As Global Labor Demand Slows, National Labor Markets Tell Different Stories

Mexico, Brazil and Japan stand out amid worldwide hiring hangover

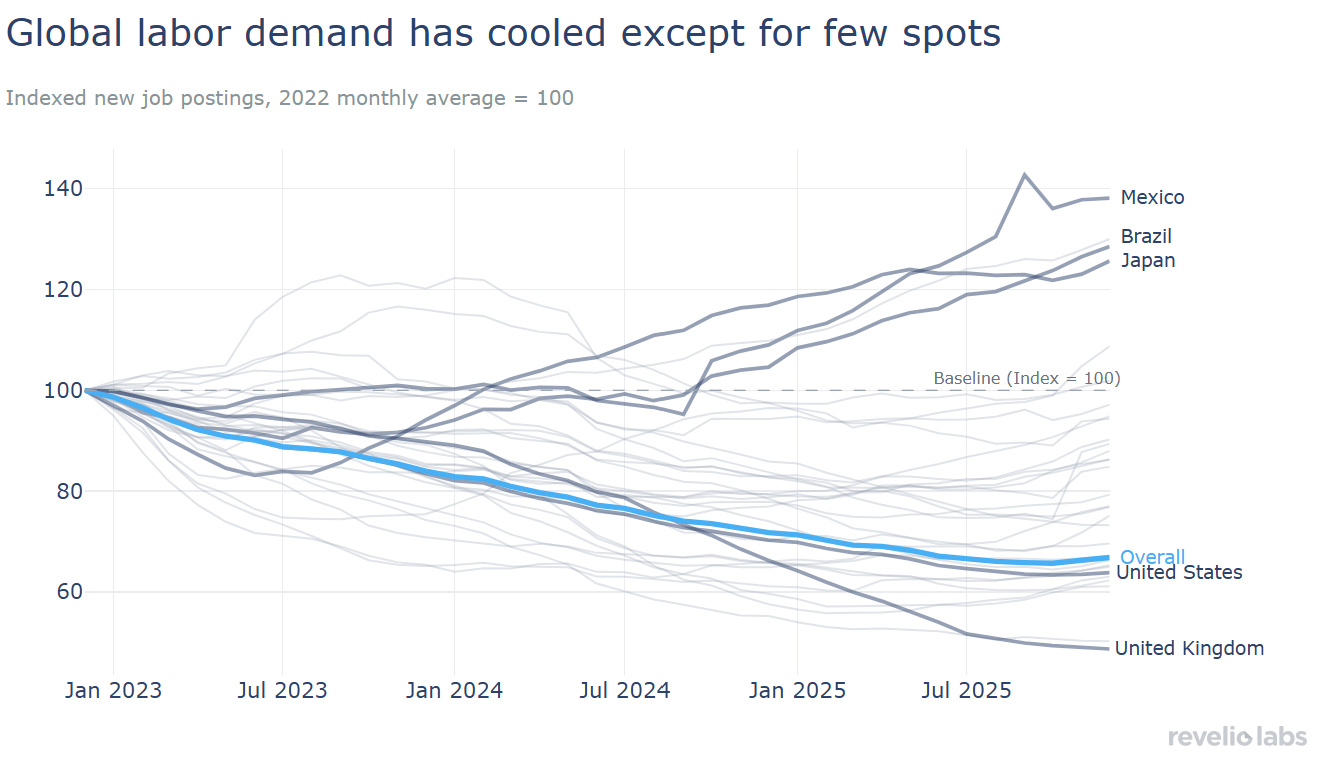

Labor demand is weakening globally, but countries diverge: Several emerging and mid-income economies continue to expand job postings in 2025, while most of North America and Europe have seen the sharpest pullbacks in job demand.

