Workforce Digest: The Great Leveling-Off Continues

A deeper dive into the workforce

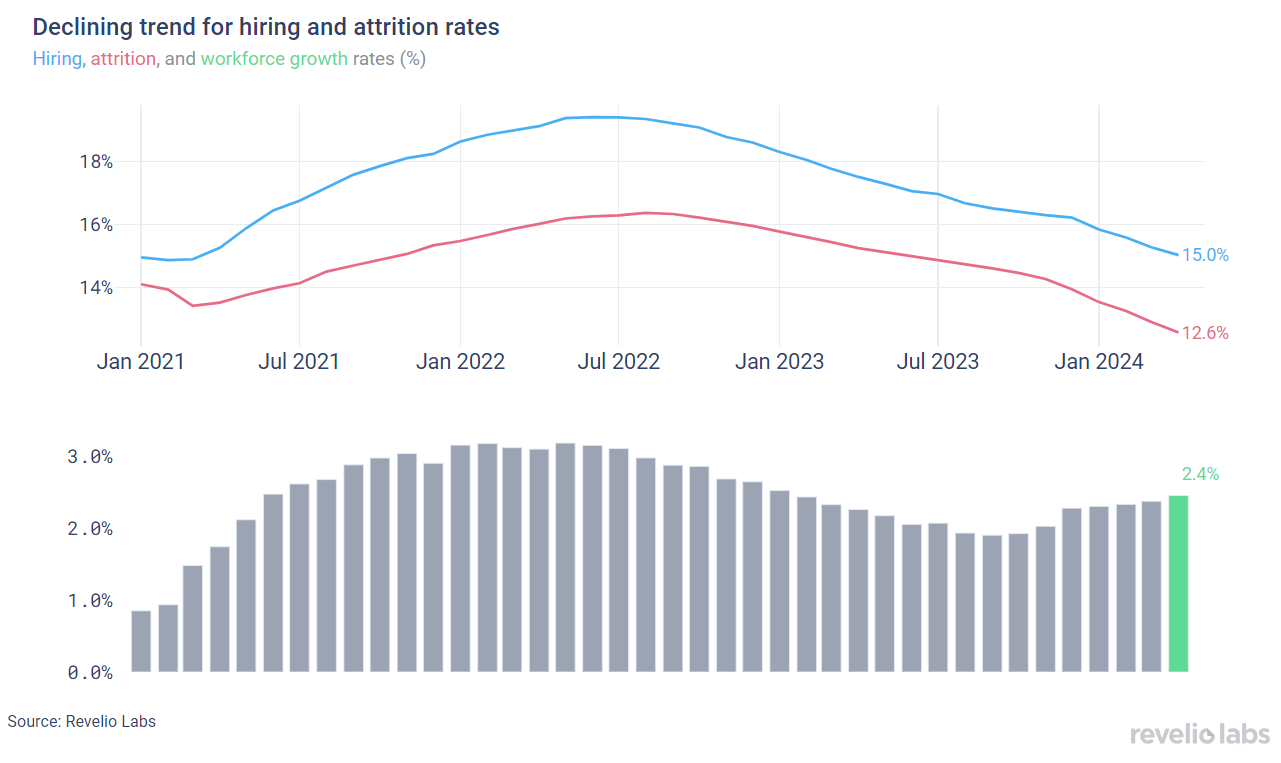

⬆️ 2.4% workforce growth rate in April 2024; slightly higher than the growth rate observed in March. The increasing workforce growth rate reflects higher hiring than attrition rates, even though both are on the decline.

