Comp vs Job Security: Experienced employees value stability over pay

A closer look at the fall in workforce sentiment

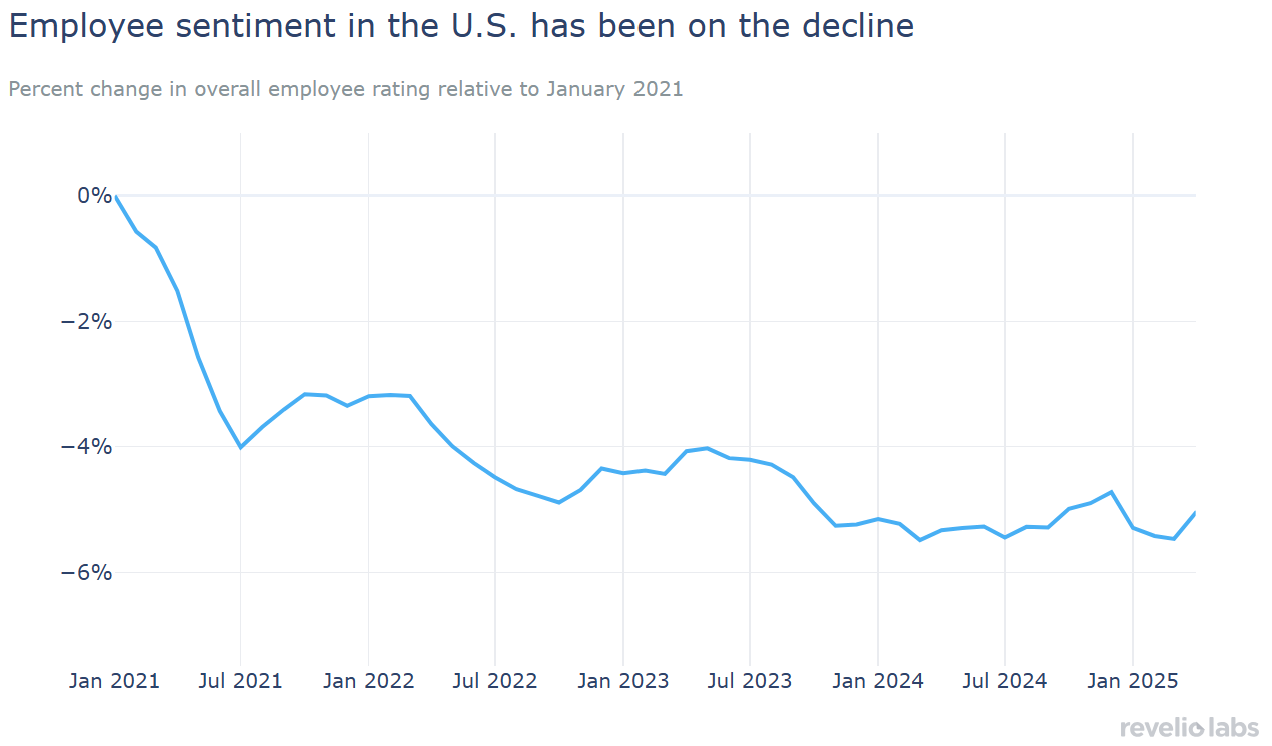

Since early 2021, U.S. workers’ ratings of their employers have dropped notably, reflecting a persistent erosion in worker morale.