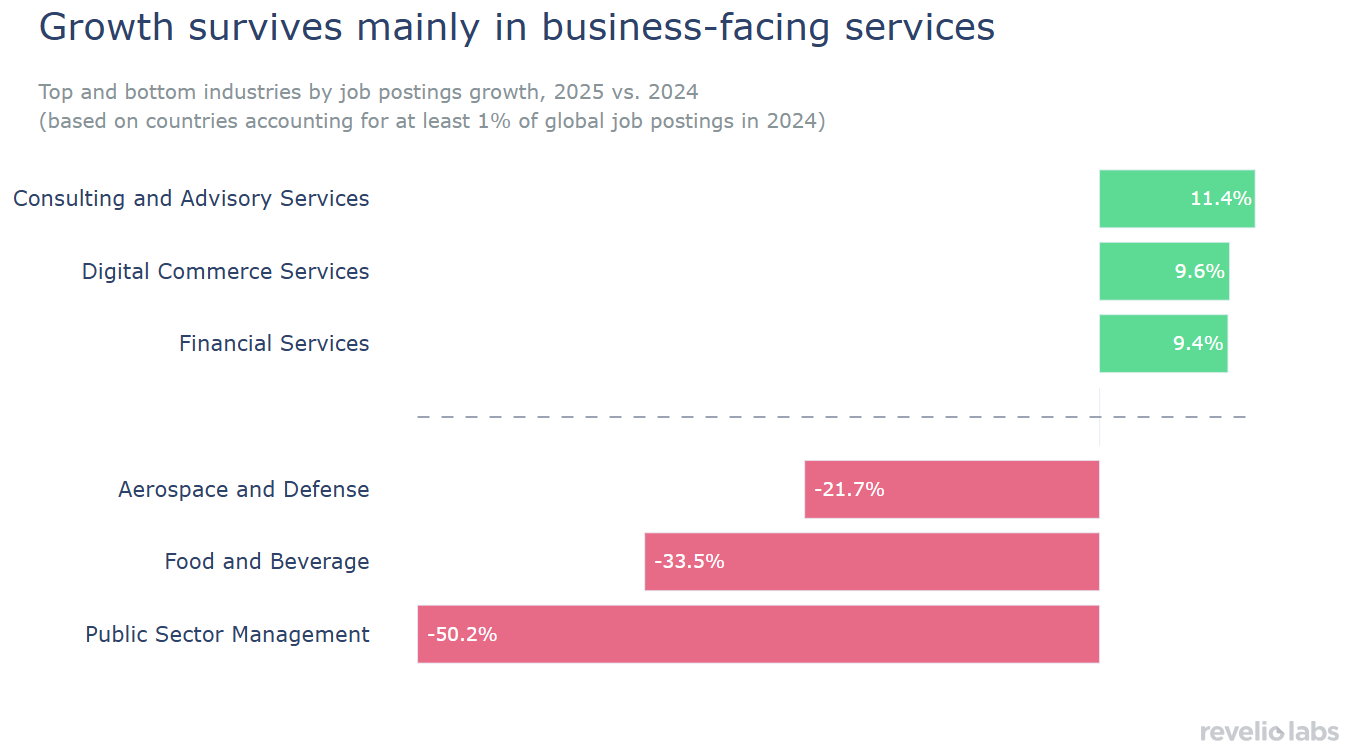

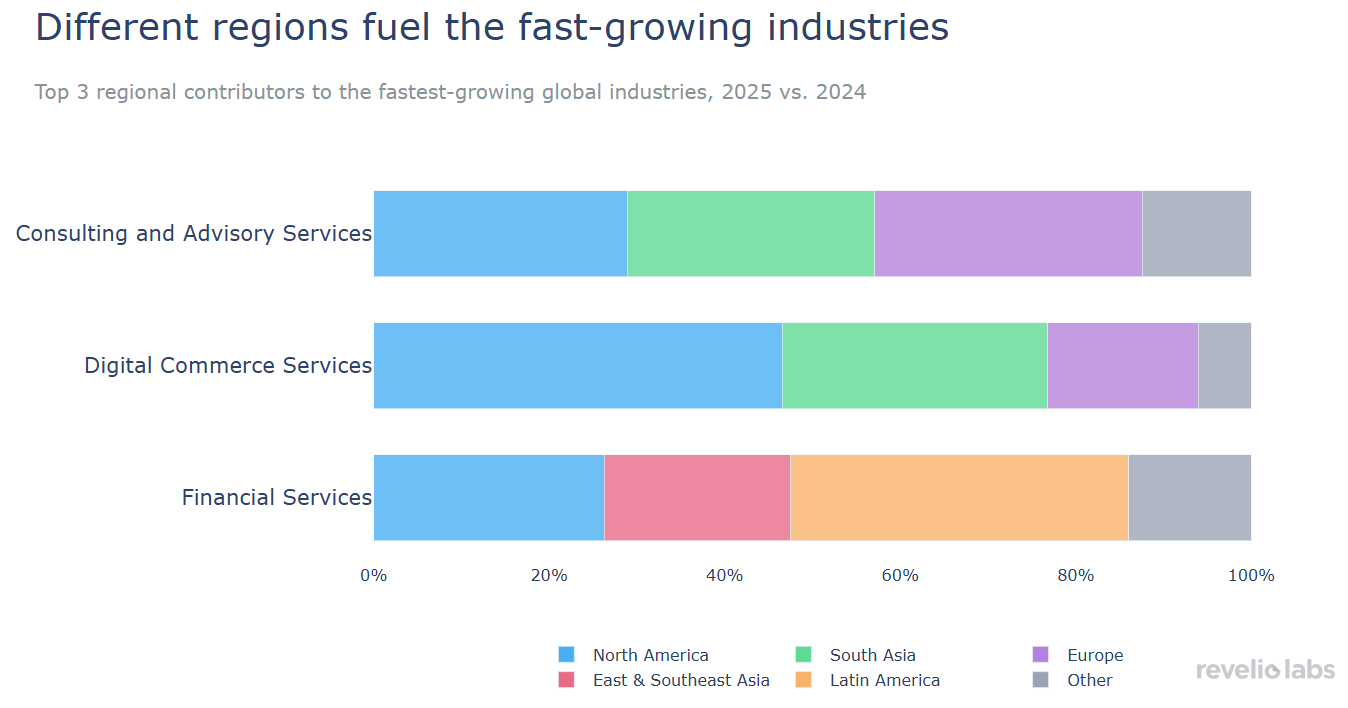

Demand is concentrated in a small set of industries, creating pockets of growth. Consulting, digital commerce, and financial services stand out as top growing industries in labor demand globally, although growth is powered by different regional engines.