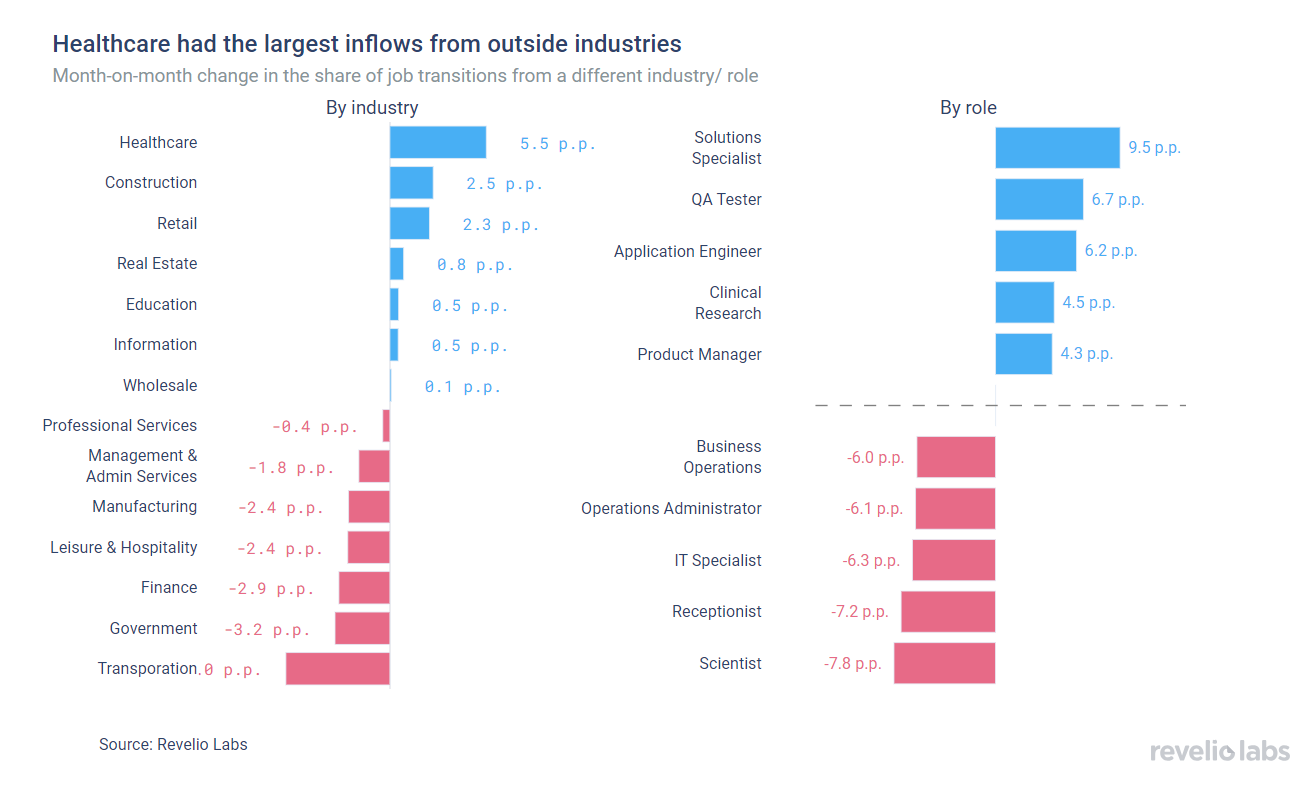

⬆️ 37.4% of workers who started a new job in April transitioned to a new role and 67.7% transitioned to a new industry. Healthcare had the largest increase in the share of workers coming from other industries.

