Immigration Still Powers US Job Growth

How government surveys are miscounting immigrants

The Current Population Survey (CPS) reports 2.2 million fewer immigrants in 2025—a hard-to-believe decline. The growing politicization of immigration, from ICE raids to rhetoric that stigmatizes immigrant communities, has contributed to a sharp drop in survey participation among immigrants, amid recently falling response rates. Many immigrants no longer feel safe sharing information with the government, leaving official data volatile and highly misleading.

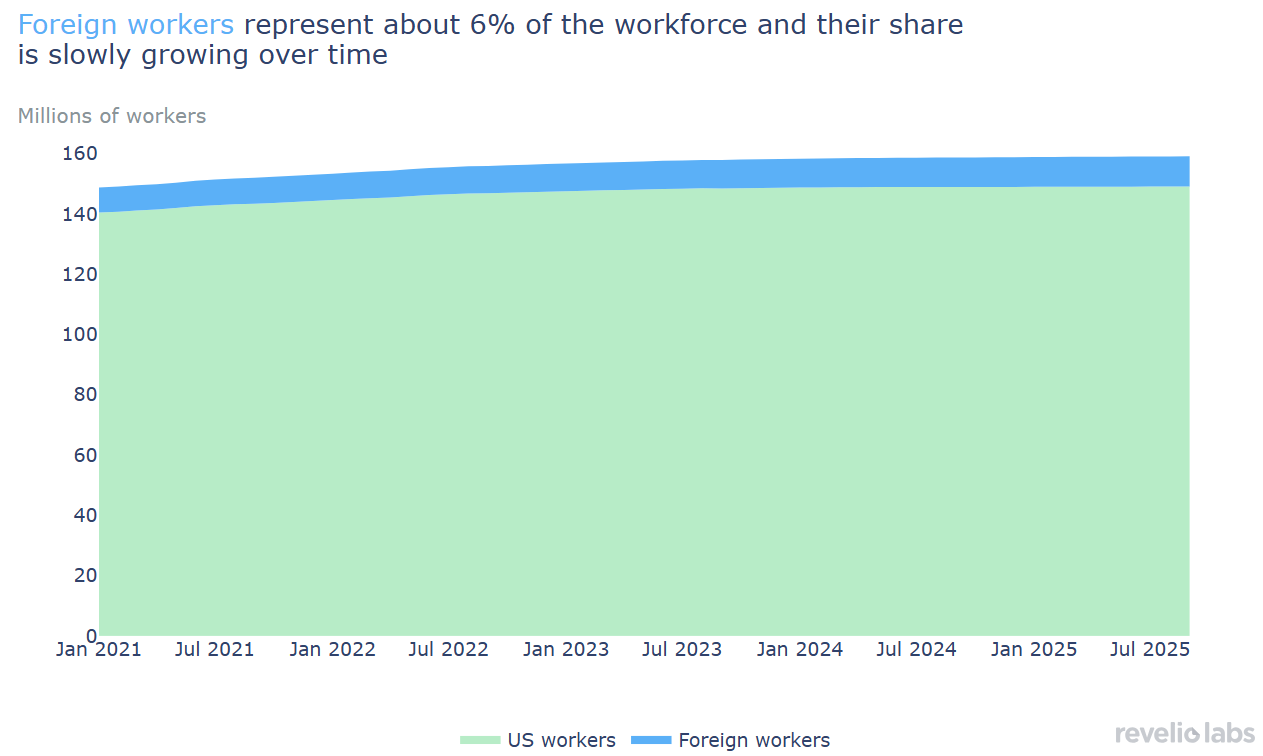

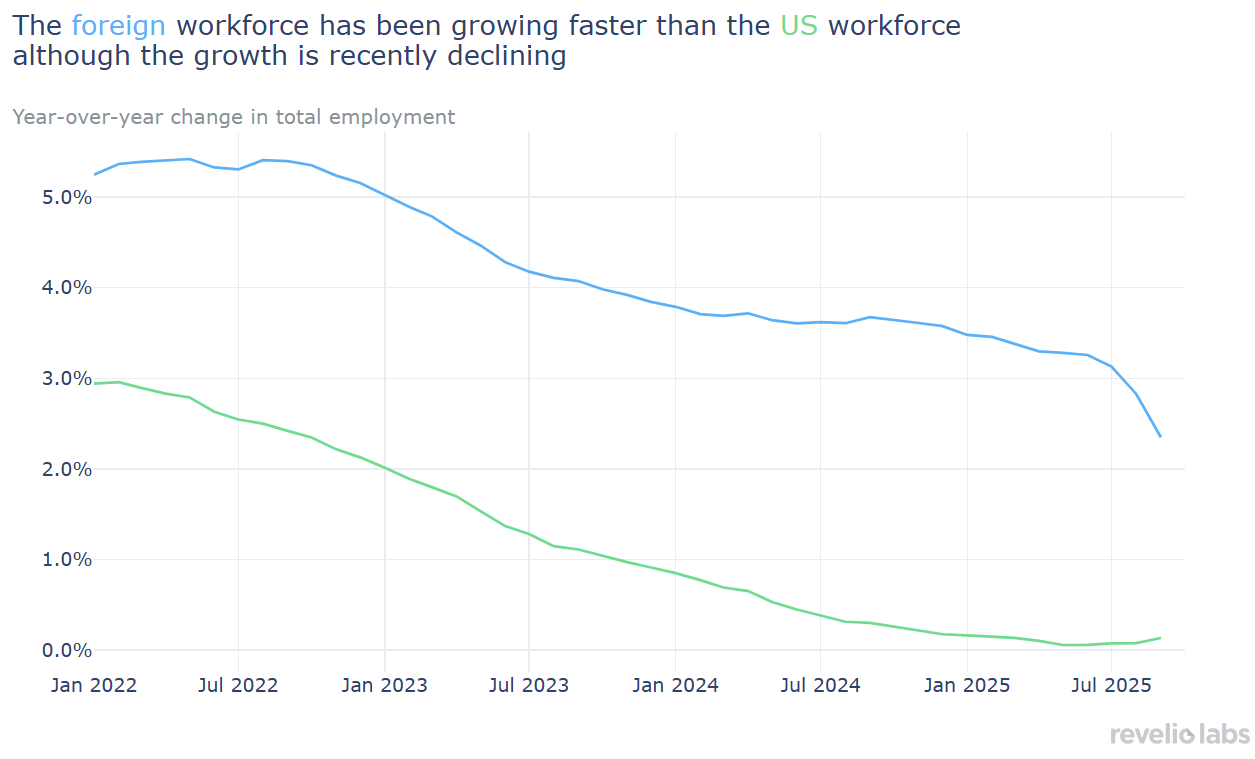

This is where alternative data for the labor market can add real value. Revelio Public Labor Statistics (RPLS) is based on information from online professional profiles far less vulnerable to survey bias. RPLS shows that foreign workers make up about 6% of the US workforce. It also shows a steady year-over-year growth in the foreign-born workforce ranging from 5% in 2022 to 2.3% in September 2025, compared to 1.2% for US workers. Immigrants have contributed about 16% of all net job gains since 2021, helping sustain total employment growth.

Based on RPLS estimates of foreign workers’ population, we estimate a monthly breakeven rate of monthly jobs growth, the monthly rate of job growth needed to keep the employment-to-population ratio steady, to be between 32,000 and 97,000 jobs.

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

