Has Fintech Made Financial Advisors Obsolete?

Robinhood now stealing business from financial advisors and giving it to engineers

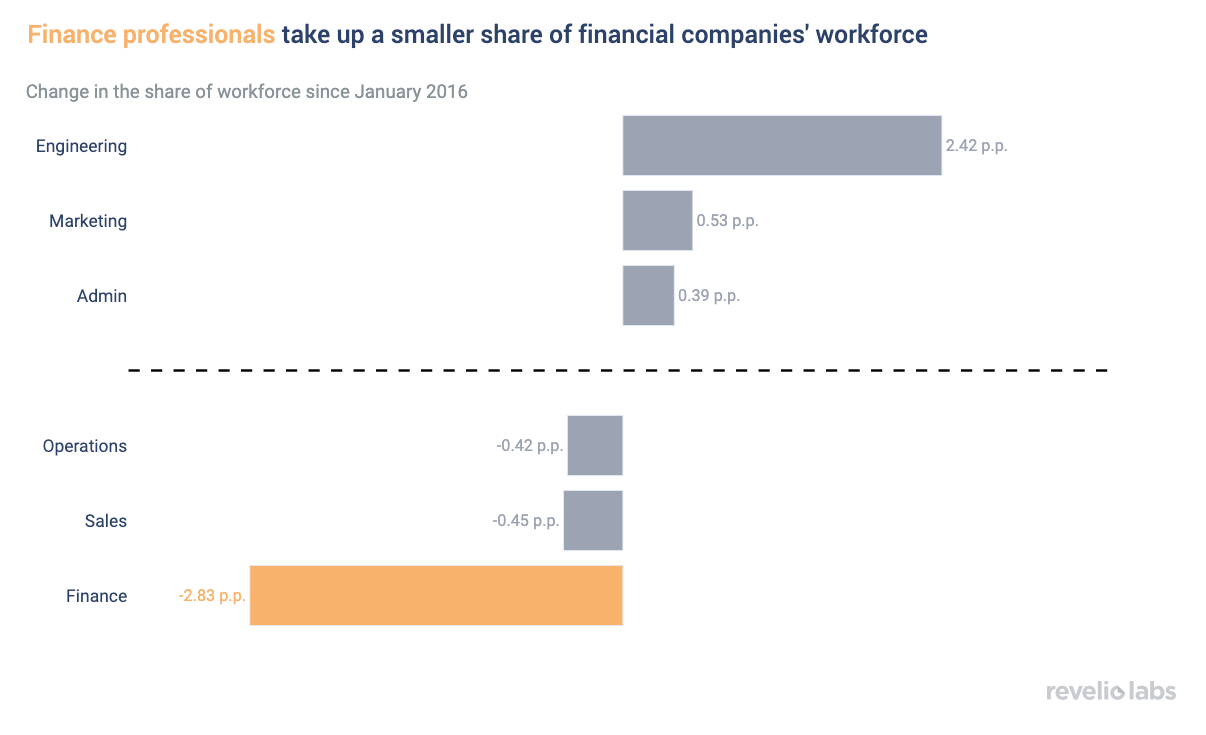

With the rise of digital financial services tools, the share of engineers in the workforce of financial institutions has increased at the expense of finance professionals.