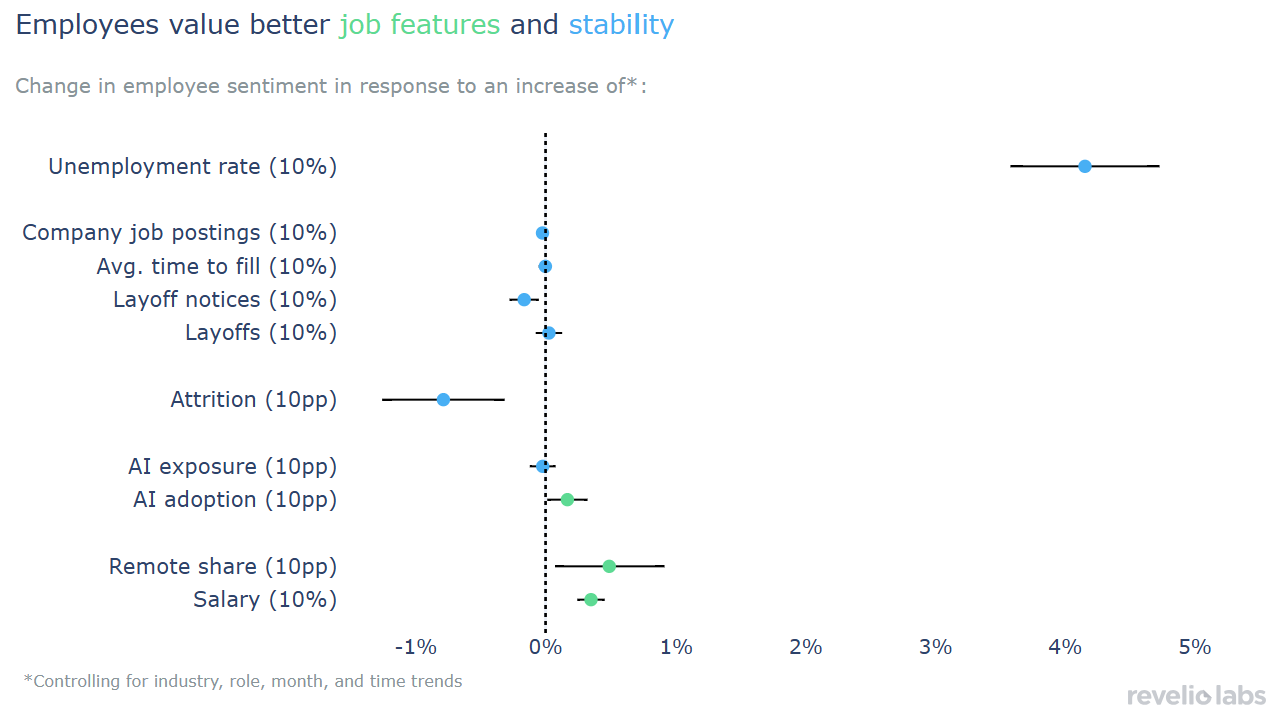

While salary and remote work flexibility are the most important positive contributors to employee sentiment, attrition and layoff notices are the biggest drags. Layoffs and attrition do not just affect those who exit but also trigger declines in morale among those who stay. In contrast, increases in salary, remote work options, and even modest AI adoption provide small but consistent boosts in sentiment.