How can the US lose more than two million immigrants in six months? This question was raised by Jed Kolko’s recent article at the Peterson Institute. The Current Population Survey (CPS) reported that between January and July 2025, the foreign-born population fell by 2.2 million people. This is a very unrealistic decline, likely caused by the steady decline in CPS response rates, particularly among immigrant households. Unsurprisingly, immigrants are increasingly more wary of supplying information to the government through surveys as the White House continues to target immigrants in different cities in the US. Yet, immigration statistics are very important in evaluating the labor market and interpreting the developments in it. As the only variable in determining population growth (next to birth and death rates) that is subject to any short-term variation (barring pandemics), the size of the foreign workforce is important in determining the “breakeven” rate: the monthly rate of job growth needed to keep the employment-to-population ratio steady. If immigration slows, fewer new jobs are needed; if it continues, the target for healthy growth rises.

As data on immigration through government surveys are becoming less reliable, alternative data prove their usefulness. Revelio Labs’ granular job history and education history data allow us to address this. While we do not directly observe people’s place of birth in online professional profiles to be able to identify “foreign-born” workers, the level of granularity in the data allows us to predict whether a worker is foreign or not. That is why Revelio Labs will start to release employment data broken down by nativity status as part of Revelio Public Labor Statistics (RPLS). Tracking employment directly from professional profiles offers a consistent view of workforce composition over time. We will not observe immigrant workers vanishing overnight and therefore will be able to measure changes that reflect real employment trends.

