Workforce Digest: Still as hot as the weather

Revelio Labs' July deep dive into the state of the workforce

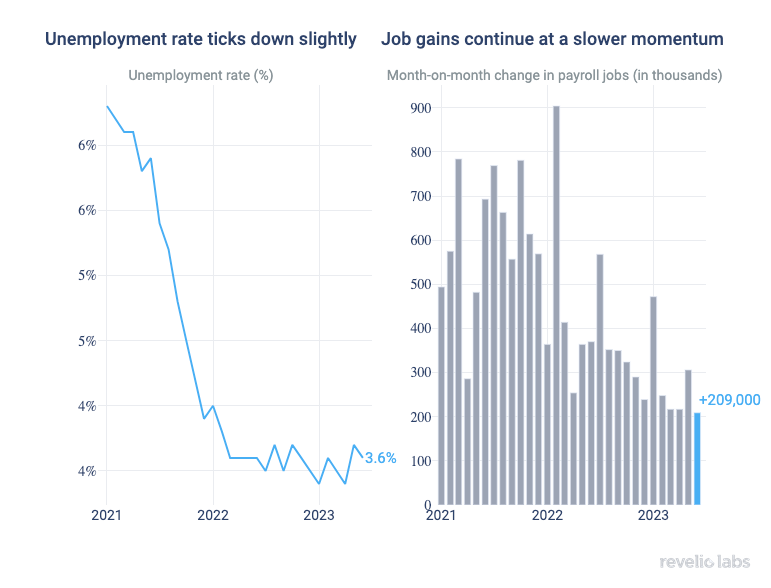

⬇️ 3.6% unemployment rate in June 2023 compared to 3.7% in May.

⬆️ 209,000 new jobs added. This is the slowest job growth since December 2020. The job gains were led by the government sector.