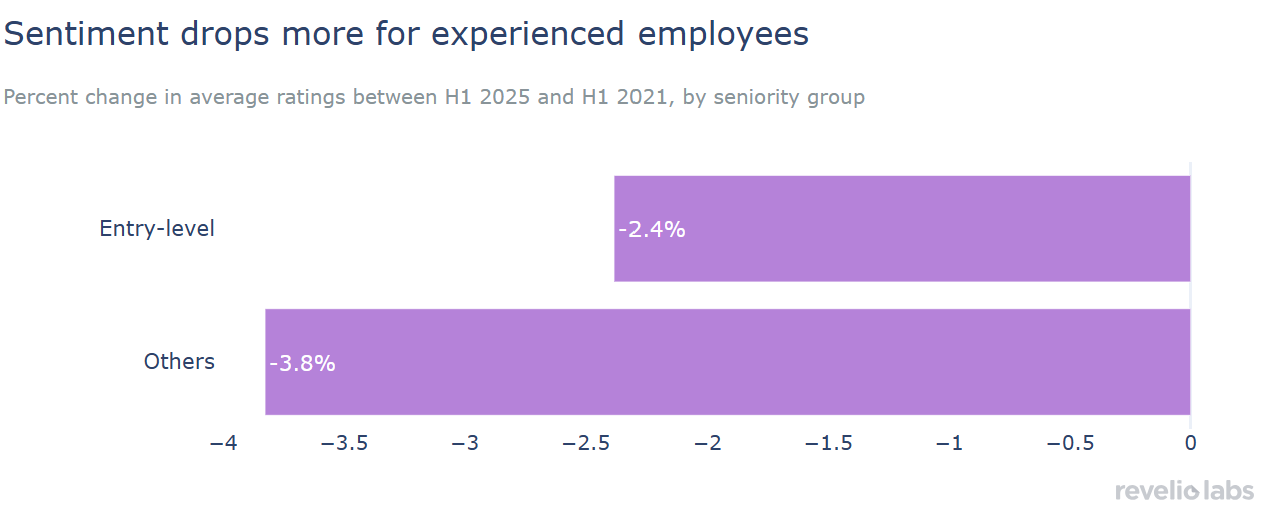

The decline in employee sentiment is notably sharper among more senior employees than among entry-level staff. Entry-level employees are largely affected by job features such as higher pay, whereas more experienced workers are more attuned to signs of instability such as rising attrition and layoffs, suggesting that job security matters more as careers progress.

As companies grapple with the forces of automation, political, and economic uncertainty, employees are recalibrating what they value most at work. In a previous newsletter, we showed that employee sentiment moves in lockstep with broader macroeconomic changes including consumer sentiment and unemployment. But much has changed in the past year, prompting us to revisit the analysis with a focus on what is happening inside the workplace. In this week’s newsletter, we ask what company-level factors best explain changes in how employees rate their workplaces. Which signals—layoffs, attrition, salary, or remote flexibility—matter most to employees, and how do those preferences differ by seniority?

Since the Great Resignation, employee sentiment in the U.S. has been in free fall. Relative to January 2021, overall sentiment has dropped by around 6%, though the pace of decline has now slowed compared to the first half of 2021. The continued erosion in employee sentiment over the past three years suggests a deeper and more persistent shift in how workers perceive their jobs. Amid layoffs, workplace restructuring, and macroeconomic uncertainty, employees today are less optimistic than at any point in the last four years.

Employee sentiment is shaped by both macroeconomic conditions and internal company dynamics. Perhaps most surprisingly, the single largest positive shift in sentiment comes from rising unemployment: a 10% increase in the unemployment rate is associated with a 4% improvement in how employees rate their workplaces. In looser labor markets, job stability may become more visible and valued, making workers more appreciative of their current roles.

Within companies, we also see strong sentiment responses to specific workplace signals. We find that factors like attrition, remote work, and layoffs play an important role in employees’ perception of their workplace. A 10 percentage point increase in current company’s attrition is associated with roughly 1% decline in sentiment. As colleagues depart, those who remain may lose confidence in leadership or anticipate a heavier workload. The next most salient signal are layoff notices: The moment employees are alerted to impending cuts leads to a 0.2% drop in sentiment. These early signals can have long-lasting effects on morale, even beyond the actual job losses. Some aspects of sentiment take a long time to recover, while others such as trust in leadership or company culture may never fully bounce back.

But not everything impacts sentiment negatively. Salary increases and remote work flexibility each raise sentiment by about 0.05%, while AI adoption contributes a modest but significant 0.02% gain, giving companies tangible levers to improve their employee’s morale.

