How Can You Know If A Merger Is A Good Idea?

Look at levels of similarity between companies' workforce compositions

Understanding the long term effects of two merging companies is complex. There are the melding of cultures, product lines, egos, workforce planning, and, not to mention, workforces themselves. With all these complex variables, it’s no wonder so many mergers fail, and even more miraculous when some wildly succeed.

So what makes a good or bad merger, and how can we predict them better?

By studying how workforces complement each other -- both by occupation and geographically -- we see a strong correlation in mergers between diverse companies and higher stock price.

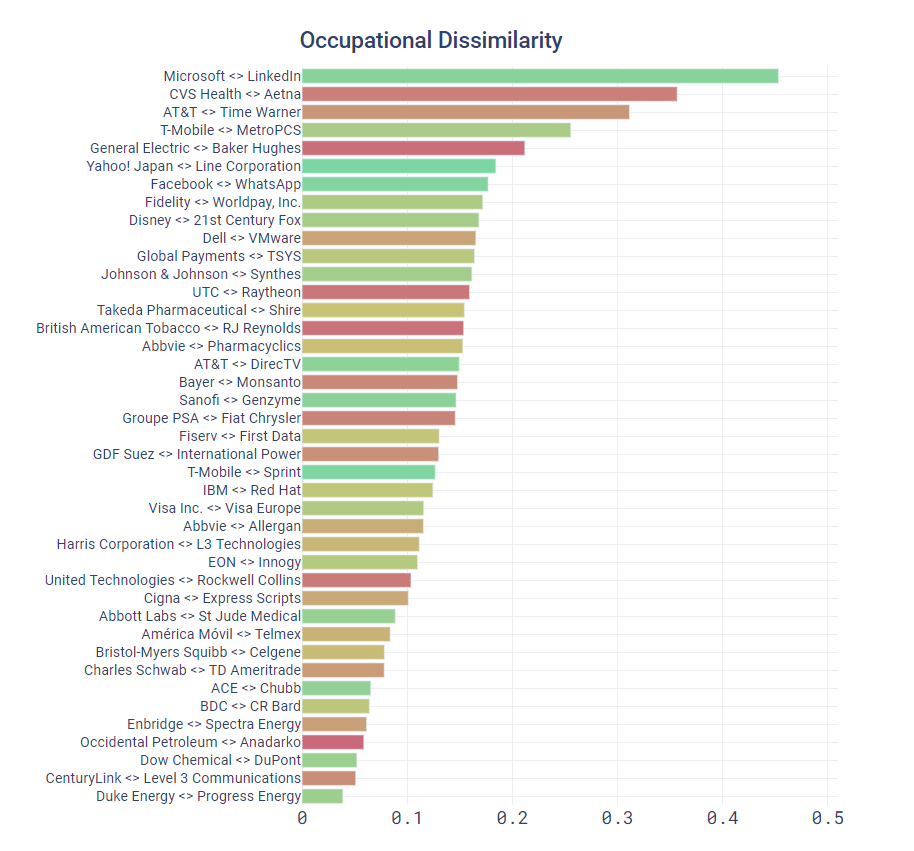

Below are a list of top mergers with their occupational differences. The color of the bar represents the excess return of the parent company beyond the average stock market two years later:

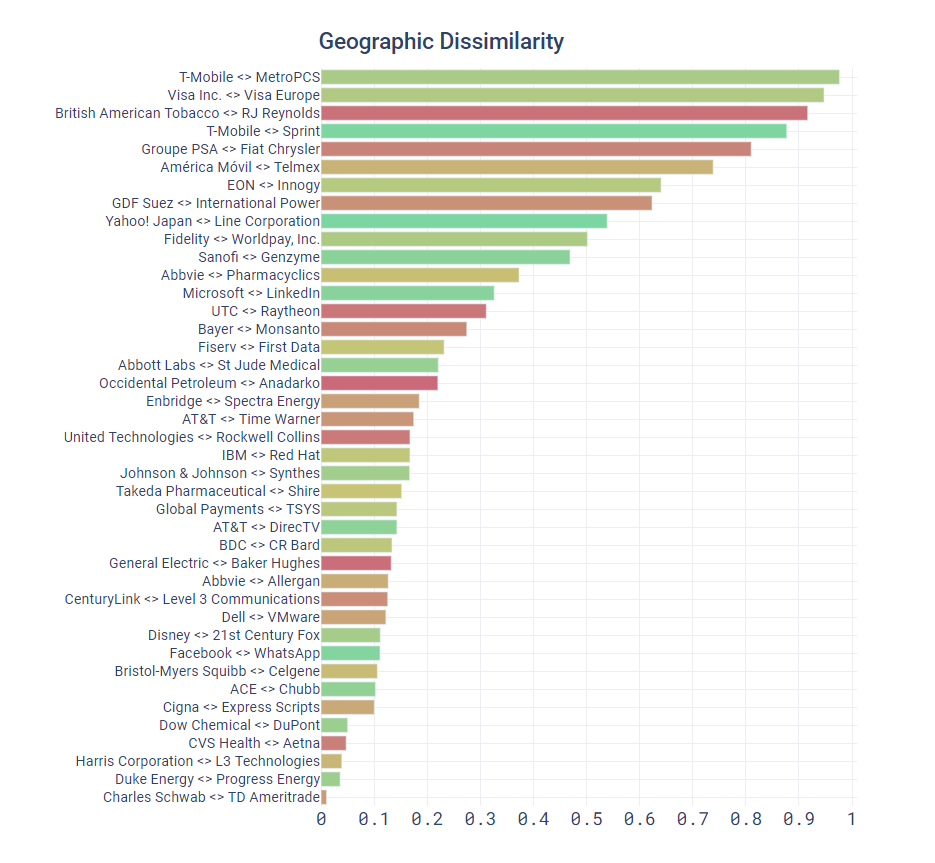

Below are a list of top mergers with their geographic differences:

Sign up for our newsletter

Our weekly data driven newsletter provides in-depth analysis of workforce trends and news, delivered straight to your inbox!