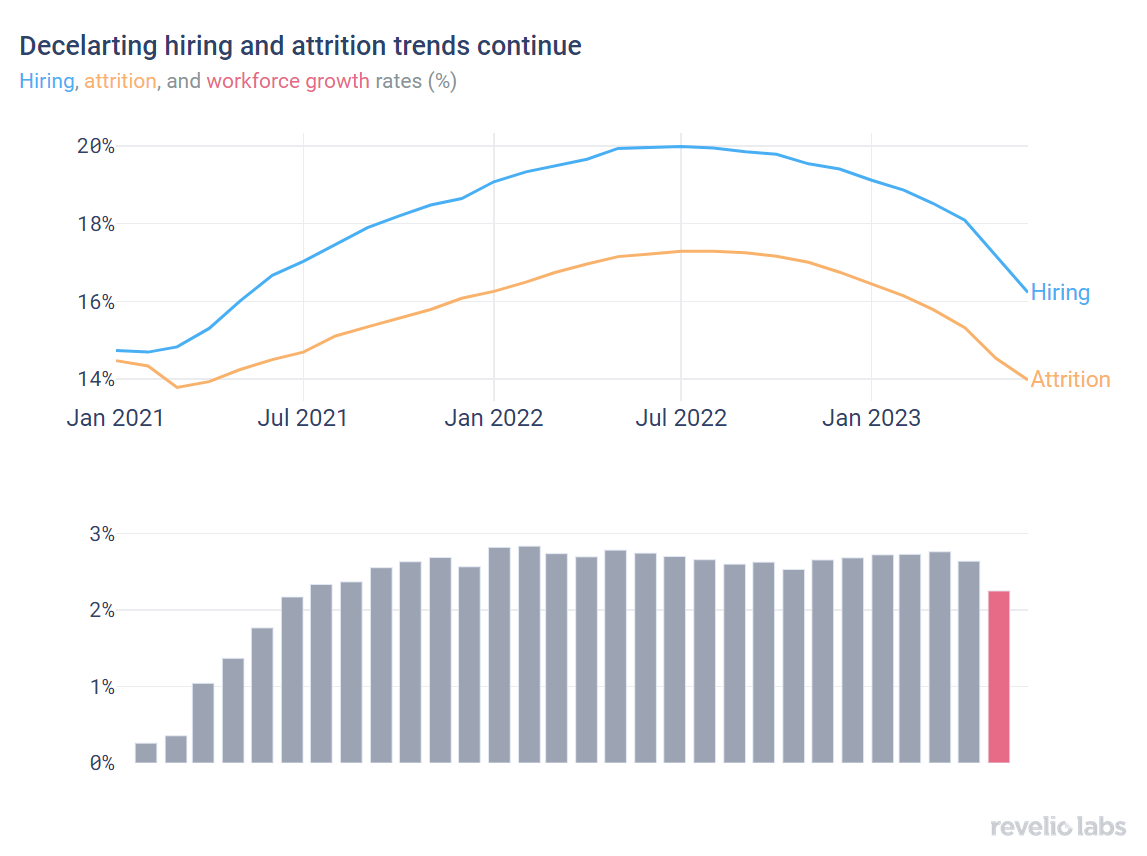

⬆️ 2.25% workforce growth rate in June 2023. This is lower than the workforce growth rate in May, which stood at 2.6%. The decrease in growth rate is a combination of a decline in attrition rate from 14.5% in May 2023 to 13.8% (0.7 p.p.) and a faster decline in the hiring rate from 17.1% to 16.2% (1 p.p.).

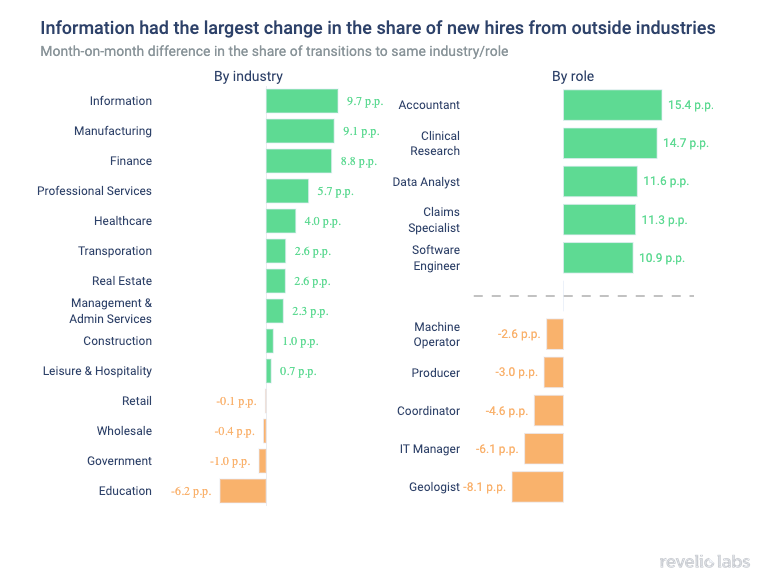

⬆️ 71.7% of workers who started a new job moved to a new industry. This is 2 percentage points higher than May. The Information industry had the largest increase in the share of workers coming from other industries.