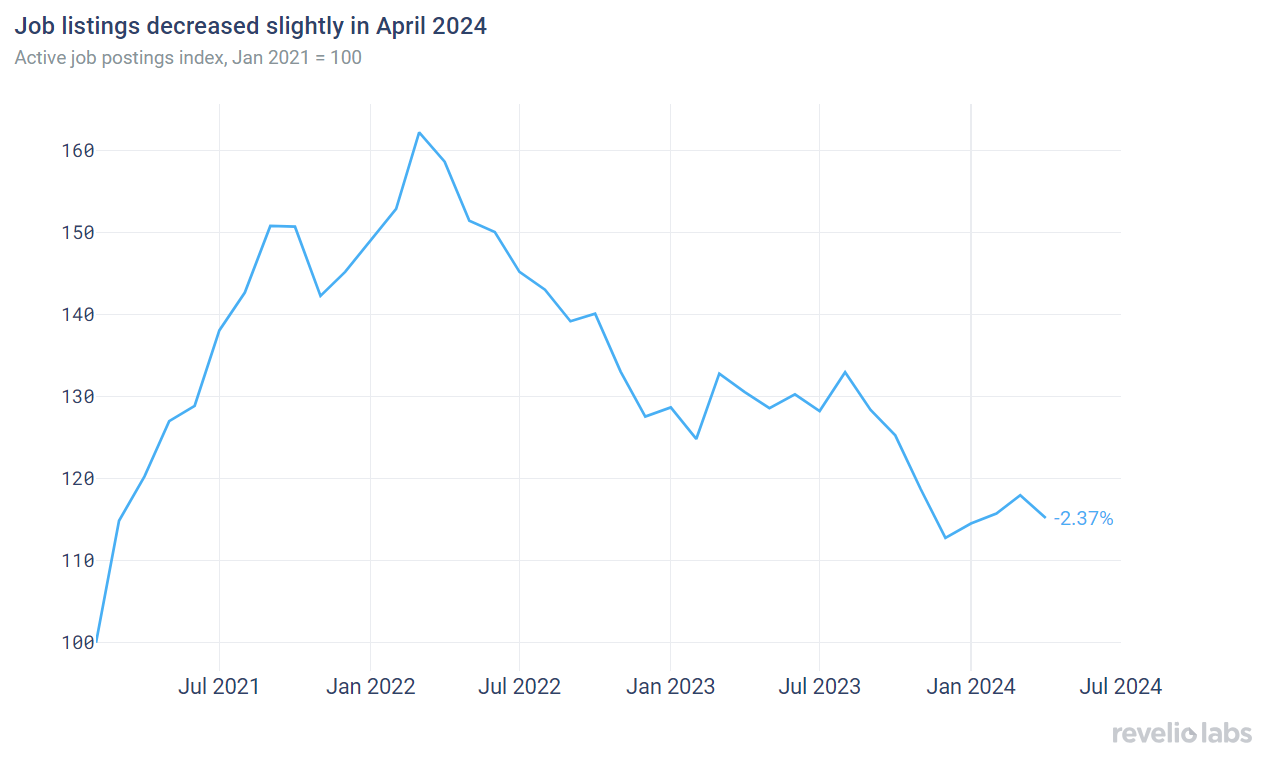

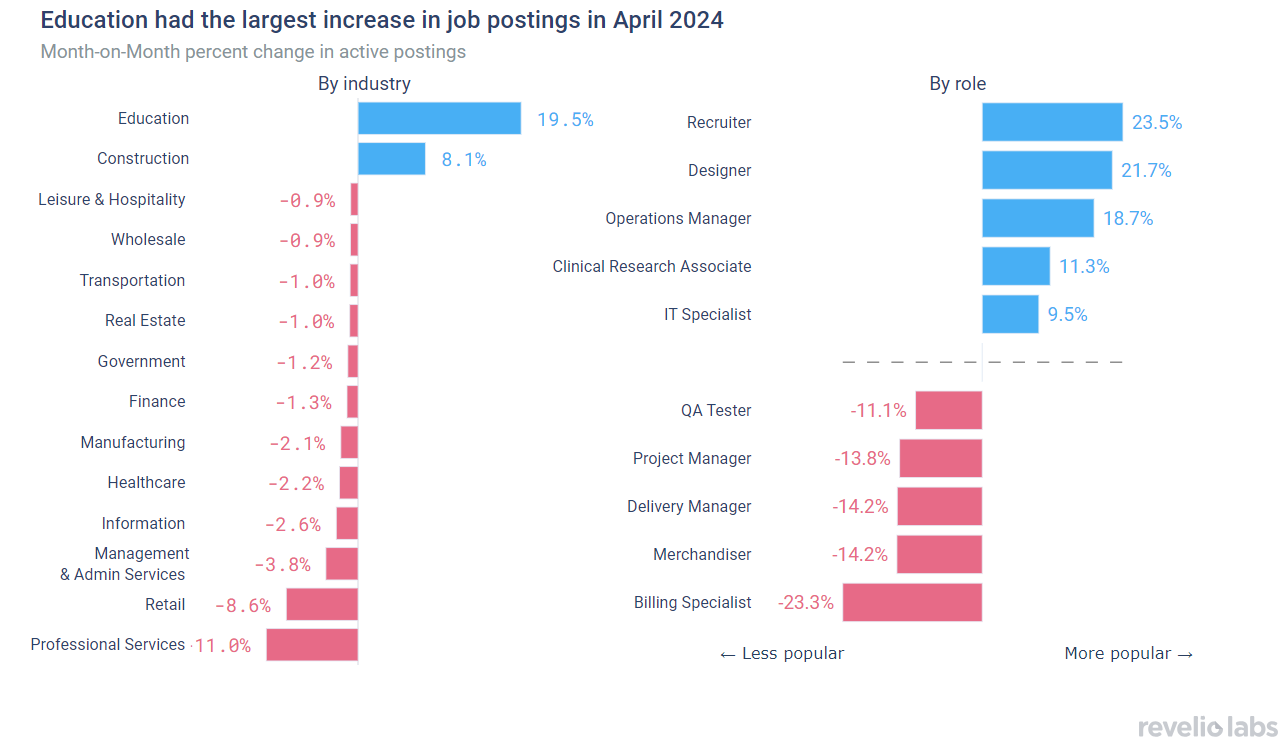

⬇️ 2.3% decrease in active job listings in April from March. The Education sector had the largest increase in the demand for workers (19.5% increase in active listings in April), while Professional Services had the largest decline in active job postings (-11% decline in March).

⬆️ 45.8 days to fill job openings in April. This is 3 days more than in March and 1.9 days more than in April 2023.

