are actively adding jobs, and some of the industries most responsible for job gains this year—namely Healthcare & Education—are now seeing declines in job openings. There is plenty to be concerned about with the current state of the Labor Market, and policymakers at the Federal Reserve are likely to weigh risks to the labor market component of their dual mandate more heavily as they assess how fast and how much to cut interest rates in the coming months.