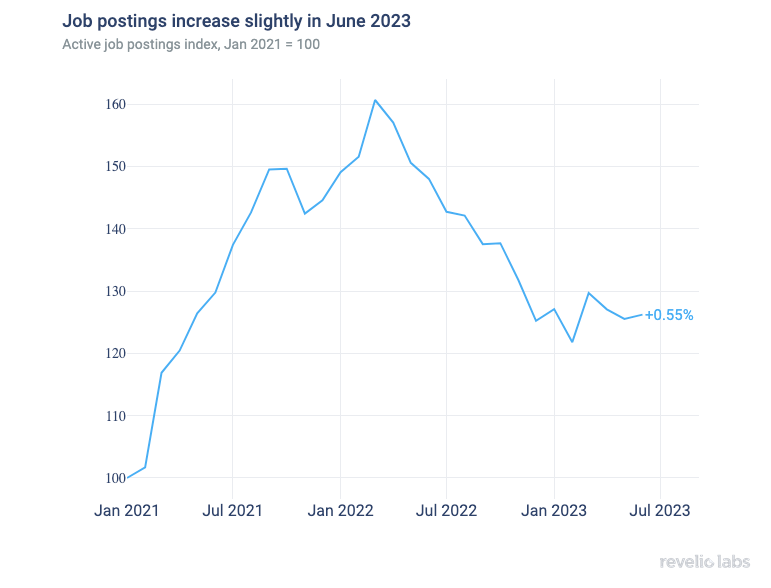

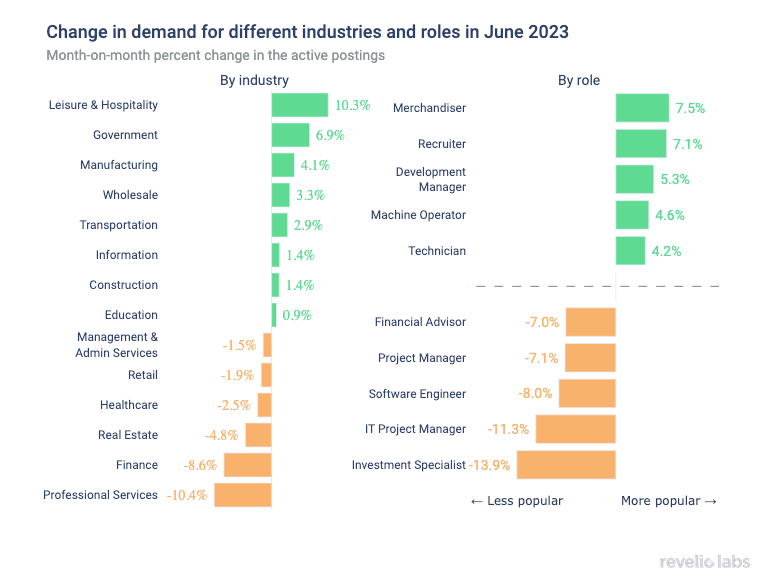

⬆️ 0.5% increase in active job postings from May. The increase is driven by the Leisure & Hospitality industry.