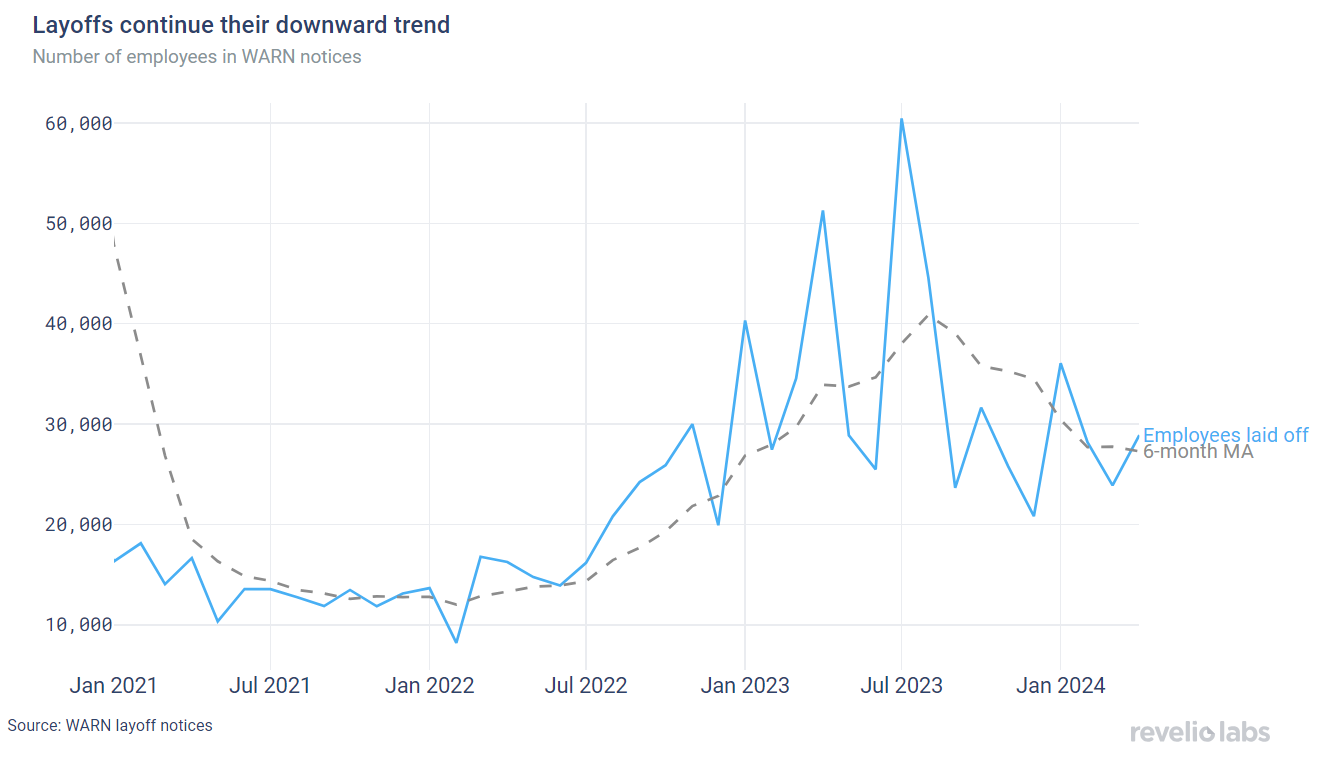

⬇️ 1.6% decrease in the number of employees notified of layoffs under the WARN Act compared to March 2024.

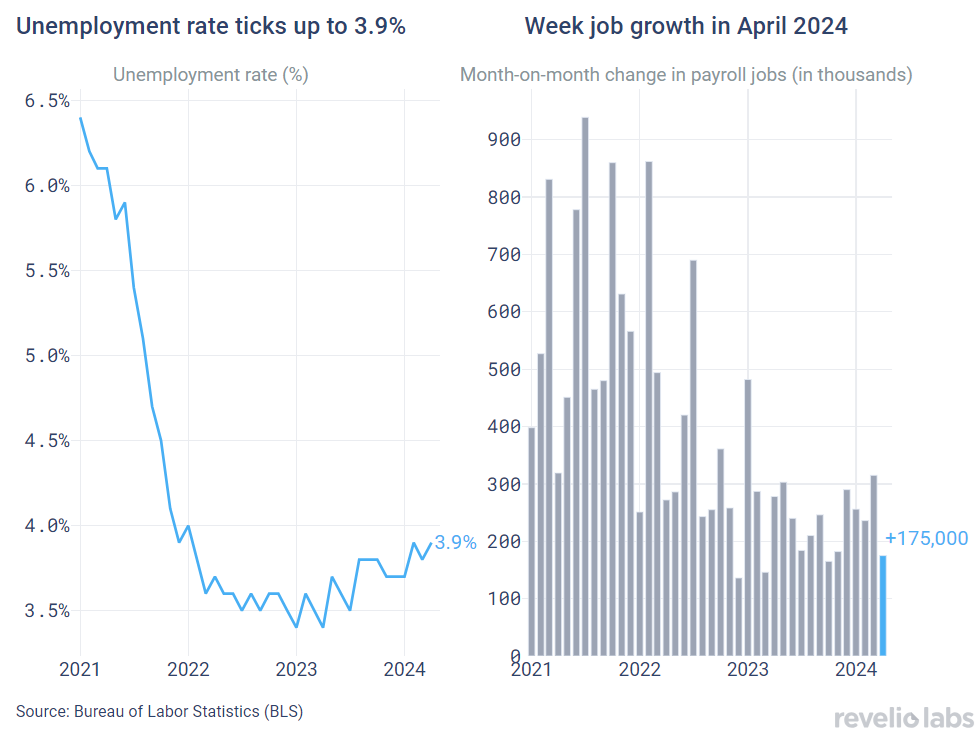

April’s Jobs Report came short of expectations

The unemployment rate ticked up slightly to 3.9%. What was most disappointing about the report is the rate of job growth. The US economy added 175,000 new jobs in April, the weakest growth since November 2023. Employment gains continue to be dominated by Health care, which have been the main driver for job gains in the past few months.