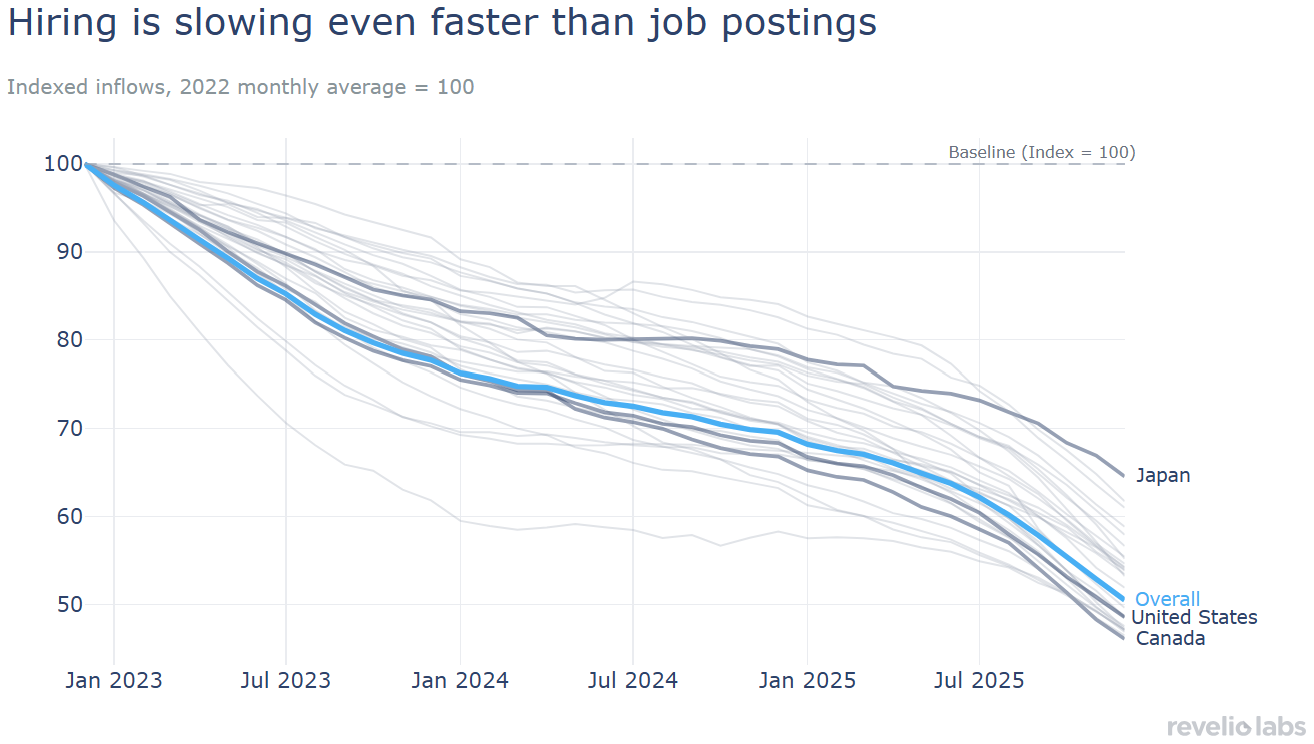

Hiring is slowing faster than postings, signaling employer caution. Firms are pulling back on actual hires even where postings remain elevated, suggesting rising selectivity driven by uncertainty.

After the post-pandemic hiring surge faded, 2024 and 2025 brought a broad-based slowdown in labor demand across most major economies. Yet beneath that global deceleration, labor demand has not contracted uniformly. In this week’s newsletter, we track how labor demand has evolved since 2022 by examining growth in job postings across regions, identifying the countries experiencing the largest swings in labor demand in 2025, and highlighting the industries that drive growth.

Revelio Labs’ global job postings data show that while aggregate labor demand has decelerated globally since 2022, trends diverge significantly across different economies. While North America and much of Europe have seen sustained declines in job postings, Mexico, Brazil, and Japan stand out as markets that rebounded from an initial decline in job postings following the post-pandemic hiring surge. Mexico’s outsized rebound reflects nearshoring and supply-chain reconfiguration tied to U.S. demand. Japan’s resilience reflects long-standing labor shortages driven by demographic decline, while Brazil’s growth aligns with expanding domestic services, tech-enabled outsourcing, and logistics demand linked to trade and infrastructure. These divergences mirror broader macro conditions. Tight monetary policy, softer consumer demand, AI productivity-boost anticipation, and tech-sector retrenchment continue to weigh on advanced economies.

While overall labor demand has cooled, some industries continue to grow. Consulting and advisory services, digital commerce services, and financial services are the top large industries with positive global year-over-year gains in 2025. In contrast, demand has contracted sharply in public sector management, food and beverage, and aerospace and defense. These declines reflect fiscal tightening, normalization after pandemic-era hiring, and delayed capital expenditure. The result is a labor market where growth is narrowly concentrated in the services sector that help firms adapt rather than expand.

Even within growing industries, the sources of growth differ markedly by region. Consulting demand comes heavily from Europe and South Asia, digital commerce growth is led by North American and emerging markets firms, and financial services expansion is disproportionately supported by Latin American and East & Southeast Asian companies. This fragmentation reflects regional specialization. Financial deepening, digital adoption, and regulatory change are advancing at different speeds across countries, determining where firms invest and hire.

Has the increase in labor demand in emerging market economies translated into hiring? When examining workers’ inflow into new positions, we find that inflows show an even sharper contraction than job postings across the board. This gap suggests that firms are constantly creating new listings while delaying actual hiring, likely due to higher uncertainty around demand, costs, and interest rates. In effect, postings increasingly reflect optionality rather than intent. The U.S. again underperforms, with hiring falling faster than the global average. Canada and parts of Europe show similar patterns, while Japan’s hiring decline is more muted. The widening wedge between postings and hires underscores a shift toward cautious, incremental hiring rather than aggressive workforce expansion.

The global hiring slowdown is real, but labor markets are not defined by a single global story. Labor demand is increasingly shaped by demographics, geography, and the ability of firms to reorganize work around structural constraints. While overall postings are declining, growth persists in specific countries and industries. Business-facing services remain resilient, but their momentum depends on very different regional engines. In an interconnected global economy, labor demand no longer adjusts country by country; policy shifts, tariffs, and investment decisions in one region increasingly ripple through labor markets worldwide. Today’s regional dynamics will determine how labor markets keep evolving in 2026.