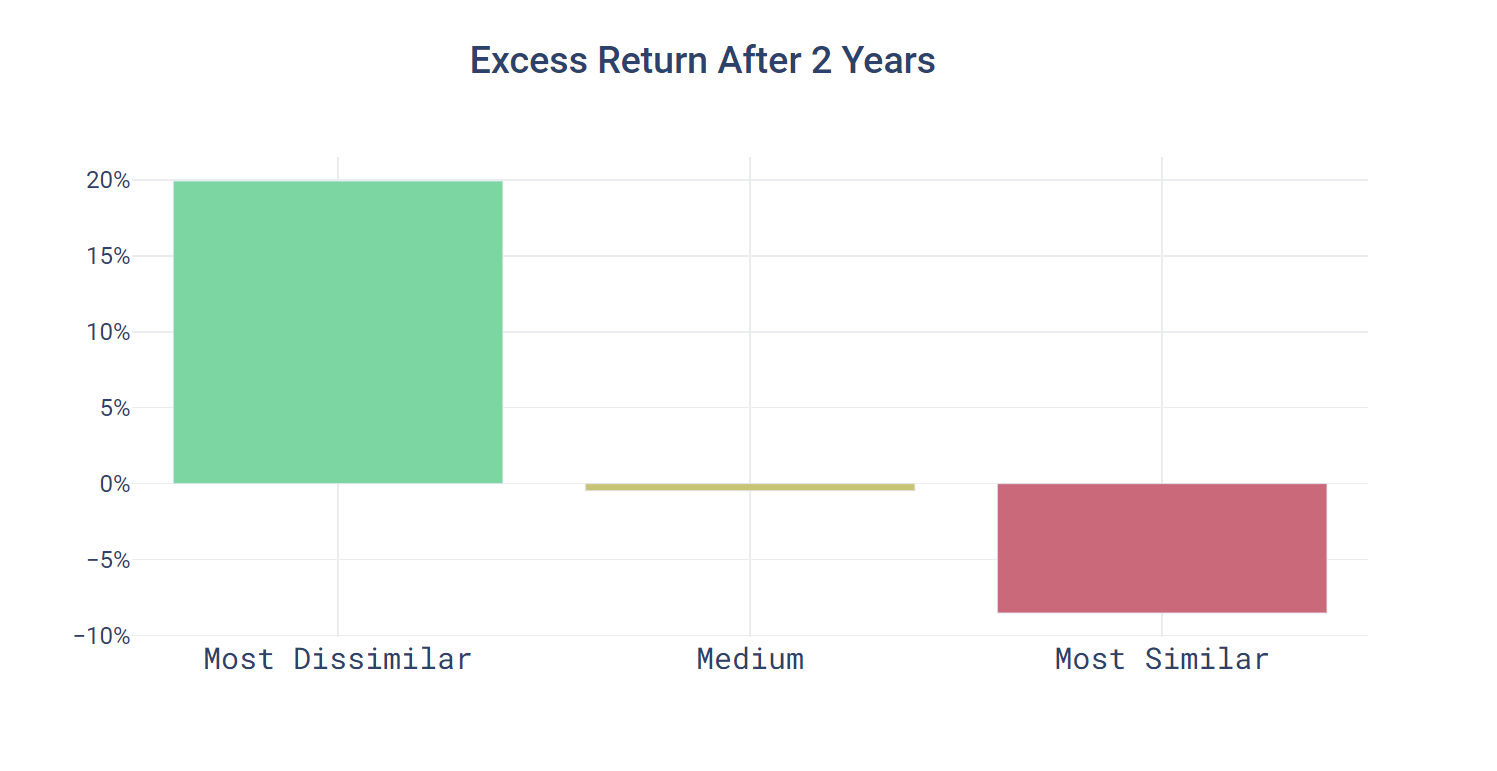

After grouping companies by their average dissimilarity, from both occupations and geography, we find strikingly divergent stock performance two years after the mergers:

Takeaways:

- It stands to reason that pairs of companies with complementary strengths and focus areas will result in the most successful mergers. We see evidence of this from the 41 largest mergers since 2010.

- Company dissimilarity can be measured either by occupational differences or geographic differences. They are both positive predictors of merger success, geographic differences being the more important of the two.

- While occupational and geographic dissimilarity are both indicators of successful mergers, they’re actually uncorrelated. Revelio Labs finds that companies are both occupationally and geographically different, the chances of a successful merger increase significantly, assuming effective workforce planning .

If you have any ideas of other metrics to track or would like to hear more about Revelio Labs, please feel free to reach out.