What does the granular workforce data from Revelio Labs have to say about the labor market, and what do they signal about the labor market in the near future?

Hiring and attrition continue their declining trend

Revelio Labs’ workforce intelligence data show that hiring and attrition rates have continued their declining trend, with attrition declining at a much faster rate, leading to an increase in the growth rate of the workforce. The hiring rate stood at 15.0% (decreasing only slightly from the 15.3% hiring rate recorded in March). Meanwhile, the attrition rate stood at 12.6% (slightly lower than the rate of 12.9% recorded in March). The workforce growth rate (difference between hiring and attrition rates) stood at 2.4% (higher than the growth rate in March on a m.o.m basis).

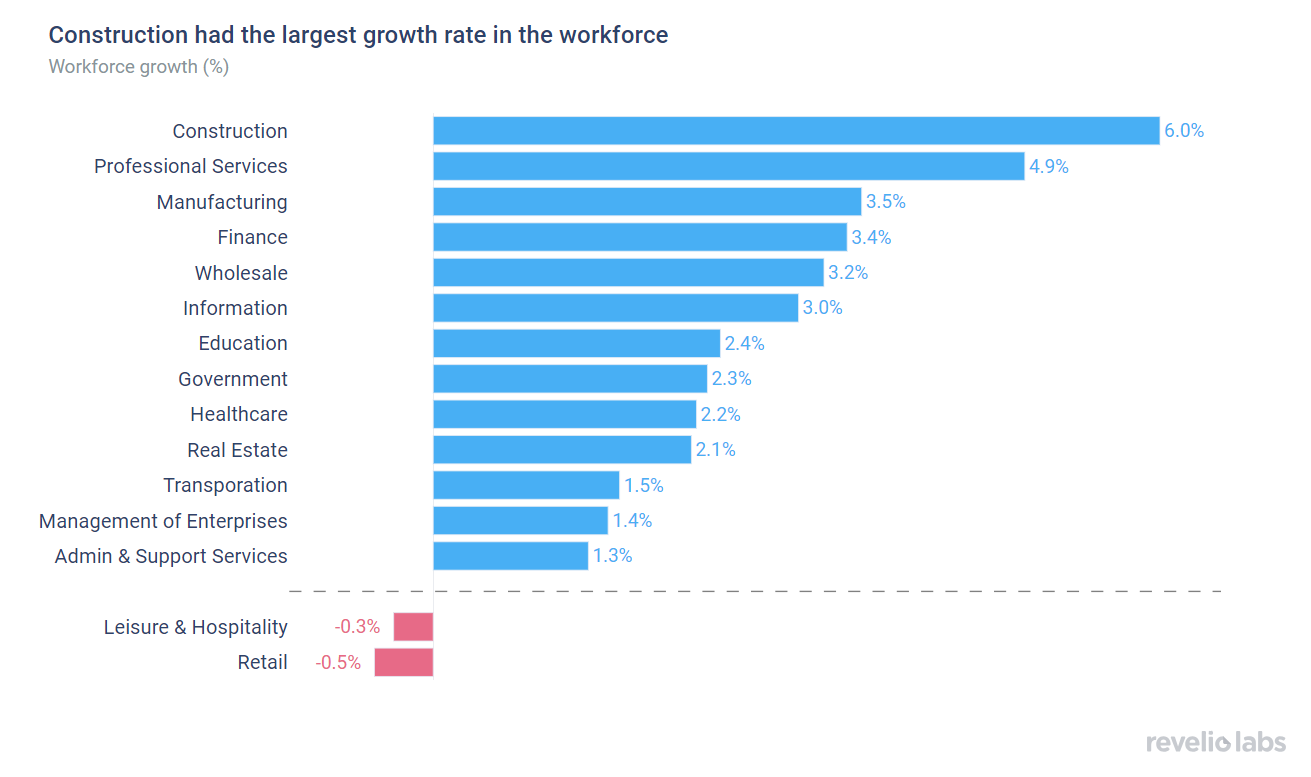

Sectoral hiring and attrition did not change much from March. Overall, most sectors saw an increase in the growth rate compared to the growth rate in March. Construction continues to lead the sectors in terms of having the highest workforce growth rate (6.0% workforce growth in March compared to 6.1% in March). The exception to the workforce growth is in the Retail and Leisure and Hospitality sectors (Retail saw a growth rate of -0.5%, compared to -0.6% in March).