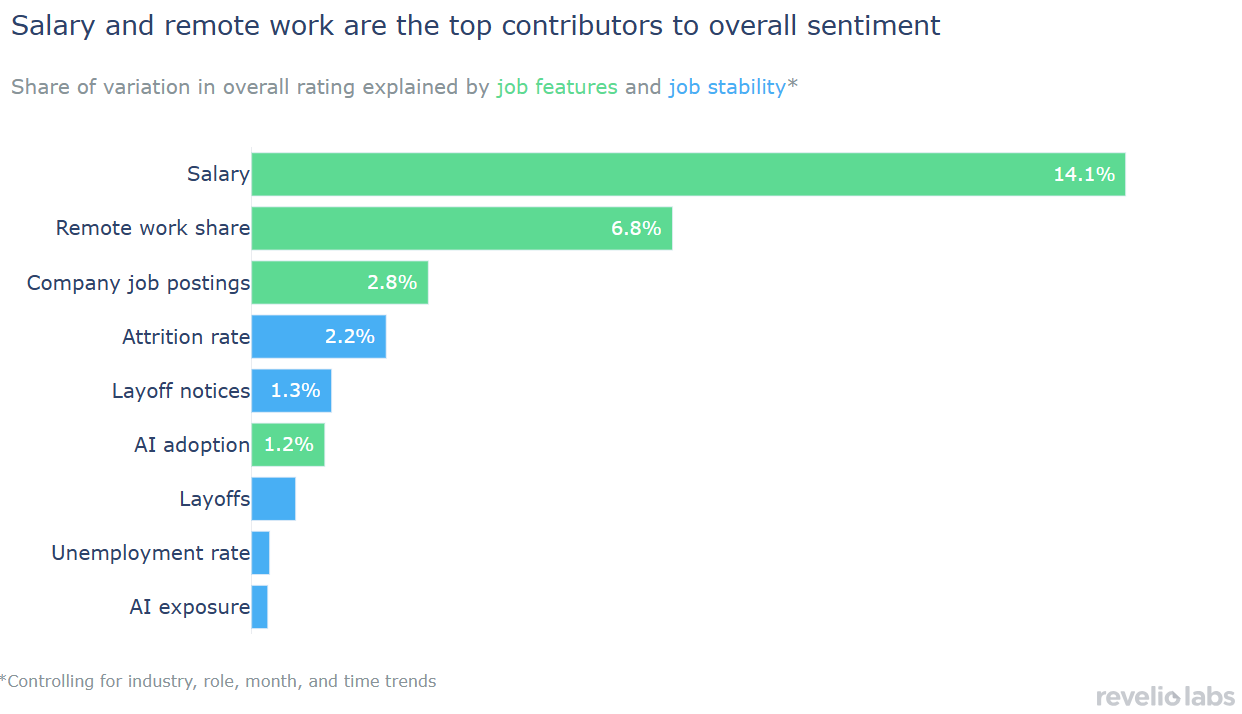

While regression coefficients measure the average marginal impact of each variable—such as how a 1% increase in “salary” or “number of job postings” shifts the overall rating, holding other factors constant, we are also interested in how much variation each variable explains. To that end we use the Shapley value decomposition to assess how much each factor contributes to the overall score across individual reviews. Applying the Shapley value decomposition to the regression specification that controls for all other respective factors, we find that salary explains the largest share of the variation in overall ratings: It accounts for 14%. The share of remote positions comes next in importance, explaining about 6% of total variation in employee sentiment. The importance of the share of remote jobs echoes how much employees value flexibility and casts doubt on the arguments that link RTO mandates to improving company culture. Factors like layoffs, unemployment, or even AI adoption appear to have a much smaller direct role in shaping overall sentiment. Finally, not shown in the plot, idiosyncratic factors like industry and seasonal timing (month effects and time trends) explain even more variance combined, underscoring how much context and timing matter.

Although overall sentiment has fallen across the board, Revelio Labs workforce data reveal that the decline in sentiment ratings is sharper among more experienced employees compared to entry-level employees. Compared to the first half of 2021, average ratings in 2025 are down 3.8% for non-entry-level workers, versus 2.4% for those just starting out. This is somewhat surprising given the broader discourse about new graduates struggling to find satisfying work. But since our analysis focuses on currently employed individuals, it reflects a sense of relief among entry-level workers simply to be employed. In contrast, more experienced employees, with greater exposure to corporate restructuring, may be more sensitive to signals of job stability—an area hit hard by ongoing layoffs and organizational shakeups in recent years.