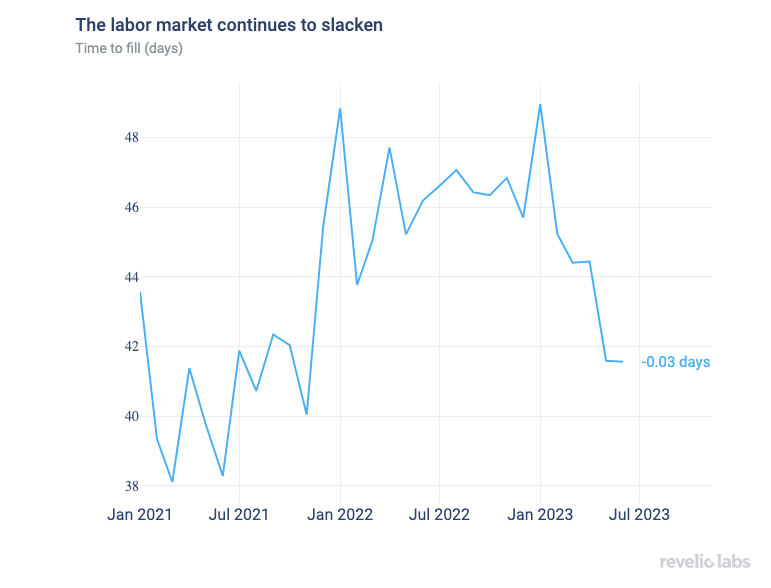

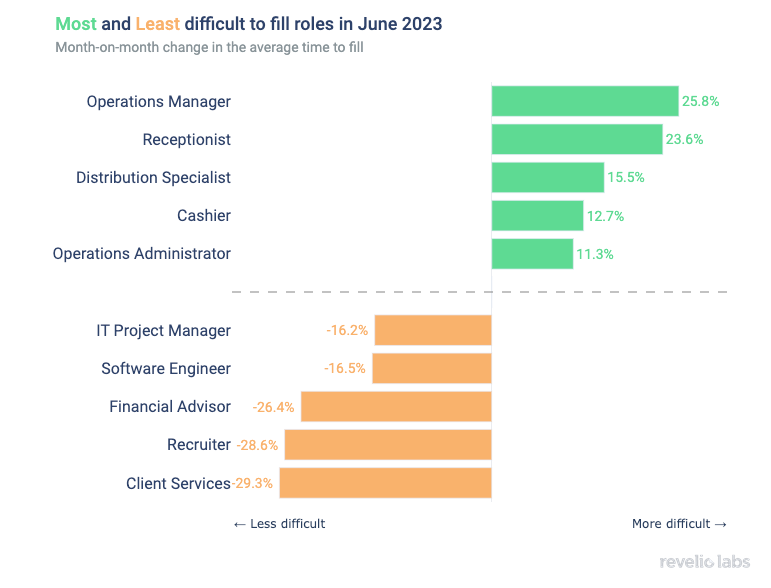

⬆️ 42 days to fill job openings. This is 0.03 days more than May 2023 and 4.5 days less than in June 2022. Customer-facing and retail roles were the hardest to fill in June.

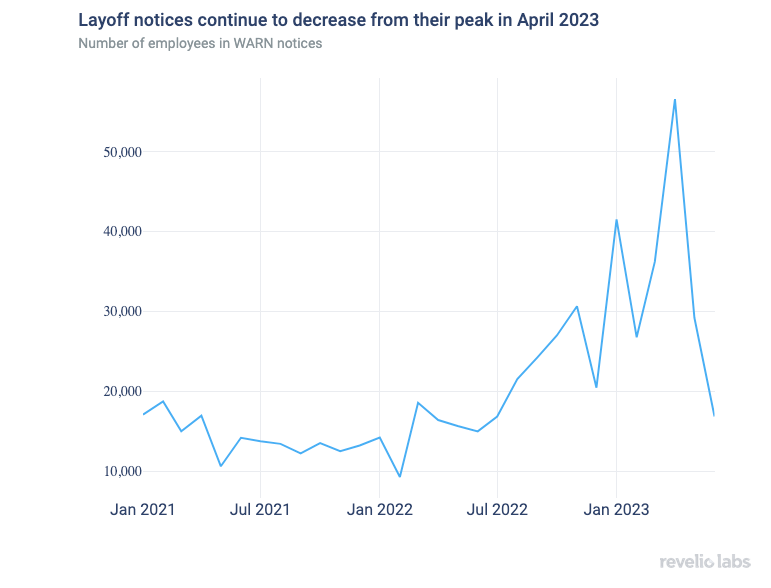

⬇️ 42% decrease in the number of employees notified of layoffs compared to May 2023 under the WARN Act.

The June Jobs Report still signals a hot labor market

Amid the summer heat, the US labor market remains hot, signaling a strong and resilient labor market. The unemployment rate remains flat, ticking down by 0.1 percentage points to 3.6%. Job growth continued for the 30th consecutive month, although it has lost some momentum. In June, the economy added 209,000 jobs, down from the revised 306,000 jobs added in May. The growth in nonfarm payroll employment came short of most forecasts, possibly linked to the slowdown in new and active job postings in April and May. While this is the slowest job growth seen in the past 30 months, it aligns with the pre-pandemic job growth levels. Jobs growth was driven predominantly by the government sector that managed to add 60,000 jobs.

What does the granular workforce data from Revelio Labs have to say about this hot labor market, and what do they signal about the labor market in the near future? Read the rest of our job report to find out.

Decelerating hiring and attrition rates result in a slower growth rate of the workforce

Despite the increase in nonfarm employment, Revelio Labs’ data show that hiring rates have started to cool down. After persistently increasing through the Summer and Fall of 2022, the hiring rate started to decrease in October 2022 and continues to decrease through June. Similarly, workforce attrition rates have been decelerating since October 2022, yet at a slower rate than hiring. The combination of the decline in attrition and faster decline in hiring result in a sustained decrease in the growth rate of the workforce. The workforce growth rate (difference between hiring and attrition rates) decreased by 0.4 percentage points compared to last month and 0.5 percentage points compared to June 2022.