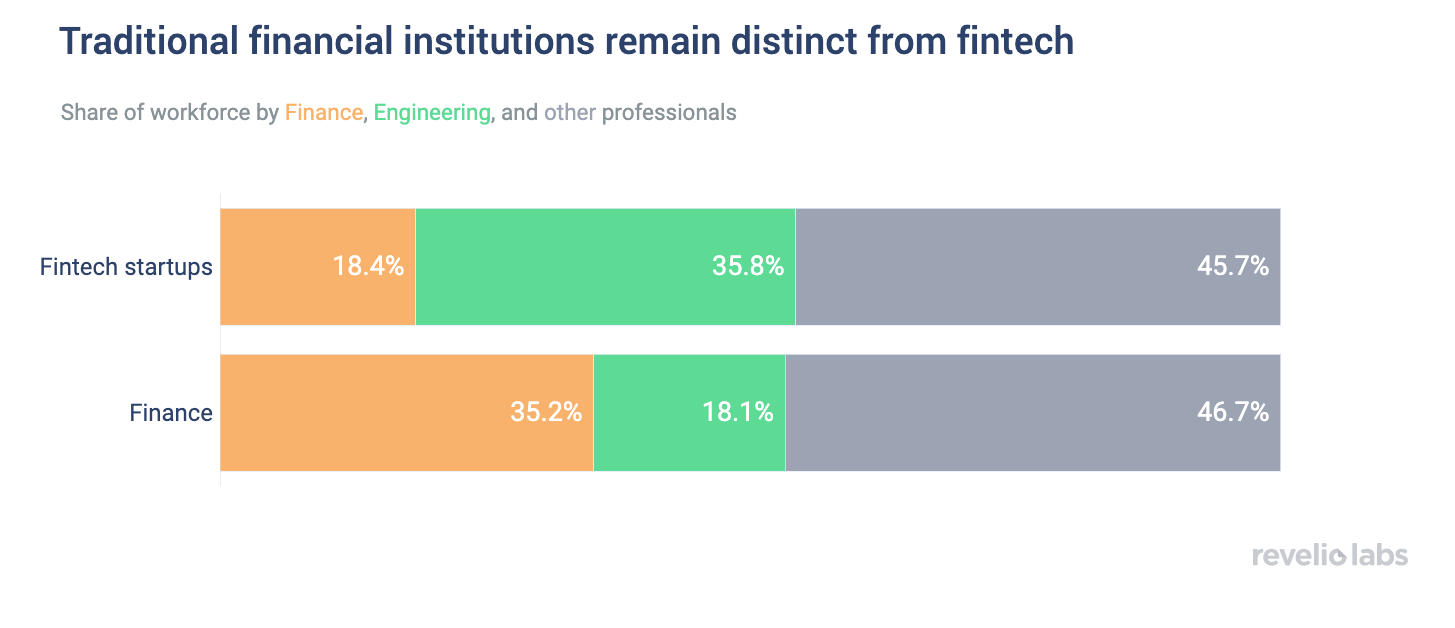

Despite the increase in the share of engineers, finance professionals still make up twice the workforce compared to engineers. Even though digital tools have replaced finance professional for retail services, they remain crucial for managing large and complex portfolios.