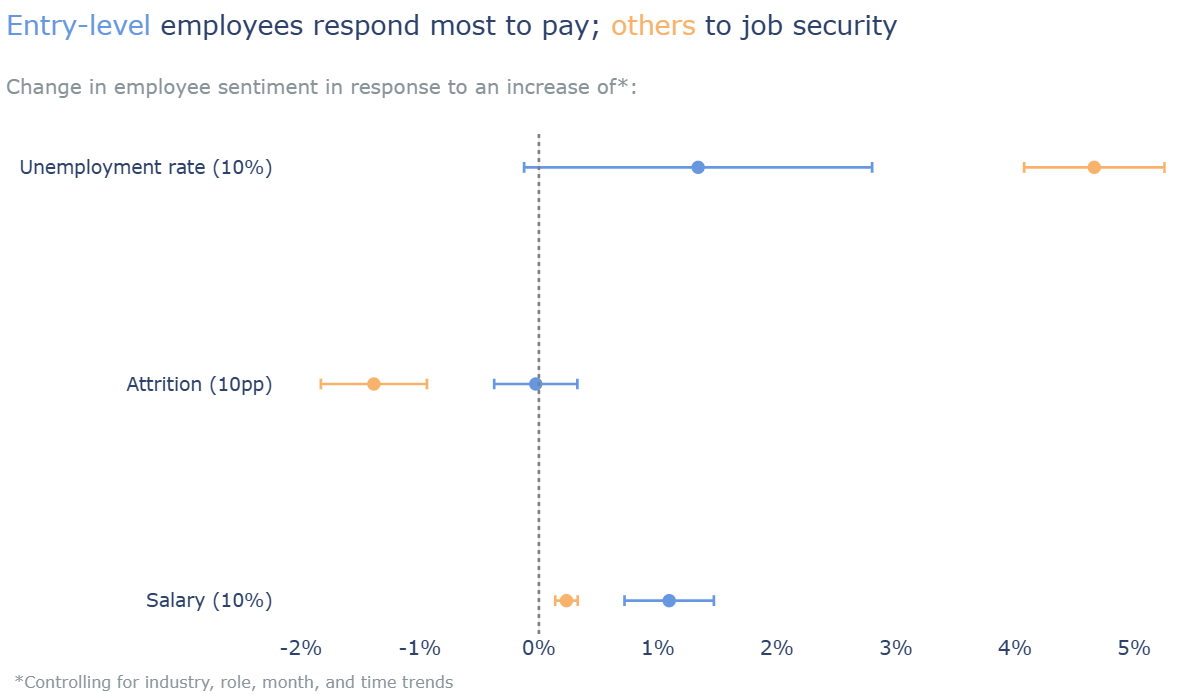

Looking at the factors that explain sentiment, we find differences in their influence between entry-level and other employees. In the plot below, we highlight the three factors with the largest differences in relative importance; namely, salary, attrition, and the unemployment rate. Entry-level employees show a stronger boost in sentiment when salaries increase, suggesting a heightened sensitivity to immediate financial rewards. In contrast, more experienced workers show a deeper sensitivity to attrition and layoffs, perhaps due to longer tenure or more awareness of corporate shifts. These distinctions matter. For HR leaders, it means that pay transparency and career growth cues may go further with early-career employees, while long-tenured staff may need stronger reassurances around retention and organizational security.

Low employee sentiment has real costs, from higher attrition and disengagement to reduced productivity. While there is a long-running slide in employee morale, this trend isn’t irreversible. The data points to clear, actionable levers for change. Employers can boost morale by focusing on what matters most to their workforce: ensuring competitive pay, offering flexibility where possible, and fostering a sense of stability during periods of organizational change. In a labor market still reeling from pandemic-era disruptions, tracking and responding to sentiment signals isn’t just good practice for companies, it’s a strategic imperative for retention, engagement, and long-term performance.