To predict whether a worker is foreign or domestic, we use information on the location of their first education entry, the languages listed on their profiles, and the location of their first job. We start with education information: Workers whose profiles include data on their high school education or undergraduate degree outside the US are considered foreign. For workers without education information, we check information about their language proficiency. If they mention languages other than English where their proficiency is native or bilingual, we consider them foreign workers. For the remaining workers, we check the location of their first job and identify them as foreign if their first job is outside the US. By classifying workers into foreign and domestic based on signals from their professional profiles, we construct a stable picture of employment and show how the immigrant workforce is evolving. It is important to note that we are not measuring employment by “foreign-born” and “US-born” workers. Rather, we are measuring employment of foreign workers who moved to the US as adults to pursue higher education or career opportunities.

As of September 2025, the foreign workforce in the US was 10 million workers, accounting for about 6.3% of the total US workforce after a steady increase from 5.6% in January 2021. This increase reflects a strong participation from immigrants not just during the great resignation, but also in the highly competitive market that followed.

While recent releases of the CPS indicate a sharp drop in immigration in 2025, employment data tells a different story. The number of foreign workers has continued to grow since 2021, with an average y-o-y growth rate of 4%, outpacing the average y-o-y growth of 1.2% among US workers. The gap in growth rates suggests that immigrants remain a key driver of employment growth. However, the y-o-y growth rate of the foreign workforce has slowed notably since the beginning of 2025 alongside changes in immigration policy since the Trump administration took office.

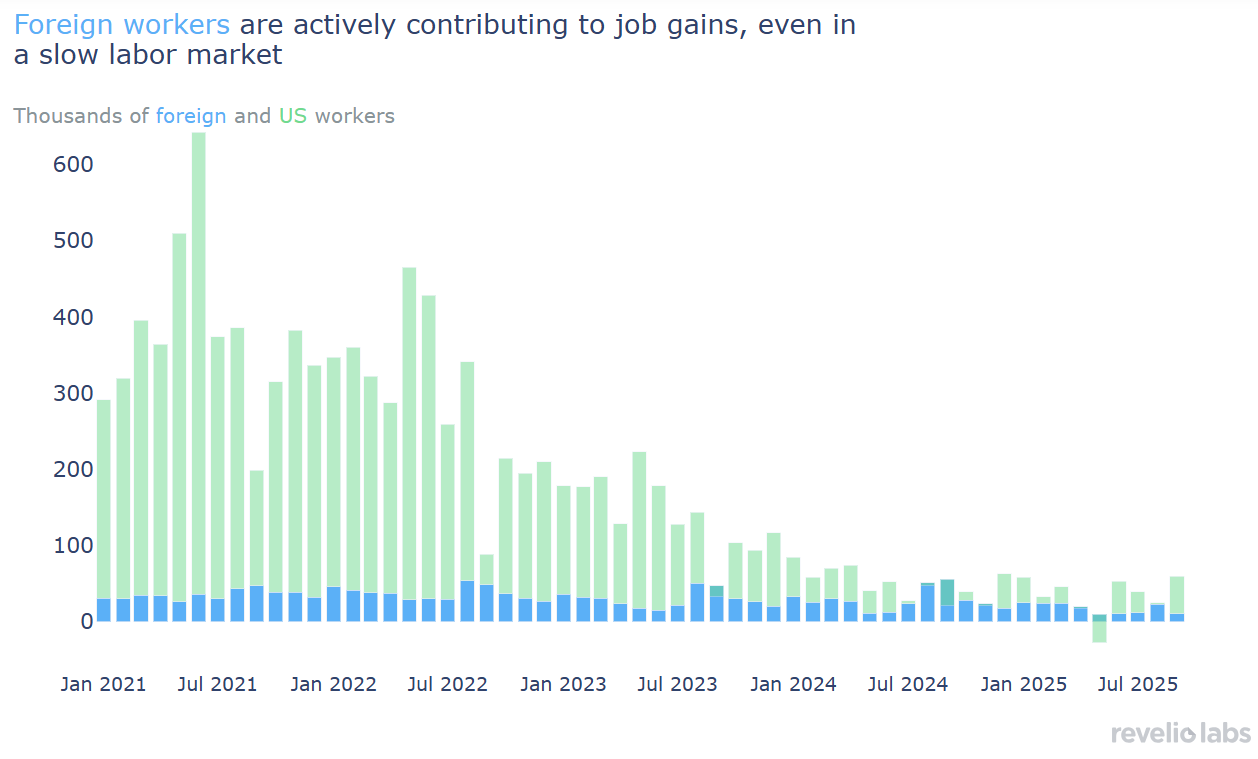

Monthly employment changes estimated by RPLS show that while overall job creation has slowed since the post-pandemic boom in 2022, foreign-born employment has consistently added to total gains. Even during months when hiring among US workers stalled or turned negative, foreign employment remained positive. With a relatively low unemployment rate, the immigrant workforce provides a buffer amid the slowdown.