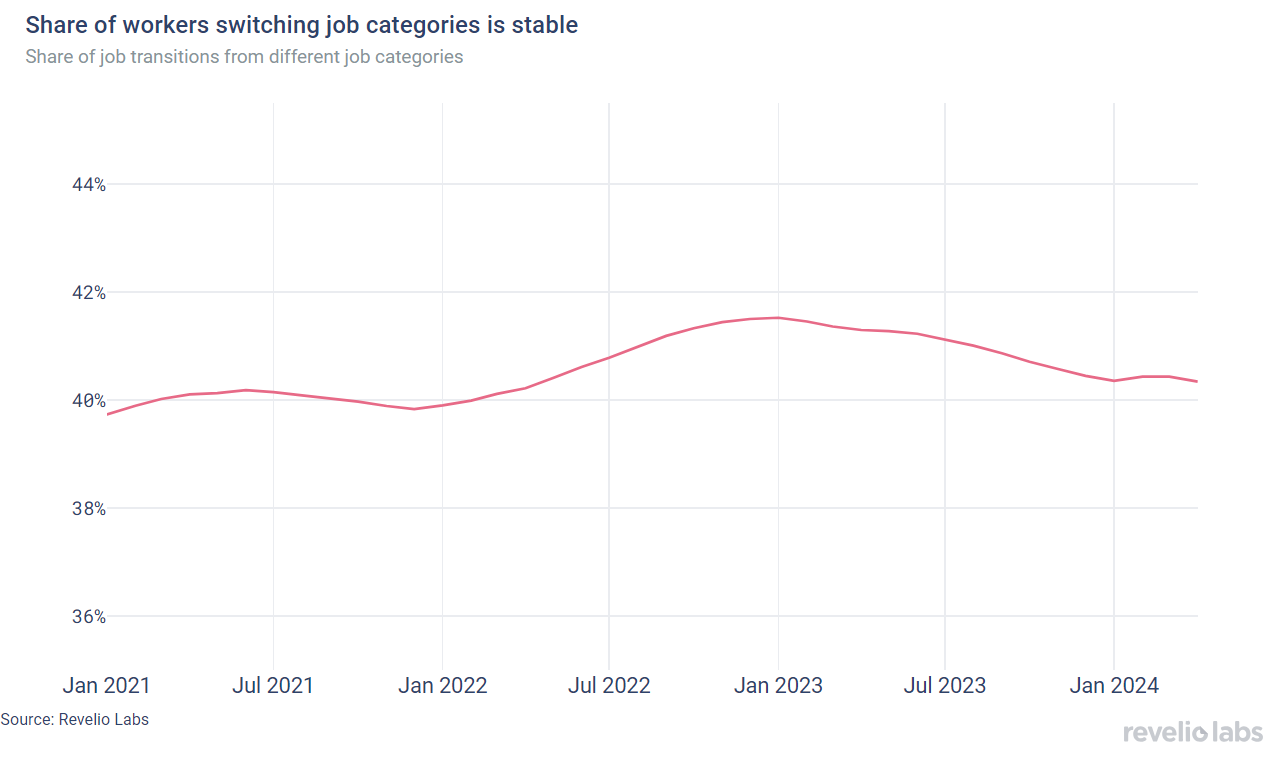

Of those who started a new job in April, 37.4% have transitioned to different roles and 67.7% have switched industries.