71% of workers who started a new job in June have switched industries

Using Revelio Labs’ extensive data on millions of workers’ profiles in the US, we are able to track workers’ transitions between industries and occupations. Our analysis shows that among workers who recorded starting a new job in June, 71% of them have switched industries. The left panel of the figure below shows the difference in the share of workers who started a new position in a specific industry, having transitioned from another industry, as compared to May 2023. Notably, the Information industry experienced a substantial increase in the influx of newcomers from outside industries. In June 2023, 73.8% of workers who started new jobs in the Information sector had backgrounds in other industries, relative to 64% in May 2023 (+ 9.7 percentage points). It is intriguing to observe this continued attraction of workers to the Information sector, despite layoffs in the industry in the past few months. Conversely, the Education Services sector witnessed the largest decline in the proportion of workers joining the industry from other sectors in June 2023.

The right panel of the figure below shows the difference in the share of workers who started a new job in a different role relative to May 2023. The accounting profession exhibited the largest increase in the share of workers transitioning from different roles relative to May 2023. On the other hand, Geology experienced the largest negative change, indicating a substantial outflow of workers from this field.

Job postings slightly increased in June but they still require the same time to fill

Following a steady decline throughout April and May, the active job postings index increased modestly in June by 0.5% compared to May, although it remains substantially lower than its level from one year ago with a year-over-year decline of 15%. The month of June witnessed interesting job postings dynamics with very large changes in the volume of new and closed job postings. New job postings increased by 8.3%, while removed job postings increased by 9%. The combination of stable active job postings and reduced hiring signal higher unemployment rate in the next months.

With the arrival of summer, there has been a surge in job opportunities within the Leisure & Hospitality sector to cater to the growing demand for travel, lodging, and entertainment. Active postings in Leisure & Hospitality increased by 10% in June relative to May (left panel of the figure below). The government continues its expansion activity: not only has it been the largest contributor to job growth in June according to the June Establishment Survey, but also active job postings in the government have increased by almost 7% through June. In contrast, companies in the professional services and finance industries have notably decreased their active job postings in June.

Demand for recruiters and technician roles have witnessed an upsurge in June (right panel of the figure below). Conversely, the demand for technical roles such as software engineers and finance personnel has experienced a significant slowdown in June, with the deceleration being particularly notable on a year-over-year basis. This decline can be attributed to reduced job postings and hiring activities in the information and finance sectors.

The modest increase in active job postings was accompanied by a slight uptick in the average time to fill open jobs relative to May 2023. Average days-to-fill stood at 41.7 days in June compared to 41.6 days in May 2023 (+0.1 days). Yet, the labor market slack has generally continued, with average days-to-fill stabilizing in the range of 41 to 44 days in the past three months compared to a peak of 49 days in January 2023.

As the labor market continues to become slacker, the time required to fill most positions has increased compared to the previous year. However, on a monthly basis, there are large variations. In June 2023, operations and customer-facing roles were the most challenging to fill compared to May. The time to fill roles such as operations manager increased by 29% relative to May. In contrast, filling client services positions was relatively less difficult, with a 29% decrease in the time to fill compared to May.

Layoffs continue to decrease

Layoff employees in layoff notices filed under the WARN Act continued to decrease in June 2023 from their peak in April 2023. The layoff index decreased by 42.3% relative to its level in May. The layoff index is currently standing at its level in January 2021, which is 12.5% higher than it was last summer. The decrease in layoff notices coincides with a declining share of permanent layoffs in total unemployment.

What are workers in America talking about this month?