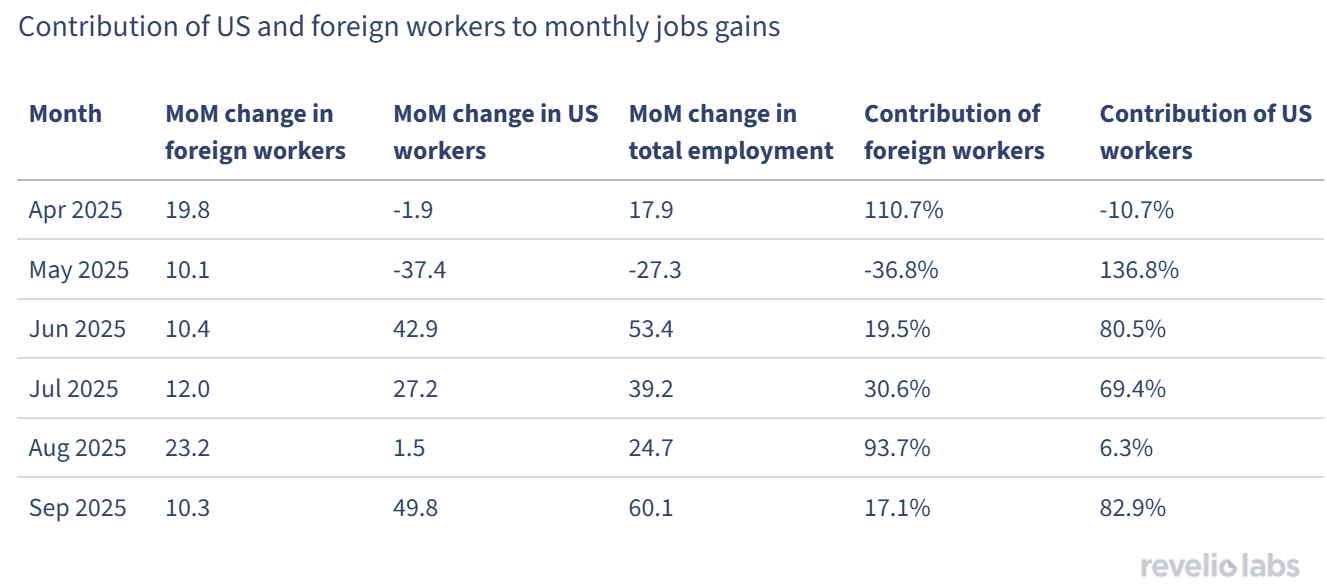

To shed more light on the role of the foreign workforce in sustaining employment growth, we look at the contribution of the foreign workforce to monthly changes in employment in the past six months. The contribution of each group is calculated as the monthly change in employment for each group divided by the monthly change in total employment, so that the contribution of foreign and US workers to total employment growth adds up to 100%. However, the contribution by each group can exceed 100%, which means that the other group had a negative contribution to employment growth. In the past six months, the contribution of the foreign workforce to employment gains ranged between -37% and 111%. This is significantly higher than the average contribution during the post pandemic boom. Over the period 2021 - 2025, foreign workers have contributed roughly 16% of net job gains.

Kolko estimates that under sharply negative immigration, the breakeven rate would fall to -180,000 jobs a month; under strong inflows, it would hover near +88,000. Using RPLS employment data, we estimate that the foreign worker population is still growing by about 2.3% year-over-year. We consider two scenarios: 1) a scenario that considers the entire adult foreign-born population represents roughly 19 percent of the US labor force, and 2) a scenario where we consider the share of foreign workers from the US workforce, which we estimate at 6.3% in September of 2025. We estimate a monthly breakeven rate to range between 32,000 jobs to 97,000 jobs, closely aligned with Kolko’s medium and high-immigration cases.

Results from the employment data confirm that immigration is still powering the US labor supply. But the role of the foreign workforce is not coming at the expense of US workers. Over the past four years, both the foreign and US workforce have grown consistently, with immigrants filling gaps rather than displacing domestic labor. Immigration remains a stabilizing force, and immigrants will not disappear overnight, even if survey data is showing it. That is why alternative employment data with high granularity can help convey a more realistic picture of the dynamics of the US labor market.