Using Revelio Labs' extensive workforce intelligence data on millions of employee profiles in the US, we track workers’ transitions between industries and occupations. Our analysis shows that 37.4% of workers who started a new job in April did so by switching their broad job categories; lower than the rate of 38.5% observed in March. Furthermore, 67.7% of workers who started a new job in April started jobs in different industries - up from the rate in March (67.4%).

The left panel in the figure below shows the difference in the share of workers who switched to a different industry relative to March 2024. The Healthcare sector had a notable increase in the influx of workers from other industries. 75.4% of workers who started a job in Healthcare in April came from other industries (+5.5 percentage points from the share in March). In contrast, the Transportation sector experienced the largest decline in the share of workers joining the industry from other industries. 79.1% of workers who started a job in transportation in April had backgrounds in other industries, relative to 85.1% in March 2024 (a 5.97 percentage-point decrease).

The right panel shows the difference in the share of workers who started a new job in a different role relative to March 2024. Technical roles, such as quality assurance, solutions and clinical research exhibited the largest increase in the share of workers transitioning from different roles compared to the previous month, while Science and operations roles witnessed the largest decline.

Job postings decreased in April 2024

The active job postings index ticked down for the first time in 2024. Job listings decreased slightly by 2.37% compared to the previous month. New job listings decreased by 4.7% month-on-month, while removed job postings also decreased by 4% from their level in March.

The decrease in job postings reflects a decline in postings in most sectors, with the Professional Services sector experiencing the largest decline (11% decline in the number of active job listings in April compared to March). Only two sectors saw an increase in active job postings. The Education sector saw a notable increase in active job listings (19.5% increase in active postings compared to March 2024), and the construction sector in which active postings increased by 8.1% compared to March). Interestingly, Recruiter and design roles saw the largest increase in active job postings in April; project management and billing jobs saw a notable decline.

The days-to-fill for open listings decreased slightly in April. Overall, average days-to-fill open positions continue on its increasing trend since Fall 2023. Average days-to-fill stood at 42.2 days in April, down from 45.3 days in March (-3.1 days). The general increase in the number of days required to fill open job postings over the Fall and Winter quarters signals a move back towards a tightening labor market.

Layoffs continue to decrease

The number of employees receiving layoff notices under the WARN Act slightly increased in April, stabilizing the downward trend in the number of employees notified of layoffs since the beginning of 2024. The number of layoffs remains elevated compared to 2022.

Quarterly highlight: What is the workforce in America talking about?

By examining thousands of employee reviews posted in April, we picked the most common topics that appeared in positive and negative reviews relative to the previous month (March). In April, workers continued to be positive about flexibility. They were also positive about their friendly and supportive teams. However, employees were concerned with hours, balance, and management.

Highlight of the Month: Banks are increasing their demand for AI talent, but financial expertise is still a requirement

The use of AI has transformed the financial industry as AI has numerous applications for enhancing customer service, strengthening security, and boosting operational efficiency. With the increased use of AI in the financial industry, banks have increased their demand for AI personnel. Our recent research shows that banks are demanding AI personnel with very specialized skills. AI workers in financial institutions are required to have a unique combination of finance domain knowledge and AI technical skills. By examining job descriptions of AI in the finance industry, we find that AI professionals in finance are more likely to mention finance applications such as risk management, credit cards, and anti-fraud models in their profile descriptions. This talent is much harder to find in the market, which may narrow the pool of suitable candidates available for banks.

Conclusion

After being spoiled by jobs reports that exceed expectations, April's report was finally a little underwhelming - but still strong. The rate of job growth was underwhelming and slightly below expectations, with 175,000 new jobs in April, the weakest growth since November 2023. The weakening job growth, along with slightly higher unemployment send more signals of cooling. Both hiring and attrition rates continue to decline, but the dynamics of hiring and attrition leave the workforce with a stable growth rate. Looking ahead, the continued decline in hiring and attrition and the stable job opening rate signal a continuation of the Great Leveling-Off through the Summer.

Please view our data and methodology for this job report here and our recent research on demand for AI talent in banks here.