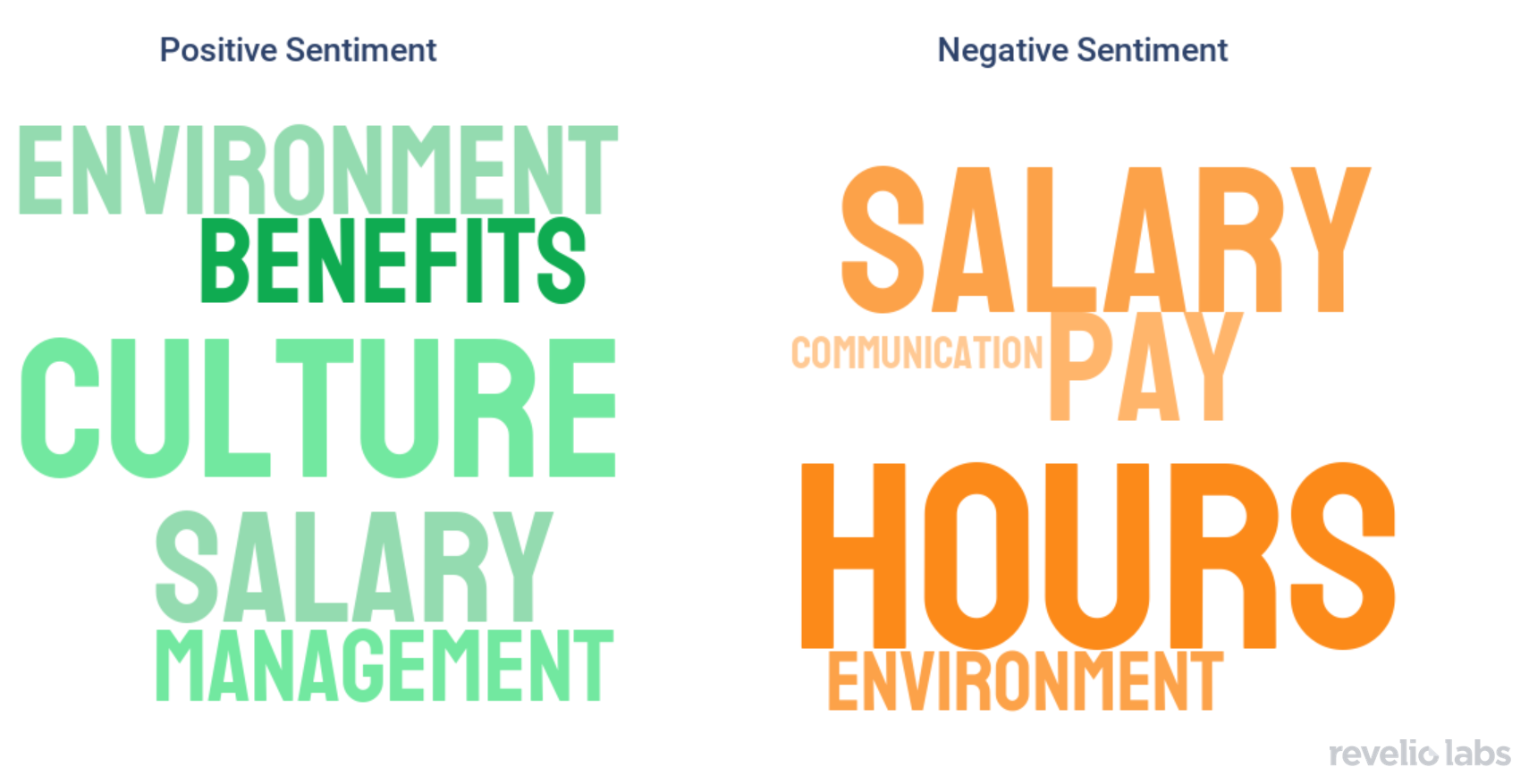

By examining thousands of employee reviews during the month of May, we picked the most common words that appear in positive and negative reviews relative to May. Employees were more positive about the work environment and culture, but more negative about salaries and long hours.

Highlight of the month: Women are more vulnerable to the increasing prevalence of generative AI technology

Our recent research highlights the negative consequences of generative AI technology on women. 71% of employees in the top 15 AI-exposed occupations are women. Watch our Economist Hakki Ozdenoren discussing the results of this research.

Conclusion

June’s jobs report was quite strong, despite falling short of expectations. With stable unemployment and labor force participation rates, job growth that aligns with pre-pandemic rates, and wage growth rates that outpaces inflation, the labor market seems to be highly resilient. Revelio Labs workforce data show signs of stability. Although the hiring rate has been decreasing since mid-2022, the workforce attrition rate has also been declining. Yet, the effect on the total workforce is not very large. Additionally, job postings are holding steady, and the number of layoffs is declining. While one or two months do not establish a definitive trend, we are eagerly watching for further developments throughout the summer.

Please view our data and methodology for this job report here and check out our recent research on AI's labor market consequences here