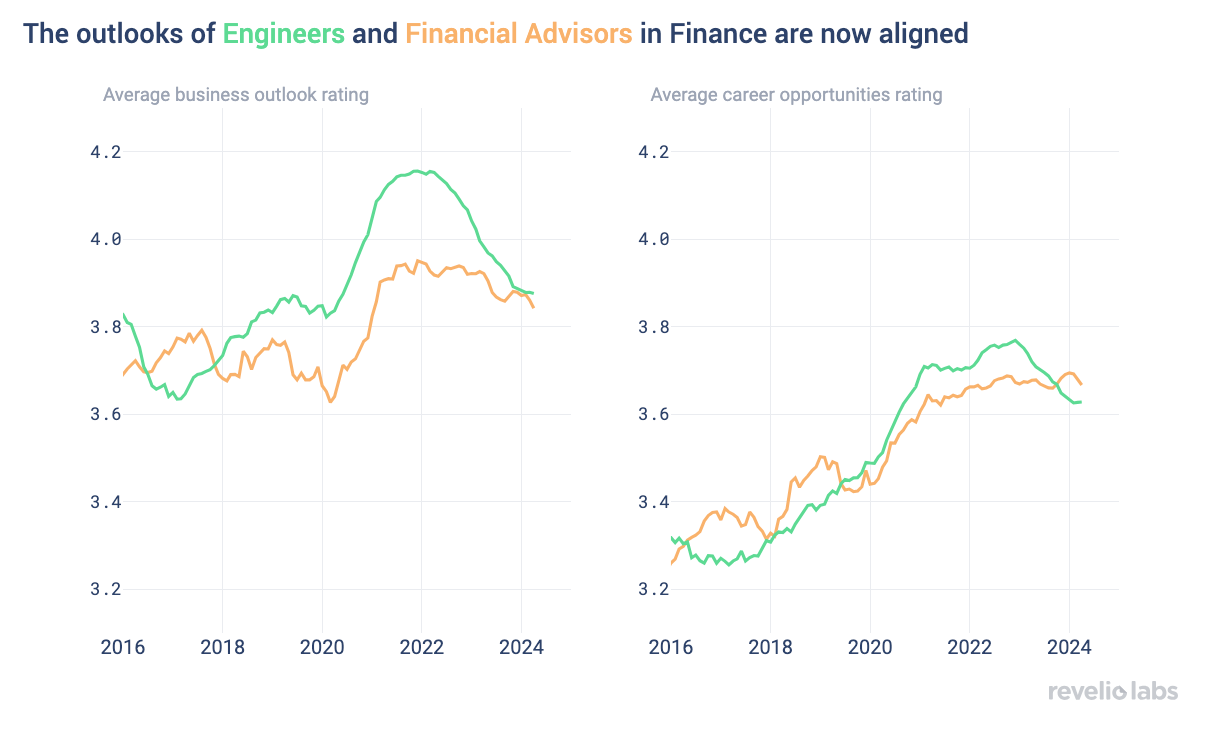

Employee sentiment regarding business outlook and career opportunities has improved over time for both engineers and financial advisors at financial service institutions. However, engineers consistently report a more positive view on both business outlook and career opportunities compared to financial advisors.

The financial services industry is undergoing a digital revolution, with traditional institutions like banks and investment firms rapidly incorporating customized digital tools that enable clients to self-service. Now, clients can manage their finances from anywhere with mobile banking apps and robo-advisors for automated investment management. These tools are fundamentally reshaping the customer experience by offering convenience, accessibility, and a high degree of personalization. As financial institutions shift their business model to mimic fintech, how does this shift affect the composition of their workforce? Are financial advisors becoming obsolete?

The rise of customized digital tools in traditional financial institutions necessitates a growing pool of engineers to develop and maintain these technologies. Since 2016, the share of engineers in the workforce of financial institutions has increased by 2.42 percentage points. These changes have also impacted the role of financial advisors and other finance professionals. As these digital tools enable clients to self-service, the demand for such professionals in handling smaller retail accounts has decreased by 2.83 percentage points, leading to a significant shift in the workforce composition.

While the focus on digital solutions in traditional financial services institutions has led to a change in the workforce, these institutions are far from becoming fintech companies. In fintech companies, the share of engineers is twice that of finance professionals. In contrast, in traditional financial services, there are half as many engineers as finance professionals. This indicates that even though financial institutions are moving towards using customized digital services for retail clients, the role of the financial advisor remains crucial for managing complex portfolios. We have previously shown that AI and engineering roles in financial institutions require a combination of AI technical skills and finance domain knowledge. This talent can be hard to find in the market and is often up-skilled internally from more classical financial analysts.

The financial services industry's embrace of technology is transforming roles, prompting the question: How do employees perceive these changes? We examine the sentiment of engineers and financial advisors in financial institutions, focusing on their views on business outlook and career opportunities. Interestingly, while sentiment regarding both aspects has improved over time, engineers have consistently reported a more positive view on both business outlook and career opportunities compared to financial advisors. However, most recently, the sentiment around career opportunities for engineers dipped below that of financial advisors, and business outlook ratings have converged. Many factors can explain the recent decline in engineers’ sentiment regarding career opportunities, including the fear of job automation as programmers and software engineers face threats from AI.

As clients continue to embrace the digital tools offered by financial institutions, the workforce in financial services institutions will continue to adapt. Despite the growing need for engineers to focus on technology, financial advisors remain essential. Both roles will have to adjust: Engineers will need to acquire more knowledge in the finance domain, and financial advisors will need to shift their skillset away from retail finance.